Permira Debt Managers appoints David Hirschmann as Head of

... UK origination, bringing the total team size to 19. PDM’s most recent direct lending fund, Permira Credit Solutions 2 (PCS2), has already completed seven transactions since its first close at approximately €400m in October 2014. The Fund seeks to address a gap in the market for medium-sized business ...

... UK origination, bringing the total team size to 19. PDM’s most recent direct lending fund, Permira Credit Solutions 2 (PCS2), has already completed seven transactions since its first close at approximately €400m in October 2014. The Fund seeks to address a gap in the market for medium-sized business ...

Managing Finance and Budgets

... A Limited Company is obliged by law to lodge accounts with the Registrar of Companies. The company itself It may be possible to interview directors, inspect the premises, interview employees. Credit Agencies Specialist Agencies exist to provide information about creditworthiness. Information is take ...

... A Limited Company is obliged by law to lodge accounts with the Registrar of Companies. The company itself It may be possible to interview directors, inspect the premises, interview employees. Credit Agencies Specialist Agencies exist to provide information about creditworthiness. Information is take ...

public debt

... any income. It does not add to the productive assets of the country. For Eg. debts utilised for transfer payments in form of subsidies, old age pension, special incentives to weaker sections etc. Unproductive public loans are a net burden on the community. The government will have to resort to addit ...

... any income. It does not add to the productive assets of the country. For Eg. debts utilised for transfer payments in form of subsidies, old age pension, special incentives to weaker sections etc. Unproductive public loans are a net burden on the community. The government will have to resort to addit ...

theory of capital structure

... As we previously uncovered when we looked at financial leverage, this is not a surprising result. As a firm increases its use of debt, the risk to the stockholder increases and, as a consequence, the stockholder’s required rate of return will increase. Modigliani and Miller simply defined how the st ...

... As we previously uncovered when we looked at financial leverage, this is not a surprising result. As a firm increases its use of debt, the risk to the stockholder increases and, as a consequence, the stockholder’s required rate of return will increase. Modigliani and Miller simply defined how the st ...

the three stages of raising money

... family know and trust the entrepreneurs and they don’t have to take time to build relationships and credibility with investors who are unfamiliar with them. Also, friends and family are normally more reasonable in demanding terms, and entrepreneurs want to keep as much equity, or ownership, as possi ...

... family know and trust the entrepreneurs and they don’t have to take time to build relationships and credibility with investors who are unfamiliar with them. Also, friends and family are normally more reasonable in demanding terms, and entrepreneurs want to keep as much equity, or ownership, as possi ...

BVR8ppt

... companies in the sector, to estimate the cost of equity and capital. Use an estimated market value of equity, based upon applying a multiple (say a PE ratio) to your private company’s earnings to arrive at a debt to equity ratio. Use your DCF estimates of equity and debt value to compute your cost o ...

... companies in the sector, to estimate the cost of equity and capital. Use an estimated market value of equity, based upon applying a multiple (say a PE ratio) to your private company’s earnings to arrive at a debt to equity ratio. Use your DCF estimates of equity and debt value to compute your cost o ...

Managing Risks in a Rising Interest Rate

... nonprofit organizations had an opportunity to achieve taxfree investment returns in excess of borrowing costs. Match funding at the short end of the yield curve usually offers the best opportunity for arbitrage. Seeking investment returns in excess of borrowing costs at the long end of the yield cur ...

... nonprofit organizations had an opportunity to achieve taxfree investment returns in excess of borrowing costs. Match funding at the short end of the yield curve usually offers the best opportunity for arbitrage. Seeking investment returns in excess of borrowing costs at the long end of the yield cur ...

Debt Equity Ratio - Sa-Dhan

... all other things being equal. When an MFI is regulated, the degree to which it is allowed to leverage its equity is based on capital adequacy standards. It is important for all organisations to maintain a proper balance between debt and equity. If an MFI has a large amount of equity and very little ...

... all other things being equal. When an MFI is regulated, the degree to which it is allowed to leverage its equity is based on capital adequacy standards. It is important for all organisations to maintain a proper balance between debt and equity. If an MFI has a large amount of equity and very little ...

