CASCADES INC - Barchart.com

... KINGSEY FALLS, QC, June 16, 2016 – Cascades Inc. (TSX: CAS), leader in the recovery and manufacturing of green packaging and tissue products, is pleased to announce that it will build a new tissue converting plant in Scappoose, Oregon, USA. The US$64 million investment includes new state-of-the-art ...

... KINGSEY FALLS, QC, June 16, 2016 – Cascades Inc. (TSX: CAS), leader in the recovery and manufacturing of green packaging and tissue products, is pleased to announce that it will build a new tissue converting plant in Scappoose, Oregon, USA. The US$64 million investment includes new state-of-the-art ...

How to Invest in REITs

... particular company, nor does it intend to provide investment, legal or tax advice. Investors should consult with their own investment, legal or tax advisers regarding the appropriateness of investing in any of the securities or investment strategies discussed in this presentation. Nothing herein sho ...

... particular company, nor does it intend to provide investment, legal or tax advice. Investors should consult with their own investment, legal or tax advisers regarding the appropriateness of investing in any of the securities or investment strategies discussed in this presentation. Nothing herein sho ...

Responsible Asset Management

... with opportunity. This process is intended to create diversified investment strategies in order to meet the needs and goals of the client. These investment strategies may include investments in, but not limited to, equity and fixed Income securities, exchange-traded products, mutual funds, options, ...

... with opportunity. This process is intended to create diversified investment strategies in order to meet the needs and goals of the client. These investment strategies may include investments in, but not limited to, equity and fixed Income securities, exchange-traded products, mutual funds, options, ...

Advantages and Disadvantages of a Registered Public

... Issuer does not have to apply for 12g3-2(b) exemption (or comply with the above filing requirements) if it provides to investors certain operational and financial information required under Rule 144A For ADR offerings the Depositary must file a short registration statement (Form F-6) with the SE ...

... Issuer does not have to apply for 12g3-2(b) exemption (or comply with the above filing requirements) if it provides to investors certain operational and financial information required under Rule 144A For ADR offerings the Depositary must file a short registration statement (Form F-6) with the SE ...

I Overview of Market System

... It is possible to adopt Japanese GAAP, US GAAP, International Financial Reporting Standards (IFRS), or standards that a supervising J-Adviser as well as an audit firm deems equivalent to any of the abovementioned standards and TOKYO PRO Market deems appropriate. When using "standards TOKYO PRO Marke ...

... It is possible to adopt Japanese GAAP, US GAAP, International Financial Reporting Standards (IFRS), or standards that a supervising J-Adviser as well as an audit firm deems equivalent to any of the abovementioned standards and TOKYO PRO Market deems appropriate. When using "standards TOKYO PRO Marke ...

19. Investments 3: Securities Market Basics

... If you are not comfortable making your own investment decisions and would like someone to help you decide what to buy and sell, you may want to think about using a full-service broker or an investment advisor. A full-service brokerage firm provides a variety of services to its clients including rese ...

... If you are not comfortable making your own investment decisions and would like someone to help you decide what to buy and sell, you may want to think about using a full-service broker or an investment advisor. A full-service brokerage firm provides a variety of services to its clients including rese ...

department of labor retirement initiative fails to consider current

... laws. Specifically, the CEA Report claims that the different legal standards that apply to the provision of investment advice by broker-dealers and investment advisers, and the different ways in which broker-dealers and investment advisers are compensated, cause broker-dealers and some investment ad ...

... laws. Specifically, the CEA Report claims that the different legal standards that apply to the provision of investment advice by broker-dealers and investment advisers, and the different ways in which broker-dealers and investment advisers are compensated, cause broker-dealers and some investment ad ...

Shares Registration

... A corporate bond is a debt security issued by a corporation and sold to investors. The backing for the bond is usually the payment ability of the company, which is typically money to be earned from future operations. In some cases, the company's physical assets may be used as collateral for bonds. ...

... A corporate bond is a debt security issued by a corporation and sold to investors. The backing for the bond is usually the payment ability of the company, which is typically money to be earned from future operations. In some cases, the company's physical assets may be used as collateral for bonds. ...

