06.09.11 Presentation fr 2010 Innovation Award Winner. White

... Budget calculation and presentations: • Budget graph for Board: Debt “hump” • Interest expense for Operating Budget • Summarize by year and water versus sewer, interest and principal payments for rate calculations and to insure we make bond revenue covenants for a six year financial plan • Used this ...

... Budget calculation and presentations: • Budget graph for Board: Debt “hump” • Interest expense for Operating Budget • Summarize by year and water versus sewer, interest and principal payments for rate calculations and to insure we make bond revenue covenants for a six year financial plan • Used this ...

Moldova Poverty Trends 2001/2002

... Malawi’s public debt burden has been reduced substantially following the HIPC completion point & MDRI But interest payments remain very high because of domestic debt This analysis examined public debt sustainability & the debt management framework to recommend options for reducing Malawi’s debt vuln ...

... Malawi’s public debt burden has been reduced substantially following the HIPC completion point & MDRI But interest payments remain very high because of domestic debt This analysis examined public debt sustainability & the debt management framework to recommend options for reducing Malawi’s debt vuln ...

Comments on Mendoza

... 1. Is there anything such as an intrinsically sustainable debt per se? No: some debts just seem to be more sustainable than others, according to certain ad-hoc criteria and rules of thumb. Willingness to pay is difficult to model Senior and subordinated debts might not be equally sustainable 2. ...

... 1. Is there anything such as an intrinsically sustainable debt per se? No: some debts just seem to be more sustainable than others, according to certain ad-hoc criteria and rules of thumb. Willingness to pay is difficult to model Senior and subordinated debts might not be equally sustainable 2. ...

20070306_Richard

... • Politicians did not understand the economic repercussions of “tough talk” • “Tough love” from foreign investors could hurt the economy: eg, capital flight, fewer trade lines • Competing priorities imply delay in debt decision • Conclusion: Policy stubbornness can damage economic prospects ...

... • Politicians did not understand the economic repercussions of “tough talk” • “Tough love” from foreign investors could hurt the economy: eg, capital flight, fewer trade lines • Competing priorities imply delay in debt decision • Conclusion: Policy stubbornness can damage economic prospects ...

PowerPoint-Präsentation

... Right to be Heard (which may be seen as part of debtor protection) Fair and equal treatment of all creditors ...

... Right to be Heard (which may be seen as part of debtor protection) Fair and equal treatment of all creditors ...

Proceedings of 29th International Business Research Conference

... negative on the stock returns, showing particular severity for Taiwan and UK markets. Results further suggest that the time varying trend in the variance and volatility increase during the debt ceiling period are statistically significant for most countries. Each country’s US debt proportion to GDP ...

... negative on the stock returns, showing particular severity for Taiwan and UK markets. Results further suggest that the time varying trend in the variance and volatility increase during the debt ceiling period are statistically significant for most countries. Each country’s US debt proportion to GDP ...

here - Feasta

... future as a result of an economic collapse. The collapse will give the de-growth we want. Our task will be to stop the pro-growth systems being restored ...

... future as a result of an economic collapse. The collapse will give the de-growth we want. Our task will be to stop the pro-growth systems being restored ...

Managing Banking Relationships

... Given the scale of deleveraging by banks operating in Ireland, i.e. CBRE estimate that there was c.€21 billion paid for Irish originated loans in 2014 alone, many companies and their advisors will have to negotiate with loan acquirers (Lonestar, Apollo, Goldman Sachs, Carval etc) and their administr ...

... Given the scale of deleveraging by banks operating in Ireland, i.e. CBRE estimate that there was c.€21 billion paid for Irish originated loans in 2014 alone, many companies and their advisors will have to negotiate with loan acquirers (Lonestar, Apollo, Goldman Sachs, Carval etc) and their administr ...

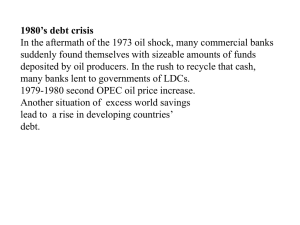

5. International Debt Crisis:a

... Since much developing countries’ debt is denominated in dollars, developing countries’ real value of debt service is up. Exports are down because of world recession. In the early 1980’s, when commodity prices fell, the terms of trade swung against LDCs. On August 12, 1982 Mexico declared a temporary ...

... Since much developing countries’ debt is denominated in dollars, developing countries’ real value of debt service is up. Exports are down because of world recession. In the early 1980’s, when commodity prices fell, the terms of trade swung against LDCs. On August 12, 1982 Mexico declared a temporary ...

Model of debt crisis, Romer 4th edition section 12.10

... • So there are two equilibria, one when the interest factor and the probability of default are low, one where no investor want to hold the debt • For a sufficiently large riskless rate RMIN (Figure 12.6 next) the red curve is on the right of the blue curve and the only equilibrium is π=1. You don’t ...

... • So there are two equilibria, one when the interest factor and the probability of default are low, one where no investor want to hold the debt • For a sufficiently large riskless rate RMIN (Figure 12.6 next) the red curve is on the right of the blue curve and the only equilibrium is π=1. You don’t ...

