Simplicity Is the Ultimate Sophistication

... Source: Morningstar, 4/17. Start date of 7/31/06 is the Hartford Balanced Income Fund’s inception date. Risk is measured by standard deviation. Standard deviation is a measure of how returns over time have varied from the mean; a lower number signifies lower volatility. Stocks are represented by the ...

... Source: Morningstar, 4/17. Start date of 7/31/06 is the Hartford Balanced Income Fund’s inception date. Risk is measured by standard deviation. Standard deviation is a measure of how returns over time have varied from the mean; a lower number signifies lower volatility. Stocks are represented by the ...

YOUR INVESTMENT WITH CORONATION

... Coronation is not licensed to provide financial advice, and while we think it’s relatively simple to navigate around our fund range, we do believe that most investors would benefit from good financial advice. Case studies show that investors who receive professional advice are more likely to have ap ...

... Coronation is not licensed to provide financial advice, and while we think it’s relatively simple to navigate around our fund range, we do believe that most investors would benefit from good financial advice. Case studies show that investors who receive professional advice are more likely to have ap ...

Corporate Law Bulletin 78 - February 2004

... through a better-priced bid or offer on another market centre if the person entering the order makes an informed decision to affirmatively opt out of the trade-through protections. Informed consent would need to be given on an order-by-order basis. This exception is designed to provide greater flexi ...

... through a better-priced bid or offer on another market centre if the person entering the order makes an informed decision to affirmatively opt out of the trade-through protections. Informed consent would need to be given on an order-by-order basis. This exception is designed to provide greater flexi ...

John Hancock High Yield Municipal Bond Fund

... manager uses detailed analysis of an appropriate index to model portfolio performance and composition, then blends the macro assessment with security analysis in a comprehensive and disciplined fashion. The fund does not intend to use frequent trading as part of its strategy. In general, the manager ...

... manager uses detailed analysis of an appropriate index to model portfolio performance and composition, then blends the macro assessment with security analysis in a comprehensive and disciplined fashion. The fund does not intend to use frequent trading as part of its strategy. In general, the manager ...

The new revenue recognition standard - asset management

... and open-ended investment companies), which invest in a variety of different products. While the legal forms of the arrangements vary, these vehicles generally provide for investor capital to be pooled and invested to earn a return. Funds typically pay base management fees and performance-based fees ...

... and open-ended investment companies), which invest in a variety of different products. While the legal forms of the arrangements vary, these vehicles generally provide for investor capital to be pooled and invested to earn a return. Funds typically pay base management fees and performance-based fees ...

4212201 WFA Hedge Fund Guide

... Following are some of the most significant risks associated with investing in hedge funds and funds of hedge funds. The list is not exhaustive. Particular hedge funds may involve other risks that will be disclosed in the official offering documents or in any supplement to those documents for the ind ...

... Following are some of the most significant risks associated with investing in hedge funds and funds of hedge funds. The list is not exhaustive. Particular hedge funds may involve other risks that will be disclosed in the official offering documents or in any supplement to those documents for the ind ...

hussman strategic dividend value fund

... U.S., an investment in the Fund involves greater risks than an investment in a mutual fund that does not invest in such companies. Risks can result from varying stages of economic and political development, differing regulatory environments, trading days and accounting standards, uncertain tax laws, ...

... U.S., an investment in the Fund involves greater risks than an investment in a mutual fund that does not invest in such companies. Risks can result from varying stages of economic and political development, differing regulatory environments, trading days and accounting standards, uncertain tax laws, ...

High-performing credit specialist pVe keeps a wary eye on

... Matrix to get up and running, PVE went solo as fully-fledged independent firm in 2010. Since then assets have grown from around $50 million to $300 million – with the lion’s share of the firm’s current AUM (more than $200 million) being run in a managed account portfolio called PVE Special Credit Si ...

... Matrix to get up and running, PVE went solo as fully-fledged independent firm in 2010. Since then assets have grown from around $50 million to $300 million – with the lion’s share of the firm’s current AUM (more than $200 million) being run in a managed account portfolio called PVE Special Credit Si ...

Can mutual funds successfully adopt factor investing strategies?

