The Return of the Home State and the Rise of `Embedded` Investor

... trajectory of investment treaty-making is about (i) placing a check on tribunals’ discretion and (ii) striking a balance between the protection of investors abroad and the right to regulate at home. Intervention by the home State is one of the means through which these two goals are to be achieved. ...

... trajectory of investment treaty-making is about (i) placing a check on tribunals’ discretion and (ii) striking a balance between the protection of investors abroad and the right to regulate at home. Intervention by the home State is one of the means through which these two goals are to be achieved. ...

Liquidity Management Policy Summary

... investments via a pooled arrangement in which the underlying assets from each diversified option are invested collectively across the various asset classes. The allocation to these asset classes within each option is the main determinant of the overall risk and return characteristics, including an o ...

... investments via a pooled arrangement in which the underlying assets from each diversified option are invested collectively across the various asset classes. The allocation to these asset classes within each option is the main determinant of the overall risk and return characteristics, including an o ...

A Clearer View of Your Path to Retirement

... Investments in target date funds are subject to the risks of their underlying funds, and asset allocations are subject to change over time in accordance with each fund’s prospectus. An investment in or retirement income from a target date portfolio is not guaranteed at any time, including on or afte ...

... Investments in target date funds are subject to the risks of their underlying funds, and asset allocations are subject to change over time in accordance with each fund’s prospectus. An investment in or retirement income from a target date portfolio is not guaranteed at any time, including on or afte ...

DOL Fiduciary Rule Q and A - Nevada Independent Insurance

... doing so due to the new compliance requirements, or may establish or increase minimum account balances for clients. Firms may also respond by shifting business into fee-based accounts. Advisory accounts, which typically charge investors a flat fee of assets under management, are not appropriate for ...

... doing so due to the new compliance requirements, or may establish or increase minimum account balances for clients. Firms may also respond by shifting business into fee-based accounts. Advisory accounts, which typically charge investors a flat fee of assets under management, are not appropriate for ...

PL00142-1055_Exact Market Cash Fund PDS

... income. The amount you receive will be proportionate to the number of units your Service operator holds on your behalf relative to the number of units on issue at the end of the distribution period. The amount will vary and sometimes there might not be any distribution. At the end of each distributi ...

... income. The amount you receive will be proportionate to the number of units your Service operator holds on your behalf relative to the number of units on issue at the end of the distribution period. The amount will vary and sometimes there might not be any distribution. At the end of each distributi ...

Amendment No 3 dated August 10, 2016 to the Simplified Prospectus

... ee) On page 117, the following paragraph is added after the paragraph beginning with “The fund may use derivative consistent with its investment objective…” under “Investment strategies”: “The fund also uses derivatives to hedge the exposure of its investments denominated in foreign currencies attr ...

... ee) On page 117, the following paragraph is added after the paragraph beginning with “The fund may use derivative consistent with its investment objective…” under “Investment strategies”: “The fund also uses derivatives to hedge the exposure of its investments denominated in foreign currencies attr ...

Equity Investment Philosophy

... A sample portfolio holdings sheet, broken out by sectors/industries. Quarterly returns of the product since inception A copy of your organizational chart. Please include a chart that at least shows the full structure of the relevant team for this submission. A sample contract, PPM, or other offering ...

... A sample portfolio holdings sheet, broken out by sectors/industries. Quarterly returns of the product since inception A copy of your organizational chart. Please include a chart that at least shows the full structure of the relevant team for this submission. A sample contract, PPM, or other offering ...

How important is dividend yield?

... Generally speaking, income from stock investments comes from two sources: Increase in the market price of the stock or capital gains and dividend payouts. Looking at the yield of the stock can be important for you if you are interested in making money off of your stock. The dividend yield of a stock ...

... Generally speaking, income from stock investments comes from two sources: Increase in the market price of the stock or capital gains and dividend payouts. Looking at the yield of the stock can be important for you if you are interested in making money off of your stock. The dividend yield of a stock ...

europe - Veille info tourisme

... deceleration of the Eurozone GDP growth. Regardless of these factors, Europe is still considered a safe investment for cross-border investors, mainly from Asia and the Middle East. Moreover, the current favourable exchange rate of the Euro compared to major currencies should further boost internatio ...

