Foundation Investment Policy

... re-direct contributions and disbursements from individual investment managers as appropriate, in addition to shifting assets from one investment manager to another. Large Cash Flows: Should the Endowment receive a large donation or large amount of proceeds from fundraising efforts that exceeds $25,0 ...

... re-direct contributions and disbursements from individual investment managers as appropriate, in addition to shifting assets from one investment manager to another. Large Cash Flows: Should the Endowment receive a large donation or large amount of proceeds from fundraising efforts that exceeds $25,0 ...

lloyds investment funds limited

... The assets of the Fund are generally invested in a managed portfolio of sterling fixed interest securities which have been issued by governments, local authorities, public utilities and corporations. If it appears advisable to hold assets having a short term maturity, then the Fund may also place mo ...

... The assets of the Fund are generally invested in a managed portfolio of sterling fixed interest securities which have been issued by governments, local authorities, public utilities and corporations. If it appears advisable to hold assets having a short term maturity, then the Fund may also place mo ...

2013 Audit - Hartsel Fire Protection District

... Our responsibility is to express opinions on these financial statements based on our audit. We conducted our audit in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about ...

... Our responsibility is to express opinions on these financial statements based on our audit. We conducted our audit in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about ...

Real Estate Investment Vehicles and Agency Theory

... domain is the agency theory, which deals with the analysis of legal contractual relationships when ownership and control is separated and market imperfections/information asymmetries are present (Cieleback, 2004; pp 5-7). Following Jensen/Meckling an agency relationship exists when “one or more pers ...

... domain is the agency theory, which deals with the analysis of legal contractual relationships when ownership and control is separated and market imperfections/information asymmetries are present (Cieleback, 2004; pp 5-7). Following Jensen/Meckling an agency relationship exists when “one or more pers ...

Why Does the Law of One Price Fail?

... mutual funds charge fees, showed how to calculate the impact of loads and expense ratios on portfolio value, and listed the expense ratio, load, and dollar cost of the expense ratio and load for a one-year $10,000 investment in each of the four funds participants could select. All of the fee sheet i ...

... mutual funds charge fees, showed how to calculate the impact of loads and expense ratios on portfolio value, and listed the expense ratio, load, and dollar cost of the expense ratio and load for a one-year $10,000 investment in each of the four funds participants could select. All of the fee sheet i ...

Private Equity`s Place in Defined Contribution Schemes

... are pooled. There are almost no pure DC assets where members make an investment choice and receive market returns on their funds. Therefore, Switzerland is excluded from this analysis. ...

... are pooled. There are almost no pure DC assets where members make an investment choice and receive market returns on their funds. Therefore, Switzerland is excluded from this analysis. ...

New Investment Guidance from TPR means Responsible

... London, 30th March 2017 – The Pensions Regulator (TPR) today outlined new guidance for trustees of definedbenefit (DB) schemes saying they “need” to pay attention to Environmental, Social and Governance (ESG) factors where they are financially significant. This represents an important step forward f ...

... London, 30th March 2017 – The Pensions Regulator (TPR) today outlined new guidance for trustees of definedbenefit (DB) schemes saying they “need” to pay attention to Environmental, Social and Governance (ESG) factors where they are financially significant. This represents an important step forward f ...

Dynamic Factor Timing and the Predictability of Actively Managed

... To examine how mutual funds generate alpha, we run the attribution model on holdings and return data for all of the mutual funds in our sample, and define factor groupings along size, style, and industry dimensions. We find that, between 1993 and 2012, and for funds with at least 36 months of return ...

... To examine how mutual funds generate alpha, we run the attribution model on holdings and return data for all of the mutual funds in our sample, and define factor groupings along size, style, and industry dimensions. We find that, between 1993 and 2012, and for funds with at least 36 months of return ...

SAI - Cortina Asset Management

... Value Fund (the “Small Cap Value Fund”) are each a series of Cortina Funds, Inc. (“Cortina”), an openend, management investment company, commonly called a mutual fund, that was incorporated under Wisconsin law on April 27, 2004 and is registered with the Securities and Exchange Commission (the “SEC” ...

... Value Fund (the “Small Cap Value Fund”) are each a series of Cortina Funds, Inc. (“Cortina”), an openend, management investment company, commonly called a mutual fund, that was incorporated under Wisconsin law on April 27, 2004 and is registered with the Securities and Exchange Commission (the “SEC” ...

