characteristics of financial instruments and a description of risk

... The risk associated with the possibility of system failures, personnel or procedural problems, as well as the intended actions of persons representing the parties to the transaction or third parties, aimed at obtaining illegitimate benefits. This risk may affect directly or indirectly the parties to ...

... The risk associated with the possibility of system failures, personnel or procedural problems, as well as the intended actions of persons representing the parties to the transaction or third parties, aimed at obtaining illegitimate benefits. This risk may affect directly or indirectly the parties to ...

Portfolio rebalancing is the process of bringing the different asset

... Portfolios are adjusted if and when a particular asset class deviates from its target allocation by more than a certain amount—say plus or minus five percentage points. So if, for example, the target for large-cap stocks was 60%, but a market rise caused that share to climb above 65%, stocks would ...

... Portfolios are adjusted if and when a particular asset class deviates from its target allocation by more than a certain amount—say plus or minus five percentage points. So if, for example, the target for large-cap stocks was 60%, but a market rise caused that share to climb above 65%, stocks would ...

Managing Short-Term Capital Flows in New Central Banking

... For new (performing) general purpose standard loans (Group 1), general provisions were increased from 1 percent to 4 percent. Specific provisions for closely followed up loans (Group 2) increased from 2 percent to 8 percent. The higher provisioning requirements are for banks having a consumer loan p ...

... For new (performing) general purpose standard loans (Group 1), general provisions were increased from 1 percent to 4 percent. Specific provisions for closely followed up loans (Group 2) increased from 2 percent to 8 percent. The higher provisioning requirements are for banks having a consumer loan p ...

Cash Is KIng, and There`s no heIr To The Throne

... The contents of this document should not be treated as advice in relation to any potential investment. Past investment results are not indicative of future investment results. The value of all investments and the income derived therefrom can decrease as well as increase. This may be partly due to ex ...

... The contents of this document should not be treated as advice in relation to any potential investment. Past investment results are not indicative of future investment results. The value of all investments and the income derived therefrom can decrease as well as increase. This may be partly due to ex ...

Student Study Notes - Chapter 5

... from your income statement) and then adjust this amount up or down to account for any income statement entries that do not actually provide or use cash. The accrual income statement must be converted to a cash basis in order to report cash flow from operating activities. The two most common items on ...

... from your income statement) and then adjust this amount up or down to account for any income statement entries that do not actually provide or use cash. The accrual income statement must be converted to a cash basis in order to report cash flow from operating activities. The two most common items on ...

PVH CORP. /DE/ (Form: 8-K, Received: 01/07/2015

... Act of 1995. Investors are cautioned that such forward-looking statements are inherently subject to risks and uncertainties, many of which cannot be predicted with accuracy, and some of which might not be anticipated, including, without limitation (i) the Company ’ s plans, strategies, objectives, e ...

... Act of 1995. Investors are cautioned that such forward-looking statements are inherently subject to risks and uncertainties, many of which cannot be predicted with accuracy, and some of which might not be anticipated, including, without limitation (i) the Company ’ s plans, strategies, objectives, e ...

Repo and Securities Lending - Federal Reserve Bank of New York

... agents. 10 In addition to providing collateral management and settlement services, the clearing banks finance the dealers’ securities during the day under current market practice. 11 The intraday credit exposure results in high concentration risk of the clearing banks vis-à-vis tri-party repo borrow ...

... agents. 10 In addition to providing collateral management and settlement services, the clearing banks finance the dealers’ securities during the day under current market practice. 11 The intraday credit exposure results in high concentration risk of the clearing banks vis-à-vis tri-party repo borrow ...

A Call to ARMs: Adjustable Rate Mortgages in the 1980s

... benefit from lower interest rates in the future without incurring the cost of refinancing. Third, ARMs appeal to households that expect their income to be positively correlated with interest rate fluctuations so that their payments and their ability to make those payments would tend to rise and fall ...

... benefit from lower interest rates in the future without incurring the cost of refinancing. Third, ARMs appeal to households that expect their income to be positively correlated with interest rate fluctuations so that their payments and their ability to make those payments would tend to rise and fall ...

