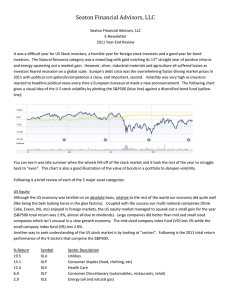

2011 - Seaton Financial Advisors, LLC

... affected by so many variables that conservative investors may wish to tread lightly. Bonds present perhaps the biggest investment challenge. With no way to know where interest rates are headed, at least in the near term, it’s difficult to craft a strategy that carefully balances yield and risk. I th ...

... affected by so many variables that conservative investors may wish to tread lightly. Bonds present perhaps the biggest investment challenge. With no way to know where interest rates are headed, at least in the near term, it’s difficult to craft a strategy that carefully balances yield and risk. I th ...

Fillable - Insurance Associates

... I/We hereby certify and declare that the above statement presents accurately my financial condition to the best of my knowledge and belief and I/We hereby authorize and request any person, firm or corporation to furnish any information requested by Meadowbrook Insurance Services concerning any trans ...

... I/We hereby certify and declare that the above statement presents accurately my financial condition to the best of my knowledge and belief and I/We hereby authorize and request any person, firm or corporation to furnish any information requested by Meadowbrook Insurance Services concerning any trans ...

commercial debt finance for district energy

... n Senior debt will not compete with PWLB on price or tenor n If project is de-risked it can get close n If used it will increase project returns and allow PWLB to be used for ‘core’ services ...

... n Senior debt will not compete with PWLB on price or tenor n If project is de-risked it can get close n If used it will increase project returns and allow PWLB to be used for ‘core’ services ...

US subprime credit crisis and its implications from a corporate

... available shelf facilities in sufficient amount loan portfolio with longer maturity/maturities spread over time only a part of the debt needs to be renewed under the unfavourable (and possible temporary) circumstances significant portion of the debt portfolio in debt instruments bearing fix interest ...

... available shelf facilities in sufficient amount loan portfolio with longer maturity/maturities spread over time only a part of the debt needs to be renewed under the unfavourable (and possible temporary) circumstances significant portion of the debt portfolio in debt instruments bearing fix interest ...

PRESS RELEASE 11 July 2017 TIM PHILLIPS JOINS

... Deutsche Bank as Director – head of Credit for Russia/CIS & EE. His role included coordinating approval of new business proposals, complex/structured transactions to include consideration of market risk, legal, compliance, tax, operational and regulatory issues; as well as understanding and articul ...

... Deutsche Bank as Director – head of Credit for Russia/CIS & EE. His role included coordinating approval of new business proposals, complex/structured transactions to include consideration of market risk, legal, compliance, tax, operational and regulatory issues; as well as understanding and articul ...

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

... Affimed’s proprietary, next-generation bispecific antibodies, called TandAbs for their tandem antibody structure, are designed to direct and establish a bridge between either NK-cells or T-cells and cancer cells, triggering a signal cascade that leads to the destruction of cancer cells. Affimed has ...

... Affimed’s proprietary, next-generation bispecific antibodies, called TandAbs for their tandem antibody structure, are designed to direct and establish a bridge between either NK-cells or T-cells and cancer cells, triggering a signal cascade that leads to the destruction of cancer cells. Affimed has ...

W Newbury`s Bond Rating History

... Bonds that are rated B generally lack characteristics of the desirable investment. Assurance of interest and principal payments or maintenance of other terms of the contract over any long period of time may be small. The bonds in the Aa, A, Baa, Ba and B, groups which Moody’s believes possesses the ...

... Bonds that are rated B generally lack characteristics of the desirable investment. Assurance of interest and principal payments or maintenance of other terms of the contract over any long period of time may be small. The bonds in the Aa, A, Baa, Ba and B, groups which Moody’s believes possesses the ...

The Role of Short Selling in Equity Markets

... Securities lending is a long-standing practice that allows broker-dealers to avoid delivery failures associated with trade settlement. Prior to the adoption of electronic settlement in the 1970s through the Depository Trust & Clearing Corporation (DTC), broker-dealers had to physically deliver secur ...