6. Key Indicators

... • Total debt divided by total liabilities. • Demonstrates ability to liquidate the firm, cover all liabilities out of all assets, and still have “cash” left over. • Should not exceed 0.50 to minimize financial risk exposure. • Some firms fail however at lower levels. 2. Leverage ratio: • Total debt ...

... • Total debt divided by total liabilities. • Demonstrates ability to liquidate the firm, cover all liabilities out of all assets, and still have “cash” left over. • Should not exceed 0.50 to minimize financial risk exposure. • Some firms fail however at lower levels. 2. Leverage ratio: • Total debt ...

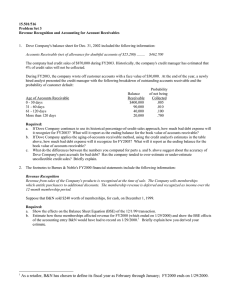

15.501/516 Problem Set 3 Revenue Recognition and Accounting for Account Receivables

... The company had credit sales of $870,000 during FY2003. Historically, the company's credit manager has estimated that 4% of credit sales will not be collected. During FY2003, the company wrote off customer accounts with a face value of $30,000. At the end of the year, a newly hired analyst presented ...

... The company had credit sales of $870,000 during FY2003. Historically, the company's credit manager has estimated that 4% of credit sales will not be collected. During FY2003, the company wrote off customer accounts with a face value of $30,000. At the end of the year, a newly hired analyst presented ...

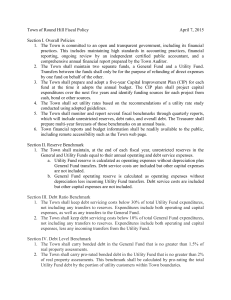

Fiscal Policy - The Town of Round Hill

... 3. The Town shall prepare and adopt a five-year Capital Improvement Plan (CIP) for each fund at the time it adopts the annual budget. The CIP plan shall project capital expenditures over the next five years and identify funding sources for each project from cash, bond or other sources. 4. The Town s ...

... 3. The Town shall prepare and adopt a five-year Capital Improvement Plan (CIP) for each fund at the time it adopts the annual budget. The CIP plan shall project capital expenditures over the next five years and identify funding sources for each project from cash, bond or other sources. 4. The Town s ...

Style 1* Title Slide

... Prudent debt management in the years before the crisis played a role in enhancing EM resilience to the crisis. (sometimes requiring difficult cost-risk tradeoffs) During the crisis, debt managers had room to maneuver and were able to adapt quickly – absorbed some risk from the market. The avai ...

... Prudent debt management in the years before the crisis played a role in enhancing EM resilience to the crisis. (sometimes requiring difficult cost-risk tradeoffs) During the crisis, debt managers had room to maneuver and were able to adapt quickly – absorbed some risk from the market. The avai ...

Article by Nicholas Dietrich of Gowlings expanding on comments

... M&A in the summer of 2007 has been the rapid and dramatic loss of leverage in the LBO markets. Just as the federal government and some senior and influential business leaders have lamented the hollowing-out of public corporate Canada through take-private acquisitions, many by foreign entities, it se ...

... M&A in the summer of 2007 has been the rapid and dramatic loss of leverage in the LBO markets. Just as the federal government and some senior and influential business leaders have lamented the hollowing-out of public corporate Canada through take-private acquisitions, many by foreign entities, it se ...

Household Spending and Debt

... their clients to service their debts. Regulatory authorities have taken measures to strengthen mortgage rules since 2008 and continue to monitor closely the financial situation of households. In addition, other government bodies have developed useful information to educate households and sensitize t ...

... their clients to service their debts. Regulatory authorities have taken measures to strengthen mortgage rules since 2008 and continue to monitor closely the financial situation of households. In addition, other government bodies have developed useful information to educate households and sensitize t ...

Account Stated CLE slideshow 10-22

... Stonebraker: Missouri’s gift to the Consumer’s Bar “But where the account stated is based in part upon transactions which are illegal and void, and this is shown in defense to the action thereon, we regard it as clear that the consideration for the debtor's express or implied promise to pay the bal ...

... Stonebraker: Missouri’s gift to the Consumer’s Bar “But where the account stated is based in part upon transactions which are illegal and void, and this is shown in defense to the action thereon, we regard it as clear that the consideration for the debtor's express or implied promise to pay the bal ...