Changing the Corporate Elite? Not So Easy. Female Directors

... Report, 2003; Swedish Code of Corporate Governance, 2004). Women are expected to bring new talent and resources to firms, improve board work by providing critical perspectives, and enhance board independence (e.g. Adams & Ferreira, 2009; Hillman, Shropshire & Cannella, 2007; Nielsen & Huse, 2010). Y ...

... Report, 2003; Swedish Code of Corporate Governance, 2004). Women are expected to bring new talent and resources to firms, improve board work by providing critical perspectives, and enhance board independence (e.g. Adams & Ferreira, 2009; Hillman, Shropshire & Cannella, 2007; Nielsen & Huse, 2010). Y ...

The Long-Run Performance of German Stock Mutual Funds

... were extremely small throughout our observation period: HANSAsecur, HWG-Fonds, MAIN IUNIVERSAL-FONDS, Oppenheim Privat, and Privatfonds. Most funds pay dividends annually, a few retain dividends fully. Thesaurus (managed by DIT) is an important member of the latter group. In both groups shareholders ...

... were extremely small throughout our observation period: HANSAsecur, HWG-Fonds, MAIN IUNIVERSAL-FONDS, Oppenheim Privat, and Privatfonds. Most funds pay dividends annually, a few retain dividends fully. Thesaurus (managed by DIT) is an important member of the latter group. In both groups shareholders ...

malta 2016 - HFM Global

... requires skill, careful consideration and supportive collaborations. Therefore, considerable attention needs to be placed on the choice of jurisdiction, regulatory environment and the project team that is working on the process. Malta’s fund regulatory regime ensures the highest standards of probity ...

... requires skill, careful consideration and supportive collaborations. Therefore, considerable attention needs to be placed on the choice of jurisdiction, regulatory environment and the project team that is working on the process. Malta’s fund regulatory regime ensures the highest standards of probity ...

Q - How do we protect investors so that they are only

... Form has been submitted no changes are permitted to the relationships and nature of the proposal. Any changes (e.g. changes to Delivery Bodies), will result in automatic elimination from this competition.” Due to the innovative nature of this competition and the additional information on outcome pay ...

... Form has been submitted no changes are permitted to the relationships and nature of the proposal. Any changes (e.g. changes to Delivery Bodies), will result in automatic elimination from this competition.” Due to the innovative nature of this competition and the additional information on outcome pay ...

Brochure - The Brookdale Group

... and an MBA from Harvard Business School. Memberships and Civic Involvement Mr. Davidson is a current member and past Chairman of the Board of Directors of the National Association of Real Estate Investment Managers (NAREIM) and is active in several other industry organizations including the Urban La ...

... and an MBA from Harvard Business School. Memberships and Civic Involvement Mr. Davidson is a current member and past Chairman of the Board of Directors of the National Association of Real Estate Investment Managers (NAREIM) and is active in several other industry organizations including the Urban La ...

A Portfolio Built on Divident Growth - Presentation by Scott Malatesta

... All information as of 12/31/12. 1. Based on trailing one-year All Urban Consumer Price Index change of +1.7% as of 11/30/12. Reflects the Morningstar Taxable Money Market Funds Category, the Morningstar Short-Term Bond Fund Category and the Morningstar Intermediate Government Bond Funds Category ave ...

... All information as of 12/31/12. 1. Based on trailing one-year All Urban Consumer Price Index change of +1.7% as of 11/30/12. Reflects the Morningstar Taxable Money Market Funds Category, the Morningstar Short-Term Bond Fund Category and the Morningstar Intermediate Government Bond Funds Category ave ...

Mackenzie Canadian Large Cap Growth Fund

... Management’s Responsibility for Financial Reporting The accompanying financial statements have been prepared by Mackenzie Financial Corporation, as Manager of Mackenzie Canadian Large Cap Growth Fund (the “Fund”). The Manager is responsible for the integrity, objectivity and reliability of the data ...

... Management’s Responsibility for Financial Reporting The accompanying financial statements have been prepared by Mackenzie Financial Corporation, as Manager of Mackenzie Canadian Large Cap Growth Fund (the “Fund”). The Manager is responsible for the integrity, objectivity and reliability of the data ...

