Letter Of Demand - ATA Australian Trades Association

... I draw your attention to the above invoice that to date remains unpaid. Despite numerous attempts to contact your account department through reminder telephone calls and repeated invoices sent / emailed to you, your debt for the account remains unpaid. We advise that if payment is not received for t ...

... I draw your attention to the above invoice that to date remains unpaid. Despite numerous attempts to contact your account department through reminder telephone calls and repeated invoices sent / emailed to you, your debt for the account remains unpaid. We advise that if payment is not received for t ...

Publication in doc format - Irish Congress of Trade Unions

... Protecting a minimum adequate standard of living By their very nature, debts are urgent, they compound rapidly over time, and can speedily spiral into trouble. Creditors often have set policies and procedures on the minimum level of repayment they can accept. People who are indebted often agree to a ...

... Protecting a minimum adequate standard of living By their very nature, debts are urgent, they compound rapidly over time, and can speedily spiral into trouble. Creditors often have set policies and procedures on the minimum level of repayment they can accept. People who are indebted often agree to a ...

The Debt Ceiling and the Road Ahead

... Higher interest rates for Treasury bonds might also result in higher interest rates on other, nongovernmental loans such as mortgages and consumer credit. Since many interest rates are based on Treasury rates, rates generally would likely be affected. And since bond prices fall when rates rise, you ...

... Higher interest rates for Treasury bonds might also result in higher interest rates on other, nongovernmental loans such as mortgages and consumer credit. Since many interest rates are based on Treasury rates, rates generally would likely be affected. And since bond prices fall when rates rise, you ...

Debt Covenants

... – Violation allows the debt to be accelerated. More commonly lenders reduce the size of the credit facility, increase the interest rate (spread) and require additional collateral. Think of a standard bargaining game with outside options. ...

... – Violation allows the debt to be accelerated. More commonly lenders reduce the size of the credit facility, increase the interest rate (spread) and require additional collateral. Think of a standard bargaining game with outside options. ...

Ankara, Turkey, September 12, 2006

... i.e., serious difficulty in rolling over significant amounts of bonds as they mature or come due. Thus, especially dangerous are: bunching ...

... i.e., serious difficulty in rolling over significant amounts of bonds as they mature or come due. Thus, especially dangerous are: bunching ...

Private Debt Financing

... because the lender can only seize the assets posted as collateral. Because this feature is advantageous to the borrower, the lender may charge a higher interest rate to compensate for the greater risk to his capital. Recourse Loan: Preferred by lenders because, in the event of a default, the lender ...

... because the lender can only seize the assets posted as collateral. Because this feature is advantageous to the borrower, the lender may charge a higher interest rate to compensate for the greater risk to his capital. Recourse Loan: Preferred by lenders because, in the event of a default, the lender ...

Chapter 15 Powerpoint

... Municipal Bonds and the Tax Reform Act of 1986 • Interest on state and local government bonds is exempt at federal level • Industrial Development Bonds (IDB’s) offer tax-exempt status for private development (controls) • Registered bonds – owner specifically named • Bearer bonds – whoever holds the ...

... Municipal Bonds and the Tax Reform Act of 1986 • Interest on state and local government bonds is exempt at federal level • Industrial Development Bonds (IDB’s) offer tax-exempt status for private development (controls) • Registered bonds – owner specifically named • Bearer bonds – whoever holds the ...

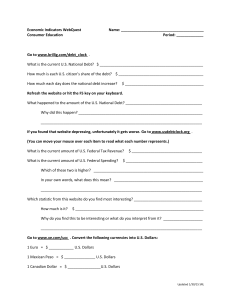

Unit 3: Economic Indicators WebQuest

... Refresh the website or hit the F5 key on your keyboard. What happened to the amount of the U.S. National Debt? _____________________________________ Why did this happen? ____________________________________________________________ _____________________________________________________________________ ...

... Refresh the website or hit the F5 key on your keyboard. What happened to the amount of the U.S. National Debt? _____________________________________ Why did this happen? ____________________________________________________________ _____________________________________________________________________ ...

