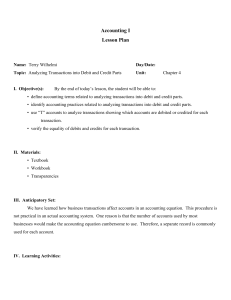

Accounting I Lesson Plan - Terry Wilhelmi`s Home Page

... 2) How is each account classified? Cash is an asset with a normal debit balance. Ben Furman is an owner’s equity account with a normal credit balance. 3) How is each account balance changed? Cash and Capital accounts are increased. 4) How is each amount entered in the account? The asset account, Cas ...

... 2) How is each account classified? Cash is an asset with a normal debit balance. Ben Furman is an owner’s equity account with a normal credit balance. 3) How is each account balance changed? Cash and Capital accounts are increased. 4) How is each amount entered in the account? The asset account, Cas ...

Part 2A of Form ADV: Forester Capital Management Ltd. Forester

... of the company, research to see if any competitive advantages exist for the company and is there information and circumstances that would act as a catalyst to drive this company and its stock to reach our perceived fair value. Through this level of review we narrow the selection down to 3545 our “hi ...

... of the company, research to see if any competitive advantages exist for the company and is there information and circumstances that would act as a catalyst to drive this company and its stock to reach our perceived fair value. Through this level of review we narrow the selection down to 3545 our “hi ...

ICAS 2015 Template

... Bank-specific or bank-characteristics data are collected from BankScope database. The sample dataset consists of 19 commercial banks in Malaysia over the period 2002-20111. The dataset compromises over 190 bank-year observations for each variable. We choose the year of 2002 as a beginning of the tim ...

... Bank-specific or bank-characteristics data are collected from BankScope database. The sample dataset consists of 19 commercial banks in Malaysia over the period 2002-20111. The dataset compromises over 190 bank-year observations for each variable. We choose the year of 2002 as a beginning of the tim ...

annual report - Beige Capital

... BEIGE Capital Savings and Loans (BCSL) was adjudged the best Savings and Loans Company and inducted into the ‘Made in Ghana Hall of Fame’ at the 3rd Made in Ghana Awards 2015. The Company was also commended for its general banking and investment services in the Financial Services Provider category. ...

... BEIGE Capital Savings and Loans (BCSL) was adjudged the best Savings and Loans Company and inducted into the ‘Made in Ghana Hall of Fame’ at the 3rd Made in Ghana Awards 2015. The Company was also commended for its general banking and investment services in the Financial Services Provider category. ...

Chapter 1

... A simple capital needs analysis takes into account all financial cash flow factors. A risk adjusted capital needs analysis provides a subjective attempt to account for uncertainty. Monte Carlo Simulations can present the probability of achieving a certain outcome. Total Portfolio Management provides ...

... A simple capital needs analysis takes into account all financial cash flow factors. A risk adjusted capital needs analysis provides a subjective attempt to account for uncertainty. Monte Carlo Simulations can present the probability of achieving a certain outcome. Total Portfolio Management provides ...

Spiceland, Chapter 3

... Reports the cash effects of transactions that enter into the determination of net income. The direct method and indirect method are two different approaches to report cash flows from operations. Each has its advantages and disadvantages, but each reconciles to the same number for total cash flows fr ...

... Reports the cash effects of transactions that enter into the determination of net income. The direct method and indirect method are two different approaches to report cash flows from operations. Each has its advantages and disadvantages, but each reconciles to the same number for total cash flows fr ...

Settlement model

... The fact that final securities transfers precede final funds transfers in this model clearly has the potential to expose sellers of securities to substantial principal risk To provide strong assurances that sellers will receive payment for delivered securities : creation of an assured payment system ...

... The fact that final securities transfers precede final funds transfers in this model clearly has the potential to expose sellers of securities to substantial principal risk To provide strong assurances that sellers will receive payment for delivered securities : creation of an assured payment system ...

Addressing Market Liquidity

... yield curve, issuing bonds with longer maturities (such as 10-year, 15-year, 20-year and then 30-year). In addition, it also established a public calendar of issuance so that the exact size of each treasury bill and bond issue is made known one week before the auction. To build their yield curves, I ...

... yield curve, issuing bonds with longer maturities (such as 10-year, 15-year, 20-year and then 30-year). In addition, it also established a public calendar of issuance so that the exact size of each treasury bill and bond issue is made known one week before the auction. To build their yield curves, I ...

Bank Capital Methodology And Assumptions - A

... • Changed some of the weights we use to calculate RWA to align them more closely to the stress scenarios presented in Appendix IV of "Understanding Standard & Poor's Rating Definitions," published June 3, 2009; • Revised some of the data we use in the RACF and the risk weights we apply to improve gl ...

... • Changed some of the weights we use to calculate RWA to align them more closely to the stress scenarios presented in Appendix IV of "Understanding Standard & Poor's Rating Definitions," published June 3, 2009; • Revised some of the data we use in the RACF and the risk weights we apply to improve gl ...

