Module1.2

... ABSs (asset backed securities) are same as MBSs but cash flows are from a pool of home equity loans, auto loans, student loans, credit card receivables, . . . Now $1.3 trillion in student loans (but not all have been securitized, i.e., made into ABSs). ...

... ABSs (asset backed securities) are same as MBSs but cash flows are from a pool of home equity loans, auto loans, student loans, credit card receivables, . . . Now $1.3 trillion in student loans (but not all have been securitized, i.e., made into ABSs). ...

DATE

... Currently, investors in [insert state here] and throughout the country are compelled to sign mandatory pre-dispute arbitration clauses when they invest with broker dealers, and, in many instances, investment advisers. Mandatory pre-dispute arbitration contracts require that investors submit to arbit ...

... Currently, investors in [insert state here] and throughout the country are compelled to sign mandatory pre-dispute arbitration clauses when they invest with broker dealers, and, in many instances, investment advisers. Mandatory pre-dispute arbitration contracts require that investors submit to arbit ...

Perfect Storm or Perfect Nonsense Size: 33.5kb Last

... revenues to offset the declining structured finance business at larger institutions and the regional and community bank C&D business models. These discredited toxic business models had generated the majority of their income growth. Complicating this effort is the reduction of leverage formerly used ...

... revenues to offset the declining structured finance business at larger institutions and the regional and community bank C&D business models. These discredited toxic business models had generated the majority of their income growth. Complicating this effort is the reduction of leverage formerly used ...

Current Acid-test Debt to Action Ratio Ratio Equity Ratio

... Identify and explain the deficiencies in the statement prepared by the company’s accountant. Include in your answer items that require additional disclosure, either on the face of the statement or in a note. ...

... Identify and explain the deficiencies in the statement prepared by the company’s accountant. Include in your answer items that require additional disclosure, either on the face of the statement or in a note. ...

Bill to strengthen regulation of short selling (15.12.99)

... Bill to strengthen regulation of short selling Wednesday, December 15, 1999 A bill which seeks to amend the Securities Ordinance (Cap.333) to strengthen the regulation of short selling and to increase penalties for "uncovered" short selling was approved by the Executive Council for introduction into ...

... Bill to strengthen regulation of short selling Wednesday, December 15, 1999 A bill which seeks to amend the Securities Ordinance (Cap.333) to strengthen the regulation of short selling and to increase penalties for "uncovered" short selling was approved by the Executive Council for introduction into ...

CMHC Newcomer

... 5% down payment for the purchase price (or lending value) portion ≤ $500,000. 10% down payment for the purchase price (or lending value) portion > $500,000. Maximum purchase price or as-improved property value must be below $1,000,000. At least one borrower (or guarantor) must have a minimum credit ...

... 5% down payment for the purchase price (or lending value) portion ≤ $500,000. 10% down payment for the purchase price (or lending value) portion > $500,000. Maximum purchase price or as-improved property value must be below $1,000,000. At least one borrower (or guarantor) must have a minimum credit ...

Leveraged ETF credit risks

... Most exchange-traded products are index investments, backed by the actual portfolio of equities or bonds. Although an investor may be taking on the underlying risks of those portfolio holdings, they are not exposed to any risk from the issuer's financial state. For example, if State Street (NYSE:STT ...

... Most exchange-traded products are index investments, backed by the actual portfolio of equities or bonds. Although an investor may be taking on the underlying risks of those portfolio holdings, they are not exposed to any risk from the issuer's financial state. For example, if State Street (NYSE:STT ...

The Timeless Case for Floating-Rate Loans as a Strategic Allocation

... of principal and interest. The value of income securities also may decline because of real or perceived concerns about the issuer’s ability to make principal and interest payments. Borrowing to increase investments (leverage) will exaggerate the effect of any increase or decrease in the value of Fun ...

... of principal and interest. The value of income securities also may decline because of real or perceived concerns about the issuer’s ability to make principal and interest payments. Borrowing to increase investments (leverage) will exaggerate the effect of any increase or decrease in the value of Fun ...

Ch#18 Bank Management

... • The composition of banks balance sheet will determine how its profitability is influenced by interest rate fluctuations. • If a bank expects interest rates to consistently decrease over time, it will consider allocating most of its funds to rate insensitive assets, such as long-term and medium-ter ...