Bureau Of Consumer Financial Protection

... as national gatekeepers in their own markets. Further, some of these firms may be “larger” than they appear as they are often part of massive multi-state or multinational conglomerates. Our organizations also regularly hear from consumers regarding the other markets proposed in the Advance Notice: M ...

... as national gatekeepers in their own markets. Further, some of these firms may be “larger” than they appear as they are often part of massive multi-state or multinational conglomerates. Our organizations also regularly hear from consumers regarding the other markets proposed in the Advance Notice: M ...

DEMOCRATIC REPUBLIC OF CONGO Debt Treatment

... their appropriate contribution in terms of debt relief to the enhanced HIPC Initiative, on top of traditional debt relief mechanisms and consistent with the proportional burden sharing based on their relative exposure in net present value of total external debt at Decision Point after the full use o ...

... their appropriate contribution in terms of debt relief to the enhanced HIPC Initiative, on top of traditional debt relief mechanisms and consistent with the proportional burden sharing based on their relative exposure in net present value of total external debt at Decision Point after the full use o ...

Regulamento da Compensação

... a) Constitution of Guarantees by the Participants, according to the provisions set out in OMIClear’s Instruction A06/2014 – Management and Evaluation of Guarantees; b) Deposits with Qualified Credit Institutions (QCI), under its Investment Policy (repo operations or collateralized deposits). 2. The ...

... a) Constitution of Guarantees by the Participants, according to the provisions set out in OMIClear’s Instruction A06/2014 – Management and Evaluation of Guarantees; b) Deposits with Qualified Credit Institutions (QCI), under its Investment Policy (repo operations or collateralized deposits). 2. The ...

Eighth UNCTAD Debt Management Conference Principles for Promoting Responsible Sovereign Lending and Borrowing

... GDP (Bn USD) Ave. Exchange Rate (ARP/US$) Imports (% GDP) Investment (% GDP) International Reserves (% GDP) Total Deposits (Bn USD) ...

... GDP (Bn USD) Ave. Exchange Rate (ARP/US$) Imports (% GDP) Investment (% GDP) International Reserves (% GDP) Total Deposits (Bn USD) ...

Household Leveraging and Deleveraging

... • Mortgage charge-offs likely to remain high. » Foreclosures are on the rise again after having been forestalled by HAMP and other factors. • Even as lenders’ standards ease, new borrowing should be dampened by lack of home equity. » CoreLogic: Close to 30% of mortgage borrowers have little or no eq ...

... • Mortgage charge-offs likely to remain high. » Foreclosures are on the rise again after having been forestalled by HAMP and other factors. • Even as lenders’ standards ease, new borrowing should be dampened by lack of home equity. » CoreLogic: Close to 30% of mortgage borrowers have little or no eq ...

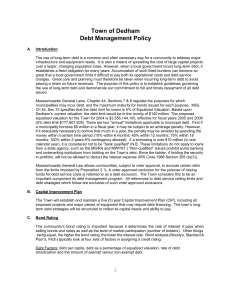

Debt Management Policy - Massachusetts Municipal Association

... The use of long-term debt is a common and often necessary way for a community to address major infrastructure and equipment needs. It is also a means of spreading the cost of large capital projects over a larger, changing population base. However, when a local government incurs long-term debt, it es ...

... The use of long-term debt is a common and often necessary way for a community to address major infrastructure and equipment needs. It is also a means of spreading the cost of large capital projects over a larger, changing population base. However, when a local government incurs long-term debt, it es ...

Business Cycle

... economy doesn’t create enough jobs, high school & college graduates have trouble finding work. • If prices rise, but incomes do not, our ability to buy what we need declines. ...

... economy doesn’t create enough jobs, high school & college graduates have trouble finding work. • If prices rise, but incomes do not, our ability to buy what we need declines. ...

doc - Homework Market

... economists believed that equilibrium would be reached and maintained at a level consistent with full employment by the actions of three self-regulating markets (Amacher & Pate, 2012). This theory says that any economy is able to survive without the help of a government. The most important thing that ...

... economists believed that equilibrium would be reached and maintained at a level consistent with full employment by the actions of three self-regulating markets (Amacher & Pate, 2012). This theory says that any economy is able to survive without the help of a government. The most important thing that ...