APRA Prudential Standard APS 330 Capital and Credit Risk

... One of APRA's main focus areas in ensuring that the member's funds are safe is to ensure that financial institutions hold adequate amounts of capital. In 2008 Prudential Standard 'APS 330 Capital Adequacy: Public Disclosure of Prudential Information' became effective. The standard requires financial ...

... One of APRA's main focus areas in ensuring that the member's funds are safe is to ensure that financial institutions hold adequate amounts of capital. In 2008 Prudential Standard 'APS 330 Capital Adequacy: Public Disclosure of Prudential Information' became effective. The standard requires financial ...

A Causal Framework for Credit Default Theory

... corporate financial conditions, leading to possible credit defaults. Most existing theories1 of credit default do not meet this causal requirement. The purpose of this paper is to set down a framework from which causal credit default theories can be developed through a new structure for incorporatin ...

... corporate financial conditions, leading to possible credit defaults. Most existing theories1 of credit default do not meet this causal requirement. The purpose of this paper is to set down a framework from which causal credit default theories can be developed through a new structure for incorporatin ...

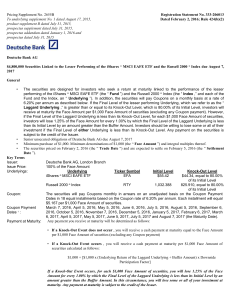

DEUTSCHE BANK AKTIENGESELLSCHAFT (Form

... Issuer’s Estimated Value of the Securities The Issuer’s estimated value of the securities is equal to the sum of our valuations of the following two components of the securities: (i) a bond and (ii) an embedded derivative(s). The value of the bond component of the securities is calculated based on ...

... Issuer’s Estimated Value of the Securities The Issuer’s estimated value of the securities is equal to the sum of our valuations of the following two components of the securities: (i) a bond and (ii) an embedded derivative(s). The value of the bond component of the securities is calculated based on ...

Technical Handbook

... received after the cut-off time and there is insufficient cover available because the tier two investment has already been effected, these payment orders shall not be effected until sufficient funds are once again available in the account. Retransfer, including interest, is effected on the maturity ...

... received after the cut-off time and there is insufficient cover available because the tier two investment has already been effected, these payment orders shall not be effected until sufficient funds are once again available in the account. Retransfer, including interest, is effected on the maturity ...

insights - Private Ocean

... question. Will the recent (at least 25 years) relationship prevail and stocks continue to underperform with an ERP of zero or negative? Or do we currently witness a great buying opportunity for stocks as the long-run risk differential from 1926 to 2008 based on Ibbotson continues and the recent diff ...

... question. Will the recent (at least 25 years) relationship prevail and stocks continue to underperform with an ERP of zero or negative? Or do we currently witness a great buying opportunity for stocks as the long-run risk differential from 1926 to 2008 based on Ibbotson continues and the recent diff ...

Timothy Plan High Yield Bond Fund Class I

... intended to address any individual's investment objectives, financial situation or personal circumstances. We recommend that investors define their goals, risk tolerance, time horizon and investment objectives in addition to researching possible investment choices. Target date funds are built for in ...

... intended to address any individual's investment objectives, financial situation or personal circumstances. We recommend that investors define their goals, risk tolerance, time horizon and investment objectives in addition to researching possible investment choices. Target date funds are built for in ...

The Second Circuit`s Role in Expanding the SEC`s Jurisdiction Abroad

... The Second Circuit has had such a profound impact on securities law that it has been referred to in this context as the "Mother Court."1 The breadth and significance of Second Circuit securities law decisions is not surprising. New York City is the financial center of the United States and the secur ...

... The Second Circuit has had such a profound impact on securities law that it has been referred to in this context as the "Mother Court."1 The breadth and significance of Second Circuit securities law decisions is not surprising. New York City is the financial center of the United States and the secur ...

Accelerating growth and creating value

... Consolidated Financial Statements are available on our Investor Relations website under www.siemens.com. Siemens ties a portion of its executive incentive compensation to achieving economic value added (EVA) targets. EVA measures the profitability of a business (using Group profit for the Operating ...

... Consolidated Financial Statements are available on our Investor Relations website under www.siemens.com. Siemens ties a portion of its executive incentive compensation to achieving economic value added (EVA) targets. EVA measures the profitability of a business (using Group profit for the Operating ...