Characteristics of Different Types of Loans Commercial Loans

... floor, etc.) in the instrument to either lower its initial cost to the borrower or better help the borrower match the risk and return profile of an investment Flipper Repo ...

... floor, etc.) in the instrument to either lower its initial cost to the borrower or better help the borrower match the risk and return profile of an investment Flipper Repo ...

GambaTriantis2013HEC.. - University of Warwick

... sweep covenant is similar to secured debt. Morellec (2001) explores the joint effects of asset liquidity and pledging assets as collateral on the debt capacity of a firm. ...

... sweep covenant is similar to secured debt. Morellec (2001) explores the joint effects of asset liquidity and pledging assets as collateral on the debt capacity of a firm. ...

A Brief Postwar History of US Consumer Finance

... postwar period. Those include money market funds (first offered in 1971), index funds (1976), index-linked CDs (1987) exchange-traded funds (1993) and a host of corporate securities aimed at retail investors. 6 (See Table 1 for a postwar timeline of selected financial innovations.) The way consumers ...

... postwar period. Those include money market funds (first offered in 1971), index funds (1976), index-linked CDs (1987) exchange-traded funds (1993) and a host of corporate securities aimed at retail investors. 6 (See Table 1 for a postwar timeline of selected financial innovations.) The way consumers ...

ECON 2105H

... a) An increase in households’ saving rate increases the supply of loanable funds, ceteris paribus, leading to a surplus of funds. Because of the surplus, the real interest rate will fall to a lower equilibrium level and the share of income going to investment will increase. There are two factors aff ...

... a) An increase in households’ saving rate increases the supply of loanable funds, ceteris paribus, leading to a surplus of funds. Because of the surplus, the real interest rate will fall to a lower equilibrium level and the share of income going to investment will increase. There are two factors aff ...

New England could pay more than $800 million above market prices

... ($28MM from FERC filing pg. 501, line 19, adj. for project cost increase. $40MM uses ave. utility real estate tax rate of 2.85%, excluding State Education tax) ...

... ($28MM from FERC filing pg. 501, line 19, adj. for project cost increase. $40MM uses ave. utility real estate tax rate of 2.85%, excluding State Education tax) ...

Description of Financial Instruments and Principal

... variety of factors including tax status, credit quality, issuer type, maturity, callability, and secured/unsecured. A bond might be sold at above or below par (the amount paid out at maturity), but the market price will approach par value as the bond approaches maturity. A riskier bond has to provid ...

... variety of factors including tax status, credit quality, issuer type, maturity, callability, and secured/unsecured. A bond might be sold at above or below par (the amount paid out at maturity), but the market price will approach par value as the bond approaches maturity. A riskier bond has to provid ...

Investment Quarterly

... inevitably lead to financial losses and corporate defaults, as interest rates rise and economic growth slows. However, managing financial risks will be a major challenge for ...

... inevitably lead to financial losses and corporate defaults, as interest rates rise and economic growth slows. However, managing financial risks will be a major challenge for ...

accounting for long-term assets, long

... Aside from these differences in terms, the entries for using up PP&E, intangible assets, or natural resources are structurally the same. For example, to record depreciation expense, we increase the expense and increase accumulated depreciation. To record amortization expense, we increase the expense ...

... Aside from these differences in terms, the entries for using up PP&E, intangible assets, or natural resources are structurally the same. For example, to record depreciation expense, we increase the expense and increase accumulated depreciation. To record amortization expense, we increase the expense ...

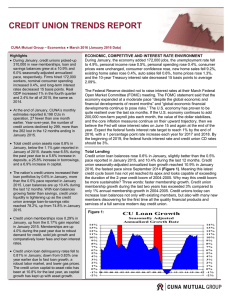

March

... Credit union loan balances rose 0.6% in January, slightly better than the 0.5% pace reported in January 2015, and 10.4% during the last 12 months. Credit union seasonally-adjusted annualized loan growth reached 10.9% in January 2016, the fastest pace since September 2014 (Figure 1). Meaning this lat ...

... Credit union loan balances rose 0.6% in January, slightly better than the 0.5% pace reported in January 2015, and 10.4% during the last 12 months. Credit union seasonally-adjusted annualized loan growth reached 10.9% in January 2016, the fastest pace since September 2014 (Figure 1). Meaning this lat ...

