guide to absolute return investing

... Issued by BlackRock Investment Management (Australia) Limited ABN 13 006165975, AFS Licence 230523. BlackRock, its officers and employees believe that the information in this document is correct at the time of compilation, but no warranty of accuracy or reliability is given and no responsibility ari ...

... Issued by BlackRock Investment Management (Australia) Limited ABN 13 006165975, AFS Licence 230523. BlackRock, its officers and employees believe that the information in this document is correct at the time of compilation, but no warranty of accuracy or reliability is given and no responsibility ari ...

Investment Strategy Module - Introduction and Objectives

... The focus of the Investment Strategy module is to provide you with an understanding of the investment theories to implement the investment process. Throughout this module, you will be exposed to case studies from real experiences that illustrate the range of considerations in managing investment por ...

... The focus of the Investment Strategy module is to provide you with an understanding of the investment theories to implement the investment process. Throughout this module, you will be exposed to case studies from real experiences that illustrate the range of considerations in managing investment por ...

e - Homework Minutes

... Therefore, better governance would mean that an investor’s fund would be better used to give excess returns to shareholders. The returns may be in the form of dividends and/or increased market value. In either way, it means that governance achieves this excess by operating performance. Those firms w ...

... Therefore, better governance would mean that an investor’s fund would be better used to give excess returns to shareholders. The returns may be in the form of dividends and/or increased market value. In either way, it means that governance achieves this excess by operating performance. Those firms w ...

Agarwal Daniel Naik

... Flows, Performance, and Managerial Incentives in the Hedge Fund Industry In recent years, the hedge fund industry has emerged as an alternative investment vehicle to the traditional mutual fund industry. It differs from the mutual fund industry in two important ways. First, hedge funds are much les ...

... Flows, Performance, and Managerial Incentives in the Hedge Fund Industry In recent years, the hedge fund industry has emerged as an alternative investment vehicle to the traditional mutual fund industry. It differs from the mutual fund industry in two important ways. First, hedge funds are much les ...

Mutual Fund Performance and the Incentive to Generate Alpha

... folio management services, or a packaged bundle of portfolio management and investment advice. Not surprisingly, the two types of funds are targeted at different types of investors. According to an Investment Company Institute (ICI) survey, 51% of mutual fund shareholders indicate that they have an ...

... folio management services, or a packaged bundle of portfolio management and investment advice. Not surprisingly, the two types of funds are targeted at different types of investors. According to an Investment Company Institute (ICI) survey, 51% of mutual fund shareholders indicate that they have an ...

Notice Concerning Issuance of Investment Corporation Bonds

... 3,400 million yen Breakdown : The First Series Bonds : 1,800 million yen The Second Series Bonds : 1,600 million yen Subject to the provisions of the Act on Book-Entry of Company Bonds, Shares, etc., investment corporation bond certificates for the Investment Corporation Bonds will not be issued. 10 ...

... 3,400 million yen Breakdown : The First Series Bonds : 1,800 million yen The Second Series Bonds : 1,600 million yen Subject to the provisions of the Act on Book-Entry of Company Bonds, Shares, etc., investment corporation bond certificates for the Investment Corporation Bonds will not be issued. 10 ...

TNI BLUE CHIP UAE FUND - The National Investor

... Units of the Fund may increase in value as well as decrease. Moreover, past performance of the Fund Manager is not a guarantee of its future performance. The Fund Manager therefore cannot and does not guarantee the performance of the Fund. Prospective investors should carefully note the consideratio ...

... Units of the Fund may increase in value as well as decrease. Moreover, past performance of the Fund Manager is not a guarantee of its future performance. The Fund Manager therefore cannot and does not guarantee the performance of the Fund. Prospective investors should carefully note the consideratio ...

Two Essays on Managerial Behaviors in the Mutual Fund Industry

... to tell if this manager has engaged in window-dressing or he has stock selection skill as long as the disclosed winners do not depreciate much. Fund investors are likely to believe that this manager has stock selection skill because it is natural for investors to attribute improved fund performance ...