... supporting the existence of the long-term reversal anomaly is substantially weaker than the evidence supporting the low-risk, small cap, and value anomalies. Based on our results, we argue that it is less likely that new academic knowledge can successfully be adopted in the investment management ind ...

... supporting the existence of the long-term reversal anomaly is substantially weaker than the evidence supporting the low-risk, small cap, and value anomalies. Based on our results, we argue that it is less likely that new academic knowledge can successfully be adopted in the investment management ind ...

Market Discipline and Internal Governance in the Mutual Fund Industry

... implications: (1) The larger the fund size, the smaller the marginal return of taking idiosyncratic risk. This should be the case due to the larger price impact associated with larger fund size. (2) the more idiosyncratic risk a fund takes, the larger the diseconomy of scale it has to face. A fund w ...

... implications: (1) The larger the fund size, the smaller the marginal return of taking idiosyncratic risk. This should be the case due to the larger price impact associated with larger fund size. (2) the more idiosyncratic risk a fund takes, the larger the diseconomy of scale it has to face. A fund w ...

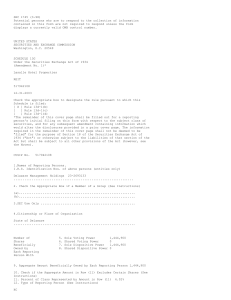

0000921739-04-000026 - Lasalle Hotel Properties

... Ownership of More than Five Percent on Behalf of Another Person. If any other person is known to have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, such securities, a statement to that effect should be included in response to this item a ...

... Ownership of More than Five Percent on Behalf of Another Person. If any other person is known to have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, such securities, a statement to that effect should be included in response to this item a ...

Tab 1.1 - University of Maine System

... Douglas S. Swanson, managing director, is the team leader and head portfolio manager for the U.S. Value Driven team within our Global Fixed Income, Currency & Commodities (GFICC) group. Located in Columbus, Doug is responsible for establishing daily tactical decision-making for taxable bond money ma ...

... Douglas S. Swanson, managing director, is the team leader and head portfolio manager for the U.S. Value Driven team within our Global Fixed Income, Currency & Commodities (GFICC) group. Located in Columbus, Doug is responsible for establishing daily tactical decision-making for taxable bond money ma ...

New York 2008

... My name is Glenn August and I am the President of Oak Hill Advisors. I've been at Oak Hill for almost 21 years. For the entire time, we've been focusing on the leveraged capital markets, including leveraged loans, high-yield debt, mezzanine debt, distressed debt and turn-around private equity. We go ...

... My name is Glenn August and I am the President of Oak Hill Advisors. I've been at Oak Hill for almost 21 years. For the entire time, we've been focusing on the leveraged capital markets, including leveraged loans, high-yield debt, mezzanine debt, distressed debt and turn-around private equity. We go ...

Financial Mechanism under the UNFCCC

... Has its own criteria and principles (such as the principle of global benefits) ...

... Has its own criteria and principles (such as the principle of global benefits) ...

Target Date Funds FRED REISH, ESQ.

... investment alternative (i.e., a specific product, portfolio or service) is a fiduciary act and, therefore, ERISA obligates fiduciaries to act prudently and solely in the interest of the plan’s participants and beneficiaries. A fiduciary must engage in an objective, thorough, and analytical process t ...

... investment alternative (i.e., a specific product, portfolio or service) is a fiduciary act and, therefore, ERISA obligates fiduciaries to act prudently and solely in the interest of the plan’s participants and beneficiaries. A fiduciary must engage in an objective, thorough, and analytical process t ...

One Hat Too Many? Investment Desegregation in Private Equity

... partner was legally obliged to focus entirely and without conflict on maximizing the value of these specific investments. But this narrow focus is quickly expanding and, as it does so, beginning to blur. Changes in the fortunes of the buyout market and, more generally, credit markets have prompted f ...

... partner was legally obliged to focus entirely and without conflict on maximizing the value of these specific investments. But this narrow focus is quickly expanding and, as it does so, beginning to blur. Changes in the fortunes of the buyout market and, more generally, credit markets have prompted f ...

