IOSR Journal of Business and Management (IOSR-JBM)

... Stock markets support resource allocation and spur growth through different channels. By reducing transaction costs and liquidity costs, stock markets can positively affect the average productivity of capital (Levine 1991; Bencivenga, et al. 1996 in Adenuga, 2010).Stock exchanges play an increasingl ...

... Stock markets support resource allocation and spur growth through different channels. By reducing transaction costs and liquidity costs, stock markets can positively affect the average productivity of capital (Levine 1991; Bencivenga, et al. 1996 in Adenuga, 2010).Stock exchanges play an increasingl ...

Middle Market Leverage Multiples

... Growing Private Capital Investment in Dermatology Practices Dermatology practices continue to attract private equity interest and outside capital investment. Beginning with Audax Group’s October 2011 recapitalization of Advanced Dermatology & Cosmetic Surgery, six dermatology platform investments h ...

... Growing Private Capital Investment in Dermatology Practices Dermatology practices continue to attract private equity interest and outside capital investment. Beginning with Audax Group’s October 2011 recapitalization of Advanced Dermatology & Cosmetic Surgery, six dermatology platform investments h ...

Worldpay takeover may be first of many as US firms go Brexit

... blossoming content catalogue," AJ Bell said. "The 9.9% stake held by Liberty Global, the US-based owner of Virgin Media, means talk of a bid will never be far away and fears over a post-Brexit advertising slowdown has knocked the shares." On Burberry, AJ Bell noted that the luxury fashion retailer h ...

... blossoming content catalogue," AJ Bell said. "The 9.9% stake held by Liberty Global, the US-based owner of Virgin Media, means talk of a bid will never be far away and fears over a post-Brexit advertising slowdown has knocked the shares." On Burberry, AJ Bell noted that the luxury fashion retailer h ...

gross domestic product

... Gross Domestic Product • We can see these three sources of investment finance by using the fact that aggregate expenditure equals aggregate income. • Start with Y = C + S + T = C + I + G + (X – M) • Then rearrange to obtain I = S + (T – G) + (M – X) • Private saving S plus government saving (T ...

... Gross Domestic Product • We can see these three sources of investment finance by using the fact that aggregate expenditure equals aggregate income. • Start with Y = C + S + T = C + I + G + (X – M) • Then rearrange to obtain I = S + (T – G) + (M – X) • Private saving S plus government saving (T ...

Atradius NV - Crédito y Caución

... Asset quality is a key credit strength for Atradius, and reflects a modest level of investment risk and low level of intangible assets, slightly offset by an elevated level of reinsurance recoverables, relative to peers. The group's high-risk assets as a percentage of shareholders' equity is very lo ...

... Asset quality is a key credit strength for Atradius, and reflects a modest level of investment risk and low level of intangible assets, slightly offset by an elevated level of reinsurance recoverables, relative to peers. The group's high-risk assets as a percentage of shareholders' equity is very lo ...

News release

... the next three years, to enhance industry and specialist expertise and strengthen its lead in the market. The investment will be funded by PwC UK and will focus mainly on bringing in leading talent from the market as well as seconding specialist partners and directors from PwC’s global network. Mich ...

... the next three years, to enhance industry and specialist expertise and strengthen its lead in the market. The investment will be funded by PwC UK and will focus mainly on bringing in leading talent from the market as well as seconding specialist partners and directors from PwC’s global network. Mich ...

chapter 1

... False. It is true that the greatest benefit to diversification occurs when stocks are uncorrelated. However, most stocks tend to move in the same direction. There are still benefits to diversification any time stocks are less than perfectly positively correlated. ...

... False. It is true that the greatest benefit to diversification occurs when stocks are uncorrelated. However, most stocks tend to move in the same direction. There are still benefits to diversification any time stocks are less than perfectly positively correlated. ...

INVESTMENT BANKING

... 1. I or a household member have a financial interest in the securities of the following companies: none 2. I or a household member is an officer, director, or advisory board member of the following companies: none 3. I have received compensation within the past 12 months from the following companies ...

... 1. I or a household member have a financial interest in the securities of the following companies: none 2. I or a household member is an officer, director, or advisory board member of the following companies: none 3. I have received compensation within the past 12 months from the following companies ...

Singapore`s Balance of Payments, 1965 to 2003: An Analysis

... The sharp and sustained rise in Singapore’s saving resulted in a doubling of the national saving rate from around 20% in the early 1970s to around 40% in the mid-1980s. It rose further to over 50% by 1995, and peaked at a high of 53% in 1998, before moderating somewhat in recent years. This sharp in ...

