SECURITIZATION IN INDIA

... Pay Through – Where the payment to the investors are routed through SPV who does not strictly pay the investors only when the receivables are collected by it, but keeps paying on the stipulated dates irrespective of the collection dates. In order to allow for smoothed payment to investors by removin ...

... Pay Through – Where the payment to the investors are routed through SPV who does not strictly pay the investors only when the receivables are collected by it, but keeps paying on the stipulated dates irrespective of the collection dates. In order to allow for smoothed payment to investors by removin ...

The Traditional Securitization Process Bank

... • Underestimate ρ (credit risk, liquidity risk) Source: St. Louis Federal Reserve Bank database, FRED website. ...

... • Underestimate ρ (credit risk, liquidity risk) Source: St. Louis Federal Reserve Bank database, FRED website. ...

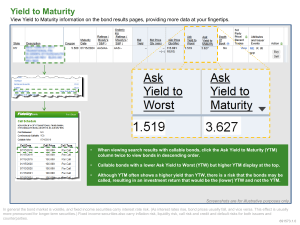

Yield to Maturity

... Although YTM often shows a higher yield than YTW, there is a risk that the bonds may be called, resulting in an investment return that would be the (lower) YTW and not the YTM. ...

... Although YTM often shows a higher yield than YTW, there is a risk that the bonds may be called, resulting in an investment return that would be the (lower) YTW and not the YTM. ...

Understanding the Bond Market

... Bonds are a well-established asset class holding trillions of dollars globally. Even though they pass for “boring” in the general public and with some novice investors, debt instruments are anything but. When you understand them in more depth, you will gain new insights into many news stories from r ...

... Bonds are a well-established asset class holding trillions of dollars globally. Even though they pass for “boring” in the general public and with some novice investors, debt instruments are anything but. When you understand them in more depth, you will gain new insights into many news stories from r ...

Traded loans (borderline between securities and other financial

... maintained: that is, the loan should be reclassified as a security only if there is evidence of a market and there are quotations in the market. This change of category of financial instrument is achieved via a change in classification entry in the other changes in the volume of assets account and n ...

... maintained: that is, the loan should be reclassified as a security only if there is evidence of a market and there are quotations in the market. This change of category of financial instrument is achieved via a change in classification entry in the other changes in the volume of assets account and n ...

US High Yield Fund

... The Fund seeks both high current income and capital appreciation by investing in a diversified portfolio of high-yield bonds from U.S. corporate issuers. The Philosophy The Fund is managed according to a disciplined philosophy, which emphasizes diversification and extensive proprietary and public cr ...

... The Fund seeks both high current income and capital appreciation by investing in a diversified portfolio of high-yield bonds from U.S. corporate issuers. The Philosophy The Fund is managed according to a disciplined philosophy, which emphasizes diversification and extensive proprietary and public cr ...

A1 Advanced products for managing the bank`s balance sheet

... A1 Advanced products for managing the bank’s balance sheet Seminar outline (3 days) DAY ONE Morning: Asset backed securities: 1. Principles of asset-backed securities. 2. Reasons for creating asset-backed securities. 3. Mortgage prepayment option. 4. Yield, average life and duration calculations. 5. ...

... A1 Advanced products for managing the bank’s balance sheet Seminar outline (3 days) DAY ONE Morning: Asset backed securities: 1. Principles of asset-backed securities. 2. Reasons for creating asset-backed securities. 3. Mortgage prepayment option. 4. Yield, average life and duration calculations. 5. ...

Economics 434 Financial Markets - SHANTI Pages

... • What if their correlation is one? (Which means that either both pay off or both default, not one or the other) • Then each of Security 1 and Security 2 have a 90 percent chance of paying off • Both get a B- rating • Compared to independence pricing – “Independence” assumption overprice Security On ...

... • What if their correlation is one? (Which means that either both pay off or both default, not one or the other) • Then each of Security 1 and Security 2 have a 90 percent chance of paying off • Both get a B- rating • Compared to independence pricing – “Independence” assumption overprice Security On ...

