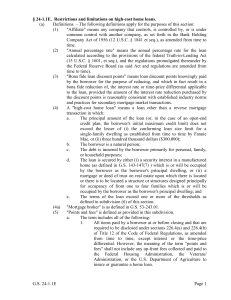

G.S. 24-1.1E - North Carolina General Assembly

... No lending without due regard to repayment ability. – As used in this subsection, the term "obligor" refers to each borrower, co-borrower, cosigner, or guarantor obligated to repay a loan. A lender may not make a high-cost home loan unless the lender reasonably believes at the time the loan is consu ...

... No lending without due regard to repayment ability. – As used in this subsection, the term "obligor" refers to each borrower, co-borrower, cosigner, or guarantor obligated to repay a loan. A lender may not make a high-cost home loan unless the lender reasonably believes at the time the loan is consu ...

Belarus in recession, banking sector in difficulties

... smaller entities on account of the erosion of their capital bases. These withdrawals, as well as repeated and systematic bank recapitalization measures – coming to an estimated average amount of 2% of GDP annually and mostly carried out by the state (IMF, 2013; p. 35) –, are responsible for the fact ...

... smaller entities on account of the erosion of their capital bases. These withdrawals, as well as repeated and systematic bank recapitalization measures – coming to an estimated average amount of 2% of GDP annually and mostly carried out by the state (IMF, 2013; p. 35) –, are responsible for the fact ...

Chapter 2

... purchased a van, which is expected to use in 10 years (no residual value after 10 years), at a price of $80,000 for his business transportation, On the same day, he paid $20,000 for it comprehensive insurance for one year. On September 1, he employed a shop assistant with agreed monthly salaries of ...

... purchased a van, which is expected to use in 10 years (no residual value after 10 years), at a price of $80,000 for his business transportation, On the same day, he paid $20,000 for it comprehensive insurance for one year. On September 1, he employed a shop assistant with agreed monthly salaries of ...

0 Loan insured by CMHC

... Internal refinancing Consequently, the Bank will be able to proceed with the reimbursement of its mortgage debt with the refinancing funds. Any leftover, if applicable, will be used to pay certain debts agreed to with the Borrower, or the Bank will remit the extra funds to the Borrower directly on ( ...

... Internal refinancing Consequently, the Bank will be able to proceed with the reimbursement of its mortgage debt with the refinancing funds. Any leftover, if applicable, will be used to pay certain debts agreed to with the Borrower, or the Bank will remit the extra funds to the Borrower directly on ( ...

Savings Accounts

... to leave a certain amount of money on deposit for an agreed about period of time. Money Market Accounts offer you a higher interest and liquidity in exchange for maintaining a high minimum balance. ...

... to leave a certain amount of money on deposit for an agreed about period of time. Money Market Accounts offer you a higher interest and liquidity in exchange for maintaining a high minimum balance. ...

Bonds, Interest Rates, and the Impact of Inflation

... because they want a steady stream of income are surprised to learn that bond prices can fluctuate, just as they do with any security traded in the secondary market. If you sell a bond before its maturity date, you may get more than its face value; you could also receive less if you must sell when bo ...

... because they want a steady stream of income are surprised to learn that bond prices can fluctuate, just as they do with any security traded in the secondary market. If you sell a bond before its maturity date, you may get more than its face value; you could also receive less if you must sell when bo ...

GMAC Demand Notes – What`s the Risk

... protection at some point in the distant future to reduce pension and healthcare burdens, we simply don’t believe it will happen anytime soon. Second, the assumption is that if GM were to file bankruptcy, they will immediately start dipping into GMAC Demand Note accounts to pay off creditors. The rea ...

... protection at some point in the distant future to reduce pension and healthcare burdens, we simply don’t believe it will happen anytime soon. Second, the assumption is that if GM were to file bankruptcy, they will immediately start dipping into GMAC Demand Note accounts to pay off creditors. The rea ...

Introduction to High-Yield Bond Covenants

... Early redemption features can have a material impact on the total return of a bond, depending on a bond’s call features. High-yield bonds typically have a non-call period during which a company’s option to retire the issue is limited but not impossible. For example, most bonds contain a “make whole” ...

... Early redemption features can have a material impact on the total return of a bond, depending on a bond’s call features. High-yield bonds typically have a non-call period during which a company’s option to retire the issue is limited but not impossible. For example, most bonds contain a “make whole” ...

Recession Rebound Reaches Six-Year

... burdens by refinancing copious amounts of bonds and mortgages at lower rates. The resulting balance sheet improvement, reinforced by appreciating asset values, has partially compensated for weak income gains and, hence, supported stronger consumer spending than would otherwise be the case. But seven ...

... burdens by refinancing copious amounts of bonds and mortgages at lower rates. The resulting balance sheet improvement, reinforced by appreciating asset values, has partially compensated for weak income gains and, hence, supported stronger consumer spending than would otherwise be the case. But seven ...

