Submission to Committee for Social Development

... 2012 noted a rise in pensioner poverty in contrast to a fall in Great Britain. A significant contributory factor was the far less reliance on occupational pensions in Northern Ireland. Some claimants are likely to have modest savings yet low income. As a result, consideration should be given to an a ...

... 2012 noted a rise in pensioner poverty in contrast to a fall in Great Britain. A significant contributory factor was the far less reliance on occupational pensions in Northern Ireland. Some claimants are likely to have modest savings yet low income. As a result, consideration should be given to an a ...

Here - Punter Southall Transaction Services

... whatever the market conditions. In effect, schemes are setting their expected returns for assets such as equities as being fixed relative to gilt yields such that their discount rate effectively flows entirely from the gilt yield even though it is not set directly by reference to the gilt yield. T ...

... whatever the market conditions. In effect, schemes are setting their expected returns for assets such as equities as being fixed relative to gilt yields such that their discount rate effectively flows entirely from the gilt yield even though it is not set directly by reference to the gilt yield. T ...

This PDF is a selection from a published volume from... Economic Research Volume Title: NBER Macroeconomics Annual 2007, Volume 22

... to the inability to the higher rate for the lenders, not because generate project of any arbitrary restriction on the menus of the financial claims that they can issue. The main issues addressed that they here are general enough straint ...

... to the inability to the higher rate for the lenders, not because generate project of any arbitrary restriction on the menus of the financial claims that they can issue. The main issues addressed that they here are general enough straint ...

Document

... Controlling sales through effective stock management – Stock goes off, stock goes out of date, stock reduces in value, overstocking and leaving a surplus a company will sell for less is not good business practice. Stock control and effective resupplying – Getting in replacement good before they ...

... Controlling sales through effective stock management – Stock goes off, stock goes out of date, stock reduces in value, overstocking and leaving a surplus a company will sell for less is not good business practice. Stock control and effective resupplying – Getting in replacement good before they ...

DBRS Recovery Ratings for Non-Investment Grade

... or maintenance capital expenditures) is one early warning sign of potential default. In other cases, consideration might be appropriate for situations where an issuer may pre-emptively file for bankruptcy protection in order to reorganize its capital structure or gain concessions from labour, suppli ...

... or maintenance capital expenditures) is one early warning sign of potential default. In other cases, consideration might be appropriate for situations where an issuer may pre-emptively file for bankruptcy protection in order to reorganize its capital structure or gain concessions from labour, suppli ...

REAL ESTATE SETTLEMENT PROCEDURES ACT (RESPA) T E

... related mortgage loan shall be offered to any person. 12 U.S.C. § 2607(a). In interpreting this provision HUD has said: When a thing of value is received repeatedly and is connected in any way with the volume or value of the business referred, the receipt of the thing of value is evidence that it is ...

... related mortgage loan shall be offered to any person. 12 U.S.C. § 2607(a). In interpreting this provision HUD has said: When a thing of value is received repeatedly and is connected in any way with the volume or value of the business referred, the receipt of the thing of value is evidence that it is ...

Risk-Adjusted Performance of Private Equity Investments

... well as the possibility of transferring risk to the lenders. The leverage risk usually changes over the holding period: being initially high, but subsequently diminishing due to debt redemption and increasing equity values. With knowledge of the equity betas over time, we can create a mimicking port ...

... well as the possibility of transferring risk to the lenders. The leverage risk usually changes over the holding period: being initially high, but subsequently diminishing due to debt redemption and increasing equity values. With knowledge of the equity betas over time, we can create a mimicking port ...

building the case for social investment in credit unions

... be the main driver of capital adequacy regulation, which would allow the majority of credit unions to achieve a better capital adequacy position, and a better level of surplus generation year on year. The number of retail deposit holders in a bank is not the driver of its reserve requirements, and s ...

... be the main driver of capital adequacy regulation, which would allow the majority of credit unions to achieve a better capital adequacy position, and a better level of surplus generation year on year. The number of retail deposit holders in a bank is not the driver of its reserve requirements, and s ...