... deceleration of the Eurozone GDP growth. Regardless of these factors, Europe is still considered a safe investment for cross-border investors, mainly from Asia and the Middle East. Moreover, the current favourable exchange rate of the Euro compared to major currencies should further boost internatio ...

Solactive US Quality Dividend Low Volatility Index

... With its innovative and systematic approach, the index certificate makes it possible to tap into the potential of high dividends geared towards sustainability. The index provides access to a source of returns that is both traditional and important. ...

... With its innovative and systematic approach, the index certificate makes it possible to tap into the potential of high dividends geared towards sustainability. The index provides access to a source of returns that is both traditional and important. ...

One Hat Too Many? Investment Desegregation in Private Equity

... reasons why attempts to limit investment strategies, either by regulation or litigation, may be self-defeating. Market and contractual solutions are likely to be far superior, although the law may have some work to do to create conditions that encourage free contracting on these issues. I. FUND FORM ...

... reasons why attempts to limit investment strategies, either by regulation or litigation, may be self-defeating. Market and contractual solutions are likely to be far superior, although the law may have some work to do to create conditions that encourage free contracting on these issues. I. FUND FORM ...

33 Journal of the Statistical and Social Inquiry Society of

... Opening a production plant abroad can also reduce costs if there are economies of scale or scope of multi-plant production. This would be the case if the firm owns a firm-specific asset (Caves, 1971, 1996), i.e., an asset which is usually intangible and to which other firms do not have access (Marku ...

... Opening a production plant abroad can also reduce costs if there are economies of scale or scope of multi-plant production. This would be the case if the firm owns a firm-specific asset (Caves, 1971, 1996), i.e., an asset which is usually intangible and to which other firms do not have access (Marku ...

The Economic Analysis of Real Option Value

... cash-flow-based intrinsic valuation of that security’s price. That is, the intrinsic valuation of the security (based on a discounted cash flow valuation analysis) may simply not support the apparently excessive public stock price of that security. In such instances, some market analysts have argued ...

... cash-flow-based intrinsic valuation of that security’s price. That is, the intrinsic valuation of the security (based on a discounted cash flow valuation analysis) may simply not support the apparently excessive public stock price of that security. In such instances, some market analysts have argued ...

Is Intellectual Property "Investment"? Eli Lilly v. Canada and the

... any contribution in cash, in kind or in services, invested or reinvested in any sector of economic activity.” 11 Investment may also be defined by reference to an illustrative, but non-exhaustive list, which explicitly mentions intellectual property. 12 Many commentators have taken the inclusion of ...

... any contribution in cash, in kind or in services, invested or reinvested in any sector of economic activity.” 11 Investment may also be defined by reference to an illustrative, but non-exhaustive list, which explicitly mentions intellectual property. 12 Many commentators have taken the inclusion of ...

Sparinvest White paper - Risk Containment in Emerging Markets

... portfolio. But the most risk-averse investors have resisted the attractions of these markets precisely because of their reputation for involving additional risk. The intention of this paper is to review emerging market-specific risks and consider whether they are compensated by the potential rewards ...

... portfolio. But the most risk-averse investors have resisted the attractions of these markets precisely because of their reputation for involving additional risk. The intention of this paper is to review emerging market-specific risks and consider whether they are compensated by the potential rewards ...

making the case

... Parts produced in-house must not be ignored, but they should be included only after careful consideration of corporate dynamics, process ownership, and budgetary approval level. Building from the historical data, project the additive manufacturing workload for the near term, which is typically one t ...

... Parts produced in-house must not be ignored, but they should be included only after careful consideration of corporate dynamics, process ownership, and budgetary approval level. Building from the historical data, project the additive manufacturing workload for the near term, which is typically one t ...

