Timothy Plan High Yield Bond Fund Class I

... intended to address any individual's investment objectives, financial situation or personal circumstances. We recommend that investors define their goals, risk tolerance, time horizon and investment objectives in addition to researching possible investment choices. Target date funds are built for in ...

... intended to address any individual's investment objectives, financial situation or personal circumstances. We recommend that investors define their goals, risk tolerance, time horizon and investment objectives in addition to researching possible investment choices. Target date funds are built for in ...

Investing in Real Estate in a Shariah Compliant Way

... Evidence investors’ right to return based on profitable investment Return results from actual asset ownership ...

... Evidence investors’ right to return based on profitable investment Return results from actual asset ownership ...

11-1 Low-Risk Choices - St. Pius X High School

... issuer to repay the bond early (before the maturity date) at a set amount – The amount is typically higher than the face value – If interest rates are dropping, corporations may choose to call the bonds because they can re-issue them at a lower interest rate. ...

... issuer to repay the bond early (before the maturity date) at a set amount – The amount is typically higher than the face value – If interest rates are dropping, corporations may choose to call the bonds because they can re-issue them at a lower interest rate. ...

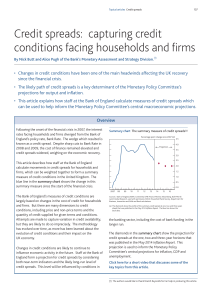

NBER WORKING PAPER SERIES PRICE Nicolae Gârleanu

... sharply, and central banks stretched their balance sheets to facilitate funding. These funding problems had significant asset-pricing effects, the most extreme example being the failure of the Law of One Price: securities with (nearly) identical cash flows traded at different prices, giving rise to ...

... sharply, and central banks stretched their balance sheets to facilitate funding. These funding problems had significant asset-pricing effects, the most extreme example being the failure of the Law of One Price: securities with (nearly) identical cash flows traded at different prices, giving rise to ...

ROYAL BANK OF CANADA

... Return is positive, Royal Bank of Canada will repay the principal amount at maturity plus pay a return equal to 1.5 (the “Multiplier”) times the Index Return, up to the Maximum Gain. If the Index Return is zero or negative, and the Index Ending Level is greater than or equal to the Trigger Level, Ro ...

... Return is positive, Royal Bank of Canada will repay the principal amount at maturity plus pay a return equal to 1.5 (the “Multiplier”) times the Index Return, up to the Maximum Gain. If the Index Return is zero or negative, and the Index Ending Level is greater than or equal to the Trigger Level, Ro ...

and Accounts Receivable Methods Percent of

... Credit Card Sales On July 16, 2011, Barton, Co. has a bank credit card sale of $500 to a customer. The bank charges a processing fee of 2%. Barton remits the credit card sale to the credit card company and waits for the payment that is received on July 28. Jul. 16 Accounts Receivable - Credit Card C ...

... Credit Card Sales On July 16, 2011, Barton, Co. has a bank credit card sale of $500 to a customer. The bank charges a processing fee of 2%. Barton remits the credit card sale to the credit card company and waits for the payment that is received on July 28. Jul. 16 Accounts Receivable - Credit Card C ...

The Islamic Finance and Markets Review – the Cayman

... file those accounts with CIMA within six months of the end of its financial year; c to pay an annual filing fee; and d to have appointed to its board of directors at least two directors at any one time. Generally, these should be individuals. If CIMA is satisfied that a regulated ...

... file those accounts with CIMA within six months of the end of its financial year; c to pay an annual filing fee; and d to have appointed to its board of directors at least two directors at any one time. Generally, these should be individuals. If CIMA is satisfied that a regulated ...

Cost of Capital for a Project

... If the firm uses debt, the equity beta is higher than the asset beta (since debt is first in line, levered equity is riskier than the firm’s underlying assets): ...

... If the firm uses debt, the equity beta is higher than the asset beta (since debt is first in line, levered equity is riskier than the firm’s underlying assets): ...

Business Advance Studies - Financial Literacy Pretest

... 6. _____ limits your liability for credit cards that are lost or stolen to $50 per card if you properly and promptly notify the card issuer of the loss. a. The Equal Credit Opportunity Act c. The Truth in Lending Act b. The Fair Credit Reporting Act d. none of these ...

... 6. _____ limits your liability for credit cards that are lost or stolen to $50 per card if you properly and promptly notify the card issuer of the loss. a. The Equal Credit Opportunity Act c. The Truth in Lending Act b. The Fair Credit Reporting Act d. none of these ...

McGraw-Hill/Irwin

... • If you are considering a project that will increase the firm’s taxable income by $1 million, what tax rate should you use in your analysis? ...

... • If you are considering a project that will increase the firm’s taxable income by $1 million, what tax rate should you use in your analysis? ...

Sun Pharmaceuticals (SUNPHA)

... CAGR in FY11-16P on the back of successful acquisitions such as Caraco, Taro (recently Dusa, URL) and timely product launches (recent launch of gGleevec under exclusivity). US product basket remains robust- 572 ANDAs filed, 413 approvals received; some niche launches include Lipodox/ Doxil, Doxycycl ...

... CAGR in FY11-16P on the back of successful acquisitions such as Caraco, Taro (recently Dusa, URL) and timely product launches (recent launch of gGleevec under exclusivity). US product basket remains robust- 572 ANDAs filed, 413 approvals received; some niche launches include Lipodox/ Doxil, Doxycycl ...

SUBPriME MOrTGAGE CriSiS iN THE UNiTED STATES iN 2007–2008

... As long as housing prices kept climbing, fuelled by ever-increasing levels of debt and leveraging, all these problems remained hidden. The rising house prices provided the borrowers in financial trouble with an incentive to sell their homes and pay off their mortgages prematurely. In 2006, when pric ...

... As long as housing prices kept climbing, fuelled by ever-increasing levels of debt and leveraging, all these problems remained hidden. The rising house prices provided the borrowers in financial trouble with an incentive to sell their homes and pay off their mortgages prematurely. In 2006, when pric ...

International Financial Reporting Standards (IFRS)

... Revenue shall be measured at the fair value of the consideration received or receivable taking into account the amount of any trade discounts and volume rebates allowed by the entity. In most cases, the consideration is in the form of cash or cash equivalents and the amount of revenue is the amount ...

... Revenue shall be measured at the fair value of the consideration received or receivable taking into account the amount of any trade discounts and volume rebates allowed by the entity. In most cases, the consideration is in the form of cash or cash equivalents and the amount of revenue is the amount ...