INTERNATIONAL FINANCIAL CRISES:

... Let's see if we can puncture the myths. Is it true that the market will withdraw its support not only from a country which has financial problems that the market has at some point become aware of but also from other countries in the region that do not share those problems? We can examine the recent ...

... Let's see if we can puncture the myths. Is it true that the market will withdraw its support not only from a country which has financial problems that the market has at some point become aware of but also from other countries in the region that do not share those problems? We can examine the recent ...

Euro Strengthens With European Economy

... euro zone’s retailing industry by NTC Economics reached its highest level since January 2004, when the poll began. For much of 2004, the dollar was buoyant as the Federal Reserve lifted interest rates far above European borrowing costs, drawing money from around the world into dollar-denominated ass ...

... euro zone’s retailing industry by NTC Economics reached its highest level since January 2004, when the poll began. For much of 2004, the dollar was buoyant as the Federal Reserve lifted interest rates far above European borrowing costs, drawing money from around the world into dollar-denominated ass ...

when the dollar overtook the pound

... The euro soon after its debut came into wide use to denominate bonds. Within Europe there was a tremendous increase in issues of corporate bonds, denominated in euros, together with a rapid integration of money markets, government bond markets, equity markets, and banking. While the frenetic activit ...

... The euro soon after its debut came into wide use to denominate bonds. Within Europe there was a tremendous increase in issues of corporate bonds, denominated in euros, together with a rapid integration of money markets, government bond markets, equity markets, and banking. While the frenetic activit ...

Balance of payments

... The central bank stands ready to buy and sell its currency at a fixed price Central banks hold reserves to sell when have to intervene in the foreign exchange market ...

... The central bank stands ready to buy and sell its currency at a fixed price Central banks hold reserves to sell when have to intervene in the foreign exchange market ...

Document

... which imports exceed exports, increased to USD54 billion in August from a revised USD 50.5 billion, the Commerce Department said. The median forecast of economists in a Bloomberg poll was for a shortfall of USD 51.4 billion. A larger deficit means more dollars need to be converted to other currencie ...

... which imports exceed exports, increased to USD54 billion in August from a revised USD 50.5 billion, the Commerce Department said. The median forecast of economists in a Bloomberg poll was for a shortfall of USD 51.4 billion. A larger deficit means more dollars need to be converted to other currencie ...

Module Exchange Rates and Macroeconomic Policy

... So, in theory a free-floating exchange rate allows a nation some insulation from recessions that begin in other nations. ...

... So, in theory a free-floating exchange rate allows a nation some insulation from recessions that begin in other nations. ...

Document

... High degree of factor mobility = OCA; low degree = flexible exchange rates If demand shifts from products of country B to products of country A, a depreciation of the B currency would restore external balance, relieve unemployment in B and contain inflation in A. "This is the most favourable case fo ...

... High degree of factor mobility = OCA; low degree = flexible exchange rates If demand shifts from products of country B to products of country A, a depreciation of the B currency would restore external balance, relieve unemployment in B and contain inflation in A. "This is the most favourable case fo ...

Economic Globalization

... government. Each of the countries agreed that the fixed exchange rate for its currency would be based on the gold standard. This means that all printed money, such as paper money, would be convertible to gold and could be cashed in at any time for that gold. What is the problem with this? Countries ...

... government. Each of the countries agreed that the fixed exchange rate for its currency would be based on the gold standard. This means that all printed money, such as paper money, would be convertible to gold and could be cashed in at any time for that gold. What is the problem with this? Countries ...

(X) – Updated September 10, 2014

... *Stock Market trying to put in short term high *Every oil rally has failed Avoid – *Gold, precious metals ...

... *Stock Market trying to put in short term high *Every oil rally has failed Avoid – *Gold, precious metals ...

J. Anna Schwartz

... rescue arranged? Is there any doubt that the loan package was designed to pay dollars to Americans and other nationals who invested in Tesobonos and Cetes and dollar-denominated loans to Mexicannonfinancial firms? Is that the reason emergency loans are needed? To eliminate risk from investment in hi ...