Ending Over-Lending Avoiding Financial Calamities

... bankruptcy. Simplistically, the Debt/CF ratio measures the number of years of savings required to retire an entity’s outstanding debt. I examine the merits of this tool in measuring the indebtedness of nations and as an early warning signal to avert financial crises of nations. Current popular debt ...

... bankruptcy. Simplistically, the Debt/CF ratio measures the number of years of savings required to retire an entity’s outstanding debt. I examine the merits of this tool in measuring the indebtedness of nations and as an early warning signal to avert financial crises of nations. Current popular debt ...

The Argentina Debt Case* Jayati Ghosh

... The immediate effect of this would be to disable Argentina from repaying $832 million of debt to other bondholders (who have already received around 90 per cent of their debt) unless it also pays the holdouts in full, thereby forcing the country into technical default. Economy Minister Alex Kicillof ...

... The immediate effect of this would be to disable Argentina from repaying $832 million of debt to other bondholders (who have already received around 90 per cent of their debt) unless it also pays the holdouts in full, thereby forcing the country into technical default. Economy Minister Alex Kicillof ...

Deficits, Surpluses, and the National Debt From Deficits to Debt

... Because of deficit spending, the national debt has increased dramatically Sometimes, the government is forced to spend more than it collects because unexpected developments cause a drop in revenues or a rise in costs ...

... Because of deficit spending, the national debt has increased dramatically Sometimes, the government is forced to spend more than it collects because unexpected developments cause a drop in revenues or a rise in costs ...

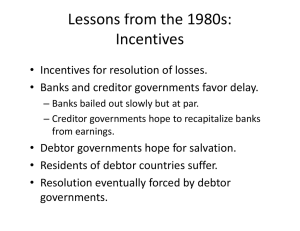

Lessons from the 1980s: Incentives • Incentives for resolution of losses.

... • Resolution eventually forced by debtor governments. ...

... • Resolution eventually forced by debtor governments. ...

key facts

... course of 13 years. The total cost of this settlement is KM 2.4 billion. This settlement is not perfect, but it is fair and affordable for BiH. It ensures that as many as 80% of all accounts will be quickly returned, in full. It is also flexible as the Law leaves room for the BiH Council of Mi ...

... course of 13 years. The total cost of this settlement is KM 2.4 billion. This settlement is not perfect, but it is fair and affordable for BiH. It ensures that as many as 80% of all accounts will be quickly returned, in full. It is also flexible as the Law leaves room for the BiH Council of Mi ...

2017 MSW BW Public EP - Credit

... BOTTOM LINE: Those who know about interest, earn it; those who don’t, pay it ...

... BOTTOM LINE: Those who know about interest, earn it; those who don’t, pay it ...

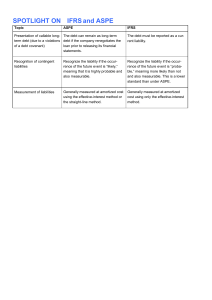

SPOTLIGHT ON*IFRS and ASPE

... Presentation of callable long- The debt can remain as long-term term debt (due to a violations debt if the company renegotiates the loan prior to releasing its financial of a debt covenant) statements. ...

... Presentation of callable long- The debt can remain as long-term term debt (due to a violations debt if the company renegotiates the loan prior to releasing its financial of a debt covenant) statements. ...

European Debt Crisis and Links to our Global South work

... Debt write-down/compensation How? • either through unilateral action • or through a debt conference style approach (ala London Debt Accord) focusing on sovereign, business and household debt • Each country should identify what is legitimate and what is not, through audits or other methods ...

... Debt write-down/compensation How? • either through unilateral action • or through a debt conference style approach (ala London Debt Accord) focusing on sovereign, business and household debt • Each country should identify what is legitimate and what is not, through audits or other methods ...

Course preparation assignment week 5

... Financial Management I Course Preparation Assignment Week Five One task of a finance manager is to raise capital and to choose between debt and equity. In this activity your outcome is to use your existing knowledge of accounting and finance to make a financing decision regarding new capital. You ar ...

... Financial Management I Course Preparation Assignment Week Five One task of a finance manager is to raise capital and to choose between debt and equity. In this activity your outcome is to use your existing knowledge of accounting and finance to make a financing decision regarding new capital. You ar ...

Irrecoverable Debts

... The Cabinet is asked to agree to write off 6 cases relating to arrears of NonDomestic Rates. The first case was declared bankrupt on the 27/4/2010 leaving a debt of £13,909.59, with the second case the company was dissolved on the 13/7/2010 leaving a debt of £4,831.47. The third case absconded witho ...

... The Cabinet is asked to agree to write off 6 cases relating to arrears of NonDomestic Rates. The first case was declared bankrupt on the 27/4/2010 leaving a debt of £13,909.59, with the second case the company was dissolved on the 13/7/2010 leaving a debt of £4,831.47. The third case absconded witho ...