2.2 Fiscal and Economic Strategy - ACT Treasury

... The Headline Net Operating Balance has been consistently presented in this way in the ACT Government’s Budget Statements since 2006-07. The continued use of the Headline Net Operating Balance ensures that comparable, comprehensive and informed assessments can be made of the Territory’s financial pe ...

... The Headline Net Operating Balance has been consistently presented in this way in the ACT Government’s Budget Statements since 2006-07. The continued use of the Headline Net Operating Balance ensures that comparable, comprehensive and informed assessments can be made of the Territory’s financial pe ...

Bonds, Interest Rates, and the Impact of Inflation

... existing bonds with higher interest rates tend to rise. Example: Jane buys a newly issued 10-year corporate bond that has a 4% coupon rate--that is, its annual payments equal 4% of the bond's principal. Three years later, she wants to sell the bond. However, interest rates have risen; corporate bond ...

... existing bonds with higher interest rates tend to rise. Example: Jane buys a newly issued 10-year corporate bond that has a 4% coupon rate--that is, its annual payments equal 4% of the bond's principal. Three years later, she wants to sell the bond. However, interest rates have risen; corporate bond ...

Chapter 6 "DO YOU UNDERSTAND" QUESTIONS Assume that the

... Answer: The borrower of the money sells a government security to the lender along with an agreement to repurchase it at a future time at a predetermined higher price that is based on the repo rate. Thus the lender of the money owns the security until the money is paid back with interest, so the secu ...

... Answer: The borrower of the money sells a government security to the lender along with an agreement to repurchase it at a future time at a predetermined higher price that is based on the repo rate. Thus the lender of the money owns the security until the money is paid back with interest, so the secu ...

Las Vegas Valley Water District Investment Policy

... reports will include a complete listing of securities held, income earned, weighted average maturity, aggregate current yield. The monthly report shall be subject to audit by the District's internal and external auditors at any time. The CFO shall also maintain records, subject to audit, of all inve ...

... reports will include a complete listing of securities held, income earned, weighted average maturity, aggregate current yield. The monthly report shall be subject to audit by the District's internal and external auditors at any time. The CFO shall also maintain records, subject to audit, of all inve ...

55-Internal Audit for Treasury Market Risk Management

... public debt office at quarterly intervals ...

... public debt office at quarterly intervals ...

"Growth in the Shadow of Expropriation"

... growth model that emphasizes political economy and contracting frictions. The political economy frictions involve disagreement and political turnover, while the contracting friction is a lack of commitment regarding foreign debt and expropriation. We show that the political economy frictions induce ...

... growth model that emphasizes political economy and contracting frictions. The political economy frictions involve disagreement and political turnover, while the contracting friction is a lack of commitment regarding foreign debt and expropriation. We show that the political economy frictions induce ...

Octagon Investment Partners XIV Ltd./Octagon

... reinvestment period, or when reinvesting proceeds from the sale of a credit risk or defaulted obligation. For this transaction, the non-model version of CDO Monitor may be used as an alternative to the model-based approach. This version of CDO Monitor is built on the foundation of six portfolio benc ...

... reinvestment period, or when reinvesting proceeds from the sale of a credit risk or defaulted obligation. For this transaction, the non-model version of CDO Monitor may be used as an alternative to the model-based approach. This version of CDO Monitor is built on the foundation of six portfolio benc ...

Debt Structure and Financial Flexibility

... A large theoretical literature shows that debt structure can improve or detract from flexibility through various channels. In this paper I consider four aspects of debt structure that are related, theoretically, to flexibility: (1) the total level of debt, (2) the mix of short- vs longmaturity debt, ...

... A large theoretical literature shows that debt structure can improve or detract from flexibility through various channels. In this paper I consider four aspects of debt structure that are related, theoretically, to flexibility: (1) the total level of debt, (2) the mix of short- vs longmaturity debt, ...

Paper: "From NIC to TIC to RAY: Calculating True Lifetime Cost of

... We note that IFR appears to omit other costs of borrowing in the public markets such as trustee fees, meeting ongoing disclosure requirements, and tax compliance costs. If these estimates are identical across structures being compared, the relative attractiveness will not change. In that case, these ...

... We note that IFR appears to omit other costs of borrowing in the public markets such as trustee fees, meeting ongoing disclosure requirements, and tax compliance costs. If these estimates are identical across structures being compared, the relative attractiveness will not change. In that case, these ...

THE U.S. CURRENT ACCOUNT DEFICIT: NOTHING TO FEAR BUT

... Just as a fast-growing business can finance its expansion through debt, so too can a fast-growing economy. The massive U.S. current account deficit (CAD) embodies this notion, as Americans have been borrowing from abroad to finance consumer and government spending. However, have American borrowing h ...

... Just as a fast-growing business can finance its expansion through debt, so too can a fast-growing economy. The massive U.S. current account deficit (CAD) embodies this notion, as Americans have been borrowing from abroad to finance consumer and government spending. However, have American borrowing h ...

On the Construction of an Early-Warning System for Systematic Risk

... operation cost, the debt paying ability and the profitability. Certain growth of investment in fixed assets can ensure the stable development of economy. And the growth rate should be in accord with the speed of economic development. When the deficit budget is too large, it may affect the healthy de ...

... operation cost, the debt paying ability and the profitability. Certain growth of investment in fixed assets can ensure the stable development of economy. And the growth rate should be in accord with the speed of economic development. When the deficit budget is too large, it may affect the healthy de ...

The Financial Structure of Startup Firms: The Role of

... where ensuring the alignment of interests between managers and shareholders is more difficult. Our question: does the ranking with regard to internal funds, external debt, and external equity that comes from established-firm theory play out for startups, which have different asset and information ch ...

