Strategy enhancement - nab asset management

... What is the MARR strategy? To manage risk and generate more robust returns we’ve increased our portfolios’ diversification over time by investing in riskcontrolled strategies, including the MARR strategy. It aims to generate attractive real returns (that is, returns above inflation) over a period of ...

... What is the MARR strategy? To manage risk and generate more robust returns we’ve increased our portfolios’ diversification over time by investing in riskcontrolled strategies, including the MARR strategy. It aims to generate attractive real returns (that is, returns above inflation) over a period of ...

ProShares Profile EMDV

... ProShares.com. There is no guarantee dividends will be paid. Companies may reduce or eliminate dividends at any time, and those that do will be dropped from the index at reconstitution. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future resul ...

... ProShares.com. There is no guarantee dividends will be paid. Companies may reduce or eliminate dividends at any time, and those that do will be dropped from the index at reconstitution. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future resul ...

Li, Yu Qiong

... IIROC is the national self-regulatory organization which oversees all investment dealers and their trading activity in Canada’s debt and equity markets. IIROC sets high quality regulatory and investment industry standards, protects investors and strengthens market integrity while maintaining efficie ...

... IIROC is the national self-regulatory organization which oversees all investment dealers and their trading activity in Canada’s debt and equity markets. IIROC sets high quality regulatory and investment industry standards, protects investors and strengthens market integrity while maintaining efficie ...

Is It Time for an Infrastructure Push?

... and execution are poor and only a fraction of the amount invested is converted into productive public capital stock—increased public investment leads to more limited long-term output gains. •• For economies with clearly identified infrastructure needs and efficient public investment processes and wh ...

... and execution are poor and only a fraction of the amount invested is converted into productive public capital stock—increased public investment leads to more limited long-term output gains. •• For economies with clearly identified infrastructure needs and efficient public investment processes and wh ...

Debt/Equity Swaps and Mexican Law: The

... which directly contravenes the general rule stated and, until 1984, strictly enforced' in the Foreign Investment Law of 1973.2 As radical as this may seem, it is consistent with Mexican economic and legislative history, as well as the country's immediate needs. Mexico's oil boom and subsequent bust, ...

... which directly contravenes the general rule stated and, until 1984, strictly enforced' in the Foreign Investment Law of 1973.2 As radical as this may seem, it is consistent with Mexican economic and legislative history, as well as the country's immediate needs. Mexico's oil boom and subsequent bust, ...

CFA Institute - CFA societies

... reporting methods for investment management firms claiming compliance with the GIPS standards. Commenting on the revisions CFA charterholder and executive director of the GIPS standards at CFA Institute, Jonathan Boersma said, “The GIPS standards, which were introduced in 1999, advance the principle ...

... reporting methods for investment management firms claiming compliance with the GIPS standards. Commenting on the revisions CFA charterholder and executive director of the GIPS standards at CFA Institute, Jonathan Boersma said, “The GIPS standards, which were introduced in 1999, advance the principle ...

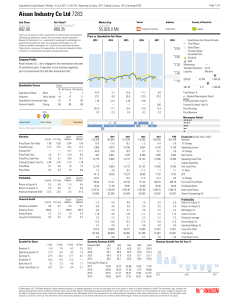

Aisan Industry Co Ltd 7283

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

Market Linked Securities

... Which investments are right for you? It is important to consider several factors before making an investment decision. An investment in Market Linked Securities may help you to modify your portfolio’s risk-return profile to more closely reflect your market views. However, at maturity you may incur ...

... Which investments are right for you? It is important to consider several factors before making an investment decision. An investment in Market Linked Securities may help you to modify your portfolio’s risk-return profile to more closely reflect your market views. However, at maturity you may incur ...

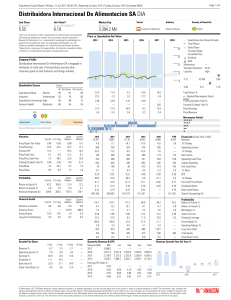

Distribuidora Internacional De Alimentacion SA DIA

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

On the Compatibility of Value at Risk, Other Risk Concepts, and

... banks’ risk taking, we need to first clarify the relation between different concepts of risk, which is the main purpose of this paper. The effects on risk taking will then be studied in a companion paper. We start from a normative rule for decisions under uncertainty, which is „maximize expected uti ...

... banks’ risk taking, we need to first clarify the relation between different concepts of risk, which is the main purpose of this paper. The effects on risk taking will then be studied in a companion paper. We start from a normative rule for decisions under uncertainty, which is „maximize expected uti ...

Mercer Climate Change Scenarios Study 2.0

... References to Mercer shall be construed to include Mercer LLC and/or its associated companies. © 2015 Mercer LLC. All rights reserved. This contains confidential and proprietary information of Mercer and is intended for the exclusive use of the parties to whom it was provided by Mercer. Its content ...

... References to Mercer shall be construed to include Mercer LLC and/or its associated companies. © 2015 Mercer LLC. All rights reserved. This contains confidential and proprietary information of Mercer and is intended for the exclusive use of the parties to whom it was provided by Mercer. Its content ...

INVESTORLIT Research Private Equity vs. Public Equity

... Here, I summarize six studies supporting that assertion. These studies, listed below in chronological order of publication, generally use a common methodology which: • excludes or minimizes investments carried at cost (residual values), and • calculates the equivalent return if invested in public ma ...

... Here, I summarize six studies supporting that assertion. These studies, listed below in chronological order of publication, generally use a common methodology which: • excludes or minimizes investments carried at cost (residual values), and • calculates the equivalent return if invested in public ma ...

