HBW with speaker notes - North Carolina Cooperative Extension

... • Investment of mortgage dollars • Interest is tax deductible • Home can increase in value Disadvantage to Buy • Commitment of time, etc. • Ties up money • Maintenance ...

... • Investment of mortgage dollars • Interest is tax deductible • Home can increase in value Disadvantage to Buy • Commitment of time, etc. • Ties up money • Maintenance ...

Economic Train Wreck Dead Ahead We find ourselves in the

... credit expansion. When the tsunami hits shore (debt expansion can’t go on forever), no matter how good they have become at surfing, a crash will wipe them out. It’s my belief that most pension funds, foundations, individuals, and corporations that do not prepare for such an eventuality will be destr ...

... credit expansion. When the tsunami hits shore (debt expansion can’t go on forever), no matter how good they have become at surfing, a crash will wipe them out. It’s my belief that most pension funds, foundations, individuals, and corporations that do not prepare for such an eventuality will be destr ...

Key Tactics: Reinvigorating and Recharging Your Business

... The current 2007 – 2009 recession while quite severe is no where near the severity of the 1929-1932 or 1937-1938 depressions. We are experiencing a 3.8% decline in GDP, compared to over an 18.2% decline in 1937-1938. We are also experiencing today unemployment in the 9.7% range , compared to 25% une ...

... The current 2007 – 2009 recession while quite severe is no where near the severity of the 1929-1932 or 1937-1938 depressions. We are experiencing a 3.8% decline in GDP, compared to over an 18.2% decline in 1937-1938. We are also experiencing today unemployment in the 9.7% range , compared to 25% une ...

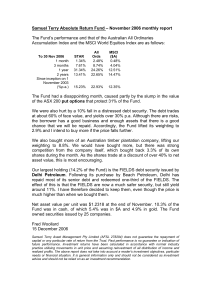

November 2006 - Samuel Terry

... We were also hurt by a 10% fall in a distressed debt security. The debt trades at about 60% of face value, and yields over 30% p.a. Although there are risks, the borrower has a good business and enough assets that there is a good chance that we will be repaid. Accordingly, the Fund lifted its weight ...

... We were also hurt by a 10% fall in a distressed debt security. The debt trades at about 60% of face value, and yields over 30% p.a. Although there are risks, the borrower has a good business and enough assets that there is a good chance that we will be repaid. Accordingly, the Fund lifted its weight ...

Practice Exam

... 3. CPA QUESTION: Unger owes a total of $50,000 to eight unsecured creditors and one fully secured creditor. Quincy is one of the unsecured creditors and is owed $6,000. Quincy has filed a petition against Unger under the liquidation provisions of Chapter 7 of the federal Bankruptcy Code. Unger has ...

... 3. CPA QUESTION: Unger owes a total of $50,000 to eight unsecured creditors and one fully secured creditor. Quincy is one of the unsecured creditors and is owed $6,000. Quincy has filed a petition against Unger under the liquidation provisions of Chapter 7 of the federal Bankruptcy Code. Unger has ...

Steve Keen's Talk at the Australian Parliamentary Library

... Solutions? • Only solutions involve drastic cut in Debt/GDP ratio – Deliberate Inflation? – Debt moratoria? • Post-crisis reforms – Palliative reforms (Glass-Steagall Act, etc.) will be “reformed” away once they cause prolonged stability – Long term success only if possibility of profitable asset p ...

... Solutions? • Only solutions involve drastic cut in Debt/GDP ratio – Deliberate Inflation? – Debt moratoria? • Post-crisis reforms – Palliative reforms (Glass-Steagall Act, etc.) will be “reformed” away once they cause prolonged stability – Long term success only if possibility of profitable asset p ...

July 2011 - Cypress Financial Planning

... Similar to a household budget, any year that the government runs a deficit (spends more than it takes in as tax revenues) results in an increase in our national debt. At present, the US owes $9.7 trillion in public debt in the form of Treasury bills, notes and bonds. If every US citizen donated $47, ...

... Similar to a household budget, any year that the government runs a deficit (spends more than it takes in as tax revenues) results in an increase in our national debt. At present, the US owes $9.7 trillion in public debt in the form of Treasury bills, notes and bonds. If every US citizen donated $47, ...

Grant versus Loans: from ex-ante to ex-post

... • Policymakers have limited incentives to buy insurance contracts with costs that must be paid upfront and benefits that may accrue only years later ...

... • Policymakers have limited incentives to buy insurance contracts with costs that must be paid upfront and benefits that may accrue only years later ...

Marie Hoerova: Discussion of E. Farhi, J. Tirole, Deadly

... – sovereign bonds of one member state held by banks in other member states; sovereign problems can become contagious – safety of the government debt a public good whose provision may be inefficient (Bolton and Jeanne, 2011) ...

... – sovereign bonds of one member state held by banks in other member states; sovereign problems can become contagious – safety of the government debt a public good whose provision may be inefficient (Bolton and Jeanne, 2011) ...

HIPC Expenditures, Ownership and the Role of Donors

... • Notwithstanding positive net transfers and high loan concessionality, • many recipients have difficulty servicing their old debts, • while facing severe administrative and managerial constraints in absorbing new aid, • suggesting a recurrent fiscal constraint • and a mismatch of aid instruments ( ...

... • Notwithstanding positive net transfers and high loan concessionality, • many recipients have difficulty servicing their old debts, • while facing severe administrative and managerial constraints in absorbing new aid, • suggesting a recurrent fiscal constraint • and a mismatch of aid instruments ( ...