The balance sheet: Telling a balanced story

... The following paragraphs offer some suggestions on how you can use the balance sheet to assess financial strength, growth, operating efficiency, and profitability. ...

... The following paragraphs offer some suggestions on how you can use the balance sheet to assess financial strength, growth, operating efficiency, and profitability. ...

Debt As % of GDP III

... system is less than it would be if all had been income-dependant. Very important to note as well, the families that bought homes substituted mortgage payments for rents--their monthly costs generally stayed the same. However, the mortgage loan adds substantial debt to the total credit market debt ra ...

... system is less than it would be if all had been income-dependant. Very important to note as well, the families that bought homes substituted mortgage payments for rents--their monthly costs generally stayed the same. However, the mortgage loan adds substantial debt to the total credit market debt ra ...

Chapter 7 Redemption Sample Motion

... The payment for this proposed redemption is to be financed through Prizm Financial Co. LLC., with all of the particulars of that financing (interest rate, finance charge, amount financed, total of payments, amount of payments, etc.) set forth in full detail in the attachment(s) hereto. As demonstrat ...

... The payment for this proposed redemption is to be financed through Prizm Financial Co. LLC., with all of the particulars of that financing (interest rate, finance charge, amount financed, total of payments, amount of payments, etc.) set forth in full detail in the attachment(s) hereto. As demonstrat ...

IMPACT OF THE EURO DEBT CRISIS ON

... to recapitalize Greek banks as a part of the restructuring agreement. If this does not happen, the Eurozone crisis will deteriorate sharply. To make the numbers work and achieve a target debt to GDP ratio of 120% by the year 2020, 100% of private creditor held debt of 200 billion Euros will have to ...

... to recapitalize Greek banks as a part of the restructuring agreement. If this does not happen, the Eurozone crisis will deteriorate sharply. To make the numbers work and achieve a target debt to GDP ratio of 120% by the year 2020, 100% of private creditor held debt of 200 billion Euros will have to ...

The CORE Problem Part 5 of X parts

... • A constitutional Amendment must be proposed by two-thirds of both the House and Senate. In order to get the necessary two-thirds needed for the 14th Amendment, all southern delegates and one senator from New Jersey were excluded from voting, making the 14th Amendment an illegal (criminal) act and ...

... • A constitutional Amendment must be proposed by two-thirds of both the House and Senate. In order to get the necessary two-thirds needed for the 14th Amendment, all southern delegates and one senator from New Jersey were excluded from voting, making the 14th Amendment an illegal (criminal) act and ...

Puerto Rico`s debt crisis and economic trends

... On June 2015 a GDB report indicated that the bank’s liquidity position decreased from $3 billion to $775 million in a 12-month period. The Board of Directors said that the government might not be able to pay some short term financial obligations. On June 29th 2015, the Governor’s said in the NY ...

... On June 2015 a GDB report indicated that the bank’s liquidity position decreased from $3 billion to $775 million in a 12-month period. The Board of Directors said that the government might not be able to pay some short term financial obligations. On June 29th 2015, the Governor’s said in the NY ...

Doing More with Less - Eastern Caribbean Central Bank

... surprise increase in your credit limit you have been “rewarded” with for being a “good” customer. Skip a payment, and interest is added to the balance at a rate between 21% to 22.5%. Credit Card debt is some of the highest cost debt that is available, but because of its convenie ...

... surprise increase in your credit limit you have been “rewarded” with for being a “good” customer. Skip a payment, and interest is added to the balance at a rate between 21% to 22.5%. Credit Card debt is some of the highest cost debt that is available, but because of its convenie ...

The Value of a “Aaa” Debt Rating

... the cost of borrowing to fund a new DPW building. Assume for illustrative purposes, that the DPW building is financed with $13,000,000 of debt. The incremental cost to the Town would be somewhere around $19,500 to $39,000 a year ($13 million times either 0.15 or 0.30 percent) for the twenty-year li ...

... the cost of borrowing to fund a new DPW building. Assume for illustrative purposes, that the DPW building is financed with $13,000,000 of debt. The incremental cost to the Town would be somewhere around $19,500 to $39,000 a year ($13 million times either 0.15 or 0.30 percent) for the twenty-year li ...