Asia Financial Crisis

... Made no attempt to help capital markets, instead allowed a 60% drop, however within a year fully recovered and continued to grow ...

... Made no attempt to help capital markets, instead allowed a 60% drop, however within a year fully recovered and continued to grow ...

AP Macro Unit 5 PPT

... 2. Mexico buys tractors from Canada 3. Canada sells syrup to the U.S. 4. Japan buys Fireworks from Mexico For all these transactions, there are different national currencies. Each country must be paid in their own currency The buyer (importer) must exchange their currency for that of the sellers (ex ...

... 2. Mexico buys tractors from Canada 3. Canada sells syrup to the U.S. 4. Japan buys Fireworks from Mexico For all these transactions, there are different national currencies. Each country must be paid in their own currency The buyer (importer) must exchange their currency for that of the sellers (ex ...

Peter Nicholl: Perspectives on monetary policy in Bosnia and

... While I believe strongly that BH should maintain its Currency Board, there will need to be changes made in other areas if BH is to have macro-economic sustainability over the medium term. The Currency Board requirement means that the CBBH can not issue KM currency in any quantity it chooses or the e ...

... While I believe strongly that BH should maintain its Currency Board, there will need to be changes made in other areas if BH is to have macro-economic sustainability over the medium term. The Currency Board requirement means that the CBBH can not issue KM currency in any quantity it chooses or the e ...

PDF Download

... $700.0bn. South Korea has reserves of $155.0bn, Taiwan more than $200.0bn. Even India has reserves in excess of $100.0bn. At some stage, these nations are going to develop sufficient self-confidence that they will reduce their degree of intervention or possibly even stop completely. At some time bef ...

... $700.0bn. South Korea has reserves of $155.0bn, Taiwan more than $200.0bn. Even India has reserves in excess of $100.0bn. At some stage, these nations are going to develop sufficient self-confidence that they will reduce their degree of intervention or possibly even stop completely. At some time bef ...

Exchange Rate Systems - Mays Business School

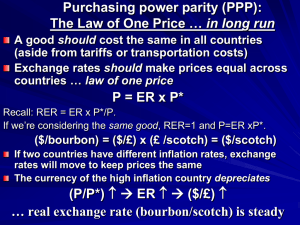

... The International Monetary System The international monetary system can be defined as the institutional framework within which international payments are made, movements of capital are accommodated, and exchange rates among currencies are determined. The exchange rate is a price, i.e., the price of ...

... The International Monetary System The international monetary system can be defined as the institutional framework within which international payments are made, movements of capital are accommodated, and exchange rates among currencies are determined. The exchange rate is a price, i.e., the price of ...

Chapter15 - University of San Diego Home Pages

... Flexible Exchange Rate System – exchange rates are determined by the forces of D and S. There is no intervention by the Central Bank Fixed Exchange Rate System – a system where central banks intervene to maintain or stabilize exchange rates at a fixed value Managed Float – A system where central ban ...

... Flexible Exchange Rate System – exchange rates are determined by the forces of D and S. There is no intervention by the Central Bank Fixed Exchange Rate System – a system where central banks intervene to maintain or stabilize exchange rates at a fixed value Managed Float – A system where central ban ...

Document

... IMF critics say: To the governments that cannot sell its debt and cannot preserve the value of their currency, IMF lends if the following conditions are promised by the borrower: 1. Reduce government expenditures or increase taxes (contractionary fiscal p.)so that you need to borrow less. Joseph S ...

... IMF critics say: To the governments that cannot sell its debt and cannot preserve the value of their currency, IMF lends if the following conditions are promised by the borrower: 1. Reduce government expenditures or increase taxes (contractionary fiscal p.)so that you need to borrow less. Joseph S ...

Problem 12

... intervention. But the pool of currencies in the marketplace is vastly larger than all the governments’ holdings. Billions of dollars worth of currencies are traded each day. Without the support of the US and Japan, it is unlikely that market intervention from even the two most influential members of ...