Political economy of debt

... • Age old relationship – the eternal ‘class struggle’ between creditors and debtors • In modern economies: The kind of struggle depends on the kind of credit relationship (not all credits are equal in economic terms) • A nation’s creditors might become a nation’s rulers (James Steuart) • Why do cred ...

... • Age old relationship – the eternal ‘class struggle’ between creditors and debtors • In modern economies: The kind of struggle depends on the kind of credit relationship (not all credits are equal in economic terms) • A nation’s creditors might become a nation’s rulers (James Steuart) • Why do cred ...

Cuando creiamos que teniamos todas las respuestas

... financial industry disclaimer “past performance is not indicative of future performance.” We don’t know if the stock market will react similarly this time. No one does. We don’t know how long a shutdown will last and how much economic drag it will induce. No one does. And we don’t know if this game ...

... financial industry disclaimer “past performance is not indicative of future performance.” We don’t know if the stock market will react similarly this time. No one does. We don’t know how long a shutdown will last and how much economic drag it will induce. No one does. And we don’t know if this game ...

democratic republic of congo

... multilateral, the largest part being owed to the World Banks IDA. In the 1990's there have been no payments to official creditors on long-term debt since 1994, and total arrears reached US$8.2million. In 1998 the debt to export ratio was 774%, which was very unsustainable considering a 3% economic d ...

... multilateral, the largest part being owed to the World Banks IDA. In the 1990's there have been no payments to official creditors on long-term debt since 1994, and total arrears reached US$8.2million. In 1998 the debt to export ratio was 774%, which was very unsustainable considering a 3% economic d ...

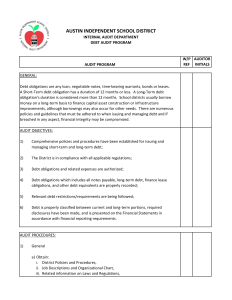

Debt Audit Program

... Debt obligations are any loan, negotiable notes, time-bearing warrants, bonds or leases. A Short-Term debt obligation has a duration of 12 months or less. A Long-Term debt obligation's duration is considered more than 12 months. School districts usually borrow money on a long-term basis to finance c ...

... Debt obligations are any loan, negotiable notes, time-bearing warrants, bonds or leases. A Short-Term debt obligation has a duration of 12 months or less. A Long-Term debt obligation's duration is considered more than 12 months. School districts usually borrow money on a long-term basis to finance c ...

Welcome to the Good Sense Budget Course

... • Use a credit card only for budgeted items • Pay the balance in full every month • If you violate rule one or rule two, put away the cards • Select a card with no annual fee • Consider a debit card instead of a credit card • Keep a list of all credit card charges for awareness • Have only one card ...

... • Use a credit card only for budgeted items • Pay the balance in full every month • If you violate rule one or rule two, put away the cards • Select a card with no annual fee • Consider a debit card instead of a credit card • Keep a list of all credit card charges for awareness • Have only one card ...

Public Debt, Fiscal Solvency & Macroeconomic Uncertainty in

... (commitment to repay using BB long-run method not credible) ...

... (commitment to repay using BB long-run method not credible) ...

Golden Rule - ander europa

... • The macro-economic scoreboard does not take into account different levels of economic development of the member states and imposes a one-size-fits-all framework • During the run-up to the crisis the ECB kept interest rates low, which was helpful for the struggling German economy, but caused overhe ...

... • The macro-economic scoreboard does not take into account different levels of economic development of the member states and imposes a one-size-fits-all framework • During the run-up to the crisis the ECB kept interest rates low, which was helpful for the struggling German economy, but caused overhe ...

Concept 6 Kaufman

... Debt/Equity Financing and Traditional/Nontraditional Financing Capital from external sources is classified as either debt capital or equity capital. Debt capital is available in three major categories: o 1. Traditional Public Offerings – can be taxable or tax exempt and can have fixed or variabl ...

... Debt/Equity Financing and Traditional/Nontraditional Financing Capital from external sources is classified as either debt capital or equity capital. Debt capital is available in three major categories: o 1. Traditional Public Offerings – can be taxable or tax exempt and can have fixed or variabl ...

Living with Sovereign Debt - Inter

... Main Policy Implications: Controlling the Flow of Debt – Political and procedural Reforms; Budgetary ...

... Main Policy Implications: Controlling the Flow of Debt – Political and procedural Reforms; Budgetary ...

The “Unknown Unknowns”: Risks of Higher Public Debt Levels in

... Investment managers today, however risky their businesses may be, tend to care about their reputations and tend to have their money on the line.... I have a pretty easy time looking at funds and figuring out what they are doing. It is nearly impossible to know what the large financial institutions w ...

... Investment managers today, however risky their businesses may be, tend to care about their reputations and tend to have their money on the line.... I have a pretty easy time looking at funds and figuring out what they are doing. It is nearly impossible to know what the large financial institutions w ...

Custody Warrant Fact Sheet - Northern Ireland Courts and Tribunals

... repayment terms. However, should you be in a position to do so, the, Office will accept payment in full at any stage. Any offer of payment made by you during the course of the interview will be reviewed and may be increased at a later stage depending on your circumstances. ...

... repayment terms. However, should you be in a position to do so, the, Office will accept payment in full at any stage. Any offer of payment made by you during the course of the interview will be reviewed and may be increased at a later stage depending on your circumstances. ...

Debt Settlement - ClearOne Advantage

... that operate for a profit. But rather than make payments to each creditor every month, the consumer makes one monthly payment to cover the total due to all creditors. If total debt is $10,000 or less, typically the ...

... that operate for a profit. But rather than make payments to each creditor every month, the consumer makes one monthly payment to cover the total due to all creditors. If total debt is $10,000 or less, typically the ...