89KB - NZQA

... Carl could recommend to Bill that they offer a prompt payment discount / do credit checks on all customers before allowing credit / set up a system to show an alert for aged debtors / follow up on overdue accounts (any other relevant example) ...

... Carl could recommend to Bill that they offer a prompt payment discount / do credit checks on all customers before allowing credit / set up a system to show an alert for aged debtors / follow up on overdue accounts (any other relevant example) ...

PHS templates for offers of Debt Securities Hybrid Instruments and

... relevant entity’s business operations, financial position and results, and the investor’s investment in the debentures if they occur. If a particular risk falls into multiple categories below, it is sufficient to include the risk under one category. There is no need to repeat the risk in more than o ...

... relevant entity’s business operations, financial position and results, and the investor’s investment in the debentures if they occur. If a particular risk falls into multiple categories below, it is sufficient to include the risk under one category. There is no need to repeat the risk in more than o ...

IAT FED

... Development of strict rules to qualify observable parameters may transfer business to non regulated industry (hedge funds) Tailor made synthetic instruments (CDO’s, Power Duals…) may become less secure for investors Workshop on Accounting Risk Management and Prudential Regulation Basel, 11 – 12 Nove ...

... Development of strict rules to qualify observable parameters may transfer business to non regulated industry (hedge funds) Tailor made synthetic instruments (CDO’s, Power Duals…) may become less secure for investors Workshop on Accounting Risk Management and Prudential Regulation Basel, 11 – 12 Nove ...

A factor portfolio

... For example, a security with a positive interest rate beta performs better when rates increase, and thus would hedge the value of a portfolio against interest rate risk. ...

... For example, a security with a positive interest rate beta performs better when rates increase, and thus would hedge the value of a portfolio against interest rate risk. ...

1 Too Low for Too Long Interest Rates, Bank Risk Taking and Bank

... of three forces: interest rate pass-through risk shifting and leverage. The model differentiates the impact of interest rates on bank risk taking according to the degree of bank’s capitalization. When capital is endogenously determined, and when banks can adjust their capital holdings in response to ...

... of three forces: interest rate pass-through risk shifting and leverage. The model differentiates the impact of interest rates on bank risk taking according to the degree of bank’s capitalization. When capital is endogenously determined, and when banks can adjust their capital holdings in response to ...

Insurance-related investments strategy

... insurance premium - for taking the risk of a particular natural catastrophe causing losses above a certain level. As the occurrence of natural catastrophes has no expected correlation with share market movements, the strategy is an attractive source of diversification. For example, during the global ...

... insurance premium - for taking the risk of a particular natural catastrophe causing losses above a certain level. As the occurrence of natural catastrophes has no expected correlation with share market movements, the strategy is an attractive source of diversification. For example, during the global ...

Effect of Liquidity Risk on Financial Performance of Insurance

... managers, operations managers, marketing managers and finance managers were interviewed in all the six listed insurance firms. Census survey was conducted in the entire six listed insurance firms in Kenya. The sampling frame of this study was a total of 36 managers from the six listed insurance comp ...

... managers, operations managers, marketing managers and finance managers were interviewed in all the six listed insurance firms. Census survey was conducted in the entire six listed insurance firms in Kenya. The sampling frame of this study was a total of 36 managers from the six listed insurance comp ...

Institutional Ownership and Credit Spreads: An Information

... there is ample evidence questioning whether most institutional investors are in the business of monitoring. For instance, Chen, Harford, and Li (2007) show that in mergers and acquisitions, only independent institutions with long-term investments specialize in monitoring, while others do not. Hendry ...

... there is ample evidence questioning whether most institutional investors are in the business of monitoring. For instance, Chen, Harford, and Li (2007) show that in mergers and acquisitions, only independent institutions with long-term investments specialize in monitoring, while others do not. Hendry ...

Real Regulatory Capital Management and Dividend Payout

... solidity of the banks. Moreover, dividends transfer wealth from a bank to its owners, thus representing an asset substitution (Jensen and Meckling, 1979) that favors equity holders at the expense of creditors and other stakeholders, such as regulators (Lv et al., 2012). In this study, we provide evi ...

... solidity of the banks. Moreover, dividends transfer wealth from a bank to its owners, thus representing an asset substitution (Jensen and Meckling, 1979) that favors equity holders at the expense of creditors and other stakeholders, such as regulators (Lv et al., 2012). In this study, we provide evi ...

benefits of alternative investments

... information has been prepared by PTCo. It contains general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. You should consider, with a financial or other adviser, whether the information is suitable for you ...

... information has been prepared by PTCo. It contains general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. You should consider, with a financial or other adviser, whether the information is suitable for you ...

Chapter 23 Hedging with Financial Derivatives

... 61) The main advantage of using options on futures contracts rather than the futures contracts themselves is that A) interest rate risk is controlled while preserving the possibility of gains. B) interest rate risk is controlled, while removing the possibility of losses. C) interest rate risk is not ...

... 61) The main advantage of using options on futures contracts rather than the futures contracts themselves is that A) interest rate risk is controlled while preserving the possibility of gains. B) interest rate risk is controlled, while removing the possibility of losses. C) interest rate risk is not ...

self-study questions

... Response A: Consistency, or the use of the same accounting principles from period to period by the same firm, helps make accounting information more useful, but it is not the primary criterion by which accounting information is judged. Response B: Predictive value, or the ability of information to h ...

... Response A: Consistency, or the use of the same accounting principles from period to period by the same firm, helps make accounting information more useful, but it is not the primary criterion by which accounting information is judged. Response B: Predictive value, or the ability of information to h ...

2017 10K - The York Water Company

... authorities. Despite the Company’s adequate water supply, customers may be required to cut back water usage under such drought restrictions which would negatively impact revenues. The Company has addressed some of this vulnerability by instituting minimum customer charges which are intended to cover ...

... authorities. Despite the Company’s adequate water supply, customers may be required to cut back water usage under such drought restrictions which would negatively impact revenues. The Company has addressed some of this vulnerability by instituting minimum customer charges which are intended to cover ...

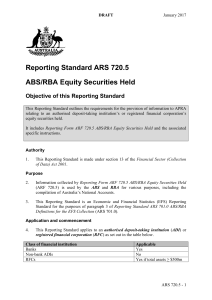

Reporting Standard ARS 720.5 ABS/RBA Equity Securities Held

... Data for resident and non-resident issuers are collected separately. Note that this treatment differs from the Reporting Form ARF 720.0A ABS/RBA Statement of Financial Position (Banks & RFCs) (ARF 720.0A) where equity securities issued by non-residents are not separately identified. Values Closing b ...

... Data for resident and non-resident issuers are collected separately. Note that this treatment differs from the Reporting Form ARF 720.0A ABS/RBA Statement of Financial Position (Banks & RFCs) (ARF 720.0A) where equity securities issued by non-residents are not separately identified. Values Closing b ...