PDF

... Previous empirical estimates may have also omitted the effects of a “home country bias.” Virtually every BIT includes a provision that protects the foreign investor from “home country bias;” that the foreign investor be treated no different than a domestic firm. All else being equal, preference for ...

... Previous empirical estimates may have also omitted the effects of a “home country bias.” Virtually every BIT includes a provision that protects the foreign investor from “home country bias;” that the foreign investor be treated no different than a domestic firm. All else being equal, preference for ...

Document

... your time at Accelerator participating in the decisions regarding scientific, business, intellectual property, and management aspects of potential start-up companies. The fellow has the opportunity to work and interact with the Accelerator team as well as experienced scientists and investors from th ...

... your time at Accelerator participating in the decisions regarding scientific, business, intellectual property, and management aspects of potential start-up companies. The fellow has the opportunity to work and interact with the Accelerator team as well as experienced scientists and investors from th ...

The Impact of Non-Transparency on Foreign Direct Investment

... Let us start by considering the question of transparency in economic policy-making of governments. The lack of transparency has for us five different origins. First, economic policy – making will be seen as non-transparent if it is subject to corruption and bribery . By definition, bribery involves ...

... Let us start by considering the question of transparency in economic policy-making of governments. The lack of transparency has for us five different origins. First, economic policy – making will be seen as non-transparent if it is subject to corruption and bribery . By definition, bribery involves ...

From big to small: the relative size effect on corporate capital

... measures of industry q’s may be better suited to represent the investment opportunities of stand-alone firms than those of corporate divisions. Chevalier (2004) investigates the relative weight of these methodological issues by looking at the investment behavior of divisions in the years before they ...

... measures of industry q’s may be better suited to represent the investment opportunities of stand-alone firms than those of corporate divisions. Chevalier (2004) investigates the relative weight of these methodological issues by looking at the investment behavior of divisions in the years before they ...

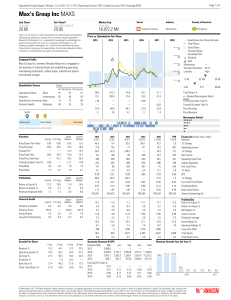

Max`s Group Inc MAXS

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

Co-investments in funds of funds and separate accounts

... After formal commitment to a co-investment, the final step before funding is the completion of all of the legal documents. These include documents used to acquire the subject company, as well as the documents governing the terms between the equity sponsor and co-investor(s). The legal documents used ...

... After formal commitment to a co-investment, the final step before funding is the completion of all of the legal documents. These include documents used to acquire the subject company, as well as the documents governing the terms between the equity sponsor and co-investor(s). The legal documents used ...

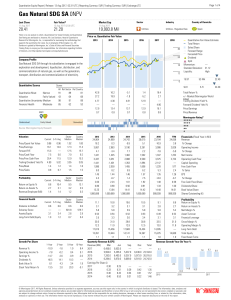

Gas Natural SDG SA 0NPV

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

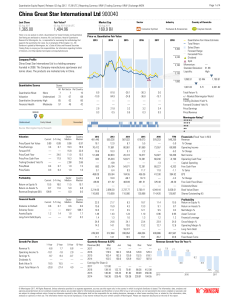

China Great Star International Ltd 900040

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

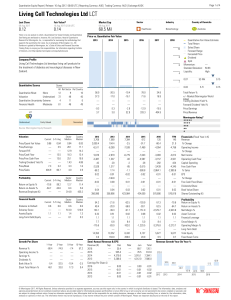

Living Cell Technologies Ltd LCT

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

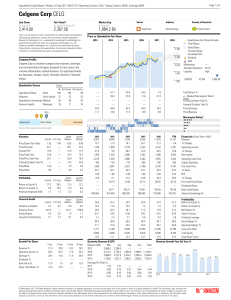

Celgene Corp CELG

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

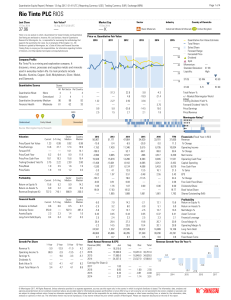

Rio Tinto PLC RIOS

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

VENTURE COMPANY TYPES AND PHASES of THEIR

... two categories of small companies – those bought out and new ones which have been founded by laborers of the well-known science-based corporations focused on new concepts and developments implementation (spin off). To her opinion the core sign to classify venture companies is specialization category ...

... two categories of small companies – those bought out and new ones which have been founded by laborers of the well-known science-based corporations focused on new concepts and developments implementation (spin off). To her opinion the core sign to classify venture companies is specialization category ...

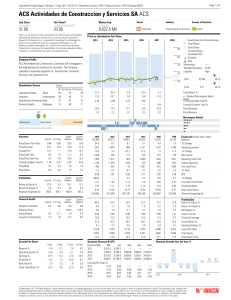

ACS Actividades de Construccion y Servicios SA ACS

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

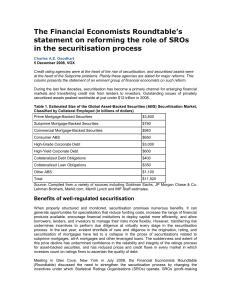

Roundtable`s Evaluation of the SEC`s Proposals for Reform

... capital would nevertheless insulate ratings decisions on securitized debt from undue influence by issuers. This argument became increasingly less persuasive as income from rating structured debt began to increase sharply and account for almost half of the revenues of the three dominant firms. A furt ...