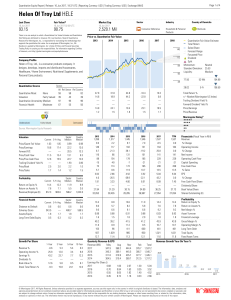

Helen Of Troy Ltd HELE

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

Target Date Funds FRED REISH, ESQ.

... changes to disclosures regarding target date funds, their asset allocations and their glide paths. Among the most important changes are: • The SEC’s proposal would require marketing materials for a target date fund that includes the target date in its name to disclose the asset allocation of the fun ...

... changes to disclosures regarding target date funds, their asset allocations and their glide paths. Among the most important changes are: • The SEC’s proposal would require marketing materials for a target date fund that includes the target date in its name to disclose the asset allocation of the fun ...

Retirement Plan Enrollment Booklet

... You should carefully consider the investment objectives, risks, charges and expenses of the investment options offered under the retirement plan before investing. Smallcompany (small cap) investing involves specific risks not necessarily encountered in large-company investing, such as increased vola ...

... You should carefully consider the investment objectives, risks, charges and expenses of the investment options offered under the retirement plan before investing. Smallcompany (small cap) investing involves specific risks not necessarily encountered in large-company investing, such as increased vola ...

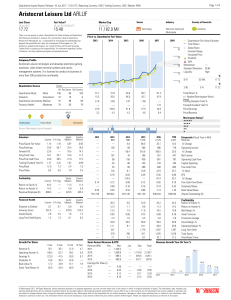

Aristocrat Leisure Ltd ARLUF

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

Trading Behaviors Under Floating Exchange Rate System: An Analysis of South Korea’s Financial Market

... Most previous papers focus on the impacts of exchange rate volatility on stock prices and returns; for example, Chen and Shen (2004) investigate the inter-linkages between Taiwan’s stock and exchange rate markets. Their results show that unrestricted trading volumes reveal more information regarding ...

... Most previous papers focus on the impacts of exchange rate volatility on stock prices and returns; for example, Chen and Shen (2004) investigate the inter-linkages between Taiwan’s stock and exchange rate markets. Their results show that unrestricted trading volumes reveal more information regarding ...

Best Practices for Stable NAV LGIPs

... In June 2015, GASB released an exposure draft of a proposed statement entitled Accounting and Financial Reporting for Certain External Investment Pools. In the ED, GASB specified that if an external investment pool meets the specified criteria, the pool would be able to elect to measure for financia ...

... In June 2015, GASB released an exposure draft of a proposed statement entitled Accounting and Financial Reporting for Certain External Investment Pools. In the ED, GASB specified that if an external investment pool meets the specified criteria, the pool would be able to elect to measure for financia ...

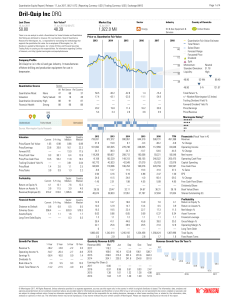

Dril-Quip Inc DRQ

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

Eagle Materials Incorporated

... Fidelity International Limited ("FIL"), Pembroke Hall, 42 Crow Lane, Hamilton, Bermuda, and various foreign-based subsidiaries provide investment advisory and management services to a number of non-U.S. investment companies and certain institutional investors. FIL, which is a qualified institution u ...

... Fidelity International Limited ("FIL"), Pembroke Hall, 42 Crow Lane, Hamilton, Bermuda, and various foreign-based subsidiaries provide investment advisory and management services to a number of non-U.S. investment companies and certain institutional investors. FIL, which is a qualified institution u ...

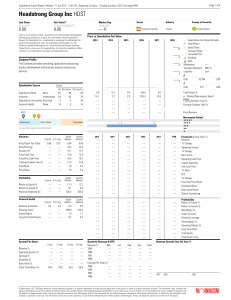

Headstrong Group Inc HDST

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

SEC Comment - The Committee For The Fiduciary Standard

... they pay for fees and expenses associated with their own plan, while 65% reported they pay no fees,… (and) 17% stated they do pay fees.” (g) RAND. The SEC’s 2008 Rand Report, “Investor and Industry Perspectives on Investment Advisers and Broker Dealers,” is widely cited for revealing that investors ...

... they pay for fees and expenses associated with their own plan, while 65% reported they pay no fees,… (and) 17% stated they do pay fees.” (g) RAND. The SEC’s 2008 Rand Report, “Investor and Industry Perspectives on Investment Advisers and Broker Dealers,” is widely cited for revealing that investors ...

Journal of Finance and Investment Analysis, vol. 4, no.2, 2015,... ISSN: 2241-0998 (print version), 2241-0996(online)

... investors. One of the most critical stumbling blocks is lack of diversification, which leads to suboptimal portfolio choices, higher welfare costs and even to overall instability of financial markets (see Brennan and Torous, 1999, Bennett and Sias, 2011). A host of studies addresses the lack of dive ...

... investors. One of the most critical stumbling blocks is lack of diversification, which leads to suboptimal portfolio choices, higher welfare costs and even to overall instability of financial markets (see Brennan and Torous, 1999, Bennett and Sias, 2011). A host of studies addresses the lack of dive ...

Presentazione di PowerPoint

... Manipulating Enron’s publicly reported financial results; and making public statements and representations about Enron’s financial performance and results that were false and misleading in that they did not fairly and accurately reflect Enron’s actual financial condition and performance, and they om ...

... Manipulating Enron’s publicly reported financial results; and making public statements and representations about Enron’s financial performance and results that were false and misleading in that they did not fairly and accurately reflect Enron’s actual financial condition and performance, and they om ...