The UK equity gap

... 1. What is the equity gap? Defining the equity gap In the UK, a view often expressed is that while we are successful at basic research and generating new ideas and early-stage companies, we are far less successful at developing these initiatives into genuinely global firms. This is a view held acro ...

... 1. What is the equity gap? Defining the equity gap In the UK, a view often expressed is that while we are successful at basic research and generating new ideas and early-stage companies, we are far less successful at developing these initiatives into genuinely global firms. This is a view held acro ...

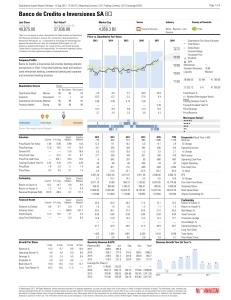

Banco de Credito e Inversiones SA BCI

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

Large Cap Growth - Dahab Associates, Inc.

... The letter should be brief and indicate the specific search for which the proposal is intended and any investment vehicles for which this search is being offered (and for which any minimums fees/account sizes are waived, if applicable). It should name the strategy under consideration and the portfol ...

... The letter should be brief and indicate the specific search for which the proposal is intended and any investment vehicles for which this search is being offered (and for which any minimums fees/account sizes are waived, if applicable). It should name the strategy under consideration and the portfol ...

Quantitative Financial Risk Management

... No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without either the p ...

... No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without either the p ...

FREE Sample Here - We can offer most test bank and

... 37. Refer to Exhibit 1-5. If next year the real rates all rise by 10% while inflation climbs from 1.5% to 2.5%, what will be the nominal rate of return on each security? a. 1.24% and 1.52% b. 1.35% and 3.52% c. 3.89% and 6.11% d. 3.52% and 3.89% e. 1.17% and 6.11% ANS: C The computations for the new ...

... 37. Refer to Exhibit 1-5. If next year the real rates all rise by 10% while inflation climbs from 1.5% to 2.5%, what will be the nominal rate of return on each security? a. 1.24% and 1.52% b. 1.35% and 3.52% c. 3.89% and 6.11% d. 3.52% and 3.89% e. 1.17% and 6.11% ANS: C The computations for the new ...

Slide 1

... Performance quoted is past performance and cannot guarantee comparable future results; current performance may be higher or lower. Results shown assume the reinvestment of dividends. An investment cannot be made directly in an index. ...

... Performance quoted is past performance and cannot guarantee comparable future results; current performance may be higher or lower. Results shown assume the reinvestment of dividends. An investment cannot be made directly in an index. ...

long-term portfolio guide - Responsible Investment Association

... A discussion of each action area follows in this paper. We address the management of institutional-investment portfolios and mutual funds, with particular focus on public equities. Investments in publicly-traded equities and bonds are the single biggest component in the collective portfolio of in ...

... A discussion of each action area follows in this paper. We address the management of institutional-investment portfolios and mutual funds, with particular focus on public equities. Investments in publicly-traded equities and bonds are the single biggest component in the collective portfolio of in ...

Annual Report

... DEAR SHAREHOLDERS, CLIENTS AND EMPLOYEES As we look back on 2013, we remember it as the year we laid the groundwork for the largest investment and capabilities upgrade program that Bank Leumi USA has ever embarked upon, despite the challenges we faced in meeting our financial growth and profitabilit ...

... DEAR SHAREHOLDERS, CLIENTS AND EMPLOYEES As we look back on 2013, we remember it as the year we laid the groundwork for the largest investment and capabilities upgrade program that Bank Leumi USA has ever embarked upon, despite the challenges we faced in meeting our financial growth and profitabilit ...

WORD

... announce the halting of margin purchase and short sale transactions in those securities; this provision will not apply, however, to securities that are delisted because the issuer undergoes a merger, consolidation, or acquisition or a share conversion. 2. When a securities investment trust enterpris ...

... announce the halting of margin purchase and short sale transactions in those securities; this provision will not apply, however, to securities that are delisted because the issuer undergoes a merger, consolidation, or acquisition or a share conversion. 2. When a securities investment trust enterpris ...