The determinants of government bond yield spreads in

... goal of creating a standardized European public debt market. Indeed, euro-area governments have witnessed a considerable narrowing in their borrowing costs following the introduction of the single currency. However, the financial crisis has marked the beginning of a turnaround in the EMU government ...

... goal of creating a standardized European public debt market. Indeed, euro-area governments have witnessed a considerable narrowing in their borrowing costs following the introduction of the single currency. However, the financial crisis has marked the beginning of a turnaround in the EMU government ...

NBER WORKING PAPER SERIES SUSTAINABLE SHADOW BANKING Guillermo Ordonez Working Paper 19022

... safe assets. I assume a planner would like banks to invest in risky assets if the risky asset is superior or in safe assets if the risky asset is inferior. However, banks have incentives to always invest in risky assets, regardless of their type. This excessive risk-taking arises because outside in ...

... safe assets. I assume a planner would like banks to invest in risky assets if the risky asset is superior or in safe assets if the risky asset is inferior. However, banks have incentives to always invest in risky assets, regardless of their type. This excessive risk-taking arises because outside in ...

DOC - Europa.eu

... The Short Selling Regulation sets out certain restrictions on uncovered short sales of sovereign debt, in order to reduce the risks of settlement failure. To enter a short sale, an investor must have borrowed the sovereign debt, entered into an agreement to borrow it, or have an arrangement with a t ...

... The Short Selling Regulation sets out certain restrictions on uncovered short sales of sovereign debt, in order to reduce the risks of settlement failure. To enter a short sale, an investor must have borrowed the sovereign debt, entered into an agreement to borrow it, or have an arrangement with a t ...

SECURITIES AND EXCHANGE COMMISSION Washington, D.C.

... products and pricing may have upon the Company, (d) the likelihood that revenues may vary significantly from one accounting period to another accounting period due to a variety of factors, including customers' buying decisions, the Company's product mix and general market and economic conditions, (e ...

... products and pricing may have upon the Company, (d) the likelihood that revenues may vary significantly from one accounting period to another accounting period due to a variety of factors, including customers' buying decisions, the Company's product mix and general market and economic conditions, (e ...

Defaultable Debt, Interest Rates and the Current Account

... does not lead to default at a rate that resembles those observed in many economies over the last 150 years. To see the intuition behind why default occurs so rarely in a model with transitory shocks and a stable trend, consider that the decision to default rests on the difference between the present ...

... does not lead to default at a rate that resembles those observed in many economies over the last 150 years. To see the intuition behind why default occurs so rarely in a model with transitory shocks and a stable trend, consider that the decision to default rests on the difference between the present ...

May 15, 2017 Basel Committee on Banking Supervision Bank for

... Nowhere does the Second Consultation acknowledge that regulated money market funds in the United States, Europe and elsewhere now are subject to much stricter requirements than those in place in 2008. This is surprising, because the Committee’s initial consultation discussed in some detail the money ...

... Nowhere does the Second Consultation acknowledge that regulated money market funds in the United States, Europe and elsewhere now are subject to much stricter requirements than those in place in 2008. This is surprising, because the Committee’s initial consultation discussed in some detail the money ...

Old Globe Theatre dba The Old Globe

... remaining trust assets. The fair value of the future benefits to be received by The Old Globe was determined using a discounted cash‐flow model and was recorded in the statement of changes in net assets as temporarily restricted contributions in the year the trust w ...

... remaining trust assets. The fair value of the future benefits to be received by The Old Globe was determined using a discounted cash‐flow model and was recorded in the statement of changes in net assets as temporarily restricted contributions in the year the trust w ...

challenges smes face in acquiring loans from banks

... to firms to finance their business activities (Scarborough 2012). Firms prefer commercial loans because they have lower interest rates as compared to other debt options (Gary 2005). Commercial banks gives different kinds of loans to businesses. Short term loans are loans given to firms for less or w ...

... to firms to finance their business activities (Scarborough 2012). Firms prefer commercial loans because they have lower interest rates as compared to other debt options (Gary 2005). Commercial banks gives different kinds of loans to businesses. Short term loans are loans given to firms for less or w ...

Asset Allocation by Institutional Investors after the Recent Financial

... not traditionally allocated a high percentage of their portfolios to equities, even their allocation to domestic equities dropped from 11% to 6% between 2005 and 2009. With global stocks off 50% in 2008, it is not surprising that equities became a smaller part of institutional allocations. Since ins ...

