Regulatory Notice 12-40

... SEC Approves New FINRA Rule 5123 Regarding Private Placements of Securities ...

... SEC Approves New FINRA Rule 5123 Regarding Private Placements of Securities ...

The changing policy framework

... Latin America’s fiscal adjustment: Contribution of consumption and investment Changes between 1980-84 and 19992001 (percent of GDP) ...

... Latin America’s fiscal adjustment: Contribution of consumption and investment Changes between 1980-84 and 19992001 (percent of GDP) ...

Alternative Investment Fund Managers Directive

... Id. (detailing an example of how onerous the reporting may be to qualify for a passport, the author notes that Annex IV requires “at least three hundred points of reference data and other risk metrics . . . .”) ...

... Id. (detailing an example of how onerous the reporting may be to qualify for a passport, the author notes that Annex IV requires “at least three hundred points of reference data and other risk metrics . . . .”) ...

Integration of financial services

... met the majority of our objectives for 2001, although we did fall short in a couple of areas. Looking back at 2001, what pleases me most is that despite significant acquisition costs, higher loan losses, one-time restructuring charges, weak equity markets and larger-than-forecast losses in RBC Dain ...

... met the majority of our objectives for 2001, although we did fall short in a couple of areas. Looking back at 2001, what pleases me most is that despite significant acquisition costs, higher loan losses, one-time restructuring charges, weak equity markets and larger-than-forecast losses in RBC Dain ...

SA BlackRock VCP Global Multi Asset Portfolio Summary

... attractiveness of countries and sectors, as well as average market capitalization. The subadviser will assess each investment’s changing characteristics relative to its contribution to portfolio risk within that discipline and will sell the investment when it no longer offers an appropriate return-t ...

... attractiveness of countries and sectors, as well as average market capitalization. The subadviser will assess each investment’s changing characteristics relative to its contribution to portfolio risk within that discipline and will sell the investment when it no longer offers an appropriate return-t ...

February 9, 1994 File No. ---------------

... power to vote shares, are analogous to the powers conferred on broker-dealers and banks, whose activities are subject to exemptions from the Act with respect to shares over which they may have investment discretion as described below. Thirdly, the Equitable Entities are subject to extensive regulati ...

... power to vote shares, are analogous to the powers conferred on broker-dealers and banks, whose activities are subject to exemptions from the Act with respect to shares over which they may have investment discretion as described below. Thirdly, the Equitable Entities are subject to extensive regulati ...

Municipal Market: How Rates Rise Matters

... Investors should contact a tax advisor regarding the suitability of tax-exempt investments in their portfolios. If sold prior to maturity, municipal securities are subject to gain/losses based on the level of interest rates, market conditions and the credit quality of the issuer. Income may be subje ...

... Investors should contact a tax advisor regarding the suitability of tax-exempt investments in their portfolios. If sold prior to maturity, municipal securities are subject to gain/losses based on the level of interest rates, market conditions and the credit quality of the issuer. Income may be subje ...

Chapter 2 -- The Business, Tax, and Financial Environments

... Describe the purpose and make up of financial markets. Demonstrate an understanding of how letter ratings of the major rating agencies help you to judge a security’s default risk. Understand what is meant by the term “term structure of interest rates” and relate it to a “yield curve.” Van Horne and ...

... Describe the purpose and make up of financial markets. Demonstrate an understanding of how letter ratings of the major rating agencies help you to judge a security’s default risk. Understand what is meant by the term “term structure of interest rates” and relate it to a “yield curve.” Van Horne and ...

JP Morgan Securities LLC | Wrap Fee Program Brochure | Advisory

... (“JPMorgan”), a publicly-held financial services holding company. JPMorgan and its affiliates (together “J.P. Morgan”) are engaged in a large number of financial businesses worldwide, including banking, asset management, securities brokerage and investment advisory services. JPMS is registered as a ...

... (“JPMorgan”), a publicly-held financial services holding company. JPMorgan and its affiliates (together “J.P. Morgan”) are engaged in a large number of financial businesses worldwide, including banking, asset management, securities brokerage and investment advisory services. JPMS is registered as a ...

