Money, Banks, Credit

... 1. Unsecured loans – loan based on reputation. No collateral used. 2. Secured loans – have collateral to back up the loan. Ex. You need something of equal value to cover the cost of the loan the bank can take if you default on the loan (don’t pay) ...

... 1. Unsecured loans – loan based on reputation. No collateral used. 2. Secured loans – have collateral to back up the loan. Ex. You need something of equal value to cover the cost of the loan the bank can take if you default on the loan (don’t pay) ...

Do you have hidden risks in your bond portfolio?

... 1 Source: Morningstar as of 12/31/16. Core bond returns represented by IA SBBI IT Govt Index from 1926 to 1975 and the Bloomberg Barclays U.S. Aggregate Bond Index from 1976 to 2016. Stock returns are represented by IA SBBI Large Stock Index from 1929 to 1970 and the S&P 500 Index from 1971 to 2016. ...

... 1 Source: Morningstar as of 12/31/16. Core bond returns represented by IA SBBI IT Govt Index from 1926 to 1975 and the Bloomberg Barclays U.S. Aggregate Bond Index from 1976 to 2016. Stock returns are represented by IA SBBI Large Stock Index from 1929 to 1970 and the S&P 500 Index from 1971 to 2016. ...

New Client Questionnaire

... Which of the following statements best describes your investment objectives? o _____ My highest priority is to preserve my investments and I am willing to accept minimal return in order to do so o _____ I seek to generate income from my investments and am interested in investments that have historic ...

... Which of the following statements best describes your investment objectives? o _____ My highest priority is to preserve my investments and I am willing to accept minimal return in order to do so o _____ I seek to generate income from my investments and am interested in investments that have historic ...

Claim for Securities

... Rule 503—Voidable Securities Transactions (a) Nothing in these Series 500 Rules shall be construed as limiting the rights of a trustee in a liquidation proceeding under the Act to avoid any securities transaction as fraudulent, preferential, or otherwise voidable under applicable law. (b) Nothing ...

... Rule 503—Voidable Securities Transactions (a) Nothing in these Series 500 Rules shall be construed as limiting the rights of a trustee in a liquidation proceeding under the Act to avoid any securities transaction as fraudulent, preferential, or otherwise voidable under applicable law. (b) Nothing ...

Notice of a bondholder intention to sell a certain number of bonds to

... MICEX Securities Market Section's trading system, which is addressed to the Issuer's agent, on the appropriate bond purchase date (if the bondholder is not a member of MICEX' Securities ...

... MICEX Securities Market Section's trading system, which is addressed to the Issuer's agent, on the appropriate bond purchase date (if the bondholder is not a member of MICEX' Securities ...

Credit Unions and Caisses Populaires SECTOR OUTLOOK 3Q16

... The Bank of Canada’s October Monetary Policy Report expects economic growth in Canada to be lower than previously projected in July due to slower near-term housing resale activity and lower exports. New measures implemented to promote stability in Canada’s housing market (details provided below) are ...

... The Bank of Canada’s October Monetary Policy Report expects economic growth in Canada to be lower than previously projected in July due to slower near-term housing resale activity and lower exports. New measures implemented to promote stability in Canada’s housing market (details provided below) are ...

Investment Grade Bond Fund

... Prior to 7/31/2007, the Investment Grade Bond Fund was an actively managed strategy that diversified its investments among fixed income securities (bills, notes, bonds, and mortgage backed securities) issued by the U.S. Treasury and federal government agencies and in other fixed income securities ra ...

... Prior to 7/31/2007, the Investment Grade Bond Fund was an actively managed strategy that diversified its investments among fixed income securities (bills, notes, bonds, and mortgage backed securities) issued by the U.S. Treasury and federal government agencies and in other fixed income securities ra ...

financial ratios - Timeless Investor

... Other issues in financial analysis of Insurance Companies • Look for significant differences between fair value of investments and their costs or amortized costs. • Check the equity section for unrealized gains (losses). • Check for a deferred policy acquisition cost buildup. • Check that loss rese ...

