MATH-1410-6A Project 3

... Project on Student Debt in an effort to increase public awareness about rising student debt and its impact on our society. According to the program’s October 2012 report, Student Debt and the Class of 2011, recent graduates from public and private nonprofit 4-year colleges carried an average student ...

... Project on Student Debt in an effort to increase public awareness about rising student debt and its impact on our society. According to the program’s October 2012 report, Student Debt and the Class of 2011, recent graduates from public and private nonprofit 4-year colleges carried an average student ...

CHAPTER 1

... Executive Cheese has issued debt with a market value of $100 million and has outstanding 15 million shares with a market price of $10 a share. It now announces that it intends to issue a further $60 million of debt and to use the proceeds to buy back common stock. Debtholders, seeing the extra risk, ...

... Executive Cheese has issued debt with a market value of $100 million and has outstanding 15 million shares with a market price of $10 a share. It now announces that it intends to issue a further $60 million of debt and to use the proceeds to buy back common stock. Debtholders, seeing the extra risk, ...

All You Need to Know about the Credit Crunch

... around the world. Some firms, like Northern Rock, have been too dependent on this source of finance and have suffered as a result. There is quite some debate about whether the blame lies with consumers for putting too much on credit and overspending or whether banks are the culprits for irresponsibl ...

... around the world. Some firms, like Northern Rock, have been too dependent on this source of finance and have suffered as a result. There is quite some debate about whether the blame lies with consumers for putting too much on credit and overspending or whether banks are the culprits for irresponsibl ...

Microcredit vs. Microsaving

... Are BRI borrowers more likely to be deemed creditworthy? Comparison of assessments for a given borrower between credit officers with whom there is a lending relationship and others without prior relationship. ...

... Are BRI borrowers more likely to be deemed creditworthy? Comparison of assessments for a given borrower between credit officers with whom there is a lending relationship and others without prior relationship. ...

Newsletter-2007-12 - Patient Capital Management Inc

... conditions than is usually the case. As we have often discussed in our previous newsletters (archived at www.patientcapital.com) the total amount of debt in the American economy has increased dramatically over the last several years. As the charts below illustrate, (all courtesy of The Chartstore.co ...

... conditions than is usually the case. As we have often discussed in our previous newsletters (archived at www.patientcapital.com) the total amount of debt in the American economy has increased dramatically over the last several years. As the charts below illustrate, (all courtesy of The Chartstore.co ...

CIBC first Canadian bank to tap Europe`s negative yields

... Covered bonds, such as those issued by CIBC, are secured by mortgages on a bank’s balance sheet and have existed in Europe for years, but they only grew popular among Canadian banks in the past decade. Investors like them because their buyers have a claim on the assets, or mortgages, should the issu ...

... Covered bonds, such as those issued by CIBC, are secured by mortgages on a bank’s balance sheet and have existed in Europe for years, but they only grew popular among Canadian banks in the past decade. Investors like them because their buyers have a claim on the assets, or mortgages, should the issu ...

London Borough of Lewisham

... difficulty maintaining their payments. In these cases we will make every effort to help. Others may deliberately set out to delay, or not make payments at all. In these situations we will take action to secure and recover payments. Where appropriate we will charge additional fees to cover the cost o ...

... difficulty maintaining their payments. In these cases we will make every effort to help. Others may deliberately set out to delay, or not make payments at all. In these situations we will take action to secure and recover payments. Where appropriate we will charge additional fees to cover the cost o ...

Seminar 8 - Wednesday 19-10-2016 questions

... a) “External” Bank Loan. Face value of AED 1,000,000; Annual Interest Rate of 8%; Monthly repayments and a 2 year duration (lifespan) of loan until full amortization b) Bond issue. Face value (principal) of AED 1,000,000, Coupon rate of 5% with payment annual and duration to maturity being 2 years. ...