... to tell if this manager has engaged in window-dressing or he has stock selection skill as long as the disclosed winners do not depreciate much. Fund investors are likely to believe that this manager has stock selection skill because it is natural for investors to attribute improved fund performance ...

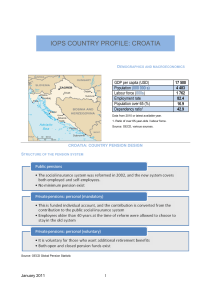

IOPS COUNTRY PROFILE: CROATIA

... There are therefore both open and closed funds. The state provides an annual subsidy of up to HRK 1,250 and allows a deduction of up to HRK 1,050 per month from personal taxable income. This means that there is a double benefit – state subsidy and tax deduction – for these contributions. Contributio ...

... There are therefore both open and closed funds. The state provides an annual subsidy of up to HRK 1,250 and allows a deduction of up to HRK 1,050 per month from personal taxable income. This means that there is a double benefit – state subsidy and tax deduction – for these contributions. Contributio ...

california Tax-Free Funds

... With the Federal Reserve expected to continue its measured approach to interest rate hikes, yields on U.S. Treasuries and other fixed income securities are slowly increasing from the low levels of the recent past. We expect the Fed to pause after each increase in the federal funds rate and to carefu ...

... With the Federal Reserve expected to continue its measured approach to interest rate hikes, yields on U.S. Treasuries and other fixed income securities are slowly increasing from the low levels of the recent past. We expect the Fed to pause after each increase in the federal funds rate and to carefu ...

Conference Program

... including their strategy, research and portfolio management structure and discuss their investment process and approach to portfolio construction. He will also discuss trends effecting their SUCCEED client base including search activity and their important and growing OCIO/Delegated Investment busin ...

... including their strategy, research and portfolio management structure and discuss their investment process and approach to portfolio construction. He will also discuss trends effecting their SUCCEED client base including search activity and their important and growing OCIO/Delegated Investment busin ...

Our Beliefs About Investing

... Diversification is analogous simply to the age-old adage, “Don’t put all your eggs in one basket.” Naïve investors often practice diversification by selecting more than one financial advisor, and naïve financial advisors often practice diversification through product proliferation. At its core, dive ...

... Diversification is analogous simply to the age-old adage, “Don’t put all your eggs in one basket.” Naïve investors often practice diversification by selecting more than one financial advisor, and naïve financial advisors often practice diversification through product proliferation. At its core, dive ...

The Asset Allocation Debate: Provocative Questions

... explained most of the portfolio’s total return and volatility over time. Active investment decisions— security selection and/or market-timing—played minor roles. These findings were subsequently confirmed by Vanguard and other researchers (Ibbotson and Kaplan, 2000). Investment advisors have general ...

... explained most of the portfolio’s total return and volatility over time. Active investment decisions— security selection and/or market-timing—played minor roles. These findings were subsequently confirmed by Vanguard and other researchers (Ibbotson and Kaplan, 2000). Investment advisors have general ...

Exercises - lasse h. pedersen

... Selection vs. Timing. Explain the meanings of market timing and security selection, highlighting their similarities and differences. ...

... Selection vs. Timing. Explain the meanings of market timing and security selection, highlighting their similarities and differences. ...

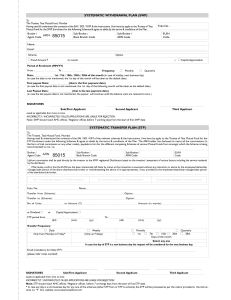

STP Form - Shreem Wealth Creators

... c. Capital appreciation: The capital appreciation as on the dates mentioned below will be transferred to any other scheme of Tata MF, subject to the terms of the scheme. For investors availing of the transfer of capital appreciation, where in any week, month or quarter, there is no appreciation or t ...

... c. Capital appreciation: The capital appreciation as on the dates mentioned below will be transferred to any other scheme of Tata MF, subject to the terms of the scheme. For investors availing of the transfer of capital appreciation, where in any week, month or quarter, there is no appreciation or t ...

The Future Of Collective Investment Schemes In

... The potential in the Kenyan capital market is far from being fully utilised. There is a lot of uninvested capital that could be tapped into the capital market either by long-term investors or speculators. The industry has a collective responsibility of taking the capital market to the people or by w ...

