OH 020609a- Eventual Return to Historical Roots

... that adherence to the “gold-exchange” ½ gold standard helped make the Depression worse. What they say is true in isolation, though they ignore the fact that not returning to a pure gold standard after WWI was a key to allowing the excess leverage that created the crash and the over-indebted economy ...

... that adherence to the “gold-exchange” ½ gold standard helped make the Depression worse. What they say is true in isolation, though they ignore the fact that not returning to a pure gold standard after WWI was a key to allowing the excess leverage that created the crash and the over-indebted economy ...

Cash Flow

... • Be able to advise the management on the organisation’s financial position using cash flow statements (HL) ...

... • Be able to advise the management on the organisation’s financial position using cash flow statements (HL) ...

Monthly Economic and Financial Developments May 2008 Release Date: 7 July 2008

... unemployment rate deteriorated marginally to 5.3% in April, while annualized inflation crept up to 3.3% in May from 3.0% a month earlier. For The Bahamas, the potential for further growth in European arrivals has improved, given the 6.2% decline in the value of the US dollar against the euro during ...

... unemployment rate deteriorated marginally to 5.3% in April, while annualized inflation crept up to 3.3% in May from 3.0% a month earlier. For The Bahamas, the potential for further growth in European arrivals has improved, given the 6.2% decline in the value of the US dollar against the euro during ...

Cash Budgets

... In general, Accounts Receivable, Inventory, Accounts Payable (on the balance sheet), and cost of goods sold and some operating expenses (on the income statement) vary with sales (maintain the same percentage of sales) or cost of goods sold. Other items are either fixed with respect to changes in sal ...

... In general, Accounts Receivable, Inventory, Accounts Payable (on the balance sheet), and cost of goods sold and some operating expenses (on the income statement) vary with sales (maintain the same percentage of sales) or cost of goods sold. Other items are either fixed with respect to changes in sal ...

Some international trends in the regulation of mortgage markets

... The option to repay part of the mortgage early without incurring in a high cost is usually highly appreciated by borrowers. However, it can have an important effect on lenders, increasing the cost in cases of fixed rate funding, as the collateral provided for mortgage backed securities have to be su ...

... The option to repay part of the mortgage early without incurring in a high cost is usually highly appreciated by borrowers. However, it can have an important effect on lenders, increasing the cost in cases of fixed rate funding, as the collateral provided for mortgage backed securities have to be su ...

foreword - Port Phillip Publishing

... that Greeks can kick the can further and longer than you can stay in Athens waiting for the debt bubble to blow up. But just because you have to wait a long time for big events to occur doesn’t mean that they won’t occur. That which has to happen sooner or later will happen sometime. And the longer ...

... that Greeks can kick the can further and longer than you can stay in Athens waiting for the debt bubble to blow up. But just because you have to wait a long time for big events to occur doesn’t mean that they won’t occur. That which has to happen sooner or later will happen sometime. And the longer ...

Risk profile of households and the impact on financial stability

... policy. Higher interest rates reduce households’ access to bank lending, creating a credit crunch. ...

... policy. Higher interest rates reduce households’ access to bank lending, creating a credit crunch. ...

Presentation_Fahim

... JCR-VISCommercial Banks Internationally, mutual funds are being assessed both on the basis of performance and stability of NAV. Some of the ratings methodologies in use include: ...

... JCR-VISCommercial Banks Internationally, mutual funds are being assessed both on the basis of performance and stability of NAV. Some of the ratings methodologies in use include: ...

Defaults and Losses on Commercial Real Estate Bonds during the

... attractive in comparison to savings accounts 4, high-grade bonds, and other securities, there A typical bond yielded six percent, which was twice the rate paid on a commercial bank savings deposit and more than two percentage points higher than the rate offered by savings banks. (Willis 1995, 163) ...

... attractive in comparison to savings accounts 4, high-grade bonds, and other securities, there A typical bond yielded six percent, which was twice the rate paid on a commercial bank savings deposit and more than two percentage points higher than the rate offered by savings banks. (Willis 1995, 163) ...

Sovereign Risk, Currency Risk, and Corporate Balance Sheets.

... spread above the risk-free rate in their own currency. These positive LC credit spreads suggest that nominal LC sovereign bonds are not default-free. Furthermore, LC credit spreads remain positive even for countries where the sovereign external liabilities are almost exclusively denominated in LC, s ...

... spread above the risk-free rate in their own currency. These positive LC credit spreads suggest that nominal LC sovereign bonds are not default-free. Furthermore, LC credit spreads remain positive even for countries where the sovereign external liabilities are almost exclusively denominated in LC, s ...

Buying with a margin of safety in fixed income

... the level of risk. Yield can be generated in many forms, but it is important to always ask at what level of risk this is being offered. Fixed income asset prices have changed substantially over the past few years Opportunities in fixed income arise from the fact that fear and uncertainty are priced ...