Following the global credit crisis, share market downturn and high

... Are REITs (Listed Property Trusts) a suitable direct property exposure? A significant number of investors use Real Estate Investment Trusts (REITs) as the vehicle to obtain a direct property exposure. This is driven by the increased liquidity and reduced transaction costs associated with shares ( ...

... Are REITs (Listed Property Trusts) a suitable direct property exposure? A significant number of investors use Real Estate Investment Trusts (REITs) as the vehicle to obtain a direct property exposure. This is driven by the increased liquidity and reduced transaction costs associated with shares ( ...

Product Disclosure Statement

... registered under the U.S. Securities Act of 1933 or the securities laws of any of the states of the United States of America (U.S.). The Fund is not and will not be registered as an investment company under the U.S. Investment Company Act of 1940. Investment in units of the Fund by or on behalf of U ...

... registered under the U.S. Securities Act of 1933 or the securities laws of any of the states of the United States of America (U.S.). The Fund is not and will not be registered as an investment company under the U.S. Investment Company Act of 1940. Investment in units of the Fund by or on behalf of U ...

Webcast Presentation—Artisan Partners Global Equity Team

... These materials are presented in connection with an offer of the shares of a Fund in the series of Artisan Partners Funds, Inc. These materials are not an offer for any other mutual fund mentioned. A purchase of shares of an Artisan Partners Fund does not create an investment advisory relationship b ...

... These materials are presented in connection with an offer of the shares of a Fund in the series of Artisan Partners Funds, Inc. These materials are not an offer for any other mutual fund mentioned. A purchase of shares of an Artisan Partners Fund does not create an investment advisory relationship b ...

Setting the Discount Rate for Valuing Pension Liabilities

... guidance. Inquiries may be directed to: periscope@milliman.com. ...

... guidance. Inquiries may be directed to: periscope@milliman.com. ...

catalytic first-loss capital - Global Impact Investing Network

... Catalytic first-loss capital (CFLC) is best defined by three identifying features: It identifies the party, i.e., the Provider, that will bear first losses. The amount of loss covered is typically set and agreed upon upfront. It is catalytic. By improving the Recipient’s risk-return profile, C ...

... Catalytic first-loss capital (CFLC) is best defined by three identifying features: It identifies the party, i.e., the Provider, that will bear first losses. The amount of loss covered is typically set and agreed upon upfront. It is catalytic. By improving the Recipient’s risk-return profile, C ...

TIB Powerpoint - CP11/11

... > Some ‘clever stuff’ may be going on : removing market risk and pre-defining returns is challenging ...

... > Some ‘clever stuff’ may be going on : removing market risk and pre-defining returns is challenging ...

Mutual Fund Ratings: What is the Risk in Risk

... Investors are stuck at a crossroads. They could follow the direction preferred by many ¯nancial economists by investing in a diversi¯ed value-weighted portfolio (either through an index fund or exchange-traded fund), or they could follow others in selecting an actively-managed fund from among the th ...

... Investors are stuck at a crossroads. They could follow the direction preferred by many ¯nancial economists by investing in a diversi¯ed value-weighted portfolio (either through an index fund or exchange-traded fund), or they could follow others in selecting an actively-managed fund from among the th ...

Not-for-profit organizations

... • When two organizations have the same board of directors, the presumption is that one organization controls the other. o For instance, it is very common for a not-for-profit organization to create a separate entity to hold its investments and major capital assets, where this entity is often referre ...

... • When two organizations have the same board of directors, the presumption is that one organization controls the other. o For instance, it is very common for a not-for-profit organization to create a separate entity to hold its investments and major capital assets, where this entity is often referre ...

Does Fund Size Erode Performance? Organizational Diseconomies

... for granted that bigger funds naturally have to take larger positions per stock or have to invest in large cap stocks or not-so-good ideas? Presumably, as a small fund grows with good past performance, it can afford to hire more managers so as to cover more stocks. The fund can thereby generate addi ...

... for granted that bigger funds naturally have to take larger positions per stock or have to invest in large cap stocks or not-so-good ideas? Presumably, as a small fund grows with good past performance, it can afford to hire more managers so as to cover more stocks. The fund can thereby generate addi ...