Quantifying the Value of Implicit Government Guarantees for Large

... framework, default occurs when the value of the firm’s assets is insufficient to allow the firm to meet its contractual obligations. The unobservable business value of the firm is inferred from equity prices, together with the company’s capital structure, and the business risk of the firm. Over the ...

... framework, default occurs when the value of the firm’s assets is insufficient to allow the firm to meet its contractual obligations. The unobservable business value of the firm is inferred from equity prices, together with the company’s capital structure, and the business risk of the firm. Over the ...

Deposits and Relationship Lending

... We empirically examine the hypothesis that access to deposits with inelastic rates (core deposits) permits a bank to make contractual agreements with borrowers that are infeasible if the bank must pay market rates for its funds. Access to core deposits insulates a bank’s costs of funds from exogenou ...

... We empirically examine the hypothesis that access to deposits with inelastic rates (core deposits) permits a bank to make contractual agreements with borrowers that are infeasible if the bank must pay market rates for its funds. Access to core deposits insulates a bank’s costs of funds from exogenou ...

chapter 26: managing client portfolios

... Laws and Regulations. Fairfax should be aware of, and abide by, any securities (or other) laws or regulations relating to her “insider” status at Reston and her holding of Reston stock. Although there is no trust instrument in place, if Fairfax’s future investing is handled by an investment advis ...

... Laws and Regulations. Fairfax should be aware of, and abide by, any securities (or other) laws or regulations relating to her “insider” status at Reston and her holding of Reston stock. Although there is no trust instrument in place, if Fairfax’s future investing is handled by an investment advis ...

an alternative approach for teaching the interest

... carrying values initially. This capability supports account analysis as well as financial planning associated with debt issuances. ...

... carrying values initially. This capability supports account analysis as well as financial planning associated with debt issuances. ...

The Top Seven Financial Pitfalls Every - No

... The section of the Mortgage Debt Relief Act of 2007 that applies to this discussion is HR 3648. Homeowners in default need to speak to their tax advisor about how HR3648 applies to them. For those of us in California or in the luxury market, there’s a twist to what was just explained: Up to a millio ...

... The section of the Mortgage Debt Relief Act of 2007 that applies to this discussion is HR 3648. Homeowners in default need to speak to their tax advisor about how HR3648 applies to them. For those of us in California or in the luxury market, there’s a twist to what was just explained: Up to a millio ...

0000930413-12-002776 - Investor Relations

... Note 1 — Business and Basis of Presentation Business. Gartner, Inc. is a global information technology research and advisory company founded in 1979 with its headquarters in Stamford, Connecticut. Gartner delivers its products and services through three business segments: Research, Consulting, and E ...

... Note 1 — Business and Basis of Presentation Business. Gartner, Inc. is a global information technology research and advisory company founded in 1979 with its headquarters in Stamford, Connecticut. Gartner delivers its products and services through three business segments: Research, Consulting, and E ...

Interest Rate Risk Management for Commercial

... Formal mathematical descriptions of this relation are often called term structure of interest rate. Yield curves are used by fixed income analysts, who analyze bonds and related securities, to understand conditions in financial markets and to seek trading opportunities. Economists use the curves to ...

... Formal mathematical descriptions of this relation are often called term structure of interest rate. Yield curves are used by fixed income analysts, who analyze bonds and related securities, to understand conditions in financial markets and to seek trading opportunities. Economists use the curves to ...

The Existence of Corporate Bond Clawbacks

... Section 2. Section 3 illustrates a basic numerical analysis of the model. We present data and sample characteristics in Section 4. Section 5 provides multivariate analysis and empirical results. Section 6 discusses the results with some implications for policy. ...

... Section 2. Section 3 illustrates a basic numerical analysis of the model. We present data and sample characteristics in Section 4. Section 5 provides multivariate analysis and empirical results. Section 6 discusses the results with some implications for policy. ...

Chapter 22 Credit Risk

... 22.30. Explain carefully the distinction between real-world and risk-neutral default probabilities. Which is higher? A bank enters into a credit derivative where it agrees to pay $100 at the end of 1 year if a certain company’s credit rating falls from A to Baa or lower during the year. The 1-year ...

