INVESTMENT POLICY STATEMENT APPROVED JANUARY 30

... manner consistent with the investment objectives stated herein. The Foundation, for purposes of this policy, are the investment assets of Florida Chamber Foundation where the Foundation has full discretionary authority over the investment of the corpus and the use of the income generated by the corp ...

... manner consistent with the investment objectives stated herein. The Foundation, for purposes of this policy, are the investment assets of Florida Chamber Foundation where the Foundation has full discretionary authority over the investment of the corpus and the use of the income generated by the corp ...

THE CAPITAL ASSET PRICING MODEL`S RISK

... years, using weekly and monthly returns, respectively. Gunthorpe and Levy (1994) found that stocks with betas below one based on daily returns had betas above one based on annual returns, and vice versa. Levy, Gunthorpe, and Wachowicz (1994) indicated that the return interval used for the beta estim ...

... years, using weekly and monthly returns, respectively. Gunthorpe and Levy (1994) found that stocks with betas below one based on daily returns had betas above one based on annual returns, and vice versa. Levy, Gunthorpe, and Wachowicz (1994) indicated that the return interval used for the beta estim ...

***** 1

... adjustment to the cost of the combination contingent on future events, the acquirer shall include the estimated amount of that adjustment in the cost of the combination at the acquisition date if the adjustment is probable and can be measured reliably. However, if the potential adjustment is not rec ...

... adjustment to the cost of the combination contingent on future events, the acquirer shall include the estimated amount of that adjustment in the cost of the combination at the acquisition date if the adjustment is probable and can be measured reliably. However, if the potential adjustment is not rec ...

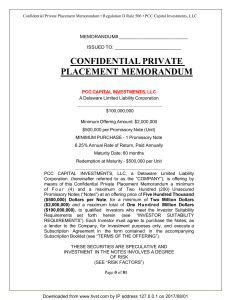

CONFIDENTIAL PRIVATE PLACEMENT MEMORANDUM

... IMPORTANT NOTICES This Confidential Private Placement Offering Memorandum (“Memorandum”) is submitted to you on a confidential basis solely for the purpose of evaluating the specific transaction described herein. This information shall not be photocopied, reproduced or distributed to others without ...

... IMPORTANT NOTICES This Confidential Private Placement Offering Memorandum (“Memorandum”) is submitted to you on a confidential basis solely for the purpose of evaluating the specific transaction described herein. This information shall not be photocopied, reproduced or distributed to others without ...

it`s not about

... to lower oil and commodity prices; the slowdown in regional trading partners; instances of political instability; and water and electricity shortages, although Kenya (home to I&M Group, a 50% shareholder in Bank One) was one of the few economies to show resilience against these headwinds. In Mauriti ...

... to lower oil and commodity prices; the slowdown in regional trading partners; instances of political instability; and water and electricity shortages, although Kenya (home to I&M Group, a 50% shareholder in Bank One) was one of the few economies to show resilience against these headwinds. In Mauriti ...

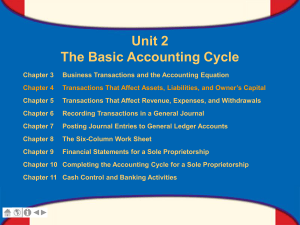

Learning Objectives

... account requires a credit. The Owner’s Drawing account , a temporary owner’s equity account, is increased with a debit. Cash, an asset account, is decreasing and requires a credit. © Paradigm Publishing, Inc. ...

... account requires a credit. The Owner’s Drawing account , a temporary owner’s equity account, is increased with a debit. Cash, an asset account, is decreasing and requires a credit. © Paradigm Publishing, Inc. ...

0001558370-16-008972 - Douglas Dynamics Investor Relations

... by generally accepted accounting principles for fiscal year-end financial statements. In the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation have been included. For further information, refer to the financial statements an ...

... by generally accepted accounting principles for fiscal year-end financial statements. In the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation have been included. For further information, refer to the financial statements an ...

Operating Conditions Applicable to the Firm

... Fixed Overheads Requirement (FOR) - 25% of annual fixed overheads ...

... Fixed Overheads Requirement (FOR) - 25% of annual fixed overheads ...

determining the risk free rate for regulated companies

... The resolution of this paradox is as follows. The CAPM is a one period model, i.e., if the investor horizon is one year then the model can only directly value a cash flow arising in one year. To employ it to value a cash flow arising subsequently requires further assumptions. In particular, it is ne ...

