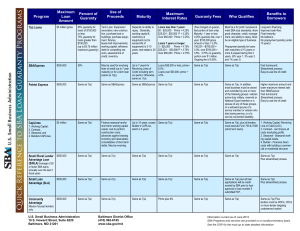

Program Maximum Loan Amount Percent of Guaranty Use of

... servicing fee of 0.625%1.5% on unpaid balance Ongoing guaranty fee (FY 2012) is 0.9375% of principal outstanding. Ongoing fee % does not change during term. ...

... servicing fee of 0.625%1.5% on unpaid balance Ongoing guaranty fee (FY 2012) is 0.9375% of principal outstanding. Ongoing fee % does not change during term. ...

Paul Wilcox: Use it or lose it - every seven years

... With the right powers, those trustees can make interest-free loans to children - to stop any funds then being passed on to divorcing in-laws, for instance. They can even add the surviving spouse as a beneficiary and then make loans to them rather than them take reversions from their own trust - this ...

... With the right powers, those trustees can make interest-free loans to children - to stop any funds then being passed on to divorcing in-laws, for instance. They can even add the surviving spouse as a beneficiary and then make loans to them rather than them take reversions from their own trust - this ...

JPMorgan Funds - US High Yield Plus Bond Fund SICAV Range

... •• The Fund invests primarily in below investment grade USD denominated debt securities. •• The Fund is therefore exposed to single country, distressed debt securities, credit, interest rate risks which may affect the price of bonds, currency and liquidity risks. Pertaining to investments in below i ...

... •• The Fund invests primarily in below investment grade USD denominated debt securities. •• The Fund is therefore exposed to single country, distressed debt securities, credit, interest rate risks which may affect the price of bonds, currency and liquidity risks. Pertaining to investments in below i ...

Economic Stabilization Act of 2008

... 11) Broker Reporting of Basis – Brokers of securities will have to start informing taxpayers and IRS of the taxpayer’s basis in securities which have been sold. This only applies to 1) stock in a corporation which is acquired through the broker on or after January 1, 2011, and 2) stock for which an ...

... 11) Broker Reporting of Basis – Brokers of securities will have to start informing taxpayers and IRS of the taxpayer’s basis in securities which have been sold. This only applies to 1) stock in a corporation which is acquired through the broker on or after January 1, 2011, and 2) stock for which an ...

Word - corporate

... Forward Loo kin g Statements 10 Th is presentatio n contains forward-loo king s tatements with in the meaning of Section 27A of the Securities Act of 193 3 and Section 21E of the Securities Exchange Act of 1934. Forward-loo king s tatements give our expectation s or forecasts of future events and c ...

... Forward Loo kin g Statements 10 Th is presentatio n contains forward-loo king s tatements with in the meaning of Section 27A of the Securities Act of 193 3 and Section 21E of the Securities Exchange Act of 1934. Forward-loo king s tatements give our expectation s or forecasts of future events and c ...

Application Form Retail Bonds 2016 (File Size: 260,84Kb)

... activity in any jurisdiction. Neither this document nor any part thereof, nor the fact of its publication, shall form the basis of, or be relied on in connection with, any contract or commitment or investment decision whatsoever. Interested investors are encouraged to perform an independent review o ...

... activity in any jurisdiction. Neither this document nor any part thereof, nor the fact of its publication, shall form the basis of, or be relied on in connection with, any contract or commitment or investment decision whatsoever. Interested investors are encouraged to perform an independent review o ...

Government Obligations Fund (TR Shares)

... Despite a pullback in inflation and softening in some economic data, short-term interest rates marched higher in the second quarter, aided by actions taken by the US Federal Reserve. The central bank in June raised the target funds range another 25 basis points—the third increase in six months—and s ...

... Despite a pullback in inflation and softening in some economic data, short-term interest rates marched higher in the second quarter, aided by actions taken by the US Federal Reserve. The central bank in June raised the target funds range another 25 basis points—the third increase in six months—and s ...

Entrepreneurship

... Economic conditions Potential for growth Amount of competition Location Form of ownership ...

... Economic conditions Potential for growth Amount of competition Location Form of ownership ...

ANGLO AMERICAN FUNDING FACTSHEET

... ANGLO AMERICAN FUNDING FACTSHEET 21 February 2017 This factsheet provides a high level overview of the Group’s main financing arrangements as at 31 December 2016. 1. Net debt management The Group’s policy is to hold the majority of its cash and borrowings at the corporate centre. Business units may ...

... ANGLO AMERICAN FUNDING FACTSHEET 21 February 2017 This factsheet provides a high level overview of the Group’s main financing arrangements as at 31 December 2016. 1. Net debt management The Group’s policy is to hold the majority of its cash and borrowings at the corporate centre. Business units may ...

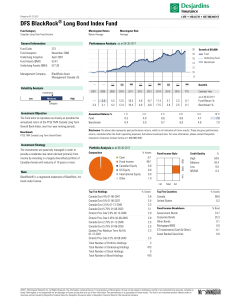

DFS BlackRock® Long Bond Index Fund

... The investments are passively managed in order to provide a moderate real return derived primarily from income by investing in a largely diversified portfolio of Canadian bonds with maturity of 10 years or more. ...

... The investments are passively managed in order to provide a moderate real return derived primarily from income by investing in a largely diversified portfolio of Canadian bonds with maturity of 10 years or more. ...

Chapter 6

... Extending Concepts to All Securities The optimal combinations result in lowest level of risk for a given return The optimal trade-off is described as the efficient frontier These portfolios are dominant ...

... Extending Concepts to All Securities The optimal combinations result in lowest level of risk for a given return The optimal trade-off is described as the efficient frontier These portfolios are dominant ...

COMMERCIAL INFORMATION AND CREDIT ANALYSIS

... Lenders always choose their clientele. An important source of new business for most lenders is introductions from professional advisers such as accountants and solicitors. But, a bank has no obligation to lend to customers introduced in this way. 2. The application by the customer; The application ( ...

... Lenders always choose their clientele. An important source of new business for most lenders is introductions from professional advisers such as accountants and solicitors. But, a bank has no obligation to lend to customers introduced in this way. 2. The application by the customer; The application ( ...

Payment Mortgages

... Fannie Mae is a government-sponsored enterprise plays a large role in the market for home mortgages. It is more or less invisible to households holding mortgages because if does not does not provide mortgages directly to households. ...

... Fannie Mae is a government-sponsored enterprise plays a large role in the market for home mortgages. It is more or less invisible to households holding mortgages because if does not does not provide mortgages directly to households. ...