... capital would nevertheless insulate ratings decisions on securitized debt from undue influence by issuers. This argument became increasingly less persuasive as income from rating structured debt began to increase sharply and account for almost half of the revenues of the three dominant firms. A furt ...

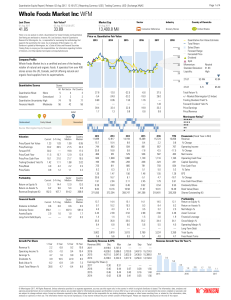

Whole Foods Market Inc WFM

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

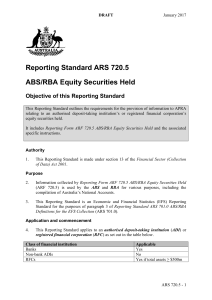

Reporting Standard ARS 720.5 ABS/RBA Equity Securities Held

... Information reported in ARF 720.5 is required primarily for purposes of the ABS and the RBA. Items on ARF 720.5 are required for various purposes, including the compilation of Australia’s National Accounts. Information reported in ARF 720.5 may also be used by APRA for prudential and publication pur ...

... Information reported in ARF 720.5 is required primarily for purposes of the ABS and the RBA. Items on ARF 720.5 are required for various purposes, including the compilation of Australia’s National Accounts. Information reported in ARF 720.5 may also be used by APRA for prudential and publication pur ...

Q1 - 2017 Commentary - The Canadian ETF Association

... As of February 2017, ETFs accounted for 8.0% of all investment fund assets (mutual funds and ETFs, collectively), an increase of 1.1 percentage points from a year earlier. Over this time period, ETFs posted double digit asset growth of 35.1%, while mutual fund assets grew by 15.0%—a still powerful r ...

... As of February 2017, ETFs accounted for 8.0% of all investment fund assets (mutual funds and ETFs, collectively), an increase of 1.1 percentage points from a year earlier. Over this time period, ETFs posted double digit asset growth of 35.1%, while mutual fund assets grew by 15.0%—a still powerful r ...

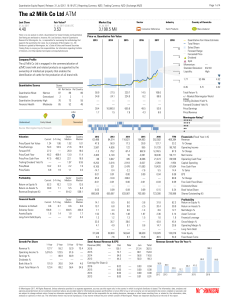

The a2 Milk Co Ltd ATM

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

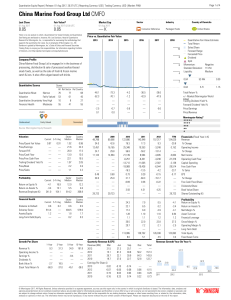

China Marine Food Group Ltd CMFO

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

Conflicts of Interest in the Financial Services Industry

... In the last few years, investors have witnessed a sharp fall-off in equity market valuations, the dramatic failures of the Enron Corporation and its auditing firm, Arthur Andersen, and serious manipulation and lack of transparency in the accounts of several large companies. Understandably, they dist ...

... In the last few years, investors have witnessed a sharp fall-off in equity market valuations, the dramatic failures of the Enron Corporation and its auditing firm, Arthur Andersen, and serious manipulation and lack of transparency in the accounts of several large companies. Understandably, they dist ...

Banker for the World: Global Capital and America`s Financialization

... deposits and making commercial loans. Although this legislation limited the activities that banks could pursue, it proved incapable of completely isolating investment from commercial activities. In the early 1980s, non-bank commercial corporations such as Sears, GM, and GE began to create structures ...

... deposits and making commercial loans. Although this legislation limited the activities that banks could pursue, it proved incapable of completely isolating investment from commercial activities. In the early 1980s, non-bank commercial corporations such as Sears, GM, and GE began to create structures ...

Credit Suisse Mid-Year Survey of Hedge Fund Investor Sentiment

... companies (referred to here as 'Credit Suisse'). As an integrated bank, Credit Suisse offers clients its combined expertise in the areas of private banking, investment banking and asset management. Credit Suisse provides advisory services, comprehensive solutions and innovative products to companies ...

... companies (referred to here as 'Credit Suisse'). As an integrated bank, Credit Suisse offers clients its combined expertise in the areas of private banking, investment banking and asset management. Credit Suisse provides advisory services, comprehensive solutions and innovative products to companies ...

InnovFin Equity Investment Guidelines

... This document is for information purposes only. This document is an outline of the principal operational guidelines for the product described herein, which are subject to change and non-exhaustive. This document is intended to provide a basis for discussions and does not constitute a recommendation, ...

... This document is for information purposes only. This document is an outline of the principal operational guidelines for the product described herein, which are subject to change and non-exhaustive. This document is intended to provide a basis for discussions and does not constitute a recommendation, ...

IOSR Journal of Business and Management (IOSR-JBM)

... Stock markets support resource allocation and spur growth through different channels. By reducing transaction costs and liquidity costs, stock markets can positively affect the average productivity of capital (Levine 1991; Bencivenga, et al. 1996 in Adenuga, 2010).Stock exchanges play an increasingl ...

... Stock markets support resource allocation and spur growth through different channels. By reducing transaction costs and liquidity costs, stock markets can positively affect the average productivity of capital (Levine 1991; Bencivenga, et al. 1996 in Adenuga, 2010).Stock exchanges play an increasingl ...