... The resolution of this paradox is as follows. The CAPM is a one period model, i.e., if the investor horizon is one year then the model can only directly value a cash flow arising in one year. To employ it to value a cash flow arising subsequently requires further assumptions. In particular, it is ne ...

Alternatives jor Debt Management

... Treasury for the cyclical implications of its debt actions, can serve as a substitute for an explicit "separation of functions" under which the Treasury would determine only the gross and the Fed the net (publicly held) maturity structure of the debt. We shall shortly ask whether the maturity struct ...

... Treasury for the cyclical implications of its debt actions, can serve as a substitute for an explicit "separation of functions" under which the Treasury would determine only the gross and the Fed the net (publicly held) maturity structure of the debt. We shall shortly ask whether the maturity struct ...

Credit Scores, Reports, and Getting Ahead in

... Southern county have scores that suggest they are very risky borrowers. ■ Between 1999 and 2004, most counties with weak consumer credit scores saw declines in the average consumer credit score, while counties with strong scores generally experienced modest gains. Nationwide, credit scores only mode ...

... Southern county have scores that suggest they are very risky borrowers. ■ Between 1999 and 2004, most counties with weak consumer credit scores saw declines in the average consumer credit score, while counties with strong scores generally experienced modest gains. Nationwide, credit scores only mode ...

Market and Public Liquidity

... For θ = .35 the immediate and delayed trading equilibrium are such that (Mi∗ , m∗i ) = (.0169, .9358) and (Md∗ , m∗d ) = (.0540, .4860), respectively. Moreover, although both equilibria are interim efficient, it can be shown that the delayed trading equilibrium (weakly) Pareto dominates the immediat ...

... For θ = .35 the immediate and delayed trading equilibrium are such that (Mi∗ , m∗i ) = (.0169, .9358) and (Md∗ , m∗d ) = (.0540, .4860), respectively. Moreover, although both equilibria are interim efficient, it can be shown that the delayed trading equilibrium (weakly) Pareto dominates the immediat ...

3354:1-20-07 Investment policy

... (7) To maintain an appropriate asset allocation based on a total return policy that is compatible with a flexible spending policy, while having the potential to produce positive real returns. (8) To provide an equity/fixed income portfolio of readily marketable assets with an asset allocation weight ...

... (7) To maintain an appropriate asset allocation based on a total return policy that is compatible with a flexible spending policy, while having the potential to produce positive real returns. (8) To provide an equity/fixed income portfolio of readily marketable assets with an asset allocation weight ...

Net Income

... accounting equation involved and if a particular account is increased or decreased; recording transactions in the permanent record; summarizing the transactions in the form of financial statements; and finally interpreting where conclusions and decisions are made from the financial statements. Throu ...

... accounting equation involved and if a particular account is increased or decreased; recording transactions in the permanent record; summarizing the transactions in the form of financial statements; and finally interpreting where conclusions and decisions are made from the financial statements. Throu ...

44 STRESS TEST FOR ISLAMIC AND CONVENTIONAL BANKS

... the sample into two groups by business model (i.e. 5 conventional banks, and 3 Islamic banks) and try to capture the impact of these shocks on each group of banks applying the same procedures as those followed for the whole banking sector. To achieve this we attempt to examine potential implications ...

... the sample into two groups by business model (i.e. 5 conventional banks, and 3 Islamic banks) and try to capture the impact of these shocks on each group of banks applying the same procedures as those followed for the whole banking sector. To achieve this we attempt to examine potential implications ...

as a PDF - Illinois Law Review

... agency from holding more than 10% of the agency’s value; and limiting the agency’s business to credit ratings). Taiwan requires rating agencies to partner with an internationally recognized rating agency, and also imposes standards similar to those in Latin America as well as overseeing agency struc ...

... agency from holding more than 10% of the agency’s value; and limiting the agency’s business to credit ratings). Taiwan requires rating agencies to partner with an internationally recognized rating agency, and also imposes standards similar to those in Latin America as well as overseeing agency struc ...

Cost Basis Reporting Law - Wolters Kluwer Financial Services

... reflect corporate actions that may occur between the date of death and conveyance of those shares to the recipient. In the case of reporting of inheritance related transfers, the broker does not need to contact the representative of estate and request values as of date of death for transferred securi ...

... reflect corporate actions that may occur between the date of death and conveyance of those shares to the recipient. In the case of reporting of inheritance related transfers, the broker does not need to contact the representative of estate and request values as of date of death for transferred securi ...