Modeling Dynamics Of Dividend Policy, Capital Structure And

... partners to contribute capital to an enterprise or a venture, whether existing or new, or to owner of a real estate or moveable asset, either on a temporary or permanent basis. Profits generated by that venture or real estate or asset are shared in accordance with the terms of the Musharakah agreeme ...

... partners to contribute capital to an enterprise or a venture, whether existing or new, or to owner of a real estate or moveable asset, either on a temporary or permanent basis. Profits generated by that venture or real estate or asset are shared in accordance with the terms of the Musharakah agreeme ...

downstream securities regulation

... under the Securities Act of 1933 (the “Securities Act”).12 It also surely delved into issuers’ “public reporting company” obligations under the Securities Exchange Act of 1934 (the “Exchange Act”).13 However, the regulation to which broker-dealers are subject (also under the Exchange Act)14 likely w ...

... under the Securities Act of 1933 (the “Securities Act”).12 It also surely delved into issuers’ “public reporting company” obligations under the Securities Exchange Act of 1934 (the “Exchange Act”).13 However, the regulation to which broker-dealers are subject (also under the Exchange Act)14 likely w ...

Document

... © 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. ...

... © 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. ...

Value Creation Tutorial VP USL 08-08-2011

... The Basics of Private Equity Private equity firms are specialized investment boutiques that raise large, typically closed-end funds to purchase majority stakes or full ownership in a portfolio of existing, often mature companies. The general partners in a PE firm provide the seed capital and manage ...

... The Basics of Private Equity Private equity firms are specialized investment boutiques that raise large, typically closed-end funds to purchase majority stakes or full ownership in a portfolio of existing, often mature companies. The general partners in a PE firm provide the seed capital and manage ...

Post-Exit considerations

... In the first phase (i.e., the establishment phase) of entrepreneurial wealth alignment, the business emerges from its nascent, formative stages of growth. At this point in time, the entrepreneur’s balance sheet may consist of relatively meager personal and investment holdings (as individual assets m ...

... In the first phase (i.e., the establishment phase) of entrepreneurial wealth alignment, the business emerges from its nascent, formative stages of growth. At this point in time, the entrepreneur’s balance sheet may consist of relatively meager personal and investment holdings (as individual assets m ...

ch15 - U of L Class Index

... • E.g., a stock you bought for $33 now trades for $48 and you want to protect the profits at $45 – If the stock retreats to $45, you lock in the profit if you place a stop order – If the stock continues to increase, you can use a crawling stop to increase the stop price ...

... • E.g., a stock you bought for $33 now trades for $48 and you want to protect the profits at $45 – If the stock retreats to $45, you lock in the profit if you place a stop order – If the stock continues to increase, you can use a crawling stop to increase the stop price ...

Brochure - The Brookdale Group

... Alignment of Interests To ensure that a sharp investment focus is maintained and that conflicts of interest between Brookdale and its institutional co-investors in each fund are eliminated or minimized, Brookdale has elected not to provide to its investment funds fee-based services such as property ...

... Alignment of Interests To ensure that a sharp investment focus is maintained and that conflicts of interest between Brookdale and its institutional co-investors in each fund are eliminated or minimized, Brookdale has elected not to provide to its investment funds fee-based services such as property ...

Document

... – stock prices tend to correctly anticipate earnings announcements beforehand – prices react correctly but not fully afterward – prices continue to move in a direction similar to their initial reaction for several months ...

... – stock prices tend to correctly anticipate earnings announcements beforehand – prices react correctly but not fully afterward – prices continue to move in a direction similar to their initial reaction for several months ...

The Fallacy behind Investor versus Fund Returns

... investor return, and its difference from time-weighted investment return, to a conventional wisdom about the meaning of this difference. Without a better analysis of the characteristics of the two returns and the meaning of the difference, however, we do not really know how to interpret it. Another ...

... investor return, and its difference from time-weighted investment return, to a conventional wisdom about the meaning of this difference. Without a better analysis of the characteristics of the two returns and the meaning of the difference, however, we do not really know how to interpret it. Another ...

Important Information about Hedge Funds

... other investment techniques. Managers of hedge funds only need to be registered as investment advisers if they meet certain assets under management thresholds. Offerings of interests in hedge funds are not required to be registered under the Securities Act of 1933 because they are structured as priv ...

... other investment techniques. Managers of hedge funds only need to be registered as investment advisers if they meet certain assets under management thresholds. Offerings of interests in hedge funds are not required to be registered under the Securities Act of 1933 because they are structured as priv ...

Robbing Peter to Pay Paul: Ponzi Schemes Throughout History

... in NASDAQ securities. Founded in 1960, Bernard L. Madoff Investment Securities LLC was mostly known for market making and acting as the middle man in the transaction of buying and selling stocks. He was a pillar in the securities industry, providing solid advice for almost 50 years. When he turned h ...

... in NASDAQ securities. Founded in 1960, Bernard L. Madoff Investment Securities LLC was mostly known for market making and acting as the middle man in the transaction of buying and selling stocks. He was a pillar in the securities industry, providing solid advice for almost 50 years. When he turned h ...

The concept of investment efficiency and its application to

... investment team or as complex as a large pension fund employing a significant number of © Institute of Actuaries and Faculty of Actuaries ...

... investment team or as complex as a large pension fund employing a significant number of © Institute of Actuaries and Faculty of Actuaries ...

Private Sector Finance and Climate Change Adaptation

... investors. They do yield economic benefits, but these accrue to the wider community and cannot be captured within the project itself. Some projects in the agriculture or water sectors might be suitable targets for equity, although supporting adaptation through equity may otherwise be difficult. Debt ...

