English

... CESD believe the Oil Fund needs improvements, including but not limited to those listed below, in some areas of action: to develop a long-term investment strategy which shall include the size of assets to impact each asset type as well as their geographical distribution. Namely, it is necessary to ...

... CESD believe the Oil Fund needs improvements, including but not limited to those listed below, in some areas of action: to develop a long-term investment strategy which shall include the size of assets to impact each asset type as well as their geographical distribution. Namely, it is necessary to ...

Security Analysis and Portfolio Management

... Borrowing funds by selling securities with an agreement to repurchase the said securities on a mutually agreed future date at an agreed price which includes interest for the funds borrowed. Reverse Repo market The reverse of the repo transaction is called ‘reverse repo’ Buying of securities ...

... Borrowing funds by selling securities with an agreement to repurchase the said securities on a mutually agreed future date at an agreed price which includes interest for the funds borrowed. Reverse Repo market The reverse of the repo transaction is called ‘reverse repo’ Buying of securities ...

Interest Rate and Credit Default Swaps

... Challenge: The rampant and unregulated use of Credit Default Swaps (CDSs) were a major contributor to the stock market crash of 2008 and the Great Recession. Research which firm sold the most CDSs and which consequently was not able to pay off the insurance it had sold when firms like Lehman Brother ...

... Challenge: The rampant and unregulated use of Credit Default Swaps (CDSs) were a major contributor to the stock market crash of 2008 and the Great Recession. Research which firm sold the most CDSs and which consequently was not able to pay off the insurance it had sold when firms like Lehman Brother ...

Prepare for the Bear, Whenever It Arrives A Study In Succession

... need, then return them to the IRA within 60 days, and there are no tax consequences. For many years it was widely believed that one 60-day rollover was allowed from each IRA a taxpayer maintained. But earlier this year the U.S. Tax Court (see Bobrow v. Commissioner) scotched that idea, interpreting ...

... need, then return them to the IRA within 60 days, and there are no tax consequences. For many years it was widely believed that one 60-day rollover was allowed from each IRA a taxpayer maintained. But earlier this year the U.S. Tax Court (see Bobrow v. Commissioner) scotched that idea, interpreting ...

Banking Services

... Loans (More money out than in) ◦ Lending helps economy function, money in hands of consumers increases demand, money in investors’ hands leads to more businesses ◦ Banks loose money if borrowers default on loans, do not pay back ...

... Loans (More money out than in) ◦ Lending helps economy function, money in hands of consumers increases demand, money in investors’ hands leads to more businesses ◦ Banks loose money if borrowers default on loans, do not pay back ...

RECESSIONS, DEPRESSIONS, DEFLATION, INFLATION

... ■ has this been helpful ? The Federal Reserve and the Treasury have their heads full of these concerns, and the more individuals understand them, the more they know about how economic trends develop and how economic policy works. If you’d like to learn more about how inflation trends, interest rate ...

... ■ has this been helpful ? The Federal Reserve and the Treasury have their heads full of these concerns, and the more individuals understand them, the more they know about how economic trends develop and how economic policy works. If you’d like to learn more about how inflation trends, interest rate ...

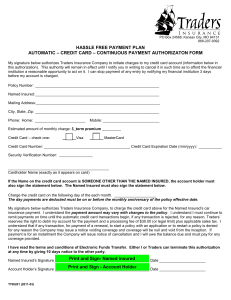

HASSLE FREE PAYMENT PLAN AUTOMATIC – CREDIT CARD

... If the Name on the credit card account is SOMEONE OTHER THAN THE NAMED INSURED, the account holder must also sign the statement below. The Named Insured must also sign the statement below. Charge the credit card on the following day of the each month. ____________________ The day payments are deduct ...

... If the Name on the credit card account is SOMEONE OTHER THAN THE NAMED INSURED, the account holder must also sign the statement below. The Named Insured must also sign the statement below. Charge the credit card on the following day of the each month. ____________________ The day payments are deduct ...

NEWS RELEASE

... company almost dominates the domestic market and is among the global market leaders for terpene resins. Strong relationships with suppliers allow for stable procurement of raw materials. Thanks to this, as well as the advantage of having blue-chip companies on its client list, the earnings base is s ...