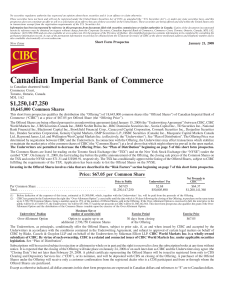

Canadian Imperial Bank of Commerce

... contains forward-looking statements within the meaning of certain securities laws. These statements include, but are not limited to, statements about the operations, business lines, financial condition, risk management, priorities, targets, ongoing objectives, strategies and outlook of CIBC for 2008 ...

... contains forward-looking statements within the meaning of certain securities laws. These statements include, but are not limited to, statements about the operations, business lines, financial condition, risk management, priorities, targets, ongoing objectives, strategies and outlook of CIBC for 2008 ...

Division 2 - Customer`s Moneys

... (e) reimbursing the holder any moneys that it has advanced to the account and any interest and returns that it is entitled to by virtue of regulation 23, so long as such withdrawal does not result in the account becoming under-margined or under-funded; (f) making a deposit in accordance with regula ...

... (e) reimbursing the holder any moneys that it has advanced to the account and any interest and returns that it is entitled to by virtue of regulation 23, so long as such withdrawal does not result in the account becoming under-margined or under-funded; (f) making a deposit in accordance with regula ...

downstream securities regulation

... under the Securities Act of 1933 (the “Securities Act”).12 It also surely delved into issuers’ “public reporting company” obligations under the Securities Exchange Act of 1934 (the “Exchange Act”).13 However, the regulation to which broker-dealers are subject (also under the Exchange Act)14 likely w ...

... under the Securities Act of 1933 (the “Securities Act”).12 It also surely delved into issuers’ “public reporting company” obligations under the Securities Exchange Act of 1934 (the “Exchange Act”).13 However, the regulation to which broker-dealers are subject (also under the Exchange Act)14 likely w ...

Regulation to amend Regulation 81

... This Appendix contains rules and accompanying commentary on those rules. Each member jurisdiction of the CSA has made these rules under authority granted to it under the securities legislation of its jurisdiction. The commentary explains the implications of a rule, offers examples or indicates diffe ...

... This Appendix contains rules and accompanying commentary on those rules. Each member jurisdiction of the CSA has made these rules under authority granted to it under the securities legislation of its jurisdiction. The commentary explains the implications of a rule, offers examples or indicates diffe ...

Circular no. 155/TT-BTC on guidelines for information disclosure on

... funds, and public investment companies shall disclose information on the means prescribed in Points a, b and c Clause 1 of this Article. 5. The SE shall disclose information on the mean prescribed in Point c Clause 1 of this Article. 6. The SDC shall disclose information on the mean prescribed in Po ...

... funds, and public investment companies shall disclose information on the means prescribed in Points a, b and c Clause 1 of this Article. 5. The SE shall disclose information on the mean prescribed in Point c Clause 1 of this Article. 6. The SDC shall disclose information on the mean prescribed in Po ...

press release

... for society. Sweco is among the ten largest consulting engineering companies in Europe, carrying out assignments in 80 countries annually throughout the world. The company has annual sales of approximately SEK 9 billion and is listed on Nasdaq Stockholm. Sweco is required to disclose the above infor ...

... for society. Sweco is among the ten largest consulting engineering companies in Europe, carrying out assignments in 80 countries annually throughout the world. The company has annual sales of approximately SEK 9 billion and is listed on Nasdaq Stockholm. Sweco is required to disclose the above infor ...

Revisiting The Inadvertent Investment Company

... application of the Investment Company Act of 1940 (the “Company Act”) to commodity pools, as opposed to mutual funds, hedge funds and private equity funds. The purpose of this article is to distinguish the boundary between an investment company, as that term is defined in the Company Act, and a comm ...

... application of the Investment Company Act of 1940 (the “Company Act”) to commodity pools, as opposed to mutual funds, hedge funds and private equity funds. The purpose of this article is to distinguish the boundary between an investment company, as that term is defined in the Company Act, and a comm ...

Guideline for Issuing institutions, executive directors and

... What are the notifying obligations? ...