TABOR Notice Template for Coordinating Entities in Arapahoe

... Estimated maximum dollar amount of proposed ...

... Estimated maximum dollar amount of proposed ...

Slide 1

... Debt and financial crises “Political incentives for additional borrowing could change quickly if financial markets began to penalize the United States for failing to put its fiscal house in order. If investors become less certain of full repayment or believe that the country is pursuing an inflatio ...

... Debt and financial crises “Political incentives for additional borrowing could change quickly if financial markets began to penalize the United States for failing to put its fiscal house in order. If investors become less certain of full repayment or believe that the country is pursuing an inflatio ...

An independent review of the fee-charging debt management industry

... industry and offer DMPs free of charge to people in debt. Almost ten years since the first independent research into fee-charging debt advice and management, the Money Advice Trust commissioned this review to provide an update on the fee-charging debt management industry in the UK. The review includ ...

... industry and offer DMPs free of charge to people in debt. Almost ten years since the first independent research into fee-charging debt advice and management, the Money Advice Trust commissioned this review to provide an update on the fee-charging debt management industry in the UK. The review includ ...

Fear and loathing of negative yielding debt: bond investor`s

... there are few good options left. Even in the U.S., long the destination of choice in times of stress, Treasuries are in such demand that when their cash flows are converted into euros, yields are even worse than the scant returns on German bunds. For euro-based buyers of 10-year Treasuries, swapping ...

... there are few good options left. Even in the U.S., long the destination of choice in times of stress, Treasuries are in such demand that when their cash flows are converted into euros, yields are even worse than the scant returns on German bunds. For euro-based buyers of 10-year Treasuries, swapping ...

Presentation - Keith Rankin

... economy that results, if creditors do not switch to a spending (use it) strategy, in a (lose it) rebalancing. The lose-it scenario may be a classic financial crisis (which may turn into an extended global recession such as the early 1930s), or a period of inflation (which may turn into a period of g ...

... economy that results, if creditors do not switch to a spending (use it) strategy, in a (lose it) rebalancing. The lose-it scenario may be a classic financial crisis (which may turn into an extended global recession such as the early 1930s), or a period of inflation (which may turn into a period of g ...

Make and serve a statutory demand, or challenge one : When you

... 1. When you can make a statutory demand You can make a statutory demand to ask for payment of a debt from an individual or company. Anyone who’s owed money (the ‘creditor’) can make a statutory demand. You don’t need a lawyer. If the debt’s over 6 years old, you can’t usually make a statutory demand ...

... 1. When you can make a statutory demand You can make a statutory demand to ask for payment of a debt from an individual or company. Anyone who’s owed money (the ‘creditor’) can make a statutory demand. You don’t need a lawyer. If the debt’s over 6 years old, you can’t usually make a statutory demand ...

Financial Reporting and Analysis Chapter 11 Web Solutions

... Lenders prefer these arrangements because it reduces their risk of default— you have an incentive to pay off the loan (or you lose the car). And, if you don’t? Well, the bank takes back the car and sells it. Management might prefer “collateralized” debt if it lowers the cost of debt. Collateralized ...

... Lenders prefer these arrangements because it reduces their risk of default— you have an incentive to pay off the loan (or you lose the car). And, if you don’t? Well, the bank takes back the car and sells it. Management might prefer “collateralized” debt if it lowers the cost of debt. Collateralized ...

The Debt-Ceiling Crisis - Center for American Progress

... benchmark for interest rates on common financial products in the United States such as mortgages and auto loans. A spike in interest rates on Treasury bonds because of a default would limit businesses and consumers from borrowing and could raise their current borrowing costs. A default could also ca ...

... benchmark for interest rates on common financial products in the United States such as mortgages and auto loans. A spike in interest rates on Treasury bonds because of a default would limit businesses and consumers from borrowing and could raise their current borrowing costs. A default could also ca ...

Slide 1

... Please join me in this short trip inside our debt-based financial system • Keynesianism and Monetarism have both failed because neither of them takes account of the mechanics of the debt system itself • This work proposes to replace them with an economic debt model that takes into account the mechan ...

... Please join me in this short trip inside our debt-based financial system • Keynesianism and Monetarism have both failed because neither of them takes account of the mechanics of the debt system itself • This work proposes to replace them with an economic debt model that takes into account the mechan ...