Financial Engineering is BACK!

... The CURRAN RISK to defense is that equity markets can climb higher into 2015-2016 because of unprecedented global ZIRP and global QE policies. This is especially true in the EU which is just getting started with its asset inflation policies. This is the one market where I am willing to take some ris ...

... The CURRAN RISK to defense is that equity markets can climb higher into 2015-2016 because of unprecedented global ZIRP and global QE policies. This is especially true in the EU which is just getting started with its asset inflation policies. This is the one market where I am willing to take some ris ...

Europe`s bank loan funds – where now?

... For all those uncertainties, the US market in CLOs is humming while its European counterpart remains closed. According to data provider S&P Capital IQ LCD, the first quarter of this year saw a jump in US CLO issuance from $1.22 billion to $5.83 billion. April 2012 then saw a further upsurge in activ ...

... For all those uncertainties, the US market in CLOs is humming while its European counterpart remains closed. According to data provider S&P Capital IQ LCD, the first quarter of this year saw a jump in US CLO issuance from $1.22 billion to $5.83 billion. April 2012 then saw a further upsurge in activ ...

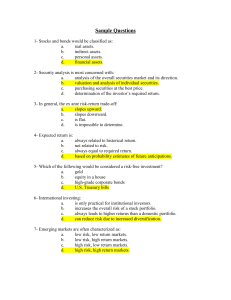

Sample Questions - U of L Class Index

... 17- The measure that allows investors to assess total performance over a stated period of time is the: a. total return. b. cumulative total return. c. cumulative average return. d. total indexed return. 18- Which of the following return measures smoothes out variations in performance? a. total retur ...

... 17- The measure that allows investors to assess total performance over a stated period of time is the: a. total return. b. cumulative total return. c. cumulative average return. d. total indexed return. 18- Which of the following return measures smoothes out variations in performance? a. total retur ...

Case Study 1 Understanding Economic Equivalence

... Car loans are usually repaid over 3, 4, or 5 years. The APR on a car loan can be as low as 2.9% (if the timing is right) or as high as 12%. As a first-time car buyer, Enrico can secure a $15,000 car loan at 9% compounded monthly to be repaid over 60 months. A 30-year, fixed rate mortgage is currentl ...

... Car loans are usually repaid over 3, 4, or 5 years. The APR on a car loan can be as low as 2.9% (if the timing is right) or as high as 12%. As a first-time car buyer, Enrico can secure a $15,000 car loan at 9% compounded monthly to be repaid over 60 months. A 30-year, fixed rate mortgage is currentl ...

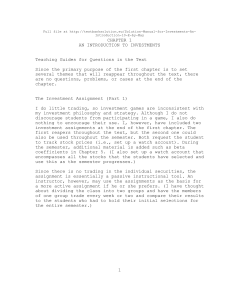

FREE Sample Here - We can offer most test bank and

... financial markets are efficient and the course will not generate higher returns, the instructor is given an excellent opportunity to discuss why markets are efficient and the advantages offered by such efficiency. Point out the rapid dissemination of information, the investor's need to be informed, ...

... financial markets are efficient and the course will not generate higher returns, the instructor is given an excellent opportunity to discuss why markets are efficient and the advantages offered by such efficiency. Point out the rapid dissemination of information, the investor's need to be informed, ...

State-owned banks - Study of Financial System Guarantees

... over 700 to just under 200. Most of that decline is the result of voluntary mergers between credit unions. Some, however, involved transfers of business required by State regulators in cases where credit unions were in breach of legislative requirements or, in a small number of cases (primarily in t ...

... over 700 to just under 200. Most of that decline is the result of voluntary mergers between credit unions. Some, however, involved transfers of business required by State regulators in cases where credit unions were in breach of legislative requirements or, in a small number of cases (primarily in t ...

Chapter 11

... What is a derivative security? A derivative security has its value determined by, or derived from, the value of another investment vehicle. They represent a contract on an underlying security or asset ...

... What is a derivative security? A derivative security has its value determined by, or derived from, the value of another investment vehicle. They represent a contract on an underlying security or asset ...

PowerPoint **

... 1. The owner, Jack, invested $200,000 cash to set up a business on 1 May 20X6. 2. On 2 May 20X6, Jack provided a motor van, which cost $80,000, to the business. 3. On 4 May 20X6, Jack Company purchased office equipment using $25,000 cash. 4. On 10 May 20X6, Jack Company borrowed a bank loan of $15,0 ...

... 1. The owner, Jack, invested $200,000 cash to set up a business on 1 May 20X6. 2. On 2 May 20X6, Jack provided a motor van, which cost $80,000, to the business. 3. On 4 May 20X6, Jack Company purchased office equipment using $25,000 cash. 4. On 10 May 20X6, Jack Company borrowed a bank loan of $15,0 ...

Accounting Mnemonics-How to Remember the Debit and Credit

... Accounting Equation is Total Assets= Total Liabilities + Total Equities Accounts have a left side and a right side. The left side is always the debit side and the right side is always the credit side. We use T-Accounts for learning and they represent ledger accounts. For example, the ledger account ...