Working in partnership with financial intermediaries

... planning qualifications. Prior to joining Kleinwort Benson, Leigh worked for Ely Fund Managers (now part of Rathbones) and Killik & Co, the advisory stockbrokers. Leigh has been selected as one of Private Asset Managers’ top 40 under 40 - 2013. In 2012, he was recognised as one of London’s leading l ...

... planning qualifications. Prior to joining Kleinwort Benson, Leigh worked for Ely Fund Managers (now part of Rathbones) and Killik & Co, the advisory stockbrokers. Leigh has been selected as one of Private Asset Managers’ top 40 under 40 - 2013. In 2012, he was recognised as one of London’s leading l ...

NABARD

... discounting of bills of exchange and seed/special capital, etc. SFCs have been set up with the objective of catalysing higher investment, generating greater employment and widening the ownership base of industries. They have also started providing assistance to newer types of business activities lik ...

... discounting of bills of exchange and seed/special capital, etc. SFCs have been set up with the objective of catalysing higher investment, generating greater employment and widening the ownership base of industries. They have also started providing assistance to newer types of business activities lik ...

Lincoln Financial Securities Corporation (LFS) Brokerage

... (GNMA), Treasury, Government Agencies & other Government Bonds ...

... (GNMA), Treasury, Government Agencies & other Government Bonds ...

MWRA Side Letter

... Employees’ Retirement System can be invested in any bank or financial institution which directly or through any subsidiary has outstanding loans to any individual corporation engaged in the manufacture, distribution or sale of firearms, munitions, including rubber or plastic bullets, tear gas, armor ...

... Employees’ Retirement System can be invested in any bank or financial institution which directly or through any subsidiary has outstanding loans to any individual corporation engaged in the manufacture, distribution or sale of firearms, munitions, including rubber or plastic bullets, tear gas, armor ...

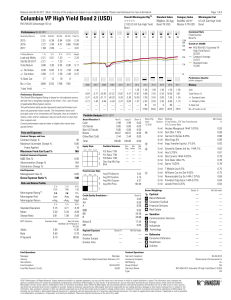

Columbia VP High Yield Bond 2 (USD)

... The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate; thus an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or ...

... The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate; thus an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or ...

Pathways PDS - North Online

... 234655), referred to in this PDS as 'ipac' or 'the Responsible Entity', is the Responsible Entity of the Funds and issuer of this Product Disclosure Statement (PDS). ipac portfolio management limited (ABN 51 071 315 618, AFSL 234658), referred to in this PDS as 'the Portfolio Manager', has been appo ...

... 234655), referred to in this PDS as 'ipac' or 'the Responsible Entity', is the Responsible Entity of the Funds and issuer of this Product Disclosure Statement (PDS). ipac portfolio management limited (ABN 51 071 315 618, AFSL 234658), referred to in this PDS as 'the Portfolio Manager', has been appo ...

Capital Formation Agenda - Small Business Investor Alliance

... is expensive and, in most cases, the investment adviser rules are not designed for private equity funds. For example, the initial cost to register with the SEC is often in excess of $100,000. Annual costs to comply with SEC Investment Adviser rules are often $250,000 or more per year. Additionally, ...

... is expensive and, in most cases, the investment adviser rules are not designed for private equity funds. For example, the initial cost to register with the SEC is often in excess of $100,000. Annual costs to comply with SEC Investment Adviser rules are often $250,000 or more per year. Additionally, ...

prospectus

... to invest at least 80% of the Fund’s assets in the common stocks of companies composing the Nasdaq-100 Index. This strategy may be changed upon 60 days’ written notice to shareholders. In seeking to track the performance of the Nasdaq-100 Index, the Fund’s subadviser, Northern Trust Investments, Inc ...

... to invest at least 80% of the Fund’s assets in the common stocks of companies composing the Nasdaq-100 Index. This strategy may be changed upon 60 days’ written notice to shareholders. In seeking to track the performance of the Nasdaq-100 Index, the Fund’s subadviser, Northern Trust Investments, Inc ...

Challenges arising from alternative investment management

... Alternative investment management differs from traditional asset management in a number of respects. First, it is distinct in terms of both its targets – aiming to achieve an absolute performance, regardless of trends in underlying markets – and its strategies, in particular exploiting inefficiencie ...

... Alternative investment management differs from traditional asset management in a number of respects. First, it is distinct in terms of both its targets – aiming to achieve an absolute performance, regardless of trends in underlying markets – and its strategies, in particular exploiting inefficiencie ...