... a) “External” Bank Loan. Face value of AED 1,000,000; Annual Interest Rate of 8%; Monthly repayments and a 2 year duration (lifespan) of loan until full amortization b) Bond issue. Face value (principal) of AED 1,000,000, Coupon rate of 5% with payment annual and duration to maturity being 2 years. ...

Creditor Rights and Capital Structure: Evidence from International Data:

... origin, financial market development and per capital GDP). In contrast, the effect of shareholder rights on leverage is relatively weak. The observed negative relation between creditor rights and leverage is not consistent with the view that strong creditor protection induces lenders to provide cred ...

... origin, financial market development and per capital GDP). In contrast, the effect of shareholder rights on leverage is relatively weak. The observed negative relation between creditor rights and leverage is not consistent with the view that strong creditor protection induces lenders to provide cred ...

PowerPoint Presentation - Ramp

... – Most people need a loan to buy a home – Interest money is tax deductible – When it is bad: Monthly payments too high for income ...

... – Most people need a loan to buy a home – Interest money is tax deductible – When it is bad: Monthly payments too high for income ...

The Economy as 2012 Begins

... • Greece, Portugal and Hungary have junk ratings. • LTRO – long-term lending to banks - banks borrow from ECB, buy sovereign debt of PIIGS, make money on spread. - can keep lower % assets for capital. - this is money printing • EFSF (bailout fund) accused of buying its own bonds at auction on Nov 7t ...

... • Greece, Portugal and Hungary have junk ratings. • LTRO – long-term lending to banks - banks borrow from ECB, buy sovereign debt of PIIGS, make money on spread. - can keep lower % assets for capital. - this is money printing • EFSF (bailout fund) accused of buying its own bonds at auction on Nov 7t ...

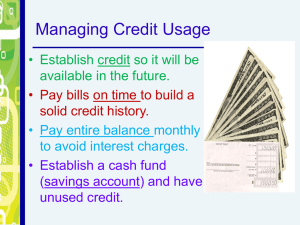

Personal Financial Literacy - Warren Hills Regional School District

... – This is a good time to save money and earn interest (bank/investments) In a bad economy – People are pessimistic about future income and buy less, interest rates tend to drop – This is a good time to buy because you can get better values! ...

... – This is a good time to save money and earn interest (bank/investments) In a bad economy – People are pessimistic about future income and buy less, interest rates tend to drop – This is a good time to buy because you can get better values! ...

Lecture 11: Real Estate

... – Debt is incurred a little at a time – Payment schedules are different, can become ever more indebted while paying the minimum amount each month. ...

... – Debt is incurred a little at a time – Payment schedules are different, can become ever more indebted while paying the minimum amount each month. ...

Cabot Financial (Europe) Limited, the UK`s leading debt purchaser

... pioneer of debt purchase within the UK and, combined with our existing expertise in debt recovery, offers an excellent platform form which we can achieve similar success within the Irish market." Ken Maynard, Chief Executive of Cabot Financial Group, commented: “With the growth of consumer debt with ...

... pioneer of debt purchase within the UK and, combined with our existing expertise in debt recovery, offers an excellent platform form which we can achieve similar success within the Irish market." Ken Maynard, Chief Executive of Cabot Financial Group, commented: “With the growth of consumer debt with ...

EU446 Patterns of economic integration in Europe

... Public Debt (2): How about growing out of your difficulties? ...

... Public Debt (2): How about growing out of your difficulties? ...

Currency Crashes in Emerging Markets: An Empirical Treatment

... External effects exert a strong and sensible influence on the likelihood of crash incidence ◦ Higher debt, lower reserves, and a more overvalued real exchange rate all seem to raise the odds of crash incidence. ...

... External effects exert a strong and sensible influence on the likelihood of crash incidence ◦ Higher debt, lower reserves, and a more overvalued real exchange rate all seem to raise the odds of crash incidence. ...