... Securities lending is a long-standing practice that allows broker-dealers to avoid delivery failures associated with trade settlement. Prior to the adoption of electronic settlement in the 1970s through the Depository Trust & Clearing Corporation (DTC), broker-dealers had to physically deliver secur ...

(T+2) Settlement Cycle Introductory Materials

... added number refer to? The letter (T) stands for the term (Trade); i.e. transaction. As for the added number, it refers to the duration required for completing the settlement of a transaction. 9. Does the transition from (T + 0) to (T + 2) settlement have an impact on traders in the Saudi capital ma ...

... added number refer to? The letter (T) stands for the term (Trade); i.e. transaction. As for the added number, it refers to the duration required for completing the settlement of a transaction. 9. Does the transition from (T + 0) to (T + 2) settlement have an impact on traders in the Saudi capital ma ...

Debt As % of GDP III

... suppressed during the high interest rates of the late 1970's, were made up as rates declined in the 1980's. 9) As financial markets become more efficient in the 1980's and after, consumer and business debt increased. The efficiency and lower debt costs from mortgage-backed securities, consumer debt ...

... suppressed during the high interest rates of the late 1970's, were made up as rates declined in the 1980's. 9) As financial markets become more efficient in the 1980's and after, consumer and business debt increased. The efficiency and lower debt costs from mortgage-backed securities, consumer debt ...

Finding Value in Global Bond Markets

... a deflation hedge, as well as help offset volatility investors may be experiencing in other parts of their asset allocation. Longer term, we believe return prospects for sovereigns are most attractive outside of the G3. Structural improvements in many non-G3 economies have led to an increase in cred ...

... a deflation hedge, as well as help offset volatility investors may be experiencing in other parts of their asset allocation. Longer term, we believe return prospects for sovereigns are most attractive outside of the G3. Structural improvements in many non-G3 economies have led to an increase in cred ...

Institutional Use of Mortgage Markets

... Desirable Features for a Mortgage: • Servicing simplicity: Collecting principal and interest when rates are changing For mortgages allowing negative amortization, tracking changing principal and interest payments can be difficult ...

... Desirable Features for a Mortgage: • Servicing simplicity: Collecting principal and interest when rates are changing For mortgages allowing negative amortization, tracking changing principal and interest payments can be difficult ...

High Yield Bond Fund

... Bond values fluctuate in response to the financial condition of individual issuers, general market and economic conditions, and changes in interest rates. Changes in market conditions and government policies may lead to periods of heightened volatility in the bond market and reduced liquidity for ce ...

... Bond values fluctuate in response to the financial condition of individual issuers, general market and economic conditions, and changes in interest rates. Changes in market conditions and government policies may lead to periods of heightened volatility in the bond market and reduced liquidity for ce ...

Schroders plc – Statement of financial position

... Actuarial gains on defined benefit pension schemes Tax on items taken directly to other comprehensive income Other comprehensive income Shares cancelled Share-based payments Tax credit in respect of share schemes Dividends Own shares purchased Transactions with shareholders Transfers At 31 December ...

... Actuarial gains on defined benefit pension schemes Tax on items taken directly to other comprehensive income Other comprehensive income Shares cancelled Share-based payments Tax credit in respect of share schemes Dividends Own shares purchased Transactions with shareholders Transfers At 31 December ...

AB Global High Yield Portfolio1

... Investment in the Fund entails certain risks. Investment returns and principal value of the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The Fund is meant as a vehicle for diversification and does not represent a complete invest ...

... Investment in the Fund entails certain risks. Investment returns and principal value of the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The Fund is meant as a vehicle for diversification and does not represent a complete invest ...

(TR) BBB (TR) A3 SAMSUN YEM SANAYİ ve TİCARET A.Ş.

... countries with minimal but increasing growth rates during the same period. The economic activity in the Euro Zone continues to exhibit a weak outlook, raising questions on the faith of the economic activity as a result of quantitative easing. Policies implemented since 2013 to combat disinflation in ...

... countries with minimal but increasing growth rates during the same period. The economic activity in the Euro Zone continues to exhibit a weak outlook, raising questions on the faith of the economic activity as a result of quantitative easing. Policies implemented since 2013 to combat disinflation in ...