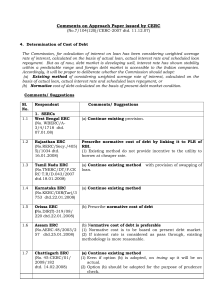

Comments on approach paper 04 - Central Electricity Regulatory

... promoters shall be at liberty to borrow loan at the rate available in the market. (2) In ROE, follow existing method: (i) Though interest rate stabilised and debt market is developing, time is required so that promoters can efficiently and easily avail loan from market at competitive rates (referred ...

... promoters shall be at liberty to borrow loan at the rate available in the market. (2) In ROE, follow existing method: (i) Though interest rate stabilised and debt market is developing, time is required so that promoters can efficiently and easily avail loan from market at competitive rates (referred ...

Agent Based-Stock Flow Consistent Macroeconomics: Towards a

... out, the national account identity between investment and savings implies that lending is a pre-condition for savings, rather than a consequence. Second, as long as banks are free to create claims which are universally accepted as means of payment, their credit creation potential does not find any up ...

... out, the national account identity between investment and savings implies that lending is a pre-condition for savings, rather than a consequence. Second, as long as banks are free to create claims which are universally accepted as means of payment, their credit creation potential does not find any up ...

Italy - Marcello Minenna

... The Sentix Index estimates the one-year probability of Italy leaving the monetary union based on the assessment of investors. The index spiked to 19% in November 2016 before recently moderating to 15%. This compared with the 2.5% average in 2012-1H16 and signals the increase in the market's concerns ...

... The Sentix Index estimates the one-year probability of Italy leaving the monetary union based on the assessment of investors. The index spiked to 19% in November 2016 before recently moderating to 15%. This compared with the 2.5% average in 2012-1H16 and signals the increase in the market's concerns ...

Credit growth in Central and Eastern Europe: new (over)shooting

... used in the paper “Private credit in 129 countries” (NBER Working Paper No. 11078), to Ivanna Vladkova-Hollar for providing us with the financial liberalization indicator, to Gergő Kiss for sharing data on housing prices in Hungary, and to Rafal Kierzenkowski, Lubos Komárek, Mindaugas Leika and Peet ...

... used in the paper “Private credit in 129 countries” (NBER Working Paper No. 11078), to Ivanna Vladkova-Hollar for providing us with the financial liberalization indicator, to Gergő Kiss for sharing data on housing prices in Hungary, and to Rafal Kierzenkowski, Lubos Komárek, Mindaugas Leika and Peet ...

Chapter 03 PowerPoint

... statements for comparison purposes • Know how to compute and interpret important financial ratios • Know the determinants of a firm’s profitability and growth • Understand the problems and pitfalls in financial statement analysis Copyright © 2011 McGraw-Hill Australia Pty Ltd PPTs t/a Essentials of ...

... statements for comparison purposes • Know how to compute and interpret important financial ratios • Know the determinants of a firm’s profitability and growth • Understand the problems and pitfalls in financial statement analysis Copyright © 2011 McGraw-Hill Australia Pty Ltd PPTs t/a Essentials of ...

CHAPTER 2

... Benser’s profitability, as measured by the amount of income available for each share of common stock, increased by 33 percent (($1.29 – $0.97)/$0.97) during 2014. Earnings per share should not be compared across companies because the number of shares issued by companies varies widely. Thus, we canno ...

... Benser’s profitability, as measured by the amount of income available for each share of common stock, increased by 33 percent (($1.29 – $0.97)/$0.97) during 2014. Earnings per share should not be compared across companies because the number of shares issued by companies varies widely. Thus, we canno ...

uba capital plc - The Nigerian Stock Exchange

... interpretation, SIC-13 Jointly Controlled Entities – Non-Monetary Contributions by Venturers, has been incorporated in IAS 28 (as revised in 2011). IFRS 11 deals with how a joint arrangement of which two or more parties have joint control should be classified and accounted for. Under IFRS 11, there ...

... interpretation, SIC-13 Jointly Controlled Entities – Non-Monetary Contributions by Venturers, has been incorporated in IAS 28 (as revised in 2011). IFRS 11 deals with how a joint arrangement of which two or more parties have joint control should be classified and accounted for. Under IFRS 11, there ...

The importance of a well-diversified portfolio

... investing for decades. Then came the global financial crisis and the seeming failure of diversification to protect portfolios, along with the perceived depreciation of all asset classes at once. It was understandable or perhaps even essential to question whether the old rules about having a well-div ...

... investing for decades. Then came the global financial crisis and the seeming failure of diversification to protect portfolios, along with the perceived depreciation of all asset classes at once. It was understandable or perhaps even essential to question whether the old rules about having a well-div ...

Mellanox Achieves Record Quarterly Revenue in the

... costs, changes in certain deferred tax assets and gains (impairment losses) on equity investments. The company believes the nonGAAP results provide useful information to both management and investors, as these non-GAAP results exclude expenses that are not indicative of our core operating results. M ...

... costs, changes in certain deferred tax assets and gains (impairment losses) on equity investments. The company believes the nonGAAP results provide useful information to both management and investors, as these non-GAAP results exclude expenses that are not indicative of our core operating results. M ...

TOBY`S HOUSE - Mary`s Shelter

... Income Taxes – Mary’s Shelter is a tax-exempt organization (“other than a private foundation”) under Section 501(c)(3) of the Internal Revenue Code and is exempt from state franchise taxes under Section 23701(d) of the California Revenue and Taxation Code. Donated Services – Donated services are ref ...

... Income Taxes – Mary’s Shelter is a tax-exempt organization (“other than a private foundation”) under Section 501(c)(3) of the Internal Revenue Code and is exempt from state franchise taxes under Section 23701(d) of the California Revenue and Taxation Code. Donated Services – Donated services are ref ...

DOC - Investor Relations

... notes, the terms “Company,” “we,” “us,” or “our” refer to Gartner, Inc. and its consolidated subsidiaries. These interim condensed consolidated financial statements have been prepared in accordance with generally accepted accounting principles (“GAAP”) in the United States of America, as defined in ...

... notes, the terms “Company,” “we,” “us,” or “our” refer to Gartner, Inc. and its consolidated subsidiaries. These interim condensed consolidated financial statements have been prepared in accordance with generally accepted accounting principles (“GAAP”) in the United States of America, as defined in ...

Our greatest resOurce can be

... This work has been replaced by infrastructure maintenance and improvement work, which generally yields lower profit margins. NPL management continues to aggressively pursue all types of work in the many states it serves throughout the country. While the turbulence in the current economic climate is ...

... This work has been replaced by infrastructure maintenance and improvement work, which generally yields lower profit margins. NPL management continues to aggressively pursue all types of work in the many states it serves throughout the country. While the turbulence in the current economic climate is ...