... intervention. But the pool of currencies in the marketplace is vastly larger than all the governments’ holdings. Billions of dollars worth of currencies are traded each day. Without the support of the US and Japan, it is unlikely that market intervention from even the two most influential members of ...

Government Influence on Exchange Rates

... The international monetary system can be defined as the institutional framework within which international payments are made, movements of capital are accommodated, and exchange rates among currencies are determined. The exchange rate is a price, i.e., the price of one currency vis-à-vis another. Si ...

... The international monetary system can be defined as the institutional framework within which international payments are made, movements of capital are accommodated, and exchange rates among currencies are determined. The exchange rate is a price, i.e., the price of one currency vis-à-vis another. Si ...

Fixed Rate System: Preview of Results

... – Your currency depreciates – Your exports become more attractive – Your export industries aren’t hurt as badly as they would otherwise be – Your country’s terms of trade worsen ...

... – Your currency depreciates – Your exports become more attractive – Your export industries aren’t hurt as badly as they would otherwise be – Your country’s terms of trade worsen ...

FRBSF E L CONOMIC ETTER

... of their dollar-denominated assets, putting further downward pressure on the dollar. Since then, officials in both countries have insisted that they were not considering any major changes to the policy of reserve holdings. Nonetheless, the potential for a sell-off of dollar-denominated assets by for ...

... of their dollar-denominated assets, putting further downward pressure on the dollar. Since then, officials in both countries have insisted that they were not considering any major changes to the policy of reserve holdings. Nonetheless, the potential for a sell-off of dollar-denominated assets by for ...

China’s RenMinBi Strategy* C.P. Chandrasekhar and Jayati Ghosh

... Given China’s huge significance in global trade (it is now the main trading partner for a majority of countries) this will obviously have major implications. Developing countries will feel the pinch immediately, because Chinese imports will become even more competitive and could threaten their domes ...

... Given China’s huge significance in global trade (it is now the main trading partner for a majority of countries) this will obviously have major implications. Developing countries will feel the pinch immediately, because Chinese imports will become even more competitive and could threaten their domes ...

From the perspective of economics and geopolitics, each new

... Dooley, Michael, David Folkerts-Landau, and Peter Garber, 2003, “An Essay on the Revived Bretton Woods System,” NBER WP no 9971, Sept. ...

... Dooley, Michael, David Folkerts-Landau, and Peter Garber, 2003, “An Essay on the Revived Bretton Woods System,” NBER WP no 9971, Sept. ...

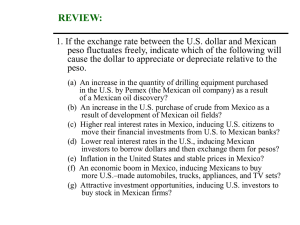

International Economics - Mr. Zittle`s Classroom

... how will it effect the cost of German goods for someone in the U.S.? 4. What will be the effect of a depreciation of the dollar against the Euro? 5. Why is the U.S. not happy about China holding the value of its currency down against the dollar? ...

... how will it effect the cost of German goods for someone in the U.S.? 4. What will be the effect of a depreciation of the dollar against the Euro? 5. Why is the U.S. not happy about China holding the value of its currency down against the dollar? ...

Reserve currency

A reserve currency (or anchor currency) is a currency that is held in significant quantities by governments and institutions as part of their foreign exchange reserves. The reserve currency is commonly used in international transactions and often considered a hard currency or safe-haven currency. People who live in a country that issues a reserve currency can purchase imports and borrow across borders more cheaply than people in other nations because they don't need to exchange their currency to do so.By the end of the 20th century, the United States dollar was considered the world's most dominant reserve currency, and the world's need for dollars has allowed the United States government as well as Americans to borrow at lower costs, granting them an advantage in excess of $100 billion per year. However, the U.S. dollar's status as a reserve currency, by increasing in value, hurts U.S. exporters.