... Accounting Equation is Total Assets= Total Liabilities + Total Equities Accounts have a left side and a right side. The left side is always the debit side and the right side is always the credit side. We use T-Accounts for learning and they represent ledger accounts. For example, the ledger account ...

Lecture 6

... B be the market value of the debt issued by the firm S be the market value of the equity issued by the firm rB be the required return to the debt rs be the required return to the firm's equity ro be the discount rate applied to the business risk of the firm ...

... B be the market value of the debt issued by the firm S be the market value of the equity issued by the firm rB be the required return to the debt rs be the required return to the firm's equity ro be the discount rate applied to the business risk of the firm ...

SEBI

... organization from holding such position. Impound and retain the proceeds or securities in respect of any transaction which is under investigation. Attach for a period not exceeding one month, one or more bank account or accounts of any intermediary or any person associated with the securities ma ...

... organization from holding such position. Impound and retain the proceeds or securities in respect of any transaction which is under investigation. Attach for a period not exceeding one month, one or more bank account or accounts of any intermediary or any person associated with the securities ma ...

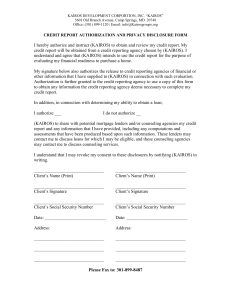

credit report authorization and privacy disclosure form

... Authorization is further granted to the credit reporting agency to use a copy of this form to obtain any information the credit reporting agency deems necessary to complete my credit report. In addition, in connection with determining my ability to obtain a loan; I authorize ___ ...

... Authorization is further granted to the credit reporting agency to use a copy of this form to obtain any information the credit reporting agency deems necessary to complete my credit report. In addition, in connection with determining my ability to obtain a loan; I authorize ___ ...

Go Back Print this page The Minsky Moment by John Cassidy

... Minsky, who died in 1996, at the age of seventy-seven, earned a Ph.D. from Harvard and taught at Brown, Berkeley, and Washington University. He didn’t have anything against financial institutions—for many years, he served as a director of the Mark Twain Bank, in St. Louis—but he knew more about how ...

... Minsky, who died in 1996, at the age of seventy-seven, earned a Ph.D. from Harvard and taught at Brown, Berkeley, and Washington University. He didn’t have anything against financial institutions—for many years, he served as a director of the Mark Twain Bank, in St. Louis—but he knew more about how ...

Lender of last resort

... Quality of collateral • What was inconsistent with Bagehot’s advice, however, was that much of this collateral was complex, opaque, hard-to-value, illiquid, difficult to buy and sell, risky, and liable to default—hardly good security. The Fed also purchased outright from banks and other financial i ...

... Quality of collateral • What was inconsistent with Bagehot’s advice, however, was that much of this collateral was complex, opaque, hard-to-value, illiquid, difficult to buy and sell, risky, and liable to default—hardly good security. The Fed also purchased outright from banks and other financial i ...

Hockey is Nothing Like Investing

... to each other. 8. Share buybacks are at record levels…and private equity selling is at record levels. Just about every company we run across has a share buyback authorization of some kind in place. There are only two good reasons to repurchase shares: company management and the Board think the stock ...

... to each other. 8. Share buybacks are at record levels…and private equity selling is at record levels. Just about every company we run across has a share buyback authorization of some kind in place. There are only two good reasons to repurchase shares: company management and the Board think the stock ...

financial market 2 - Institute of Bankers in Malawi

... asset held by the fund depending on the market assessment. (4Marks) Open – end investment scheme on the other hand is the one which offers for sale shares on a continuous basis or has outstanding any security which is redeemable at the holders option. Investors in this scheme contribute at any time ...

... asset held by the fund depending on the market assessment. (4Marks) Open – end investment scheme on the other hand is the one which offers for sale shares on a continuous basis or has outstanding any security which is redeemable at the holders option. Investors in this scheme contribute at any time ...

Exam 2

... could invest in the two securities above to form this portfolio. 10=8.8x+(1-x)*3; x=1.2069; Invest 120.69% in Alpha and –20.69% in Beta. (You would sell beta and invest more than 100% in alpha) 2. The risk-free rate is 7%, and the expected return of the market is 15%. Cushman Company has a beta of 0 ...

... could invest in the two securities above to form this portfolio. 10=8.8x+(1-x)*3; x=1.2069; Invest 120.69% in Alpha and –20.69% in Beta. (You would sell beta and invest more than 100% in alpha) 2. The risk-free rate is 7%, and the expected return of the market is 15%. Cushman Company has a beta of 0 ...

Chapter 01 - Investments: Background and Issues Chapter 01

... more attractive to investors since investors know that, when they wish to, they will be able to sell their shares. This in turn makes investors more willing to buy shares in a primary offering, and thus improves the terms on which firms can raise money in the equity market. 21. Treasury bills serve ...

... more attractive to investors since investors know that, when they wish to, they will be able to sell their shares. This in turn makes investors more willing to buy shares in a primary offering, and thus improves the terms on which firms can raise money in the equity market. 21. Treasury bills serve ...