Complex Debt

... the contract term and reducing the amount of each payment due under the contract Postponing, during a specified period, the dates on which payments are due Extending the contract term and postponing during a specified period the dates on which payments are due under the contract. ...

... the contract term and reducing the amount of each payment due under the contract Postponing, during a specified period, the dates on which payments are due Extending the contract term and postponing during a specified period the dates on which payments are due under the contract. ...

credit_test_review_powerpoint

... to your credit report by a consumer credit bureau that rate an individual’s creditworthiness for lenders? ...

... to your credit report by a consumer credit bureau that rate an individual’s creditworthiness for lenders? ...

ACC 557 Week 5 DQ2 “ Receivables” Please respond to the

... future and conducting day-to-day operations.” (“External & Internal,”). External risks have to do with making decisions that are dependent on outside factors and internal risks are dependent on internal factors. Internal risks have to do with strategies and programs that the company puts into place. ...

... future and conducting day-to-day operations.” (“External & Internal,”). External risks have to do with making decisions that are dependent on outside factors and internal risks are dependent on internal factors. Internal risks have to do with strategies and programs that the company puts into place. ...

21 avenue Charles de Gaulle 78230 LE PECQ Tel : 01 34 51 48 27

... their existence and amount as well as the identity and domicile of the debtor. Accordingly, they undertake to notify us of any dispute that may arise or of any change that may occur in the debtor’s legal status. Debts which are certain, but are not yet due and payable (and/or liquidated) may be the ...

... their existence and amount as well as the identity and domicile of the debtor. Accordingly, they undertake to notify us of any dispute that may arise or of any change that may occur in the debtor’s legal status. Debts which are certain, but are not yet due and payable (and/or liquidated) may be the ...

Growth effects of high government debt

... on real GDP growth, whereas for high debt ratios (above 95% of GDP) – in line with previous results – additional debt is found to have, on average, a negative, statistically significant effect on short-term growth. From a general policy perspective, this evidence reinforces the importance of reducin ...

... on real GDP growth, whereas for high debt ratios (above 95% of GDP) – in line with previous results – additional debt is found to have, on average, a negative, statistically significant effect on short-term growth. From a general policy perspective, this evidence reinforces the importance of reducin ...

Bankruptcy and Miller Channels

... buying more bonds. They are owed 100 or ¼ of the firm’s debt. When the firm gets 350, the new bondholders collect ¼*350 = 87.5. They lose. New shareholders contribute the 100: They get 50 / 1.1 - 100 = -54.55 ...

... buying more bonds. They are owed 100 or ¼ of the firm’s debt. When the firm gets 350, the new bondholders collect ¼*350 = 87.5. They lose. New shareholders contribute the 100: They get 50 / 1.1 - 100 = -54.55 ...

Debt and Asia’s Success*

... and individuals, all with different degree of debt exposure in different contexts. There are two features of this debt that defines its sustainability. The first is how large the debt is relative to an economy’s size, measured by the debt to GDP ratio. Though there is no absolu ...

... and individuals, all with different degree of debt exposure in different contexts. There are two features of this debt that defines its sustainability. The first is how large the debt is relative to an economy’s size, measured by the debt to GDP ratio. Though there is no absolu ...

How Europe cancelled Germany`s debt

... and foreign governments. Private companies were not compelled to take part. This has led to some of the poorest countries in the world, such as Sierra Leone, Zambia and the Democratic Republic of Congo, being sued in western courts by vulture funds, for huge amounts on debts which they paid very lit ...

... and foreign governments. Private companies were not compelled to take part. This has led to some of the poorest countries in the world, such as Sierra Leone, Zambia and the Democratic Republic of Congo, being sued in western courts by vulture funds, for huge amounts on debts which they paid very lit ...

Change Ahead - Center for Consumer Recovery

... business focused on consumer outreach rather than threats and intimidation and a “nolitigation” philosophy. His first company, CFS, with 3,900 Oklahoma employee was acknowledged as “the largest, best trained and most profitable debt collection company in the world”. At the same time, his company gai ...

... business focused on consumer outreach rather than threats and intimidation and a “nolitigation” philosophy. His first company, CFS, with 3,900 Oklahoma employee was acknowledged as “the largest, best trained and most profitable debt collection company in the world”. At the same time, his company gai ...

and debt

... – “Has the expansion of household credit run its course? Will it reverse? We cannot know the answer to these questions with any certainty, but my guess is that the democratisation of finance which has underpinned this rise in household debt probably has not yet run its course...” – “Eventually, hous ...

... – “Has the expansion of household credit run its course? Will it reverse? We cannot know the answer to these questions with any certainty, but my guess is that the democratisation of finance which has underpinned this rise in household debt probably has not yet run its course...” – “Eventually, hous ...

High earners can still struggle

... Meanwhile, in just one year, the number of households with housing cost burdens greater than 30% of income climbed by 2.3 million, hitting a record 37.3 million in 2005, according to a report by the Joint Center for Housing Studies at Harvard University. The result: The pressures of high housing cos ...

... Meanwhile, in just one year, the number of households with housing cost burdens greater than 30% of income climbed by 2.3 million, hitting a record 37.3 million in 2005, according to a report by the Joint Center for Housing Studies at Harvard University. The result: The pressures of high housing cos ...

and debt

... • Can now ask “What happens to bank income if…” – New money created more quickly – Loans repaid more quickly – Reserves re-lent more quickly? ...

... • Can now ask “What happens to bank income if…” – New money created more quickly – Loans repaid more quickly – Reserves re-lent more quickly? ...

Forward Looking Statements / Guidance

... This presentation contains forward looking information. Forward looking information is based on management assumptions and analysis. Actual experience may differ, and those differences may be material. Forward looking information is subject to uncertainties and risks. This presentation must be read ...

