International Reserves and Foreign Currency Liquidity

... Concept: Gross international reserves are external assets that are readily available to and controlled by the National Bank of Kazakhstan (NBK) for direct financing of payment imbalances, for indirectly regulating the magnitude of such imbalances, through intervention in exchange markets to affect t ...

... Concept: Gross international reserves are external assets that are readily available to and controlled by the National Bank of Kazakhstan (NBK) for direct financing of payment imbalances, for indirectly regulating the magnitude of such imbalances, through intervention in exchange markets to affect t ...

Justification for the 09.05.2017 decision by the FCMC Board on

... continue to climb with the rate of the increase accelerating in the second half of 2016. Enlivening of the real estate market is a positive trend; however, this market segment should be closely monitored in view of relatively higher pace of housing price growth over past quarters. Housing price dyna ...

... continue to climb with the rate of the increase accelerating in the second half of 2016. Enlivening of the real estate market is a positive trend; however, this market segment should be closely monitored in view of relatively higher pace of housing price growth over past quarters. Housing price dyna ...

Thank you for the business

... The preceding quote is from a conference call following the announcement that America’s largest home-loan lender saw profits fall by a third because of growing delinquencies - not only from risky subprime borrowers, but also from some credit-worthy borrowers. Too bad Mr. Mizilo did not subscribe to ...

... The preceding quote is from a conference call following the announcement that America’s largest home-loan lender saw profits fall by a third because of growing delinquencies - not only from risky subprime borrowers, but also from some credit-worthy borrowers. Too bad Mr. Mizilo did not subscribe to ...

Sofia, Bulgaria, October 13, 2006 Milen Markov Chairman of

... 1. What should be the legal form of the mutlifunds: – one legal person with separate portfolios with different level of risk – each portfolio should be a separate legal person ...

... 1. What should be the legal form of the mutlifunds: – one legal person with separate portfolios with different level of risk – each portfolio should be a separate legal person ...

1Q17 FT Preferred Securities and Income Fact

... also subject the Fund to many of the same risks associated with direct cyber security breaches. The Fund has established risk management systems designed to reduce the risks associated with cyber security. However, there is no guarantee that such efforts will succeed, especially because the Fund doe ...

... also subject the Fund to many of the same risks associated with direct cyber security breaches. The Fund has established risk management systems designed to reduce the risks associated with cyber security. However, there is no guarantee that such efforts will succeed, especially because the Fund doe ...

An explanation of accounting jargon

... This is a figure that appears in the Balance Sheet. It comprises the current assets less the current liabilities. It can be a very important figure. For example, you may have total assets of £1,000,001, but if a million of this is an old building and only £1 is in the bank then it’s not so good. Pre ...

... This is a figure that appears in the Balance Sheet. It comprises the current assets less the current liabilities. It can be a very important figure. For example, you may have total assets of £1,000,001, but if a million of this is an old building and only £1 is in the bank then it’s not so good. Pre ...

Economic Turmoil and Private Student Loans What it Means to Your Students

... • Private loans are those that exist outside the federal student loan system and are not guaranteed by the federal government. • Private loans may be provided by banks, non-profit agencies, or other financial institutions. • Private Loans for education were created to bridge the gap between the fund ...

... • Private loans are those that exist outside the federal student loan system and are not guaranteed by the federal government. • Private loans may be provided by banks, non-profit agencies, or other financial institutions. • Private Loans for education were created to bridge the gap between the fund ...

press release (Word)

... This press release does not contain or constitute an offer of, or the solicitation of an offer to buy or subscribe for, securities to any person in Australia, Canada, Japan, or the United States of America (the "United States"), or in any jurisdiction to whom or in which such offer or solicitation i ...

... This press release does not contain or constitute an offer of, or the solicitation of an offer to buy or subscribe for, securities to any person in Australia, Canada, Japan, or the United States of America (the "United States"), or in any jurisdiction to whom or in which such offer or solicitation i ...

Portfolio Selection and the Asset Allocation Decision

... Decision about the proportion of portfolio assets allocated to equity, fixed-income, and money market securities ...

... Decision about the proportion of portfolio assets allocated to equity, fixed-income, and money market securities ...

