International Derivatives Brochure

... Conversely, this represents a negative movement of R20 for the seller of the International Derivatives SSF contract. The exchange will require that the seller pay R20 into his variation margin account which will then be paid into the buyer’s variation margin account. The margin required to be paid ...

... Conversely, this represents a negative movement of R20 for the seller of the International Derivatives SSF contract. The exchange will require that the seller pay R20 into his variation margin account which will then be paid into the buyer’s variation margin account. The margin required to be paid ...

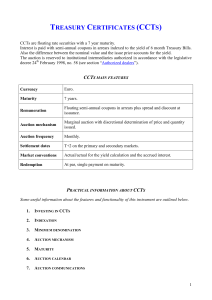

TREASURY CERTIFICATES (CCTS)

... Treasury Certificates are a kind of security very appreciated by families because of their feature to adjust coupons to market rates and therefore guarantee, in case of a negotiation before maturity, a capital amount very similar to that initially invested. CCTs have been issued, since March 1991, w ...

... Treasury Certificates are a kind of security very appreciated by families because of their feature to adjust coupons to market rates and therefore guarantee, in case of a negotiation before maturity, a capital amount very similar to that initially invested. CCTs have been issued, since March 1991, w ...

Document

... All treasury coupon securities and bills: All are used in the hope that they contain additional information relative to the above. here it is not possible to use bootstrapping as there may exist several yields for each maturity (uses instead exponential spline fitting). Treasury coupon strips: a ...

... All treasury coupon securities and bills: All are used in the hope that they contain additional information relative to the above. here it is not possible to use bootstrapping as there may exist several yields for each maturity (uses instead exponential spline fitting). Treasury coupon strips: a ...

AB - Global Value Portfolio

... convenience pricing, which offers the ability to purchase or redeem shares using the currency indicated, which is then converted into the base currency of the portfolio using a market rate at the time of purchase or redemption. Convenience pricing involves no currency hedging and does not seek to pr ...

... convenience pricing, which offers the ability to purchase or redeem shares using the currency indicated, which is then converted into the base currency of the portfolio using a market rate at the time of purchase or redemption. Convenience pricing involves no currency hedging and does not seek to pr ...

FINRA Proposes Amendments to Supervision R

... require that a member firm designate an appropriately registered principal to supervise each type of business the member firm engages in, regardless of whether registration as a broker-dealer is required for that activity. This would constitute a major change for broker-dealers that currently do not ...

... require that a member firm designate an appropriately registered principal to supervise each type of business the member firm engages in, regardless of whether registration as a broker-dealer is required for that activity. This would constitute a major change for broker-dealers that currently do not ...

Financial Market Failures and Systemic Risk

... short term borrowing and by the use of derivatives. Institutional investors, mutual funds and banks, all relied on the same financing pattern. On the BIS opinion, the systematic recourse to very high leverage is an indication of an aggressive attitude toward risk. It is motivated by excess competiti ...

... short term borrowing and by the use of derivatives. Institutional investors, mutual funds and banks, all relied on the same financing pattern. On the BIS opinion, the systematic recourse to very high leverage is an indication of an aggressive attitude toward risk. It is motivated by excess competiti ...

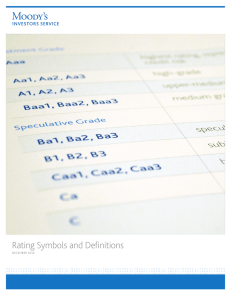

Rating Symbols and Definitions

... obligations.5 As such, Issuer Ratings incorporate any external support that is expected to apply to all current and future issuance of senior unsecured financial obligations and contracts, such as explicit support stemming from a guarantee of all senior unsecured financial obligations and contracts, ...

... obligations.5 As such, Issuer Ratings incorporate any external support that is expected to apply to all current and future issuance of senior unsecured financial obligations and contracts, such as explicit support stemming from a guarantee of all senior unsecured financial obligations and contracts, ...

Financial Management: Principles and Applications

... Diff: 1 Topic: 2.3 The Financial Marketplace: Securities Markets Keywords: stock exchanges 16) Organized security exchanges do not physically occupy space. Answer: FALSE Diff: 1 Topic: 2.3 The Financial Marketplace: Securities Markets Keywords: stock exchanges 17) Explain how securities markets prov ...

... Diff: 1 Topic: 2.3 The Financial Marketplace: Securities Markets Keywords: stock exchanges 16) Organized security exchanges do not physically occupy space. Answer: FALSE Diff: 1 Topic: 2.3 The Financial Marketplace: Securities Markets Keywords: stock exchanges 17) Explain how securities markets prov ...

Earnings Release Q3 FY 2016: Strong execution drives growth and

... Siemens Real Estate Corporate items Centrally carried pension expense Amortization of intangible assets acquired in business combinations Eliminations, Corporate Treasury and other reconciling items Reconciliation to Consolidated Financial Statements ...

... Siemens Real Estate Corporate items Centrally carried pension expense Amortization of intangible assets acquired in business combinations Eliminations, Corporate Treasury and other reconciling items Reconciliation to Consolidated Financial Statements ...

Impartial Investing - University of Michigan Law School

... on the ground that they would provide too little return to income beneficiaries, since trustees are permitted to make compensating distributions from capital appreciation to income recipients. These compensating distributions must, however, reflect the nature of the investment plan rather than a st ...

... on the ground that they would provide too little return to income beneficiaries, since trustees are permitted to make compensating distributions from capital appreciation to income recipients. These compensating distributions must, however, reflect the nature of the investment plan rather than a st ...

Probability of Default for Microfinance Institutions

... » If financial statements were less than 3 month before default event then these statements were removed from the model development » If 2 statements were available from 4 to 21 months before default event then statement closer to default event was kept and tagged as default and other statement was ...

... » If financial statements were less than 3 month before default event then these statements were removed from the model development » If 2 statements were available from 4 to 21 months before default event then statement closer to default event was kept and tagged as default and other statement was ...

ALASKA COMMUNICATIONS SYSTEMS GROUP INC

... Pursuant to the Purchase Agreement, ACS will, or will cause one or more of its affiliates to, sell to GCI, or one or more of its affiliates, ACS Wireless’s interest in AWN and substantially all the assets of ACS and its affiliates related to ACS’s wireless business (the "Acquired Assets") for a cash ...

... Pursuant to the Purchase Agreement, ACS will, or will cause one or more of its affiliates to, sell to GCI, or one or more of its affiliates, ACS Wireless’s interest in AWN and substantially all the assets of ACS and its affiliates related to ACS’s wireless business (the "Acquired Assets") for a cash ...

Session 9 Government financing and debt

... 8% per annum – but this is unlikely, as lending involves risk. Commercial banks want to make a profit from their loans, taking into account the risks involved: therefore, they add a ‘risk premium’. Imagine that you are the Director of Credit at “First Bank”, a leading commercial bank in your country ...

... 8% per annum – but this is unlikely, as lending involves risk. Commercial banks want to make a profit from their loans, taking into account the risks involved: therefore, they add a ‘risk premium’. Imagine that you are the Director of Credit at “First Bank”, a leading commercial bank in your country ...