Word 2002 Format

... arising from mandatory and voluntary non-exchange transactions with federal, state governments, organizations, or individuals that are restricted for use in a particular program. General revenues are revenues that are not required to be reported as program revenues such as property taxes levies for ...

... arising from mandatory and voluntary non-exchange transactions with federal, state governments, organizations, or individuals that are restricted for use in a particular program. General revenues are revenues that are not required to be reported as program revenues such as property taxes levies for ...

Credit Default Swaps and the synthetic CDO

... o The note issue will be of interest to investors who wish to hold credits but where opportunities are limited because of liquidity issues, or lack of market intelligence / expertise in analysis of high yield debt. o The class A, B and C notes pay from 55 bps to 275 bps over 3m euribor, (2008 expect ...

... o The note issue will be of interest to investors who wish to hold credits but where opportunities are limited because of liquidity issues, or lack of market intelligence / expertise in analysis of high yield debt. o The class A, B and C notes pay from 55 bps to 275 bps over 3m euribor, (2008 expect ...

Crisis mismanagement in the US and Europe: impact on developing

... Before the world economy could fully recover from the crisis that began more than five years ago, many observers fear that we may be poised for yet another crisis. This is largely because the underlying weaknesses that gave rise to the most serious post-war crisis, namely financial fragilities, inco ...

... Before the world economy could fully recover from the crisis that began more than five years ago, many observers fear that we may be poised for yet another crisis. This is largely because the underlying weaknesses that gave rise to the most serious post-war crisis, namely financial fragilities, inco ...

A Multi Objective and Multi Constraint Approach to the

... objectives for which some evidence is given that holds true at times. We basically propose that a firm ...

... objectives for which some evidence is given that holds true at times. We basically propose that a firm ...

Form 10-Q - Town Sports International Holdings, Inc.

... 2011 Senior Credit Facility On May 11, 2011, TSI, LLC entered into a $350,000 senior secured credit facility (“2011 Senior Credit Facility”). The 2011 Senior Credit Facility consisted of a $300,000 term loan facility (“2011 Term Loan Facility”) and a $50,000 revolving loan facility (“2011 Revolving ...

... 2011 Senior Credit Facility On May 11, 2011, TSI, LLC entered into a $350,000 senior secured credit facility (“2011 Senior Credit Facility”). The 2011 Senior Credit Facility consisted of a $300,000 term loan facility (“2011 Term Loan Facility”) and a $50,000 revolving loan facility (“2011 Revolving ...

MR0159 - Loan Value granted to Significant Security Positions Held

... What are the current regulatory requirements with respect to the margining of securities? IDA Regulation 100 sets out the various margin rates for securities. These rates are the minimum regulatory rates that are required to be used for Member firm and customer account positions and they are set bas ...

... What are the current regulatory requirements with respect to the margining of securities? IDA Regulation 100 sets out the various margin rates for securities. These rates are the minimum regulatory rates that are required to be used for Member firm and customer account positions and they are set bas ...

14ed Bonds

... YTM is rate of return earned on a bond held to maturity. Also called “promised yield.” It assumes bond will not default. Includes both interest pmt component & cap gains over bond’s life Interest rate equating bond’s price today to NPV of PMTs & FV. (Think market rate of interest) Vs. Annualized Ret ...

... YTM is rate of return earned on a bond held to maturity. Also called “promised yield.” It assumes bond will not default. Includes both interest pmt component & cap gains over bond’s life Interest rate equating bond’s price today to NPV of PMTs & FV. (Think market rate of interest) Vs. Annualized Ret ...

Econ 201 Intermediate Macroeconomics

... increases in the short run, but falls in the medium run. b. ...

... increases in the short run, but falls in the medium run. b. ...

25 Lease Analysis

... would buy the equipment from the manufacturer under the same terms that were offered to Environmental, including the maintenance and service contract. Like Environmental, OSC generally assumes that the most likely residual value for equipment of this type is the tax book value at the end of the leas ...

... would buy the equipment from the manufacturer under the same terms that were offered to Environmental, including the maintenance and service contract. Like Environmental, OSC generally assumes that the most likely residual value for equipment of this type is the tax book value at the end of the leas ...