... not traditionally allocated a high percentage of their portfolios to equities, even their allocation to domestic equities dropped from 11% to 6% between 2005 and 2009. With global stocks off 50% in 2008, it is not surprising that equities became a smaller part of institutional allocations. Since ins ...

malta financial services authority

... clients such that they are reasonably able to understand the nature and risks of the Investment Service to be provided and of the specific type of instrument that is being offered, and consequently to take investment decisions on an informed basis. In addition, the appropriateness of the instrument ...

... clients such that they are reasonably able to understand the nature and risks of the Investment Service to be provided and of the specific type of instrument that is being offered, and consequently to take investment decisions on an informed basis. In addition, the appropriateness of the instrument ...

S2AV: A valuation methodology for insurance companies

... In the authors’ experience, buyers and other users of insurance company valuations are often keen to understand the shareholder “cash flows,” i.e., the expected real world distributable profits. In such cases buyers will generally want to discount these cash flows at the investor’s required rate of ...

... In the authors’ experience, buyers and other users of insurance company valuations are often keen to understand the shareholder “cash flows,” i.e., the expected real world distributable profits. In such cases buyers will generally want to discount these cash flows at the investor’s required rate of ...

CITIGROUP`S 2007 ANNUAL REPORT ON FORM 10-K

... driven by a change in estimate of loan losses, increased NCLs and net builds to loan loss reserves. The increases were due to a weakening in credit indicators and sharply higher delinquencies on first and second mortgages related to the deterioration in the U.S. housing market. The NCL ratio increas ...

... driven by a change in estimate of loan losses, increased NCLs and net builds to loan loss reserves. The increases were due to a weakening in credit indicators and sharply higher delinquencies on first and second mortgages related to the deterioration in the U.S. housing market. The NCL ratio increas ...

0001053532-17-000022 - Lasalle Hotel Properties

... The consolidated financial statements include the accounts of the Company, the Operating Partnership, LHL and their subsidiaries in which they have a controlling interest, including joint ventures. All significant intercompany balances and transactions have been eliminated. Use of Estimates The prep ...

... The consolidated financial statements include the accounts of the Company, the Operating Partnership, LHL and their subsidiaries in which they have a controlling interest, including joint ventures. All significant intercompany balances and transactions have been eliminated. Use of Estimates The prep ...

after Morrison v National Australia Bank

... plaintiffs must prove that any losses resulted from the fraud itself and not other market forces such as investor expectations, market conditions, or developments within the company. See id, 544 US at 343: Given the tangle of factors affecting price, the most logic alone permits us to say is that th ...

... plaintiffs must prove that any losses resulted from the fraud itself and not other market forces such as investor expectations, market conditions, or developments within the company. See id, 544 US at 343: Given the tangle of factors affecting price, the most logic alone permits us to say is that th ...

perspectives on dynamic asset allocation

... theoretical framework, especially following recent, substantial, global financial crises, which resulted in a low return environment and increasing regulatory pressure. Long-term investors (such as pension funds) now face a dilemma. On one side, they need to take on risk to meet their future engagem ...

... theoretical framework, especially following recent, substantial, global financial crises, which resulted in a low return environment and increasing regulatory pressure. Long-term investors (such as pension funds) now face a dilemma. On one side, they need to take on risk to meet their future engagem ...

An Investigation into the Impact of Debt Financing

... return to shareholders whilst the use of equity does not enjoy such benefit. Besides the tax advantage, cost of debt is generally low as compared to equity due to the lower risk associated with debt as debt holders has the first claim in the case of insolvency (Damodaran, 1999:103). Debt also makes ...

... return to shareholders whilst the use of equity does not enjoy such benefit. Besides the tax advantage, cost of debt is generally low as compared to equity due to the lower risk associated with debt as debt holders has the first claim in the case of insolvency (Damodaran, 1999:103). Debt also makes ...

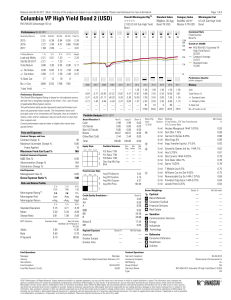

Columbia VP High Yield Bond 2 (USD)

... The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate; thus an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or ...

... The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate; thus an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or ...

ASTRAZENECA PLC (Form: F-3ASR, Received: 11/22/2016 11:52:39)

... may offer. Moreover, these subsidiaries and affiliated companies are not required and may not be able to pay us dividends or otherwise distribute or advance cash to us, which could limit the amount of funds available to meet payment obligations under the debt securities. In addition, claims of the c ...

... may offer. Moreover, these subsidiaries and affiliated companies are not required and may not be able to pay us dividends or otherwise distribute or advance cash to us, which could limit the amount of funds available to meet payment obligations under the debt securities. In addition, claims of the c ...