... • The composition of banks balance sheet will determine how its profitability is influenced by interest rate fluctuations. • If a bank expects interest rates to consistently decrease over time, it will consider allocating most of its funds to rate insensitive assets, such as long-term and medium-ter ...

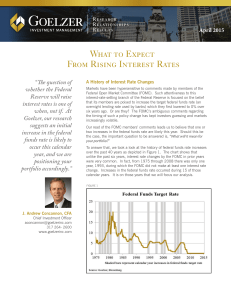

What to Expect From Rising Interest Rates

... While the impact of an increase in the federal funds rate has typically been greater for shorter versus longer-maturity yields, what is important to note is the price change on the underlying securities. As a general rule, shorter-maturity bonds are impacted less by changes in yield than are longer- ...

... While the impact of an increase in the federal funds rate has typically been greater for shorter versus longer-maturity yields, what is important to note is the price change on the underlying securities. As a general rule, shorter-maturity bonds are impacted less by changes in yield than are longer- ...

Document

... The factors are largely macro economic in nature –Demand/Supply of money: When economic growth is high, demand for money increases, pushing the interest rates up and vice versa. Government Borrowing and Fiscal Deficit : Since the government is the biggest borrower in the debt market, the level of bo ...

... The factors are largely macro economic in nature –Demand/Supply of money: When economic growth is high, demand for money increases, pushing the interest rates up and vice versa. Government Borrowing and Fiscal Deficit : Since the government is the biggest borrower in the debt market, the level of bo ...

(DOC file) No 177/2006 amending Rules No 530/2004

... on FME criteria for assessing the exposure of financial undertakings and decisions on capital adequacy ratios above the statutory minimum, with later amendments 1 Article 1 These Rules specify the criteria applied by the Financial Supervisory Authority (FME) for assessing levels of exposure and the ...

... on FME criteria for assessing the exposure of financial undertakings and decisions on capital adequacy ratios above the statutory minimum, with later amendments 1 Article 1 These Rules specify the criteria applied by the Financial Supervisory Authority (FME) for assessing levels of exposure and the ...

RMS Policy - Adinath Capital Services Limited

... system and client may take exposure on the basis of margin applicable for respective security as per VAR based margining system of the stock exchange. Client may take benefit of “credit for sale” i.e. benefit of share held as margin by selling the same by selecting Delivery option through order entr ...

... system and client may take exposure on the basis of margin applicable for respective security as per VAR based margining system of the stock exchange. Client may take benefit of “credit for sale” i.e. benefit of share held as margin by selling the same by selecting Delivery option through order entr ...

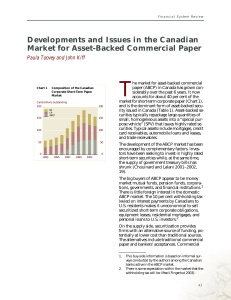

Developments and Issues in the Canadian Market

... ABCP provides funding on an anonymous basis, which could be important for some who might otherwise issue traditional commercial paper or bankers’ acceptances.5 In contrast, in ...

... ABCP provides funding on an anonymous basis, which could be important for some who might otherwise issue traditional commercial paper or bankers’ acceptances.5 In contrast, in ...

The Role of Cash Flows in Value Investing

... A firm can raise funds by issuing different types of financial securities, including both debt and equity types. Financing decisions such as these are summarized on the liabilities and owners’ equity side of the balance sheet. In addition to selling securities, a firm can raise cash by borrowing fro ...

... A firm can raise funds by issuing different types of financial securities, including both debt and equity types. Financing decisions such as these are summarized on the liabilities and owners’ equity side of the balance sheet. In addition to selling securities, a firm can raise cash by borrowing fro ...

The RAM Opportunistic Value Portfolio

... company’s assets. This asset assessment step is the most critical for our “price per pound” investment process. The flexibility of our process allows us to define an asset in the following ways: real estate, oil/gas reserves, sticky/recurring software contracts, research and development investments, ...

... company’s assets. This asset assessment step is the most critical for our “price per pound” investment process. The flexibility of our process allows us to define an asset in the following ways: real estate, oil/gas reserves, sticky/recurring software contracts, research and development investments, ...