Reward-to

... The standard deviation of the complete portfolio using the passive portfolio would be: C = 0.7 M = 0.7 24% = 16.8% Therefore, the shift entails a decline in the mean from 12.3% to 11.6% and a decline in the standard deviation from 17.5% to 16.8%. Since both mean return and standard deviation f ...

... The standard deviation of the complete portfolio using the passive portfolio would be: C = 0.7 M = 0.7 24% = 16.8% Therefore, the shift entails a decline in the mean from 12.3% to 11.6% and a decline in the standard deviation from 17.5% to 16.8%. Since both mean return and standard deviation f ...

FDI - uwcmaastricht-econ

... 2004, it accounted for 51% of these. • For LDCs as a whole it is more important than ODA. • For a number of LDCs ODA is still the main source of foreign finance. ...

... 2004, it accounted for 51% of these. • For LDCs as a whole it is more important than ODA. • For a number of LDCs ODA is still the main source of foreign finance. ...

Slides

... weeks) for an investment in a promo7on or ad campaign. • The 7me period may be very long (years or decades) for an investment in a store’s furnishings, ambiance or loca7on. ...

... weeks) for an investment in a promo7on or ad campaign. • The 7me period may be very long (years or decades) for an investment in a store’s furnishings, ambiance or loca7on. ...

I. Executive Summary

... II. Factual Background and Claims of the Investor Due to increased energy demands in the 1980s, Turkey had sought to liberalise its energy sector and attract foreign investment. For this purpose, it passed legislation that offered companies Build-Operate-Transfer (BOT) contracts whereby companies w ...

... II. Factual Background and Claims of the Investor Due to increased energy demands in the 1980s, Turkey had sought to liberalise its energy sector and attract foreign investment. For this purpose, it passed legislation that offered companies Build-Operate-Transfer (BOT) contracts whereby companies w ...

II. Dynamics and structure of foreign investments in Uzbekistan

... investments were actively involved in the oil refining, chemicals, and transportation branches. The cumulative share of these branches has made more than 54%.6 An analysis of Table 1 shows that in 2004-2005, most foreign investments involved the production sector, especially in 2005, when they decre ...

... investments were actively involved in the oil refining, chemicals, and transportation branches. The cumulative share of these branches has made more than 54%.6 An analysis of Table 1 shows that in 2004-2005, most foreign investments involved the production sector, especially in 2005, when they decre ...

Developing a Successful TPA/Investment

... Remember that 403(b) plans can be sponsored by public schools and by 501(c)(3) nonprofit organizations. While 403(b) plans of public schools have a statutory exemption from the Employee Retirement Income Security Act (ERISA), the same cannot automatically be said of those plans offered by 501(c)(3) ...

... Remember that 403(b) plans can be sponsored by public schools and by 501(c)(3) nonprofit organizations. While 403(b) plans of public schools have a statutory exemption from the Employee Retirement Income Security Act (ERISA), the same cannot automatically be said of those plans offered by 501(c)(3) ...

From Cattle to Cotton to Corn

... Products like this allow you to invest in commodities without owning the commodity itself. ETFs like this typically invest in company stocks related to the commodity, or they consist of futures and derivative contracts that track the price of the underlying commodity, or indexes. Why Buy Commodities ...

... Products like this allow you to invest in commodities without owning the commodity itself. ETFs like this typically invest in company stocks related to the commodity, or they consist of futures and derivative contracts that track the price of the underlying commodity, or indexes. Why Buy Commodities ...

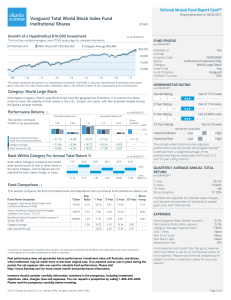

Vanguard Total World Stock Index Fund Institutional Shares

... Sector weightings for fund portfolios are determined using the Global Industry Classification Standard (GICS). GICS was developed by and is the exclusive property of Morgan Stanley Capital International Inc. and Standard & Poor's. GICS is a service mark of MSCI and S&P and has been licensed for use ...