Common clauses and stipulations in loan agreements

... stipulations in loan agreements The aim of this article is to explain some common clauses and stipulations in loan agreements underlying financial transactions. Without prejudice to common characteristics of the clauses as described below, the parties should check the wording of each particular clau ...

... stipulations in loan agreements The aim of this article is to explain some common clauses and stipulations in loan agreements underlying financial transactions. Without prejudice to common characteristics of the clauses as described below, the parties should check the wording of each particular clau ...

WORD

... paragraph 2, subparagraph 4 regarding when no closing price is available on the day of the reverse auction, plus 10 to 20 percent. Article 16 When two or more securities finance enterprises simultaneously engage securities broker(s) to conduct a reverse auction for a given security, a single revers ...

... paragraph 2, subparagraph 4 regarding when no closing price is available on the day of the reverse auction, plus 10 to 20 percent. Article 16 When two or more securities finance enterprises simultaneously engage securities broker(s) to conduct a reverse auction for a given security, a single revers ...

Document

... “Derivative” to include : A security derived from a debt instrument ,share, loan, whether secured or unsecured risk instrument or contract for differences or any other form of security. A contract which derives its value from the prices, or index of prices, of underlying securities. ...

... “Derivative” to include : A security derived from a debt instrument ,share, loan, whether secured or unsecured risk instrument or contract for differences or any other form of security. A contract which derives its value from the prices, or index of prices, of underlying securities. ...

Agriculture Risk Management - Western Region Colorado State

... a. A sure gain of $500 (1 point). b. A 50% chance to gain $1,000 and a $50% chance to gain nothing (3 points). 8. Suppose a relative left you an inheritance of $100,000, stipulating that you invest ALL the money in one of the following choices. Which one would you select? a. A “low risk, low potenti ...

... a. A sure gain of $500 (1 point). b. A 50% chance to gain $1,000 and a $50% chance to gain nothing (3 points). 8. Suppose a relative left you an inheritance of $100,000, stipulating that you invest ALL the money in one of the following choices. Which one would you select? a. A “low risk, low potenti ...

Wells Fargo/BlackRock Short-Term Investment Fund Disclosure

... illiquid due to factors affecting securities markets generally or particular industries represented in the securities markets, such as labor shortages or increased production costs and competitive conditions within an industry. A security may decline in value or become illiquid due to general market ...

... illiquid due to factors affecting securities markets generally or particular industries represented in the securities markets, such as labor shortages or increased production costs and competitive conditions within an industry. A security may decline in value or become illiquid due to general market ...

Interest Rates in Mexico The Role of Exchange Rate Expectations

... function) to the implicit yield from the secondary market of Mexico's external debt. That is, it is postulated that domestic interest rates in Mexico are closely associated to the international perception of Mexico's creditworthiness, which is captured in the behavior of itsm. 1/ The implicit hypoth ...

... function) to the implicit yield from the secondary market of Mexico's external debt. That is, it is postulated that domestic interest rates in Mexico are closely associated to the international perception of Mexico's creditworthiness, which is captured in the behavior of itsm. 1/ The implicit hypoth ...

National Foreclosure Settlement

... debtors. This description does not say that. Ally will try to force the borrower into this option. Make sure to state that the payments are not sustainable for the borrower if that is true, in which case the borrower will be considered for the other options.. 2) Underwater with Credit Degradation, r ...

... debtors. This description does not say that. Ally will try to force the borrower into this option. Make sure to state that the payments are not sustainable for the borrower if that is true, in which case the borrower will be considered for the other options.. 2) Underwater with Credit Degradation, r ...

How to Make Money with Them and Why Governments Care

... value. Moreover, there isn't a single, unique measure of it. Potential credit exposure can be your expected potential exposure or your worse case potential exposure. The different measures are useful for different purposes. Legal risks are the third element. The most important are to do with enforce ...

... value. Moreover, there isn't a single, unique measure of it. Potential credit exposure can be your expected potential exposure or your worse case potential exposure. The different measures are useful for different purposes. Legal risks are the third element. The most important are to do with enforce ...

1. Introduction to risk

... • A constant time horizon, such as one year. • A hold-to-maturity or run-off time horizon. 2.8. Any modeling of credit risk is dependent on certain data requirements being met. The quality of this data will directly affect the accuracy of the measurement of credit risk and therefore any decision to ...

... • A constant time horizon, such as one year. • A hold-to-maturity or run-off time horizon. 2.8. Any modeling of credit risk is dependent on certain data requirements being met. The quality of this data will directly affect the accuracy of the measurement of credit risk and therefore any decision to ...

Financial Management

... It deals with the Credit i.e is the provision of resources (such as granting a loan) by one party to another party where that second party does not reimburse the first party immediately, thereby generating a debt, and instead arranges either to repay or return those resources (or material(s) of equa ...

... It deals with the Credit i.e is the provision of resources (such as granting a loan) by one party to another party where that second party does not reimburse the first party immediately, thereby generating a debt, and instead arranges either to repay or return those resources (or material(s) of equa ...