Using Derivatives to Manage Interest Rate Risk Derivatives A

... County Bank (as the buyer) with a six-month maturity based on a $1 million notional principal amount The floating rate is the 3-month LIBOR and the fixed (exercise) rate is 7% Metro Bank would refer to this as a “3 vs. 6” FRA at 7 percent on a $1 million notional amount from County Bank The phrase “ ...

... County Bank (as the buyer) with a six-month maturity based on a $1 million notional principal amount The floating rate is the 3-month LIBOR and the fixed (exercise) rate is 7% Metro Bank would refer to this as a “3 vs. 6” FRA at 7 percent on a $1 million notional amount from County Bank The phrase “ ...

Risk Management Lessons from the Credit Crisis

... risk factors, could be incorrect. These fall in the broad category of model risk. As an example of the first problem, many portfolios unexpected lost money on basis trades during 2008. These involve hedged positions. For instance, a trader could buy a corporate bond and at the same time purchase a c ...

... risk factors, could be incorrect. These fall in the broad category of model risk. As an example of the first problem, many portfolios unexpected lost money on basis trades during 2008. These involve hedged positions. For instance, a trader could buy a corporate bond and at the same time purchase a c ...

Curriculum Map - Morgan County School District Re-3

... of income and compare an average budget with monthly expenditures. Plan purchases for cash and for credit. evaluate purchase in terms of needs and desires. Determine the cash required for living expenses. ...

... of income and compare an average budget with monthly expenditures. Plan purchases for cash and for credit. evaluate purchase in terms of needs and desires. Determine the cash required for living expenses. ...

Quadrants of Risk

... Organizations define types of risk differently. Some organizations consider legal risks as operational risk, and some may characterize certain hazard risks as operational risk. Financial institutions generally use the categories of market, credit, and operational risk (defined as all other risk, inc ...

... Organizations define types of risk differently. Some organizations consider legal risks as operational risk, and some may characterize certain hazard risks as operational risk. Financial institutions generally use the categories of market, credit, and operational risk (defined as all other risk, inc ...

7 tips to weather market volatility and stay

... As you saw on page 1, fixed income as a broad asset class typically does not move in lockstep with the stock market. Because of its low correlation to equities, fixed income provides a good source of diversification and can help manage the volatility of the stock market. It’s important to also under ...

... As you saw on page 1, fixed income as a broad asset class typically does not move in lockstep with the stock market. Because of its low correlation to equities, fixed income provides a good source of diversification and can help manage the volatility of the stock market. It’s important to also under ...

Phil Cosson Senior Municipal Advisor

... – Second, the debt policies transmit the message to investors and rating agencies that the municipality is committed to sound financial management; and – Third, debt policies can provide consistency and continuity to public policy development for staff and elected officials. ...

... – Second, the debt policies transmit the message to investors and rating agencies that the municipality is committed to sound financial management; and – Third, debt policies can provide consistency and continuity to public policy development for staff and elected officials. ...

MAINE STATE LEGISLATURE

... while they may not affect a vehicle’s performance, they will affect your satisfaction. Once you have your list together, organize the features from most to least important. ...

... while they may not affect a vehicle’s performance, they will affect your satisfaction. Once you have your list together, organize the features from most to least important. ...

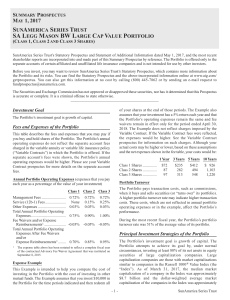

SAST - SA Legg Mason BW Large Cap Value

... assumes that your investment has a 5% return each year and that the Portfolio’s operating expenses remain the same and fee waivers remain in effect only for the period ended April 30, 2018. The Example does not reflect charges imposed by the Variable Contract. If the Variable Contract fees were refl ...

... assumes that your investment has a 5% return each year and that the Portfolio’s operating expenses remain the same and fee waivers remain in effect only for the period ended April 30, 2018. The Example does not reflect charges imposed by the Variable Contract. If the Variable Contract fees were refl ...

Safe Assets

... The analysis ignores possibilities of default and neglects transaction costs associated with interest and principal payments; that is, with collecting on loans.4 In this case, bonds pay the risk-free interest rate for period t, denoted rtf . The amount of principal and interest received or paid on b ...

... The analysis ignores possibilities of default and neglects transaction costs associated with interest and principal payments; that is, with collecting on loans.4 In this case, bonds pay the risk-free interest rate for period t, denoted rtf . The amount of principal and interest received or paid on b ...

UNIVERSITY OF LOUISVILLE ATHLETIC ASSOCIATION, INC. A

... The following discussion and analysis provides an overview of the financial position and activities of the University of Louisville Athletic Association, Inc. (Association) as of and for the years ended June 30, 2016, 2015, and 2014. This discussion has been prepared by management and should be read ...

... The following discussion and analysis provides an overview of the financial position and activities of the University of Louisville Athletic Association, Inc. (Association) as of and for the years ended June 30, 2016, 2015, and 2014. This discussion has been prepared by management and should be read ...

Financial-Accounting-6th-Edition-Libby-Test-Bank

... 63. Which of the following is true? A. Assets increase on their right side because they are on the right side of the accounting equation. B. Liabilities increase on their right side because they are on the right side of the accounting equation. C. Stockholders' equity accounts increase on their left ...

... 63. Which of the following is true? A. Assets increase on their right side because they are on the right side of the accounting equation. B. Liabilities increase on their right side because they are on the right side of the accounting equation. C. Stockholders' equity accounts increase on their left ...

A Primer on Bonds Bond Prices and Yields

... Pension funds pay lifetime annuities to recipients. è Firm expects to be in business indefinitely, its pension obligation ≈ perpetuity. è Suppose, your pension fund must make perpetual payments of $2 million/year. è The yield to maturity on all bonds is 16%. (a) duration of 5-year bonds with coupon ...

... Pension funds pay lifetime annuities to recipients. è Firm expects to be in business indefinitely, its pension obligation ≈ perpetuity. è Suppose, your pension fund must make perpetual payments of $2 million/year. è The yield to maturity on all bonds is 16%. (a) duration of 5-year bonds with coupon ...

How and Why Credit Rating Agencies are not Like Other Gatekeepers

... In addition, credit rating agencies continue to face conflicts of interest that are potentially more serious than those of other gatekeepers: they continue to be paid directly by issuers, they give unsolicited ratings that at least potentially pressure issuers to pay them fees, and they market ancil ...

... In addition, credit rating agencies continue to face conflicts of interest that are potentially more serious than those of other gatekeepers: they continue to be paid directly by issuers, they give unsolicited ratings that at least potentially pressure issuers to pay them fees, and they market ancil ...

Introduction to Real Estate

... Although population growth won't likely contribute the boost in the future that it has over the last 50 years, America's housing stock is aging and will require replacement. According to a 2009 Census Study2, of the 130 million total housing units in the United States, more than 41 million, nearly a ...

... Although population growth won't likely contribute the boost in the future that it has over the last 50 years, America's housing stock is aging and will require replacement. According to a 2009 Census Study2, of the 130 million total housing units in the United States, more than 41 million, nearly a ...

Broker-Dealer Trading Activities

... assess the quality of competing markets to assure that order flow is directed to markets providing the most beneficial terms for their customers' orders. While in the past quote-based executions in OTC securities were generally recognized as satisfying best executions obligations, the development of ...

... assess the quality of competing markets to assure that order flow is directed to markets providing the most beneficial terms for their customers' orders. While in the past quote-based executions in OTC securities were generally recognized as satisfying best executions obligations, the development of ...