... investors. They do yield economic benefits, but these accrue to the wider community and cannot be captured within the project itself. Some projects in the agriculture or water sectors might be suitable targets for equity, although supporting adaptation through equity may otherwise be difficult. Debt ...

The Case for Funds of Hedge Funds

... be significantly worse than employing a fund of funds. Having a team in-house also means that in the event things don’t work out as initially planned, the decision to terminate an underperforming manager not only has HR ramifications, which may be expensive and cumbersome, but it is also most certai ...

... be significantly worse than employing a fund of funds. Having a team in-house also means that in the event things don’t work out as initially planned, the decision to terminate an underperforming manager not only has HR ramifications, which may be expensive and cumbersome, but it is also most certai ...

Spotlight on catastrophe bonds

... exposure to very large risks such as natural disasters. Over this time, ILS as an asset class has also proved to be very attractive to pension funds and other institutional investors. In this paper we discuss the most well known type of ILS, catastrophe bonds (nicknamed ‘cat bonds’). Catastrophe bon ...

... exposure to very large risks such as natural disasters. Over this time, ILS as an asset class has also proved to be very attractive to pension funds and other institutional investors. In this paper we discuss the most well known type of ILS, catastrophe bonds (nicknamed ‘cat bonds’). Catastrophe bon ...

Is Bitcoin a Security?

... Investor interest in the cryptocurrency1 Bitcoin has exploded over the past two years.2 The market capitalization of Bitcoin rose from less than $150 million at the beginning of 2013 to over $5 billion today,3 and a Bitcoin exchange-traded fund may soon be listed on the NASDAQ Stock Market.4 Yet, as ...

... Investor interest in the cryptocurrency1 Bitcoin has exploded over the past two years.2 The market capitalization of Bitcoin rose from less than $150 million at the beginning of 2013 to over $5 billion today,3 and a Bitcoin exchange-traded fund may soon be listed on the NASDAQ Stock Market.4 Yet, as ...

Demystifying Responsible Investment Performance

... It has been 15 years since 28 banks and their USD 2 trillion in assets gathered in New York to sign a United Nations Environment Programme commitment to sound environmental management. Since then, the commitment between UNEP and those original 28 banks has grown into a unique public-private partners ...

... It has been 15 years since 28 banks and their USD 2 trillion in assets gathered in New York to sign a United Nations Environment Programme commitment to sound environmental management. Since then, the commitment between UNEP and those original 28 banks has grown into a unique public-private partners ...

the dollar amount of a firm`s investment

... the larger the previous period’s dividends, the smaller the change in dividends ...

... the larger the previous period’s dividends, the smaller the change in dividends ...

vu buddy - GROU.PS

... AAR is a measure of accounting profit relative to book value An investment is acceptable if its AAR is greater than a benchmark AAR None of the given options ...

... AAR is a measure of accounting profit relative to book value An investment is acceptable if its AAR is greater than a benchmark AAR None of the given options ...

THE QUEST FOR POLICY SPACE IN A NEW

... Investors’, in Karl P. Sauvant (ed), Yearbook on International Investment Law and Policy 2008– 2009 (New York, N.Y.: Oxford University Press, 2009), 379. ...

... Investors’, in Karl P. Sauvant (ed), Yearbook on International Investment Law and Policy 2008– 2009 (New York, N.Y.: Oxford University Press, 2009), 379. ...

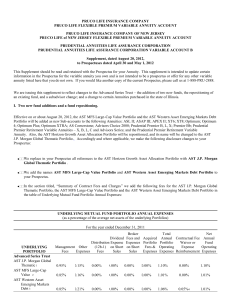

PRUCO LIFE INSURANCE COMPANY PRUCO LIFE FLEXIBLE

... Portfolios available under your contract, please refer to your contract prospectus. The following should be read in conjunction with the Prospectus and should be retained for future reference. Defined terms used herein and not otherwise defined herein shall have the meanings given to them in the Pro ...

... Portfolios available under your contract, please refer to your contract prospectus. The following should be read in conjunction with the Prospectus and should be retained for future reference. Defined terms used herein and not otherwise defined herein shall have the meanings given to them in the Pro ...

Success of the 2014-2016 Business Development Plan

... ► Strengthen the sales & marketing drive in an environment that improves ...

... ► Strengthen the sales & marketing drive in an environment that improves ...

Quest for the Holy Grail: The Fair Value of the

... dividends, have remained above their long-term averages over the last quarter-century, causing a simple contrarian strategy in US equities to fail to outperform a buy-andhold strategy over the same time period. We ask why stock valuations have been steadily increasing, will they continue to rise, an ...

... dividends, have remained above their long-term averages over the last quarter-century, causing a simple contrarian strategy in US equities to fail to outperform a buy-andhold strategy over the same time period. We ask why stock valuations have been steadily increasing, will they continue to rise, an ...

sample - Test Bank College

... 37. Refer to Exhibit 1-5. If next year the real rates all rise by 10 percent while inflation climbs from 1.5 percent to 2.5 percent, what will be the nominal rate of return on each security? a. 1.24% and 1.52% b. 1.35% and 3.52% c. 3.89% and 6.11% d. 3.52% and 3.89% e. 1.17% and 6.11% ANS: C The com ...

... 37. Refer to Exhibit 1-5. If next year the real rates all rise by 10 percent while inflation climbs from 1.5 percent to 2.5 percent, what will be the nominal rate of return on each security? a. 1.24% and 1.52% b. 1.35% and 3.52% c. 3.89% and 6.11% d. 3.52% and 3.89% e. 1.17% and 6.11% ANS: C The com ...