Chapter 1

... selling mortgage-backed securities. Standards for obtaining loans were greatly loosened, so that many mortgages were being issued to subprime borrowers with flawed credit histories. Adjustable-rate mortgages allowed borrowers to pay a very low interest rate. In 2006, housing prices began to decline, ...

... selling mortgage-backed securities. Standards for obtaining loans were greatly loosened, so that many mortgages were being issued to subprime borrowers with flawed credit histories. Adjustable-rate mortgages allowed borrowers to pay a very low interest rate. In 2006, housing prices began to decline, ...

Do Debt Markets Price Ṣukūk and Conventional Bonds

... and bonds because of the belief that these are similar. Thus, the main purpose of this paper is to report findings on this central research question as to whether there is empirical evidence to support the claim that these two types of debt instruments are the same. By using the market pricing behav ...

... and bonds because of the belief that these are similar. Thus, the main purpose of this paper is to report findings on this central research question as to whether there is empirical evidence to support the claim that these two types of debt instruments are the same. By using the market pricing behav ...

DEBT FINANCING

... Allows many companies to borrow, at a fixed interest rate, funds which otherwise would not be available and/or would only be available at a higher interest rate. ...

... Allows many companies to borrow, at a fixed interest rate, funds which otherwise would not be available and/or would only be available at a higher interest rate. ...

WHAT YOU NEED TO KNOW ABOUT THE EU

... NFC used in the SFTR is broader than under EMIR as it extends to non-EU entities (third country entities or TCEs) that would be FCs/NFCs (as appropriate) if they were in the EU. This is because EU branches of these entities are in scope for SFTR, and for the Reuse Obligation these entities will be i ...

... NFC used in the SFTR is broader than under EMIR as it extends to non-EU entities (third country entities or TCEs) that would be FCs/NFCs (as appropriate) if they were in the EU. This is because EU branches of these entities are in scope for SFTR, and for the Reuse Obligation these entities will be i ...

cash - Initial Set Up

... Notes Payable A note payable is is a written promise to pay a stated sum at one or more specified future dates. A note payable may require a singlesum repayment at the due date or maturity date or it may call for installment payments. If it requires regular payments in installments it is called an ...

... Notes Payable A note payable is is a written promise to pay a stated sum at one or more specified future dates. A note payable may require a singlesum repayment at the due date or maturity date or it may call for installment payments. If it requires regular payments in installments it is called an ...

M.Sc. ACTUARIAL SCIENCE

... To ensure transparency of the evaluation process, the internal assessment grade awarded to the students in each course in a semester shall be published on the notice board at least one week before the commencement of external examination. There shall not be any chance for improvement for internal g ...

... To ensure transparency of the evaluation process, the internal assessment grade awarded to the students in each course in a semester shall be published on the notice board at least one week before the commencement of external examination. There shall not be any chance for improvement for internal g ...

Zest Interims 2009 PDF

... Zest owns 100% of the recording and publishing rights of all five Nasio Fontaine's albums and is currently negotiating a new worldwide license deal. In addition, VP Records/Greensleeves will be releasing a "Best of" Nasio album with a DVD late in the summer of 2009. To support this release, Nasio is ...

... Zest owns 100% of the recording and publishing rights of all five Nasio Fontaine's albums and is currently negotiating a new worldwide license deal. In addition, VP Records/Greensleeves will be releasing a "Best of" Nasio album with a DVD late in the summer of 2009. To support this release, Nasio is ...

The Relationship between Mortgage Markets and House Prices

... main theoretical studies have considered mortgage credit and house prices separately. As for the studies on the specific relationship between house prices and mortgage financing can be classified in two main approaches: the financial-type or asset market approach and the macroeconomic approach. The ...

... main theoretical studies have considered mortgage credit and house prices separately. As for the studies on the specific relationship between house prices and mortgage financing can be classified in two main approaches: the financial-type or asset market approach and the macroeconomic approach. The ...

Chapter 2

... owner’s equity. SO 2 Define debits and credits and explain their use in recording business transactions. ...

... owner’s equity. SO 2 Define debits and credits and explain their use in recording business transactions. ...

First-Time International Bond Issuance—New Opportunities

... create a benchmark for the corporate sector. Some countries were planning to use at least a part of the proceeds for budgetary purposes, or, as in the case of Honduras, to cover arrears. International bonds have also been issued as part of debt restructuring process, as for instance Seychelles (2010 ...

... create a benchmark for the corporate sector. Some countries were planning to use at least a part of the proceeds for budgetary purposes, or, as in the case of Honduras, to cover arrears. International bonds have also been issued as part of debt restructuring process, as for instance Seychelles (2010 ...

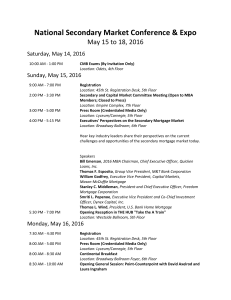

Editable Agenda - Mortgage Bankers Association

... General Session: Update on the Single Security & Common Securitization Platform Location: Broadway Ballroom, 6th Floor The common securitization platform and single security are key transition steps that are developing the foundation of the future housing finance system. As the anticipated roll-out ...

... General Session: Update on the Single Security & Common Securitization Platform Location: Broadway Ballroom, 6th Floor The common securitization platform and single security are key transition steps that are developing the foundation of the future housing finance system. As the anticipated roll-out ...

Payment and Settlement Systems – Changing Global Dynamics

... from the outset (new messages had to be developed for T2S, as no international standards previously existed) EU: in the securities industry the EU is driven by the Giovannini Protocol, aiming at eliminating barriers that hamper efficient cross border activities in Europe (harmonising different sta ...

... from the outset (new messages had to be developed for T2S, as no international standards previously existed) EU: in the securities industry the EU is driven by the Giovannini Protocol, aiming at eliminating barriers that hamper efficient cross border activities in Europe (harmonising different sta ...