NBER WORKING PAPER SERIES Mark Aguiar Gita Gopinath

... standard business cycle model in which shocks represent transitory deviations around a stable trend. We find that default occurs extremely rarely — roughly two defaults every 2,500 years. The intuition for this is described in detail in Section 3. The weakness of the standard model begins with the ...

... standard business cycle model in which shocks represent transitory deviations around a stable trend. We find that default occurs extremely rarely — roughly two defaults every 2,500 years. The intuition for this is described in detail in Section 3. The weakness of the standard model begins with the ...

Armour Residential REIT, Inc.

... reporting period. Actual results could differ from those estimates. Significant estimates affecting the accompanying financial statements include the valuation of Agency Securities and interest rate contracts. Cash Cash includes cash on deposit with financial institutions and investments in high qua ...

... reporting period. Actual results could differ from those estimates. Significant estimates affecting the accompanying financial statements include the valuation of Agency Securities and interest rate contracts. Cash Cash includes cash on deposit with financial institutions and investments in high qua ...

The Market for Corporate Control and the Cost of Debt

... We use the di¤erences-in-di¤erences approach to gauge the e¤ect of the BC laws. Specifically, we compare the change in credit spread around the time a BC law was passed (say, year t) for …rms a¤ected by the law to the change in credit spread for …rms una¤ected by the law. Our sample consists of 3,9 ...

... We use the di¤erences-in-di¤erences approach to gauge the e¤ect of the BC laws. Specifically, we compare the change in credit spread around the time a BC law was passed (say, year t) for …rms a¤ected by the law to the change in credit spread for …rms una¤ected by the law. Our sample consists of 3,9 ...

2006 Annual Report - Media Corporate IR Net

... One of the most important moves we made in 2006 to pursue growth in the wealth management business was our agreement to acquire U.S. Trust for $3.3 billion, a transaction we expect to close in the third quarter of 2007. As one of the oldest, largest and most respected private banks in the country, U ...

... One of the most important moves we made in 2006 to pursue growth in the wealth management business was our agreement to acquire U.S. Trust for $3.3 billion, a transaction we expect to close in the third quarter of 2007. As one of the oldest, largest and most respected private banks in the country, U ...

New York 2008

... Kevin Heller, the Head of Research at Focus Investment Group. We were founded in 1994 as an asset management company with a fund of funds as the principal product. We partner with private banks and other institutions looking for alternative strategies. Over these 14 years we have placed a heavy emph ...

... Kevin Heller, the Head of Research at Focus Investment Group. We were founded in 1994 as an asset management company with a fund of funds as the principal product. We partner with private banks and other institutions looking for alternative strategies. Over these 14 years we have placed a heavy emph ...

Solutions to Questions and Problems

... If it has too much cash it can simply pay a dividend, or, more likely in the current financial environment, buy back stock. It can also reduce debt. If it has insufficient cash, then it must either borrow, sell stock, or improve profitability. ...

... If it has too much cash it can simply pay a dividend, or, more likely in the current financial environment, buy back stock. It can also reduce debt. If it has insufficient cash, then it must either borrow, sell stock, or improve profitability. ...

payments and securities clearance and settlement systems in

... National Bank (SNB), and the U.S. Securities and Exchange Commission (SEC). Other central banks, securities commissions and international organizations are expected to join the IAC over the course of the program. To assure quality and effectiveness, the CISPI includes two important elements. First, ...

... National Bank (SNB), and the U.S. Securities and Exchange Commission (SEC). Other central banks, securities commissions and international organizations are expected to join the IAC over the course of the program. To assure quality and effectiveness, the CISPI includes two important elements. First, ...

Market Discipline and Subordinated Debt: A Review of

... corporate governance problem. Furthermore, both equity holders and bondholders are harmed when the banks they invest in make poor investment decisions. (The appendix assesses the evidence concerning these two potential regulatory problems.) The idealized worldview underlying subordinated debt propos ...

... corporate governance problem. Furthermore, both equity holders and bondholders are harmed when the banks they invest in make poor investment decisions. (The appendix assesses the evidence concerning these two potential regulatory problems.) The idealized worldview underlying subordinated debt propos ...

ICON Leasing Fund Twelve, LLC - corporate

... We write to briefly summarize our activity for the third quarter of 2009. A more detailed analysis, which we encourage you to read, is contained in our Form 10-Q. Our Form 10-Q and our other quarterly, annual and current reports are available in the Investor Relations section of our website, www.ico ...

... We write to briefly summarize our activity for the third quarter of 2009. A more detailed analysis, which we encourage you to read, is contained in our Form 10-Q. Our Form 10-Q and our other quarterly, annual and current reports are available in the Investor Relations section of our website, www.ico ...

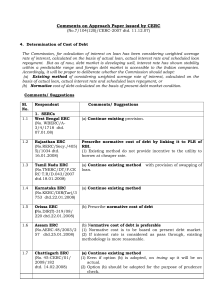

Comments on approach paper 04 - Central Electricity Regulatory

... promoters shall be at liberty to borrow loan at the rate available in the market. (2) In ROE, follow existing method: (i) Though interest rate stabilised and debt market is developing, time is required so that promoters can efficiently and easily avail loan from market at competitive rates (referred ...

... promoters shall be at liberty to borrow loan at the rate available in the market. (2) In ROE, follow existing method: (i) Though interest rate stabilised and debt market is developing, time is required so that promoters can efficiently and easily avail loan from market at competitive rates (referred ...