... The potential in the Kenyan capital market is far from being fully utilised. There is a lot of uninvested capital that could be tapped into the capital market either by long-term investors or speculators. The industry has a collective responsibility of taking the capital market to the people or by w ...

cm advisors small cap value fund cm advisors fixed income fund

... The Advisors Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when shares of the Advisors Fund are held in a taxable account. Thes ...

... The Advisors Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when shares of the Advisors Fund are held in a taxable account. Thes ...

corporate board gender diversity and stock performance

... are attentive to the demands of institutional investors for greater board diversity. Second, we expect that, paradoxically, investor decision making is influenced by gender bias and that the typical investor will reduce holdings in firms that appoint female directors. Third, we suggest that accounta ...

... are attentive to the demands of institutional investors for greater board diversity. Second, we expect that, paradoxically, investor decision making is influenced by gender bias and that the typical investor will reduce holdings in firms that appoint female directors. Third, we suggest that accounta ...

CASH AMERICA INTERNATIONAL INC

... We have audited the accompanying statements of net assets available for benefits of the Cash America International, Inc. 401(k) Savings Plan (the “Plan”) as of December 31, 2014 and 2013 and the related statements of changes in net assets available for benefits for each of the years in the two-year ...

... We have audited the accompanying statements of net assets available for benefits of the Cash America International, Inc. 401(k) Savings Plan (the “Plan”) as of December 31, 2014 and 2013 and the related statements of changes in net assets available for benefits for each of the years in the two-year ...

Payoff complementarities and financial fragility Evidence from

... strategic complementarities—the expectation that other investors will withdraw their money reduces the expected return from staying in the fund and increases the incentive for each individual investor to withdraw as well—and amplifies the damage to the fund. Detecting this mechanism in the data is a ...

... strategic complementarities—the expectation that other investors will withdraw their money reduces the expected return from staying in the fund and increases the incentive for each individual investor to withdraw as well—and amplifies the damage to the fund. Detecting this mechanism in the data is a ...

Griffin Institutional Access Real Estate Fund (Form: N

... Standard deviation measures the average deviations of a return series from its mean, and is often used as a measure of volatility/risk. A large standard deviation implies that there have been large swings in the return series of the manager. ...

... Standard deviation measures the average deviations of a return series from its mean, and is often used as a measure of volatility/risk. A large standard deviation implies that there have been large swings in the return series of the manager. ...

Informed Trading, Liquidity Provision, and Stock Selection by Mutual

... Fund Advisors (DFA) and (b) a group of index funds, are consistent with what one would expect based on the …ndings reported in the literature.6 Third, as expected, we …nd that the informed trading component is more important than the liquidity provision component in explaining crosssectional variati ...

... Fund Advisors (DFA) and (b) a group of index funds, are consistent with what one would expect based on the …ndings reported in the literature.6 Third, as expected, we …nd that the informed trading component is more important than the liquidity provision component in explaining crosssectional variati ...

Communicating Error-Free Investment Results

... an adviser adhered to industry custom or practice to avoid liability for breach of its duty of care. Rather, it is just one factor to be considered.” 2 To put it bluntly: In today’s aggressive regulatory climate, “that’s how everyone does it” is not enough to exonerate an investment manager who acci ...

... an adviser adhered to industry custom or practice to avoid liability for breach of its duty of care. Rather, it is just one factor to be considered.” 2 To put it bluntly: In today’s aggressive regulatory climate, “that’s how everyone does it” is not enough to exonerate an investment manager who acci ...

2014-15 Audit Report - Pharr-San Juan

... We have audited the accompanying financial statements of the governmental activities, the business-type activities, each major fund, and the aggregate remaining fund information of the Pharr-San Juan-Alamo Independent School District ("the District") as of and for the year ended August 31, 2015, and ...

... We have audited the accompanying financial statements of the governmental activities, the business-type activities, each major fund, and the aggregate remaining fund information of the Pharr-San Juan-Alamo Independent School District ("the District") as of and for the year ended August 31, 2015, and ...