Slide 1

... • Households – net savers • Governments – can be both borrowers and savers • Financial Intermediaries – Investment Companies – Banks – Insurance companies – Credit unions ...

... • Households – net savers • Governments – can be both borrowers and savers • Financial Intermediaries – Investment Companies – Banks – Insurance companies – Credit unions ...

15 Mosec

... • Efficient financing – Via securitization, it is possible to achieve a higher target rating for the instruments than the lenders credit rating – Lender can obtain funding at lower interest rates applicable to highly rated instruments • Balance sheet management – Securitization as a tool for ALM. – ...

... • Efficient financing – Via securitization, it is possible to achieve a higher target rating for the instruments than the lenders credit rating – Lender can obtain funding at lower interest rates applicable to highly rated instruments • Balance sheet management – Securitization as a tool for ALM. – ...

AFR Statement on SEC Final Rules Concerning Asset

... in the securities markets that helped to trigger the 2008 financial crisis. One rule sets out new controls designed to improve business practices at major credit rating firms such as Moody’s and Standard and Poors. Prior to the financial crisis, these firms certified tens of thousands of ‘toxic’ sec ...

... in the securities markets that helped to trigger the 2008 financial crisis. One rule sets out new controls designed to improve business practices at major credit rating firms such as Moody’s and Standard and Poors. Prior to the financial crisis, these firms certified tens of thousands of ‘toxic’ sec ...

Wells Fargo Securities_Sales and Trading Analystx

... customized interest rate, commodity, equity, and credit solutions for clients who want to hedge a financial risk or add a structured investment to their portfolio. The Asset Backed Finance & Securitization Group of Wells Fargo Securities provides structured lending and securitization services to cor ...

... customized interest rate, commodity, equity, and credit solutions for clients who want to hedge a financial risk or add a structured investment to their portfolio. The Asset Backed Finance & Securitization Group of Wells Fargo Securities provides structured lending and securitization services to cor ...

Lecture 3 securitization

... For a rebirth of securitization it is necessary to align the interests of originators and investors Regulators are insisting that when credit risk is transferred a certain percentage (5% to 10%) of each tranche is retained by the originator ...

... For a rebirth of securitization it is necessary to align the interests of originators and investors Regulators are insisting that when credit risk is transferred a certain percentage (5% to 10%) of each tranche is retained by the originator ...

Bailout Bill

... Other countries are experiencing credit crunches and declines in equity as well. If US companies have less accesse to funding they will not be able to conduct business or invest in other parts of the world to the same extent, which will hurt foreign markets. Because of US businesses slowing producti ...

... Other countries are experiencing credit crunches and declines in equity as well. If US companies have less accesse to funding they will not be able to conduct business or invest in other parts of the world to the same extent, which will hurt foreign markets. Because of US businesses slowing producti ...

Chapter 6

... Fifth, securitization allows for innovation over time. Financial firms seeking to lower the cost of funds to borrowers can broaden the range of assets that are transformed into securities. They can also learn to shape the securities, customizing them to fit the preferences of the ultimate buyers.2 ...

... Fifth, securitization allows for innovation over time. Financial firms seeking to lower the cost of funds to borrowers can broaden the range of assets that are transformed into securities. They can also learn to shape the securities, customizing them to fit the preferences of the ultimate buyers.2 ...

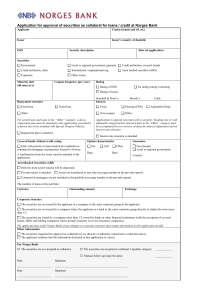

Søknadsskjema for godkjenning av obligasjoner og

... Other information The securities requested for approval as collateral are not directly or indirectly connected to credit derivatives. The applicant confirms that the information disclosed in this application is correct. ...

... Other information The securities requested for approval as collateral are not directly or indirectly connected to credit derivatives. The applicant confirms that the information disclosed in this application is correct. ...