An Investigation into the Impact of Debt Financing

... return to shareholders whilst the use of equity does not enjoy such benefit. Besides the tax advantage, cost of debt is generally low as compared to equity due to the lower risk associated with debt as debt holders has the first claim in the case of insolvency (Damodaran, 1999:103). Debt also makes ...

... return to shareholders whilst the use of equity does not enjoy such benefit. Besides the tax advantage, cost of debt is generally low as compared to equity due to the lower risk associated with debt as debt holders has the first claim in the case of insolvency (Damodaran, 1999:103). Debt also makes ...

Report

... Payment system – operational arrangement that enables individuals and institutions to transfer funds Settlement system – enables transfer of securities and cash to settle trades Liquidity system – inter-bank lending, repos, etc. ...

... Payment system – operational arrangement that enables individuals and institutions to transfer funds Settlement system – enables transfer of securities and cash to settle trades Liquidity system – inter-bank lending, repos, etc. ...

Financial Development and Economic Growth in Bulgaria

... example, several bankers complained that business owners who request credit are reluctant to provide information about their business. They are concerned that the banks will pass this information to the ir competitors or that the bank inspector him/herself will take advantage of the project idea. Al ...

... example, several bankers complained that business owners who request credit are reluctant to provide information about their business. They are concerned that the banks will pass this information to the ir competitors or that the bank inspector him/herself will take advantage of the project idea. Al ...

Greene County Bancorp 10K - The Bank of Greene County

... interest income to that of another institution or in analyzing any institution’s net interest income trend line over time, to correct any analytical distortion that might otherwise arise from the fact that financial institutions vary widely in the proportions of their portfolios that are invested in ...

... interest income to that of another institution or in analyzing any institution’s net interest income trend line over time, to correct any analytical distortion that might otherwise arise from the fact that financial institutions vary widely in the proportions of their portfolios that are invested in ...

SPIRE INC (Form: 424B2, Received: 02/23/2017 15:27:05)

... In our Gas Marketing segment, we continue to invest in contractual pipeline and storage assets and experienced personnel necessary to provide a competitive alternative for reliable natural gas supply to wholesale and other large commercial and industrial users of natural gas located in the central U ...

... In our Gas Marketing segment, we continue to invest in contractual pipeline and storage assets and experienced personnel necessary to provide a competitive alternative for reliable natural gas supply to wholesale and other large commercial and industrial users of natural gas located in the central U ...

Managing Risks and Designing Products for Agricultural

... and other calamities affect the yield of crops— substantially in extreme cases. For example, in 2003 the United Nations Food and Agriculture Organization (FAO) reported that the third successive year of widespread crop failures in Malawi (due to excessive rains, floods, hailstorms, and in some areas ...

... and other calamities affect the yield of crops— substantially in extreme cases. For example, in 2003 the United Nations Food and Agriculture Organization (FAO) reported that the third successive year of widespread crop failures in Malawi (due to excessive rains, floods, hailstorms, and in some areas ...

ALMADEN MINERALS LTD

... acquired 100% of the Elk gold deposit in Merritt, British Columbia and Almaden retains a 2% NSR (“Net Smelter Return”) royalty in the project. Under the terms of the agreement, Almaden received 35 million common shares of Gold Mountain and recorded a gain on sale in the amount of $4,122,166 and mana ...

... acquired 100% of the Elk gold deposit in Merritt, British Columbia and Almaden retains a 2% NSR (“Net Smelter Return”) royalty in the project. Under the terms of the agreement, Almaden received 35 million common shares of Gold Mountain and recorded a gain on sale in the amount of $4,122,166 and mana ...

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

... cash generated from the Company's initial public offering of its Class A Common Stock. Interest expense, which is allocated among all categories of costs and expenses, was less than $50,000 in both 1995 and 1994. The Company's effective tax rate increased to 43.5% in 1995 from 40.5% in 1994. This in ...

