Chapters 3 - 4 Financial Statements, Cash Flow, and Analysis of

... ROE is separated into profitability of each $ of sales (profit margin), efficiency of asset management (total asset turnover), and company risk (equity multiplier). Can now get insight into whether company's return is due to high profitability, good management, or compensation for risk. ...

... ROE is separated into profitability of each $ of sales (profit margin), efficiency of asset management (total asset turnover), and company risk (equity multiplier). Can now get insight into whether company's return is due to high profitability, good management, or compensation for risk. ...

Test Bank for Quiz-2 FINA252 Financial Management

... operation cash flow for this year is $1420.00. True or False? A. True B. False ...

... operation cash flow for this year is $1420.00. True or False? A. True B. False ...

Inflation, default and sovereign debt

... means that the government faces stronger incentives to borrow. In equilibrium this leads to high in ation in the model even without substantially higher debt levels, as the tax base for in ation is lower with real debt, and so the government needs to in ate more to generate the same amount of reven ...

... means that the government faces stronger incentives to borrow. In equilibrium this leads to high in ation in the model even without substantially higher debt levels, as the tax base for in ation is lower with real debt, and so the government needs to in ate more to generate the same amount of reven ...

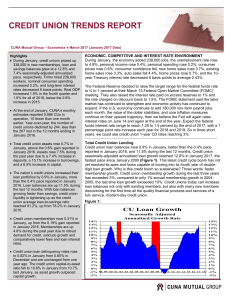

credit union trends report

... home sales rose 3.3%, auto sales fell 4.4%, home prices rose 0.7%, and the 10year Treasury interest rate decreased 6 basis points to average 2.43%. The Federal Reserve decided to raise the target range for the federal funds rate to ¾ to 1 percent at their March 15 Federal Open Market Committee (FOMC ...

... home sales rose 3.3%, auto sales fell 4.4%, home prices rose 0.7%, and the 10year Treasury interest rate decreased 6 basis points to average 2.43%. The Federal Reserve decided to raise the target range for the federal funds rate to ¾ to 1 percent at their March 15 Federal Open Market Committee (FOMC ...

Defaultable Debt, Interest Rates, and the Current Account

... functions. The latter effect arises because a positive shock to trend implies that income is higher today, but even higher tomorrow, placing a premium on the ability to access capital markets to bring forward anticipated income. In this context, the decision to default is relatively more sensitiv ...

... functions. The latter effect arises because a positive shock to trend implies that income is higher today, but even higher tomorrow, placing a premium on the ability to access capital markets to bring forward anticipated income. In this context, the decision to default is relatively more sensitiv ...

CHAPTER 3 THE LOANABLE FUNDS MODEL

... Mandatory savings (+) Federal Reserve credit creation (+) Foreign purchases of U.S. financial assets (+) Inflationary expectations (+) ...

... Mandatory savings (+) Federal Reserve credit creation (+) Foreign purchases of U.S. financial assets (+) Inflationary expectations (+) ...

The Existence of Corporate Bond Clawbacks

... credit quality, issue characteristics, and time trends using a multivariate analysis. Results are robust to several definitions of credit quality. The rest of the paper is structured as follows. We present a simple model for IPOCs in Section 2. Section 3 illustrates a basic numerical analysis of the ...

... credit quality, issue characteristics, and time trends using a multivariate analysis. Results are robust to several definitions of credit quality. The rest of the paper is structured as follows. We present a simple model for IPOCs in Section 2. Section 3 illustrates a basic numerical analysis of the ...

PDF

... 1/ The GDP chain-type price index is used to convert current-dollar amounts to real (inflation adjusted) amounts (2009 = 100). ...

... 1/ The GDP chain-type price index is used to convert current-dollar amounts to real (inflation adjusted) amounts (2009 = 100). ...

Asian Total Return Bond Fund

... Running Yield (%) Describes the income investors get from their portfolio as a percentage of market value of the securities. It should not be relied on as a measure of expected fund return (or distribution). Bonds with high probability of default are excluded from the calculation. The running yield ...

... Running Yield (%) Describes the income investors get from their portfolio as a percentage of market value of the securities. It should not be relied on as a measure of expected fund return (or distribution). Bonds with high probability of default are excluded from the calculation. The running yield ...