... 22.30. Explain carefully the distinction between real-world and risk-neutral default probabilities. Which is higher? A bank enters into a credit derivative where it agrees to pay $100 at the end of 1 year if a certain company’s credit rating falls from A to Baa or lower during the year. The 1-year ...

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

... actual results to differ materially from those discussed in such forward-looking statements ("cautionary statements") include, among other things: the impact of weather conditions on the demand for propane; fluctuations in the unit cost of propane; the ability of the Partnership to compete with othe ...

... actual results to differ materially from those discussed in such forward-looking statements ("cautionary statements") include, among other things: the impact of weather conditions on the demand for propane; fluctuations in the unit cost of propane; the ability of the Partnership to compete with othe ...

Credit Supply and the Housing Boom

... tranching of mortgages into mortgage-backed securities (MBS) plays a central role, through several channels.1 First, tranching creates highly rated assets out of pools of risky mortgages. These assets can then be purchased by those institutional investors that are restricted by regulation to only ho ...

... tranching of mortgages into mortgage-backed securities (MBS) plays a central role, through several channels.1 First, tranching creates highly rated assets out of pools of risky mortgages. These assets can then be purchased by those institutional investors that are restricted by regulation to only ho ...

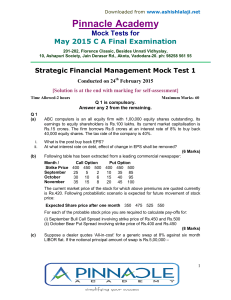

Pinnacle Academ y

... LIBOR for first reset period is 5.75%. A 3-year interest rate cap with a face value of $250 million and a strike price of 7% is available for a premium of 3.75%. Calculate effective cost of the capped loan for the following LIBOR on the next 5 rollover dates: 5.5%, 6%, 6.25%, 6.5% and 6.75%. Fixed i ...

... LIBOR for first reset period is 5.75%. A 3-year interest rate cap with a face value of $250 million and a strike price of 7% is available for a premium of 3.75%. Calculate effective cost of the capped loan for the following LIBOR on the next 5 rollover dates: 5.5%, 6%, 6.25%, 6.5% and 6.75%. Fixed i ...

Equity Income and Dividend Growth Strategies

... U.S. government bonds and Treasury bills are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of return and guaranteed principal value. U.S. government bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Treasury ...

... U.S. government bonds and Treasury bills are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of return and guaranteed principal value. U.S. government bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Treasury ...

NORTHEAST BANCORP /ME/ (Form: 10

... uncertainties, contingencies, and other factors. Accordingly, the Company cannot give you any assurance that its expectations will in fact occur or that its estimates or assumptions will be correct. The Company cautions you that actual results could differ materially from those expressed or implied ...

... uncertainties, contingencies, and other factors. Accordingly, the Company cannot give you any assurance that its expectations will in fact occur or that its estimates or assumptions will be correct. The Company cautions you that actual results could differ materially from those expressed or implied ...

US SECURITIES AND EXCHANGE COMMISSION FORM

... government in December 2009, the Company conducted a broad review of the Citi Holdings asset base to determine which assets were strategically important to Citigroup. As a result of this analysis, approximately $59 billion of assets were moved from Citi Holdings into Citicorp during the first quarte ...

... government in December 2009, the Company conducted a broad review of the Citi Holdings asset base to determine which assets were strategically important to Citigroup. As a result of this analysis, approximately $59 billion of assets were moved from Citi Holdings into Citicorp during the first quarte ...

Filed pursuant to Rule 424(b)(3) Registration File No. 333

... with any person relative to distribution of these securities. We have agreed with the selling shareholders to register the Common Stock and Underlying Common Stock. We also agreed with the selling shareholders to use our best efforts to keep the registration statement effective until the earlier of ...

... with any person relative to distribution of these securities. We have agreed with the selling shareholders to register the Common Stock and Underlying Common Stock. We also agreed with the selling shareholders to use our best efforts to keep the registration statement effective until the earlier of ...