... The sharp and sustained rise in Singapore’s saving resulted in a doubling of the national saving rate from around 20% in the early 1970s to around 40% in the mid-1980s. It rose further to over 50% by 1995, and peaked at a high of 53% in 1998, before moderating somewhat in recent years. This sharp in ...

PRIVATE EQUITY IN REAL ESTATE

... in exits, regulatory hurdles. These can be mitigated to some extent by conducting thorough due diligence of projects, sound monitoring, selection of developers based on their credibility and track record, adopting project diversification techniques across various investments. Knowledge of local cond ...

... in exits, regulatory hurdles. These can be mitigated to some extent by conducting thorough due diligence of projects, sound monitoring, selection of developers based on their credibility and track record, adopting project diversification techniques across various investments. Knowledge of local cond ...

Annual Report - Pershing Square Capital Management

... The Board is aware that there has been much discussion in the media and elsewhere about the level of fees paid to investment managers. For many years the industry standard has been a 2% asset-based management fee and a 20% performance fee paid on annual profits. The terms of our IMA with PSCM (a 1.5 ...

... The Board is aware that there has been much discussion in the media and elsewhere about the level of fees paid to investment managers. For many years the industry standard has been a 2% asset-based management fee and a 20% performance fee paid on annual profits. The terms of our IMA with PSCM (a 1.5 ...

Depository System of Ukraine in reforming state

... The result reforming the depository system of Ukraine has undergone significant structural changes. Custodians who were holders of securities accounts and registers of registered securities, which accounted for the lower level of the depository system in accordance with the Law of Ukraine "On the Na ...

... The result reforming the depository system of Ukraine has undergone significant structural changes. Custodians who were holders of securities accounts and registers of registered securities, which accounted for the lower level of the depository system in accordance with the Law of Ukraine "On the Na ...

Ch. 7 - UConn Math

... It is true that stocks offer higher long-run rates of return than do bonds, but it is also true that stocks have a higher standard deviation of return. So, which investment is preferable depends on the amount of risk one is willing to tolerate. This is a complicated issue and depends on numerous fac ...

... It is true that stocks offer higher long-run rates of return than do bonds, but it is also true that stocks have a higher standard deviation of return. So, which investment is preferable depends on the amount of risk one is willing to tolerate. This is a complicated issue and depends on numerous fac ...

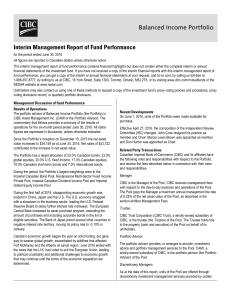

Balanced Income Portfolio Interim Management Report of Fund

... the Canadian securities regulatory authorities and in accordance with the policies and procedures relating to such investment); purchase equity or debt securities from or sell them to a Related Dealer, where it is acting as principal; undertake currency and currency derivative transactions where a R ...

... the Canadian securities regulatory authorities and in accordance with the policies and procedures relating to such investment); purchase equity or debt securities from or sell them to a Related Dealer, where it is acting as principal; undertake currency and currency derivative transactions where a R ...

IOSR Journal of Humanities and Social Science (JHSS)

... promotion agencies or even to offer tax and fiscal incentives to foreign firms that invest in the country. These benefits can be quite costly in terms of tax revenues foregone. Therefore, it is important that the benefits of FDI can be clearly identifies in order to justify the costs of the FDI prom ...

... promotion agencies or even to offer tax and fiscal incentives to foreign firms that invest in the country. These benefits can be quite costly in terms of tax revenues foregone. Therefore, it is important that the benefits of FDI can be clearly identifies in order to justify the costs of the FDI prom ...

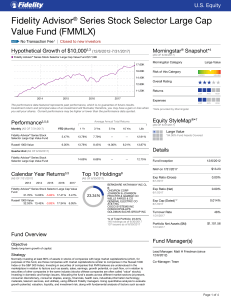

Fidelity Advisor® Series Stock Selector Large Cap Value Fund

... debt instruments, including investment grade, non-investment grade, non-rated securities and convertible bonds), and Cash & Net Other Assets (cash, repurchase agreements, receivables and payables). 10. "Tax-Advantaged Domiciles" represent countries whose tax policies may be favorable for company inc ...

... debt instruments, including investment grade, non-investment grade, non-rated securities and convertible bonds), and Cash & Net Other Assets (cash, repurchase agreements, receivables and payables). 10. "Tax-Advantaged Domiciles" represent countries whose tax policies may be favorable for company inc ...