... Other issues in financial analysis of Insurance Companies • Look for significant differences between fair value of investments and their costs or amortized costs. • Check the equity section for unrealized gains (losses). • Check for a deferred policy acquisition cost buildup. • Check that loss rese ...

Document

... – already issued securities are traded – stock exchanges, commodities exchanges, over-the-counter market ...

... – already issued securities are traded – stock exchanges, commodities exchanges, over-the-counter market ...

CHAPTER 16, CREDIT IN AMERICA CREDIT

... CREDIT- Privilege of buying something now, with the agreement to pay for it later, or borrowing money with the promise to pay it back later. The need for credit arose when the country grew from a bartering and trading society to a currency exchange. Americans began to be dependent on one another. So ...

... CREDIT- Privilege of buying something now, with the agreement to pay for it later, or borrowing money with the promise to pay it back later. The need for credit arose when the country grew from a bartering and trading society to a currency exchange. Americans began to be dependent on one another. So ...

Credit

... The material contained herein has been prepared from sources we believe to be reliable, but is provided without any representation as to accuracy or completeness. This material does not purport to be a complete analysis of the securities, companies or industries involved. This material is published ...

... The material contained herein has been prepared from sources we believe to be reliable, but is provided without any representation as to accuracy or completeness. This material does not purport to be a complete analysis of the securities, companies or industries involved. This material is published ...

Broker-dealer Companies Indicators

... higher amounts, activation of the pledge on account of unsettled liabilities for loans approved; investment of shares for establishing legal entities; contracts on absorptiontype merger as well as transfer of ownership of securities between persons within a consortium. 13. The client often (several ...

... higher amounts, activation of the pledge on account of unsettled liabilities for loans approved; investment of shares for establishing legal entities; contracts on absorptiontype merger as well as transfer of ownership of securities between persons within a consortium. 13. The client often (several ...

FINANCIAL CRISIS

... Resulted from Dot Com Bubbles Federal reserves kept short-term interest rate This condition coincided with a global savings surplus Due to high savings that accumulated large reserves Global interest rate decreased Investors were alarmed of this low return ...

... Resulted from Dot Com Bubbles Federal reserves kept short-term interest rate This condition coincided with a global savings surplus Due to high savings that accumulated large reserves Global interest rate decreased Investors were alarmed of this low return ...

Case 2–1 - Fisher College of Business

... the financial position of the company for more than one year. Often, trends in a company's financial position are more important than absolute figures. ETHICS CASE: Violating a Covenant There are many ways to change the current ratio. Some of them have a legitimate business purpose and some don't. F ...

... the financial position of the company for more than one year. Often, trends in a company's financial position are more important than absolute figures. ETHICS CASE: Violating a Covenant There are many ways to change the current ratio. Some of them have a legitimate business purpose and some don't. F ...

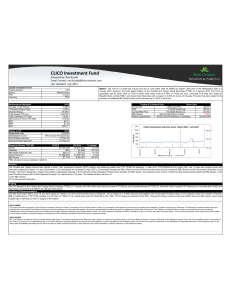

CLICO Investment Fund

... RBL's market price is TTD115.00 resulting in a CIF NAV of TTD26.17. At a listed share price of TTD22.65 on the TTSE, CIF is trading at a discount to the NAV. Through the listing, investors will have indirect access to RBL shares, which have usually high in demand but short in supply on the market. ...

... RBL's market price is TTD115.00 resulting in a CIF NAV of TTD26.17. At a listed share price of TTD22.65 on the TTSE, CIF is trading at a discount to the NAV. Through the listing, investors will have indirect access to RBL shares, which have usually high in demand but short in supply on the market. ...

INTRODUCTION TO

... not just that, they must reveal, in their annual reports from next year, what they did in each “vote”. SEBI has now made it mandatory for funds to disclose whether they voted for or against moves (suggested by companies in which they have invested) such as mergers, demergers, corporate governance ...

... not just that, they must reveal, in their annual reports from next year, what they did in each “vote”. SEBI has now made it mandatory for funds to disclose whether they voted for or against moves (suggested by companies in which they have invested) such as mergers, demergers, corporate governance ...