... Sector weightings for fund portfolios are determined using the Global Industry Classification Standard (GICS). GICS was developed by and is the exclusive property of Morgan Stanley Capital International Inc. and Standard & Poor's. GICS is a service mark of MSCI and S&P and has been licensed for use ...

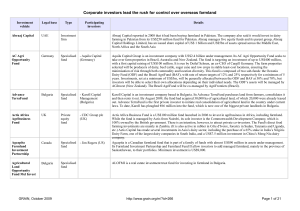

The new farm owners table

... Agrifirma was launched in 2008 to acquire land in Brazil and bring it into agricultural production. The principal shareholders formerly managed the mining investment company Galahad Gold plc from 2003 to 2007. "We are building a portfolio of land where we can successfully apply our capital, technolo ...

... Agrifirma was launched in 2008 to acquire land in Brazil and bring it into agricultural production. The principal shareholders formerly managed the mining investment company Galahad Gold plc from 2003 to 2007. "We are building a portfolio of land where we can successfully apply our capital, technolo ...

9 - FacStaff Home Page for CBU

... • CAPM is criticized because of the difficulties in selecting a proxy for the market portfolio as a benchmark • An alternative pricing theory with fewer assumptions was developed: • Arbitrage Pricing Theory ...

... • CAPM is criticized because of the difficulties in selecting a proxy for the market portfolio as a benchmark • An alternative pricing theory with fewer assumptions was developed: • Arbitrage Pricing Theory ...

RTF format

... a person who is attempting to cover up a conspiracy with Martinson. On the contrary, his reference to Cloete, who could have been asked at any time to explain his conduct and the incorrect allocations, in my view shows his honesty in this respect. If he had been party to any conspiracy with Martinso ...

... a person who is attempting to cover up a conspiracy with Martinson. On the contrary, his reference to Cloete, who could have been asked at any time to explain his conduct and the incorrect allocations, in my view shows his honesty in this respect. If he had been party to any conspiracy with Martinso ...

Real estate has a place in a well-diversified investment

... properties. All of them have trade-offs. REITS offer daily liquidity but are also the most volatile, since their pricing is subject to investor sentiment. Open-end commingled funds have an infinite life, offer quarterly liquidity and are a common vehicle for similar investors to pool their interests ...

... properties. All of them have trade-offs. REITS offer daily liquidity but are also the most volatile, since their pricing is subject to investor sentiment. Open-end commingled funds have an infinite life, offer quarterly liquidity and are a common vehicle for similar investors to pool their interests ...

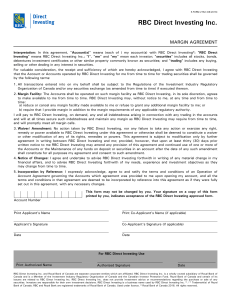

Margin Agreement - RBC Direct Investing

... Investing" means RBC Direct Investing Inc.; "I", "me" and "my" mean each investor; "securities" includes all stocks, bonds, debentures investment certificates or other similar property commonly known as securities; and "trading" includes any buying, selling or other dealing in any interest in securi ...

... Investing" means RBC Direct Investing Inc.; "I", "me" and "my" mean each investor; "securities" includes all stocks, bonds, debentures investment certificates or other similar property commonly known as securities; and "trading" includes any buying, selling or other dealing in any interest in securi ...

Study: Returns to Angel Investors in Groups

... connected to angel groups and drivers behind returns • Released in November, 2007 ...

... connected to angel groups and drivers behind returns • Released in November, 2007 ...

Insights into Evaluating Exchange Traded Funds

... progressively more onerous. Consider the fact that there were 648 product launches in 2010 alone helping to bring the number of industry offerings to over 2,600 with assets of US$1.6 trillion worldwide today.1 This growth has been fuelled by products that offer exposure to more diverse asset classes ...

... progressively more onerous. Consider the fact that there were 648 product launches in 2010 alone helping to bring the number of industry offerings to over 2,600 with assets of US$1.6 trillion worldwide today.1 This growth has been fuelled by products that offer exposure to more diverse asset classes ...