... This presentation contains forward looking information. Forward looking information is based on management assumptions and analysis. Actual experience may differ, and those differences may be material. Forward looking information is subject to uncertainties and risks. This presentation must be read ...

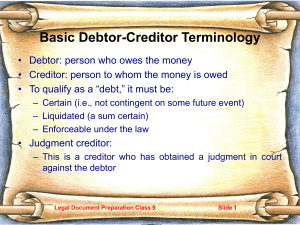

Slides in Microsoft PowerPoint Format

... – This is where the debtor gives up all of his assets (except exempt assets) – If it’s a business, it gives up all its assets and inventory and ceases to operate unless a creditor takes it over ...

... – This is where the debtor gives up all of his assets (except exempt assets) – If it’s a business, it gives up all its assets and inventory and ceases to operate unless a creditor takes it over ...

Citizens` initiative for the audit of public debt

... state not to honour its contract with its citizens to ensure education, health care, protection in old age—built up through generations of activism by citizens. No debt should be paid if it means ignoring democratic procedures, and does not allow for citizen participation in the decision-making proc ...

... state not to honour its contract with its citizens to ensure education, health care, protection in old age—built up through generations of activism by citizens. No debt should be paid if it means ignoring democratic procedures, and does not allow for citizen participation in the decision-making proc ...

Session 18: Post Class tests 1. The objective in corporate finance is

... 2. In the cost of capital approach, you estimate the cost of equity and the cost of debt at each debt ratio and the resulting cost of capital. As you increase the debt ratio, which of the fo ...

... 2. In the cost of capital approach, you estimate the cost of equity and the cost of debt at each debt ratio and the resulting cost of capital. As you increase the debt ratio, which of the fo ...

Subnational Government Financing

... technical assistance, resources and legal remedies to LGBs in distress. (Weist 2002) A related legal issue is the need for orderly bankruptcy/ work-out procedures as well as a time-bound procedure for foreclosure. In 1995, Hungary introduced a US style Chapter-11 type bankruptcy “stand-still” proced ...

... technical assistance, resources and legal remedies to LGBs in distress. (Weist 2002) A related legal issue is the need for orderly bankruptcy/ work-out procedures as well as a time-bound procedure for foreclosure. In 1995, Hungary introduced a US style Chapter-11 type bankruptcy “stand-still” proced ...

commercial debt finance for district energy

... n Tailor the approach, the documentation suite and delivery mechanisms to access alternative capital n Replace your own constrained funds – with third party debt n I propose a ‘perfect world scenario’……for the funder n Move away from this scenario: n Gearing level reduced n Cost of capit ...

... n Tailor the approach, the documentation suite and delivery mechanisms to access alternative capital n Replace your own constrained funds – with third party debt n I propose a ‘perfect world scenario’……for the funder n Move away from this scenario: n Gearing level reduced n Cost of capit ...

Directors` Guide to Credit - Federal Reserve Bank of Atlanta

... Earnings before interest and tax (EBIT) + lease and rental expense interest Lease and rental expense + current portion of long-term debt (CPLTD) Measurement of a firm’s ability to satisfy fixed financing expenses, such as interest and leases. A ratio over 1.0 indicates that the company is able to pa ...

... Earnings before interest and tax (EBIT) + lease and rental expense interest Lease and rental expense + current portion of long-term debt (CPLTD) Measurement of a firm’s ability to satisfy fixed financing expenses, such as interest and leases. A ratio over 1.0 indicates that the company is able to pa ...

Management Buy Outs

... Occasionally, sponsors bring in other equity investors or another sponsor to minimize their exposure ...

... Occasionally, sponsors bring in other equity investors or another sponsor to minimize their exposure ...

The Interest Tax Deduction

... Hence there is a cost to paying interest to corporate investors. This cost is borne not directly by the corporation, but indirectly through an additional burden on investors; i.e. they have to pay personal taxes on interest income. However, investors have to pay personal taxes on dividend income and ...

... Hence there is a cost to paying interest to corporate investors. This cost is borne not directly by the corporation, but indirectly through an additional burden on investors; i.e. they have to pay personal taxes on interest income. However, investors have to pay personal taxes on dividend income and ...

The Fed`s 405% problem

... sharply, thus potentially jeopardising the housing market recovery. Indeed, the rapid decline in mortgage applications since May could have prompted the Fed to hold on to its option to drink from the endless fountain of its own liquidity creation. The room to employ further ‘Twist’ operations is sev ...

... sharply, thus potentially jeopardising the housing market recovery. Indeed, the rapid decline in mortgage applications since May could have prompted the Fed to hold on to its option to drink from the endless fountain of its own liquidity creation. The room to employ further ‘Twist’ operations is sev ...

Presentation

... Find evidence suggesting that the relationship between default risk and debt with private creditors is more sensitive to external shocks than between default risk and debt with official creditors. Find evidence that there is less risk associated with borrowing abroad in their own currency. ...

... Find evidence suggesting that the relationship between default risk and debt with private creditors is more sensitive to external shocks than between default risk and debt with official creditors. Find evidence that there is less risk associated with borrowing abroad in their own currency. ...

Chapter 15 Focus

... mortgages than ever before, even if most existing mortgage rates remain fixed. Since March 2004, there has been a 59 percent increase in one-year adjustablerate mortgages. But that just means that they have become more expensive for new borrowers. The key question is, When do existing A.R.M.'s reset ...

... mortgages than ever before, even if most existing mortgage rates remain fixed. Since March 2004, there has been a 59 percent increase in one-year adjustablerate mortgages. But that just means that they have become more expensive for new borrowers. The key question is, When do existing A.R.M.'s reset ...