INTER PIPELINE LTD. $3,000,000,000 Common Shares Preferred

... holders thereof will become entitled to receive Common Shares or such other securities, and any other terms specific to the Subscription Receipts being offered. Where required by statute, regulation or policy, and where Securities are offered in currencies other than Canadian dollars, appropriate di ...

... holders thereof will become entitled to receive Common Shares or such other securities, and any other terms specific to the Subscription Receipts being offered. Where required by statute, regulation or policy, and where Securities are offered in currencies other than Canadian dollars, appropriate di ...

3pm - FASB Update for Private Companies - Tim Pike

... Accruals for Casino Jackpot Liabilities (Topic 924) ...

... Accruals for Casino Jackpot Liabilities (Topic 924) ...

Monetary and Fiscal Policy with Sovereign Default

... to repay its debt to relax its budget constraint and reduce distortionary taxes. The model is calibrated to the Mexican economy which has experienced periods of high inflation and sovereign risk in the recent past. In addition, domestic nominal debt matters for the Mexican government.3 I study the M ...

... to repay its debt to relax its budget constraint and reduce distortionary taxes. The model is calibrated to the Mexican economy which has experienced periods of high inflation and sovereign risk in the recent past. In addition, domestic nominal debt matters for the Mexican government.3 I study the M ...

Counterparty A

... process of composition or decomposition, creates one (or more) very different financial instruments. ...

... process of composition or decomposition, creates one (or more) very different financial instruments. ...

Lecture 4: Cost of capital and CAPM. First lecture

... Calculating the cost of capital Weighted average cost of capital = cost of debt proportion of debt in financing + cost of equity proportion of equity in financing ...

... Calculating the cost of capital Weighted average cost of capital = cost of debt proportion of debt in financing + cost of equity proportion of equity in financing ...

A Role Model for the Conduct of Fiscal Policy?

... ratio was low and falling, and monetary policy was constrained by a …xed exchange rate. In 1990, it was evident that these developments were not sustainable. The …xed exchange rate in combination with high wage and price in‡ation had eroded competitiveness. External factors became less favorable whe ...

... ratio was low and falling, and monetary policy was constrained by a …xed exchange rate. In 1990, it was evident that these developments were not sustainable. The …xed exchange rate in combination with high wage and price in‡ation had eroded competitiveness. External factors became less favorable whe ...

Document

... (MBS).3 As I will discuss later, the Federal Reserve also has provided support directly to specific institutions in cases when a disorderly failure would have threatened the financial system. Liquidity Programs for Financial Firms The first of these categories of assets--short-term liquidity provide ...

... (MBS).3 As I will discuss later, the Federal Reserve also has provided support directly to specific institutions in cases when a disorderly failure would have threatened the financial system. Liquidity Programs for Financial Firms The first of these categories of assets--short-term liquidity provide ...

Global Asset Allocation Views - JP Morgan Asset Management

... decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. In addition, users should make an independent assessment of the legal, regulatory, tax, credit, and accounting implications and determine, together with their own professional advise ...

... decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. In addition, users should make an independent assessment of the legal, regulatory, tax, credit, and accounting implications and determine, together with their own professional advise ...

Issue in Financial Stability—Activity and Financing in the Vehicle

... company). The leasing companies provide vehicle fleets to the business sector, private leasing services, and rental services in Israel and abroad, and sell vehicles at the end of their use period in the rental and leasing fleets. In recent years, the companies have been expanding the field of transa ...

... company). The leasing companies provide vehicle fleets to the business sector, private leasing services, and rental services in Israel and abroad, and sell vehicles at the end of their use period in the rental and leasing fleets. In recent years, the companies have been expanding the field of transa ...

Case for Gold Part 2

... restarting the wheels of lending and commerce. Finally, let’s toss in an end to the decline of asset prices and the commencement of a bull market in equities. The unequivocal precondition for these felicitous events would be the transformation of the dollar and other paper currencies as we know them ...

... restarting the wheels of lending and commerce. Finally, let’s toss in an end to the decline of asset prices and the commencement of a bull market in equities. The unequivocal precondition for these felicitous events would be the transformation of the dollar and other paper currencies as we know them ...

Sample Final

... the amount of borrowing needed for the next year the breakeven price needed to cover all costs of corn production labor needed on the farm during the next year the change in profit from installing an irrigation system on one field ...

... the amount of borrowing needed for the next year the breakeven price needed to cover all costs of corn production labor needed on the farm during the next year the change in profit from installing an irrigation system on one field ...