The Rivoli Company has no debt outstanding and

... following data: Assets (book = market) EBIT Cost of equity rs Stock price P0 Shares outstanding, n0 Tax rate, T(federal-plus-state) ...

... following data: Assets (book = market) EBIT Cost of equity rs Stock price P0 Shares outstanding, n0 Tax rate, T(federal-plus-state) ...

Opening Statement on the Long-Term Debt and Total Loss

... banking organizations by strengthening capital requirements, introducing liquidity requirements, and conducting rigorous annual stress tests. The other part of this effort has been to make the failure of systemically important banks possible without either causing disorder in financial markets or re ...

... banking organizations by strengthening capital requirements, introducing liquidity requirements, and conducting rigorous annual stress tests. The other part of this effort has been to make the failure of systemically important banks possible without either causing disorder in financial markets or re ...

Policy Review Medium Term Debt Strategy

... The recently published IMF Article IV Consultation reports that Zambia’s debt sustainability is maintained under current levels of borrowing ($1.75b external Eurobond funding) except for debt service-to-revenue ratio under several external shocks in the years in which Eurobond principal repayments a ...

... The recently published IMF Article IV Consultation reports that Zambia’s debt sustainability is maintained under current levels of borrowing ($1.75b external Eurobond funding) except for debt service-to-revenue ratio under several external shocks in the years in which Eurobond principal repayments a ...

Debt, Growth and the Austerity Debate

... In the United States, we support reducing mortgage principal on homes that are underwater (where the mortgage is higher than the value of the home). We have also written about plausible solutions that involve moderately higher inflation and “financial repression” — pushing down inflation-adjusted in ...

... In the United States, we support reducing mortgage principal on homes that are underwater (where the mortgage is higher than the value of the home). We have also written about plausible solutions that involve moderately higher inflation and “financial repression” — pushing down inflation-adjusted in ...

Formulario_-_Bono_del_Tesoro_Noviembre

... Ministry of Economy and Finance E. S. D. I, _________________________, in my capacity as authorized representative of __________, hereby present irrevocable application for the acquisition of Public Debt Instruments denominated Treasury Bonds in the authorized Public Auction to be held on November 2 ...

... Ministry of Economy and Finance E. S. D. I, _________________________, in my capacity as authorized representative of __________, hereby present irrevocable application for the acquisition of Public Debt Instruments denominated Treasury Bonds in the authorized Public Auction to be held on November 2 ...

Debt - IronHorse LLC

... • Easier to fund a $ 15 million deal than a $ 2 million deal. • Private equity sources generally want to put at least $ 5-8 million of their money to work. • Universe of small capital providers is specialized, scattered and expensive. • Costs about the same in terms of time to search, solicit, secur ...

... • Easier to fund a $ 15 million deal than a $ 2 million deal. • Private equity sources generally want to put at least $ 5-8 million of their money to work. • Universe of small capital providers is specialized, scattered and expensive. • Costs about the same in terms of time to search, solicit, secur ...

Debt Finance - LLEP Business Gateway

... Just as short-term capital should not be used to fund long-term plans, so the reverse is true. On the financing journey it is highly likely that a business will need both, and the task is to get the mix right. Debt will undoubtedly be involved in growing a business. Debt comes in many different form ...

... Just as short-term capital should not be used to fund long-term plans, so the reverse is true. On the financing journey it is highly likely that a business will need both, and the task is to get the mix right. Debt will undoubtedly be involved in growing a business. Debt comes in many different form ...

The International Debt Crises is a big issue and has affected

... countries Libya and is not right. When countries want to bail out of their debt they should have to take on harsher measures. When Greece wanted to bail out of their debt they should have been forced to leave the European Nation because allowing them to stay in the European Nation put the rest of us ...

... countries Libya and is not right. When countries want to bail out of their debt they should have to take on harsher measures. When Greece wanted to bail out of their debt they should have been forced to leave the European Nation because allowing them to stay in the European Nation put the rest of us ...