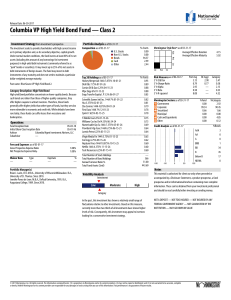

Columbia VP High Yield Bond Fund — Class 2

... purposes) in high-yield debt instruments (commonly referred to as "junk" bonds or securities). It may invest up to 25% of its net assets in debt instruments of foreign issuers. The fund may invest in debt instruments of any maturity and does not seek to maintain a particular dollar-weighted average ...

... purposes) in high-yield debt instruments (commonly referred to as "junk" bonds or securities). It may invest up to 25% of its net assets in debt instruments of foreign issuers. The fund may invest in debt instruments of any maturity and does not seek to maintain a particular dollar-weighted average ...

Team USA

... the banking sector: toxic assets keeping banks from lending and the shortage of capital at major institutions. The plan’s goal is to free up the capital of banks and institutions and stimulate the extension of credit. It helps to ensure that credit is available to large and small households and busi ...

... the banking sector: toxic assets keeping banks from lending and the shortage of capital at major institutions. The plan’s goal is to free up the capital of banks and institutions and stimulate the extension of credit. It helps to ensure that credit is available to large and small households and busi ...

Partner with a Leading Finance Company Ascentium Capital LLC

... Compensating Balances: Most banks require that you maintain certain minimum balances for the lowest rate. The consequence of this is if you maintain certain balances that they pay no, or low, interest, this inflates the bank’s actual yield above your loan interest rate. This also ties up working cap ...

... Compensating Balances: Most banks require that you maintain certain minimum balances for the lowest rate. The consequence of this is if you maintain certain balances that they pay no, or low, interest, this inflates the bank’s actual yield above your loan interest rate. This also ties up working cap ...

What is Credit- Teacher Guide

... the Student Workbook. Ask the students to follow along as you explain the types of credit found in the table, as well as the advantages and disadvantages of each. Make sure that the students understand the key characteristics of the lending institutions identified in the table. These characteristics ...

... the Student Workbook. Ask the students to follow along as you explain the types of credit found in the table, as well as the advantages and disadvantages of each. Make sure that the students understand the key characteristics of the lending institutions identified in the table. These characteristics ...

Law for Business

... challenging loan denials Credit file typically goes back seven years (unless loan is for larger sums of money) Bankruptcy information goes back ten years Employers may check Credit Scores as well as lenders Auto insurance rates consider Credit Scores* Income is not considered… Why? * - Consumer Repo ...

... challenging loan denials Credit file typically goes back seven years (unless loan is for larger sums of money) Bankruptcy information goes back ten years Employers may check Credit Scores as well as lenders Auto insurance rates consider Credit Scores* Income is not considered… Why? * - Consumer Repo ...

Concept 6 Kaufman

... Strategies used in the for-profit world can set not-for-profit organizations apart from their competitors. Debt/Equity Financing and Traditional/Nontraditional Financing Capital from external sources is classified as either debt capital or equity capital. Debt capital is available in three maj ...

... Strategies used in the for-profit world can set not-for-profit organizations apart from their competitors. Debt/Equity Financing and Traditional/Nontraditional Financing Capital from external sources is classified as either debt capital or equity capital. Debt capital is available in three maj ...

OnePath Diversified Fixed Interest

... to generate a solid track record with a high degree of consistency. PIMCO seek to add value through the use of “top-down” strategies such as exposure to interest rates, duration, changing volatility, yield curve positioning and sector rotation. PIMCO also employs “bottom-up” strategies involving ana ...

... to generate a solid track record with a high degree of consistency. PIMCO seek to add value through the use of “top-down” strategies such as exposure to interest rates, duration, changing volatility, yield curve positioning and sector rotation. PIMCO also employs “bottom-up” strategies involving ana ...

SECURITIES OPERATIONS

... Traders (members) hold seats. (Specialists, Floor traders, Odd Lot traders) Sale of seats must be approved (Pre-qualifications must be met.) Transactions tend to be centralized; advantageous for price discovery ...

... Traders (members) hold seats. (Specialists, Floor traders, Odd Lot traders) Sale of seats must be approved (Pre-qualifications must be met.) Transactions tend to be centralized; advantageous for price discovery ...