... where ensuring the alignment of interests between managers and shareholders is more difficult. Our question: does the ranking with regard to internal funds, external debt, and external equity that comes from established-firm theory play out for startups, which have different asset and information ch ...

Does the Market Discipline Banks? New Evidence from

... issued largely by Bank Holding Companies. The authors found that spreads are sensitive to measures of leverage, accruing loans past due, and real estate holdings of the holding company, but that this relationship is strongest with more recent data. These findings were largely confirmed by DeYoun ...

... issued largely by Bank Holding Companies. The authors found that spreads are sensitive to measures of leverage, accruing loans past due, and real estate holdings of the holding company, but that this relationship is strongest with more recent data. These findings were largely confirmed by DeYoun ...

Changing Times for Financial Institutions Chapter 1

... loan and 90percent for a five-year loan. All Basel II capital calculations (standardized and IRB) include an operational risk charge (under the Basic Indicator Approach, the operational capital charge is equal to 15 percent of the institution's average gross income over the previous three years). As ...

... loan and 90percent for a five-year loan. All Basel II capital calculations (standardized and IRB) include an operational risk charge (under the Basic Indicator Approach, the operational capital charge is equal to 15 percent of the institution's average gross income over the previous three years). As ...

Marginal leverage ratio as a monitoring tool of

... principle, this can be done by a ratio combining any two variable from debt, total assets and equity. However, not all such ratios are equaly valid. Effects like wrong framing and denominator neglect indicate that what we are trying to measure, i.e. debt, should appear in the numerator. Furthermore, ...

... principle, this can be done by a ratio combining any two variable from debt, total assets and equity. However, not all such ratios are equaly valid. Effects like wrong framing and denominator neglect indicate that what we are trying to measure, i.e. debt, should appear in the numerator. Furthermore, ...

Bond Basics - RBC Wealth Management

... If you purchase a bond in the primary market with a price at par, the bond’s coupon rate will equal its yield to maturity. This is because the bond’s purchase price is the same as its maturity value, so you will be earning the coupon rate every year on the original par value. However, if you purchas ...

... If you purchase a bond in the primary market with a price at par, the bond’s coupon rate will equal its yield to maturity. This is because the bond’s purchase price is the same as its maturity value, so you will be earning the coupon rate every year on the original par value. However, if you purchas ...

Beginner`s Guide to Bridging Finance

... opportunity to buy these often derelict properties and start their renovation project prior to letting and securing long-term finance or selling for a profit. Bridging loan providers will take into consideration an investor's current property portfolio as well as their potential purchase, making sur ...

... opportunity to buy these often derelict properties and start their renovation project prior to letting and securing long-term finance or selling for a profit. Bridging loan providers will take into consideration an investor's current property portfolio as well as their potential purchase, making sur ...

Defaultable Debt, Interest Rates and the Current Account

... does not lead to default at a rate that resembles those observed in many economies over the last 150 years. To see the intuition behind why default occurs so rarely in a model with transitory shocks and a stable trend, consider that the decision to default rests on the difference between the present ...

... does not lead to default at a rate that resembles those observed in many economies over the last 150 years. To see the intuition behind why default occurs so rarely in a model with transitory shocks and a stable trend, consider that the decision to default rests on the difference between the present ...

ARMAGH CREDIT UNION LTD Cheque Signatories Policy This

... 6. Payment of Credit Union Bills (up to value of £100); MUST be signed by Manager/Assistant Manager and member of staff who is an Authorised Signatory 7. Payment of Credit Union Bills (above £100.01); MUST be signed by President/Treasurer or his/her nominee and Manager/Assistant Manager/ Board Membe ...

... 6. Payment of Credit Union Bills (up to value of £100); MUST be signed by Manager/Assistant Manager and member of staff who is an Authorised Signatory 7. Payment of Credit Union Bills (above £100.01); MUST be signed by President/Treasurer or his/her nominee and Manager/Assistant Manager/ Board Membe ...

III-2 - Fannie Mae

... Whether the sales comparables and adjustments are acceptable and whether the adjustments accurately account for differences between the sales comparables and the Property. Whether the value conclusion based on sales comparables is reasonable. The appraiser's income estimate. Indicate whether rents a ...

... Whether the sales comparables and adjustments are acceptable and whether the adjustments accurately account for differences between the sales comparables and the Property. Whether the value conclusion based on sales comparables is reasonable. The appraiser's income estimate. Indicate whether rents a ...

Managing cash in your portfolio

... vehicles because of the duration risk they pose for investors. Finally, an investor must choose the cash investment that best meets his or her particular need. For example, money that is required to pay bills in the immediate future (such as 90 days or less) should be placed in readily accessible ve ...

... vehicles because of the duration risk they pose for investors. Finally, an investor must choose the cash investment that best meets his or her particular need. For example, money that is required to pay bills in the immediate future (such as 90 days or less) should be placed in readily accessible ve ...

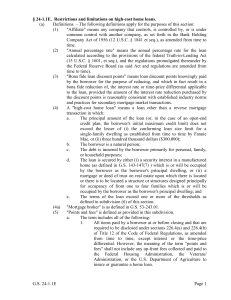

G.S. 24-1.1E - North Carolina General Assembly

... No lending without due regard to repayment ability. – As used in this subsection, the term "obligor" refers to each borrower, co-borrower, cosigner, or guarantor obligated to repay a loan. A lender may not make a high-cost home loan unless the lender reasonably believes at the time the loan is consu ...

... No lending without due regard to repayment ability. – As used in this subsection, the term "obligor" refers to each borrower, co-borrower, cosigner, or guarantor obligated to repay a loan. A lender may not make a high-cost home loan unless the lender reasonably believes at the time the loan is consu ...