Inflation-Indexed Securities: Description and Market Experience

... Low trading volume and evidence of illiquidity are consistent with the observation that inflationindexed securities are “buy-and-hold” instruments among both individual and institutional investors. In other words, investors such as banks and pension funds are buying inflation-indexed notes and bonds ...

... Low trading volume and evidence of illiquidity are consistent with the observation that inflationindexed securities are “buy-and-hold” instruments among both individual and institutional investors. In other words, investors such as banks and pension funds are buying inflation-indexed notes and bonds ...

(Convenience Translation into English from the Original Previously

... Opinion on the Individual Financial Statements In our opinion, the individual financial statements present fairly, in all material respects, the financial position of Tupy S.A. as at December 31, 2010, and its financial performance and its cash flows for the year then ended in accordance with accoun ...

... Opinion on the Individual Financial Statements In our opinion, the individual financial statements present fairly, in all material respects, the financial position of Tupy S.A. as at December 31, 2010, and its financial performance and its cash flows for the year then ended in accordance with accoun ...

Centene Corporation - corporate

... offer to sell only the debt securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date. ...

... offer to sell only the debt securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date. ...

James Stokes (Spring `10, file)

... world, and Lehman Brothers was no exception to this view. Lehman Brothers had been around for well over a hundred years and at the turn of the twenty-first century it, “was the fourth-largest investment bank in the United States” (Q&A, par. 16). Many people viewed this corporation in a similar fashi ...

... world, and Lehman Brothers was no exception to this view. Lehman Brothers had been around for well over a hundred years and at the turn of the twenty-first century it, “was the fourth-largest investment bank in the United States” (Q&A, par. 16). Many people viewed this corporation in a similar fashi ...

harvard, yale, and alternative investments: a post

... The assets of the endowment or foundation are used to supplement the income of the organization Endowment spending averages 4.4% of assets, while foundations are legally required to spend at least 5% of assets annually. Universities with larger endowments have higher average spending rates Spe ...

... The assets of the endowment or foundation are used to supplement the income of the organization Endowment spending averages 4.4% of assets, while foundations are legally required to spend at least 5% of assets annually. Universities with larger endowments have higher average spending rates Spe ...

Explaining the Excess Spread Premiums on Catastrophe Bonds

... We find that, for catastrophe-event risk, investors care the probability of exhaustion and probability of first dollar loss but not the conditional expected losses. Moreover, issuers pay a higher price for CAT bonds with non-investment grade ratings or those covering multiple perils. However, CAT bo ...

... We find that, for catastrophe-event risk, investors care the probability of exhaustion and probability of first dollar loss but not the conditional expected losses. Moreover, issuers pay a higher price for CAT bonds with non-investment grade ratings or those covering multiple perils. However, CAT bo ...

Everett mortgage email e-mail

... phone number lookup, address lookup, and more. Use your Microsoft account. What's this? Email, phone, or Skype. No account? Create one! Kiel Mortgage Home Loans “Big enough to do the job. Small enough to care.” Over the last three decades, Kiel Mortgage has been serving the home lending needs of. Ab ...

... phone number lookup, address lookup, and more. Use your Microsoft account. What's this? Email, phone, or Skype. No account? Create one! Kiel Mortgage Home Loans “Big enough to do the job. Small enough to care.” Over the last three decades, Kiel Mortgage has been serving the home lending needs of. Ab ...

An Analysis of Default Risk in the Home Equity Conversion

... have sufficient equity to fund the set aside, in addition to paying off their mortgage debt and other obligations. Thus the proportion of seniors who are eligible to obtain a HECM will fall. To understand this tradeoff, our analysis explores the impact of different credit thresholds and LESA requir ...

... have sufficient equity to fund the set aside, in addition to paying off their mortgage debt and other obligations. Thus the proportion of seniors who are eligible to obtain a HECM will fall. To understand this tradeoff, our analysis explores the impact of different credit thresholds and LESA requir ...

bonds plus 400 fund - Insight Investment

... long in breakevens. Our credit exposure was the largest positive contributor. We held a modest long in credit combined with some single name credit default swap positions. Our long in assetbacked securities also continued to perform positively. Sub-investment grade and emerging market exposure was n ...

... long in breakevens. Our credit exposure was the largest positive contributor. We held a modest long in credit combined with some single name credit default swap positions. Our long in assetbacked securities also continued to perform positively. Sub-investment grade and emerging market exposure was n ...