... cash generated from the Company's initial public offering of its Class A Common Stock. Interest expense, which is allocated among all categories of costs and expenses, was less than $50,000 in both 1995 and 1994. The Company's effective tax rate increased to 43.5% in 1995 from 40.5% in 1994. This in ...

The Equity Premium Stock and Bond Returns since 1802

... invested in various asset classes in The average nominal arithmetic 1802 would have accumulated to (or mean) return on stocks is 9.0 by the end of 1990. These series per cent per year over the entire are referred to as total return period. Although this can be inindexes, because they assume terprete ...

... invested in various asset classes in The average nominal arithmetic 1802 would have accumulated to (or mean) return on stocks is 9.0 by the end of 1990. These series per cent per year over the entire are referred to as total return period. Although this can be inindexes, because they assume terprete ...

Bonds Payable

... To provide greater security for bondholders, the bond agreement may specify that the issuing corporation make annual deposits of cash into a special fund—called a sinking fund—to be used to pay off the bond issue when it comes due. The sinking fund may be controlled by either the corporation or ...

... To provide greater security for bondholders, the bond agreement may specify that the issuing corporation make annual deposits of cash into a special fund—called a sinking fund—to be used to pay off the bond issue when it comes due. The sinking fund may be controlled by either the corporation or ...

HD VIEW 360 INC.

... The Company follows the provisions of ASC 740-10, Accounting for Uncertain Income Tax Positions. When tax returns are filed, it is highly certain that some positions taken would be sustained upon examination by the taxing authorities, while others are subject to uncertainty about the merits of the p ...

... The Company follows the provisions of ASC 740-10, Accounting for Uncertain Income Tax Positions. When tax returns are filed, it is highly certain that some positions taken would be sustained upon examination by the taxing authorities, while others are subject to uncertainty about the merits of the p ...

issue price: 101%

... recommendation by the Issuer to enter into any transaction with respect to the Securities. Each prospective investor contemplating a purchase of the Securities should make its own independent investigation of the risks associated with a transaction involving the Securities. An investment in the Secu ...

... recommendation by the Issuer to enter into any transaction with respect to the Securities. Each prospective investor contemplating a purchase of the Securities should make its own independent investigation of the risks associated with a transaction involving the Securities. An investment in the Secu ...

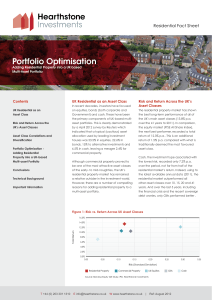

Active Equity Risk - University of California Regents

... Measures of risk are estimates of volatility, and show the amount by which asset values could increase or decrease over a given time period Portfolio risk measures are based on the volatility of each security, the size of each position, and the degree to which security prices move together Uni ...

... Measures of risk are estimates of volatility, and show the amount by which asset values could increase or decrease over a given time period Portfolio risk measures are based on the volatility of each security, the size of each position, and the degree to which security prices move together Uni ...

Interest Tax Shield Benefit

... Stockholder-Manager Agency Costs – occur to the extent that if the incentives of the managers are not perfectly identical to those of the stockholders, managers will make some decisions that benefit themselves at the expense of the stockholders. Using debt financing provides managers with incentives ...

... Stockholder-Manager Agency Costs – occur to the extent that if the incentives of the managers are not perfectly identical to those of the stockholders, managers will make some decisions that benefit themselves at the expense of the stockholders. Using debt financing provides managers with incentives ...

How to assess a manager recovery skill - ORBi

... In this section, we compare the ranking of all the risk measures we have selected with each others. We compute the risk measures for the 4,136 mutual funds in our data set over the entire period (January 2000 to March 2010). We then rank the mutual funds according to their level of risk for each ris ...

... In this section, we compare the ranking of all the risk measures we have selected with each others. We compute the risk measures for the 4,136 mutual funds in our data set over the entire period (January 2000 to March 2010). We then rank the mutual funds according to their level of risk for each ris ...