Report on the analysis of existing and potential investment

... non-Annex I Parties. Efforts to protect coastal areas from coastal storms and sea level rise are typically undertaken by governments. The necessary public resources for coastal zone adaptation are likely to be available in developed and some developing countries. However, deltaic regions, particular ...

... non-Annex I Parties. Efforts to protect coastal areas from coastal storms and sea level rise are typically undertaken by governments. The necessary public resources for coastal zone adaptation are likely to be available in developed and some developing countries. However, deltaic regions, particular ...

RFP - Dahab Associates, Inc.

... A sample portfolio holdings sheet, broken out by sectors/industries. Quarterly returns of the product since inception A copy of your organizational chart. Please include a chart that at least shows the full structure of the relevant team for this submission. A sample contract, PPM, or other offering ...

... A sample portfolio holdings sheet, broken out by sectors/industries. Quarterly returns of the product since inception A copy of your organizational chart. Please include a chart that at least shows the full structure of the relevant team for this submission. A sample contract, PPM, or other offering ...

IDRT

... We understand plan sponsors of participant directed defined contribution plans subject to ERISA are required to provide at least 30 days but not more than 90 days’ notice to participants when adding or closing an investment option(s) under the plan, including share class/rate level changes. We have ...

... We understand plan sponsors of participant directed defined contribution plans subject to ERISA are required to provide at least 30 days but not more than 90 days’ notice to participants when adding or closing an investment option(s) under the plan, including share class/rate level changes. We have ...

III.1 Guidelines on Debt Securities

... overall financial capacity (its creditworthiness) to pay its financial obligations, focusing on the obligor’s capacity and willingness to meet its financial commitments as they come due. ...

... overall financial capacity (its creditworthiness) to pay its financial obligations, focusing on the obligor’s capacity and willingness to meet its financial commitments as they come due. ...

Infrastructure Compression and Public Sector Solvency in Latin

... in the cases of Bolivia, Brazil and Argentina, but significant also in Mexico, Peru and Chile. Only Colombia and Ecuador exhibited modest increases in public infrastructure investment over the period in question. The second column reports the change in the primary (i.e., non- interest) surplus of t ...

... in the cases of Bolivia, Brazil and Argentina, but significant also in Mexico, Peru and Chile. Only Colombia and Ecuador exhibited modest increases in public infrastructure investment over the period in question. The second column reports the change in the primary (i.e., non- interest) surplus of t ...

NAFTA Chapter 11 – Issues and Opportunities

... this is the case, they argue, protecting investment from arbitrary government action is less important than protecting the environment through allowing governments policy discretion against investors. While this criticism is dealt with in detail in the critcism section in available in Annex 3, the f ...

... this is the case, they argue, protecting investment from arbitrary government action is less important than protecting the environment through allowing governments policy discretion against investors. While this criticism is dealt with in detail in the critcism section in available in Annex 3, the f ...

Assumes no US plan participation

... designation or by operation. U.S. pension plans typically designate a “named fiduciary” to establish the plan’s investment structure, asset allocation, selection of managers, etc – For a U.S. multinational, it is logical for: (i) the global custodian function being exercised by the “master trustee” ...

... designation or by operation. U.S. pension plans typically designate a “named fiduciary” to establish the plan’s investment structure, asset allocation, selection of managers, etc – For a U.S. multinational, it is logical for: (i) the global custodian function being exercised by the “master trustee” ...

The case for investing in smaller companies

... The investment process Standard Life Investments aim to identify positive drivers of change within a company that have not yet been identified by the wider market. With a focus on finding high quality, profitable businesses with significant growth potential, the smaller companies team seek to ident ...

... The investment process Standard Life Investments aim to identify positive drivers of change within a company that have not yet been identified by the wider market. With a focus on finding high quality, profitable businesses with significant growth potential, the smaller companies team seek to ident ...

Macroprudential Regulation and Macroeconomic Activity

... also its risk taking abilities.1 Bank equity2 is of utmost importance but has not really been given its due by traditional monetary macroeconomics albeit the trend seems to be changing recently. As has been documented in Van den Heuvel (2009), in most bank related work, the focus is on reserve/liqui ...

... also its risk taking abilities.1 Bank equity2 is of utmost importance but has not really been given its due by traditional monetary macroeconomics albeit the trend seems to be changing recently. As has been documented in Van den Heuvel (2009), in most bank related work, the focus is on reserve/liqui ...