R e c e n t d e... f i n a n c i a l ...

... system in, an economy as small, open, and heavily dependent on foreign capital as New Zealand’s. The increasing integration of global markets has led to an increase in the co-movement of both interest rates and equity prices across different countries. This directly affects the cost of capital for t ...

... system in, an economy as small, open, and heavily dependent on foreign capital as New Zealand’s. The increasing integration of global markets has led to an increase in the co-movement of both interest rates and equity prices across different countries. This directly affects the cost of capital for t ...

Financing US Debt: Is There Enough Money in the World and at

... Kitchen (2007) found that the US international debt position was more sustainable than commonly believed. The deterioration in public finances associated with the financial crisis and ensuing recession calls for a re-assessment. ...

... Kitchen (2007) found that the US international debt position was more sustainable than commonly believed. The deterioration in public finances associated with the financial crisis and ensuing recession calls for a re-assessment. ...

Slides

... for the operations of the business. Often, it is estimated that cash equal to about 2% of revenues is sufficient for business purposes – the rest is excess cash. Revenue for the years ending 12/02 and 12/01 were $25112m. And $26935m. respectively. Then, 2% of this amount or $502.24 and $538.7 are re ...

... for the operations of the business. Often, it is estimated that cash equal to about 2% of revenues is sufficient for business purposes – the rest is excess cash. Revenue for the years ending 12/02 and 12/01 were $25112m. And $26935m. respectively. Then, 2% of this amount or $502.24 and $538.7 are re ...

The value of tax shields IS equal to the present value

... (1980) assumption requires continuous debt rebalancing, while my assumption does not. It is not clear what this means. Given that Fernandez is analyzing a firm whose expected value grows, debt has to be rebalanced over time because debt levels have to grow, too. Assume that what Fernandez means is t ...

... (1980) assumption requires continuous debt rebalancing, while my assumption does not. It is not clear what this means. Given that Fernandez is analyzing a firm whose expected value grows, debt has to be rebalanced over time because debt levels have to grow, too. Assume that what Fernandez means is t ...

Banking Relationships and REIT Capital Structure - DataPro

... dramatic wave of industry growth requiring active property acquisitions, development and disposition strategies. Thus, from a lender perspective, less secured debt implies more potential risk. From a REIT perspective, higher leverage may not always be the optimal financing strategy given that there ...

... dramatic wave of industry growth requiring active property acquisitions, development and disposition strategies. Thus, from a lender perspective, less secured debt implies more potential risk. From a REIT perspective, higher leverage may not always be the optimal financing strategy given that there ...

Valuing Accounts Receivable

... Valuing receivables involves reporting them at their net realizable value. Net realizable value is the amount expected to be received in cash. Credit losses are considered a normal and necessary risk of doing business on a credit basis. Credit losses are debited to Bad Debts Expense. The key i ...

... Valuing receivables involves reporting them at their net realizable value. Net realizable value is the amount expected to be received in cash. Credit losses are considered a normal and necessary risk of doing business on a credit basis. Credit losses are debited to Bad Debts Expense. The key i ...

Titan Europe 2007-2 Limited Quarterly Surveillance Report for the

... have not necessarily been prepared by the Servicer. Deal Summary, CMSA and Asset Surveillance reports will not generally be issued as RIS Notices. This document is provided for information purposes to holders of the relevant notes from time to time and prospective investors who may lawfully receive, ...

... have not necessarily been prepared by the Servicer. Deal Summary, CMSA and Asset Surveillance reports will not generally be issued as RIS Notices. This document is provided for information purposes to holders of the relevant notes from time to time and prospective investors who may lawfully receive, ...

Market Segmentation Theory

... Bond Options and Yields A put option permits the investor (lender) to terminate the bond at a designated price before maturity Investors are likely to “put” their bond back to the issuer during periods of increasing interest rates. The difference in interest rates between putable and nonputable bon ...

... Bond Options and Yields A put option permits the investor (lender) to terminate the bond at a designated price before maturity Investors are likely to “put” their bond back to the issuer during periods of increasing interest rates. The difference in interest rates between putable and nonputable bon ...

Can a Victor Force the Vanquished to Pay? France Under the Nazi

... (Herbert, 1997). Under the terms of the agreement, France ceded territory to the Reich, occupied Belgium and Italy. The remainder was divided into the Occupied Zone, under direct German control, and the Free Zone. Pétain moved the government to Vichy in the Free Zone where the constitution was suspe ...

... (Herbert, 1997). Under the terms of the agreement, France ceded territory to the Reich, occupied Belgium and Italy. The remainder was divided into the Occupied Zone, under direct German control, and the Free Zone. Pétain moved the government to Vichy in the Free Zone where the constitution was suspe ...