... the level of risk. Yield can be generated in many forms, but it is important to always ask at what level of risk this is being offered. Fixed income asset prices have changed substantially over the past few years Opportunities in fixed income arise from the fact that fear and uncertainty are priced ...

Uneasy calm gives way to turbulence

... substantial pressure on many EMEs at a time when the tide of global dollar liquidity appears to be turning.3 Global credit markets were also riled by turbulence. The low interest rate environment of the past few years had gone hand in hand with a search for yield that eased credit conditions, in par ...

... substantial pressure on many EMEs at a time when the tide of global dollar liquidity appears to be turning.3 Global credit markets were also riled by turbulence. The low interest rate environment of the past few years had gone hand in hand with a search for yield that eased credit conditions, in par ...

(1) - Studyclix

... The final accounts and balance sheet give a certain amount of information about the performance of a company but this information is limited in that it does not take into account certain factors Future changes in fashion, which may make the firm’s products unattractive A change in the exchange r ...

... The final accounts and balance sheet give a certain amount of information about the performance of a company but this information is limited in that it does not take into account certain factors Future changes in fashion, which may make the firm’s products unattractive A change in the exchange r ...

PDF

... current cash (or goods) for a promise to pay cash (or goods) in the future. The promise is often supplemented with additional restrictions and covenants which determine the rights and behaviour of the parties. However, the promise is sometimes broken by the borrower. Recognition of this state of imp ...

... current cash (or goods) for a promise to pay cash (or goods) in the future. The promise is often supplemented with additional restrictions and covenants which determine the rights and behaviour of the parties. However, the promise is sometimes broken by the borrower. Recognition of this state of imp ...

BID BOND

... In the event of the withdrawal of said Bid within the time period specified, or within 60 days if no time period be specified, or the disqualification of said Bid due to failure of Principal to enter into such agreement and furnish such bonds, certificates of insurance, and all other items as requir ...

... In the event of the withdrawal of said Bid within the time period specified, or within 60 days if no time period be specified, or the disqualification of said Bid due to failure of Principal to enter into such agreement and furnish such bonds, certificates of insurance, and all other items as requir ...

Glossary

... Restructured credit ratio not included in credit at risk2 Ratio between restructured loans and advances to customers not included in loans and advances to customers at risk and total loans and advances to customers. ...

... Restructured credit ratio not included in credit at risk2 Ratio between restructured loans and advances to customers not included in loans and advances to customers at risk and total loans and advances to customers. ...

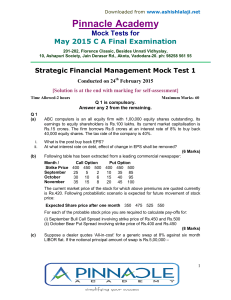

Pinnacle Academ y

... effective cost of the capped loan for the following LIBOR on the next 5 rollover dates: 5.5%, 6%, 6.25%, 6.5% and 6.75%. Fixed interest rate is 7%. For the purpose of your calculations, premium cost should be amortized over a period of 2.5 year using fixed interest rate as discount rate. Show the ef ...

... effective cost of the capped loan for the following LIBOR on the next 5 rollover dates: 5.5%, 6%, 6.25%, 6.5% and 6.75%. Fixed interest rate is 7%. For the purpose of your calculations, premium cost should be amortized over a period of 2.5 year using fixed interest rate as discount rate. Show the ef ...

DOC - Europa.eu

... What criteria should national regulators or ESMA take into account in determining whether there are adverse events or developments which could trigger a temporary ban on short selling? The Short Selling Regulation provides that in exceptional situations, national regulators will have powers to impos ...

... What criteria should national regulators or ESMA take into account in determining whether there are adverse events or developments which could trigger a temporary ban on short selling? The Short Selling Regulation provides that in exceptional situations, national regulators will have powers to impos ...

"International Reserves and Rollover Risk"

... for the government. We find that it is relatively more costly to accumulate reserves when lenders are more risk averse and when income is lower. When lenders’ risk aversion takes a high value, the government has to pay a higher risk premium for the extra risk lenders face. Moreover, we also show tha ...

... for the government. We find that it is relatively more costly to accumulate reserves when lenders are more risk averse and when income is lower. When lenders’ risk aversion takes a high value, the government has to pay a higher risk premium for the extra risk lenders face. Moreover, we also show tha ...

Highlights of Chapters 19, 16, 33, and 25

... Projects of different risk - If the project under consideration is more (or less) risky than the firm's existing assets, then calculate an "industry" WACC for the project's industry. Note: We didn’t take into account bankruptcy costs, agency costs, personal taxes, etc. in this analysis. See Chapter ...

... Projects of different risk - If the project under consideration is more (or less) risky than the firm's existing assets, then calculate an "industry" WACC for the project's industry. Note: We didn’t take into account bankruptcy costs, agency costs, personal taxes, etc. in this analysis. See Chapter ...