... What are the notifying obligations? ...

Word - corporate

... forward-looking statements to reflect events or circumstances that occur, or which we become aware of, after the date hereof, except as otherwise may be required by law. All non-GAAP financial measure reconciliations to the most comparative GAAP measure are displayed in quantitative schedules on the ...

... forward-looking statements to reflect events or circumstances that occur, or which we become aware of, after the date hereof, except as otherwise may be required by law. All non-GAAP financial measure reconciliations to the most comparative GAAP measure are displayed in quantitative schedules on the ...

Successful GTT Initial Public Offering

... an offer to sell or subscribe, nor the solicitation of an order to purchase or subscribe, securities in such countries. This press release does not constitute or form part of an offer of securities or a solicitation for purchase, subscription or sale of securities in the United States. Securities ma ...

... an offer to sell or subscribe, nor the solicitation of an order to purchase or subscribe, securities in such countries. This press release does not constitute or form part of an offer of securities or a solicitation for purchase, subscription or sale of securities in the United States. Securities ma ...

“ЗАТВЕРДЖЕНО”

... 5.2. The Fund's net asset value does not include the value of securities, the issuance registration of which has been cancelled in accordance with the procedure established by legislature. 5.3. In calculating net asset value of the Fund, the market value of Fund’s securities. Market value of the Fun ...

... 5.2. The Fund's net asset value does not include the value of securities, the issuance registration of which has been cancelled in accordance with the procedure established by legislature. 5.3. In calculating net asset value of the Fund, the market value of Fund’s securities. Market value of the Fun ...

Margin Agreement - RBC Direct Investing

... Investing" means RBC Direct Investing Inc.; "I", "me" and "my" mean each investor; "securities" includes all stocks, bonds, debentures investment certificates or other similar property commonly known as securities; and "trading" includes any buying, selling or other dealing in any interest in securi ...

... Investing" means RBC Direct Investing Inc.; "I", "me" and "my" mean each investor; "securities" includes all stocks, bonds, debentures investment certificates or other similar property commonly known as securities; and "trading" includes any buying, selling or other dealing in any interest in securi ...

Investment Banks, Scope, and Unavoidable Conflicts of Interest

... perform the menu of financial functions delineated by Merton and Bodie. Though formal and obvious structures that violate conflict of interest rules may readily be monitored prohibited, more subtle ways to circumvent the prohibitions, especially restrictions based on information flow, may arise. Thi ...

... perform the menu of financial functions delineated by Merton and Bodie. Though formal and obvious structures that violate conflict of interest rules may readily be monitored prohibited, more subtle ways to circumvent the prohibitions, especially restrictions based on information flow, may arise. Thi ...

Chapter 15: Raising Capital

... interest in the company going public Not unusual for the number of locked-up shares to exceed the number of shares held by the public, sometimes by a substantial multiple Venture capital-backed companies are particularly likely to experience a loss in value on the lockup expiration day ...

... interest in the company going public Not unusual for the number of locked-up shares to exceed the number of shares held by the public, sometimes by a substantial multiple Venture capital-backed companies are particularly likely to experience a loss in value on the lockup expiration day ...

13426 Federal Register

... does not become operative prior to 30 days after the date of filing. Rule 19b– 4(f)(6)(iii),6 however, permits the Commission to designate a shorter time if such action is consistent with the protection of investors and the public interest. Immediate utilization of the amended pricing formula contai ...

... does not become operative prior to 30 days after the date of filing. Rule 19b– 4(f)(6)(iii),6 however, permits the Commission to designate a shorter time if such action is consistent with the protection of investors and the public interest. Immediate utilization of the amended pricing formula contai ...

airities in Switzerland

... capital investment and whose investors have no legal right with regard to the Company itself, or with regard to a closely connected Company, to the redemption of their units at the net asset value." Consequently, the defmition of foreign collective investment scheine is broad and, for example, poten ...

... capital investment and whose investors have no legal right with regard to the Company itself, or with regard to a closely connected Company, to the redemption of their units at the net asset value." Consequently, the defmition of foreign collective investment scheine is broad and, for example, poten ...