... company almost dominates the domestic market and is among the global market leaders for terpene resins. Strong relationships with suppliers allow for stable procurement of raw materials. Thanks to this, as well as the advantage of having blue-chip companies on its client list, the earnings base is s ...

What Types of Financial Market Structures Exist

... distribute dividends to shareholders. For example, a corporation might instead choose to keep its profits as retained earnings to be used for new capital investment (self-financing of investment rather than debt or equity financing). On the other hand, corporations cannot charge losses to their comm ...

... distribute dividends to shareholders. For example, a corporation might instead choose to keep its profits as retained earnings to be used for new capital investment (self-financing of investment rather than debt or equity financing). On the other hand, corporations cannot charge losses to their comm ...

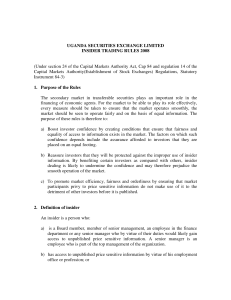

USE Insider Trading Rules-2009

... An insider shall not trade in securities during the closed periods which shall be periods 8 weeks to the publication of financial information. However, the prohibition on purchases, sales, pledges and gifts of listed securities during closed periods does not apply to: a) Purchases made under an empl ...

... An insider shall not trade in securities during the closed periods which shall be periods 8 weeks to the publication of financial information. However, the prohibition on purchases, sales, pledges and gifts of listed securities during closed periods does not apply to: a) Purchases made under an empl ...

This communication has been prepared by

... sale of any financial instrument, investment product or service, or as an official confirmation of any transaction. TD Securities is neither making any investment recommendation nor providing any professional or advisory services relating to the matters described herein. Neither TD Securities nor an ...

... sale of any financial instrument, investment product or service, or as an official confirmation of any transaction. TD Securities is neither making any investment recommendation nor providing any professional or advisory services relating to the matters described herein. Neither TD Securities nor an ...

CASLA membership form - Canadian Securities Lending Association

... Fixed Income Please describe your business function: ...

... Fixed Income Please describe your business function: ...

Southern Agriculture`s Current Financial Situation

... Loan Losses • Banks across the country have increased loan loss reserves. • Loan loss provisions represent close to 0.4 percent of total loan volume for farm banks. ...

... Loan Losses • Banks across the country have increased loan loss reserves. • Loan loss provisions represent close to 0.4 percent of total loan volume for farm banks. ...

How does a monetary policy affect the economy

... Other assets prices also channel Ms changes according to Tobin q theory and wealth effects on consumption. q = (stock-market value of firm)/assets. High q means firms can issue equity easily and buy extra assets and thus invest. However, when Ms is reduced, public spends less on stock-markets, thus ...

... Other assets prices also channel Ms changes according to Tobin q theory and wealth effects on consumption. q = (stock-market value of firm)/assets. High q means firms can issue equity easily and buy extra assets and thus invest. However, when Ms is reduced, public spends less on stock-markets, thus ...

CHAPTER 6 ANSWERS TO "DO YOU UNDERSTAND?" TEXT

... bonds and drives up their yields. At the same time, buying pressure on Treasury bonds drives their prices up and yields down. Thus, the spread widens during recessions. As the economy improves, investors may be more willing to hold the more risky (corporate) bonds. They buy more corporate bonds and ...

... bonds and drives up their yields. At the same time, buying pressure on Treasury bonds drives their prices up and yields down. Thus, the spread widens during recessions. As the economy improves, investors may be more willing to hold the more risky (corporate) bonds. They buy more corporate bonds and ...

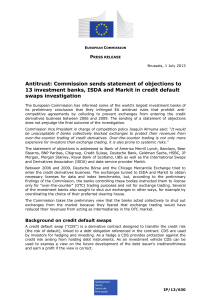

European Commission

... In the period under investigation (2006-2009) CDS were traded over-the-counter (OTC), that is to say, they were privately and bilaterally negotiated. In OTC trading an investment bank typically acts as intermediary between supply and demand in the market for credit derivatives by promising to be a ...

... In the period under investigation (2006-2009) CDS were traded over-the-counter (OTC), that is to say, they were privately and bilaterally negotiated. In OTC trading an investment bank typically acts as intermediary between supply and demand in the market for credit derivatives by promising to be a ...