Changes in Equilibrium Interest Rates

... Wealth. When the economy is growing rapidly in a business cycle expansion and wealth is increasing, the quantity of bonds demanded at each bond price (or interest rate) increases as shown in Figure 3. To see how this works, consider point B on the initial demand curve for bonds B d1. It tells us tha ...

... Wealth. When the economy is growing rapidly in a business cycle expansion and wealth is increasing, the quantity of bonds demanded at each bond price (or interest rate) increases as shown in Figure 3. To see how this works, consider point B on the initial demand curve for bonds B d1. It tells us tha ...

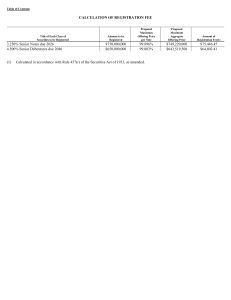

KELLOGG CO (Form: 424B5, Received: 02/26/2016 17:06:57)

... Tender Offer for 7.45% debentures due 2031 On February 25, 2016, we commenced an offer to purchase for cash (the “tender offer”) up to $440 million aggregate principal amount (the “Maximum Tender Amount”) of our 7.45% debentures due 2031 (the “2031 Debentures”). As of such date, $1,100,000,000 aggre ...

... Tender Offer for 7.45% debentures due 2031 On February 25, 2016, we commenced an offer to purchase for cash (the “tender offer”) up to $440 million aggregate principal amount (the “Maximum Tender Amount”) of our 7.45% debentures due 2031 (the “2031 Debentures”). As of such date, $1,100,000,000 aggre ...

Chapter 27 Risk Management and Financial Engineering

... If a change in the level of interest rates will adversely affect the cash flows of a company (perhaps by raising its cost of borrowing), that firm is exposed to interest rate risk. This is the single most common concern among managers engaged in risk management. Interest rate risk is the risk of suffe ...

... If a change in the level of interest rates will adversely affect the cash flows of a company (perhaps by raising its cost of borrowing), that firm is exposed to interest rate risk. This is the single most common concern among managers engaged in risk management. Interest rate risk is the risk of suffe ...

Contrmporary Finance - Sect 7

... their lender and sell their home. They want to avoid foreclosure and the lender agrees to let a new buyer purchase the home for less than the mortgage balance while the home is in foreclosure or pre-foreclosure status. In essence, the lender is willing to have the home sold and take a loss on the sa ...

... their lender and sell their home. They want to avoid foreclosure and the lender agrees to let a new buyer purchase the home for less than the mortgage balance while the home is in foreclosure or pre-foreclosure status. In essence, the lender is willing to have the home sold and take a loss on the sa ...

PALL CORP (PLL) 10-Q Quarterly report pursuant to sections 13 or

... adjustments to goodwill. The Company did not have any acquisitions during the first quarter of fiscal year 2010. The total amount of such unrecognized income tax benefits as of August 1, 2009 that would impact the effective tax rate was $15,288. In December 2007, the FASB issued authoritative guidan ...

... adjustments to goodwill. The Company did not have any acquisitions during the first quarter of fiscal year 2010. The total amount of such unrecognized income tax benefits as of August 1, 2009 that would impact the effective tax rate was $15,288. In December 2007, the FASB issued authoritative guidan ...

Credit Ratings and The Cross

... per month, only slightly lower than the 1.16% raw return. The characteristic-adjusted payoff earned by the C1 − C9 portfolio is 0.51% per month, slightly higher than the 0.47% unadjusted payoff. The monthly C1 − C10 characteristic-adjusted return is significant at 0.87% during expansions and 1.18% in ...

... per month, only slightly lower than the 1.16% raw return. The characteristic-adjusted payoff earned by the C1 − C9 portfolio is 0.51% per month, slightly higher than the 0.47% unadjusted payoff. The monthly C1 − C10 characteristic-adjusted return is significant at 0.87% during expansions and 1.18% in ...