Net Noninterest Income

... • Stock Values and Profitability Ratios • Measuring Credit, Liquidity, and Other Risks • The UBPR and Comparing Performance McGraw-Hill/Irwin Bank Management and Financial Services, 7/e ...

... • Stock Values and Profitability Ratios • Measuring Credit, Liquidity, and Other Risks • The UBPR and Comparing Performance McGraw-Hill/Irwin Bank Management and Financial Services, 7/e ...

perceptron, inc.

... recorded at market value using the specific identification method. Investments expected to be held to maturity or until market conditions improve are measured at amortized cost in the statement of financial ...

... recorded at market value using the specific identification method. Investments expected to be held to maturity or until market conditions improve are measured at amortized cost in the statement of financial ...

The role of the central bank balance sheet in monetary policy

... financial market prices. The article identifies two types of active policy. “Credit easing” measures are targeted interventions that aim to influence credit spreads by altering the composition of the central bank balance sheet in order to improve the transmission of the desired monetary policy stanc ...

... financial market prices. The article identifies two types of active policy. “Credit easing” measures are targeted interventions that aim to influence credit spreads by altering the composition of the central bank balance sheet in order to improve the transmission of the desired monetary policy stanc ...

ExerCh15

... of revenue sources did change somewhat. The NASCAR broadcasting revenue increased as a percent of total revenue by almost two percentage points, while the percent of admissions revenue to total revenue decreased by about 1%. Two of the major expense categories (direct expense of events and NASCAR pu ...

... of revenue sources did change somewhat. The NASCAR broadcasting revenue increased as a percent of total revenue by almost two percentage points, while the percent of admissions revenue to total revenue decreased by about 1%. Two of the major expense categories (direct expense of events and NASCAR pu ...

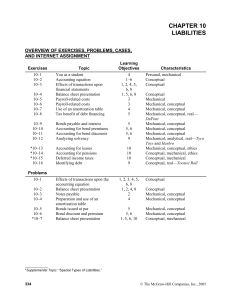

Internet Assignment

... future purchases or sales of inventory or of other assets. If they are material in dollar amount, the terms of commitments should be disclosed in financial statements. No liability normally is recorded, because the commitment relates to future transactions, rather than to past transactions. *23. The ...

... future purchases or sales of inventory or of other assets. If they are material in dollar amount, the terms of commitments should be disclosed in financial statements. No liability normally is recorded, because the commitment relates to future transactions, rather than to past transactions. *23. The ...

Wells Fargo Total Loss-Absorbing Capacity (“TLAC”) Disclosure

... The orderly liquidation authority also requires that creditors and shareholders of the financial company in receivership must bear all losses before taxpayers are exposed to any losses, and amounts owed by the financial company or the receivership to the U.S. government would generally receive a sta ...

... The orderly liquidation authority also requires that creditors and shareholders of the financial company in receivership must bear all losses before taxpayers are exposed to any losses, and amounts owed by the financial company or the receivership to the U.S. government would generally receive a sta ...

Deposits and Relationship Lending

... We empirically examine the hypothesis that access to deposits with inelastic rates (core deposits) permits a bank to make contractual agreements with borrowers that are infeasible if the bank must pay market rates for its funds. Access to core deposits insulates a bank’s costs of funds from exogenou ...

... We empirically examine the hypothesis that access to deposits with inelastic rates (core deposits) permits a bank to make contractual agreements with borrowers that are infeasible if the bank must pay market rates for its funds. Access to core deposits insulates a bank’s costs of funds from exogenou ...

Quantifying the Value of Implicit Government Guarantees for Large

... framework, default occurs when the value of the firm’s assets is insufficient to allow the firm to meet its contractual obligations. The unobservable business value of the firm is inferred from equity prices, together with the company’s capital structure, and the business risk of the firm. Over the ...

... framework, default occurs when the value of the firm’s assets is insufficient to allow the firm to meet its contractual obligations. The unobservable business value of the firm is inferred from equity prices, together with the company’s capital structure, and the business risk of the firm. Over the ...

How did US corporate securities markets differ from Europe`s before

... Economic historians have long extolled the gains from financial development. 1 By combining the capital of thousands of small investors, stock markets enabled the achievement of economies of scale or scope in large enterprises which would have posed serious challenges for most personally-owned enter ...

... Economic historians have long extolled the gains from financial development. 1 By combining the capital of thousands of small investors, stock markets enabled the achievement of economies of scale or scope in large enterprises which would have posed serious challenges for most personally-owned enter ...