... rescue arranged? Is there any doubt that the loan package was designed to pay dollars to Americans and other nationals who invested in Tesobonos and Cetes and dollar-denominated loans to Mexicannonfinancial firms? Is that the reason emergency loans are needed? To eliminate risk from investment in hi ...

Document

... 3. “Beijing, please do something-anything! – about your rigid currency regime and let the yuan appreciate” (Business Week, March 7, 2005, p. 37). a. What is meant by “your rigid currency reigme”? China has a fixed exchange rate. The yuan is tied to the dollar. b. Why does the Chinese government not ...

... 3. “Beijing, please do something-anything! – about your rigid currency regime and let the yuan appreciate” (Business Week, March 7, 2005, p. 37). a. What is meant by “your rigid currency reigme”? China has a fixed exchange rate. The yuan is tied to the dollar. b. Why does the Chinese government not ...

Backed by Gold Fiat Money - Saint Joseph High School

... – South Africa and Klondike region of Canada ...

... – South Africa and Klondike region of Canada ...

CEE Local Currency Bond Markets - The Institute of International

... Annual Meeting of Central and East European Chief Executives Berlin April 2013 ...

... Annual Meeting of Central and East European Chief Executives Berlin April 2013 ...

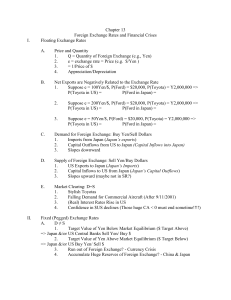

Foreign Exchange and the International Monetary System

... Foreign Exchange Risk 2. Forward Exchange Rates A forward exchange occurs when two parties agree to exchange currency at some specific future date Forward rates are typically quoted for 30, 90, or 180 days into the future Forward rates are typically the same as the spot rate plus or minus an a ...

... Foreign Exchange Risk 2. Forward Exchange Rates A forward exchange occurs when two parties agree to exchange currency at some specific future date Forward rates are typically quoted for 30, 90, or 180 days into the future Forward rates are typically the same as the spot rate plus or minus an a ...

To view this press release as a Word document

... The annual report on the investment of Israel's foreign exchange reserves for 2012 was published today1, the following are the main points in the report: ...

... The annual report on the investment of Israel's foreign exchange reserves for 2012 was published today1, the following are the main points in the report: ...

Economics focus

... (they fondly hope) faster economic growth. In theory, the question is not if, but when, these countries will join the euro: unlike Britain and Denmark, which are in the EU but not the single currency, they have no Maastricht treaty “optout”. They are supposed to meet the same entry conditions as tho ...

... (they fondly hope) faster economic growth. In theory, the question is not if, but when, these countries will join the euro: unlike Britain and Denmark, which are in the EU but not the single currency, they have no Maastricht treaty “optout”. They are supposed to meet the same entry conditions as tho ...

The Impact of Global Financial Crisis on RMB Internationalization

... research is more focused on the international currencies as pound, dollar, Euro and yen. With China's rapid economic rise, the issue of RMB internationalization gradually enters their perspective. Barry Eichengreen 2005 provides historical perspectives on reserve currency competition and discusses t ...

... research is more focused on the international currencies as pound, dollar, Euro and yen. With China's rapid economic rise, the issue of RMB internationalization gradually enters their perspective. Barry Eichengreen 2005 provides historical perspectives on reserve currency competition and discusses t ...

Currency regimes

... (current total allocation at ca. 204 bn SDRs, average rate 1 SDR = 1,50 USD) used as supplementary foreign exchange reserve asset (relatively minor importance) and unit of account XDRs are allocated to countries by the IMF Private parties do not hold or use them a 2009 proposal by Zhou Xiaochuan, ch ...

... (current total allocation at ca. 204 bn SDRs, average rate 1 SDR = 1,50 USD) used as supplementary foreign exchange reserve asset (relatively minor importance) and unit of account XDRs are allocated to countries by the IMF Private parties do not hold or use them a 2009 proposal by Zhou Xiaochuan, ch ...

Reserve currency

A reserve currency (or anchor currency) is a currency that is held in significant quantities by governments and institutions as part of their foreign exchange reserves. The reserve currency is commonly used in international transactions and often considered a hard currency or safe-haven currency. People who live in a country that issues a reserve currency can purchase imports and borrow across borders more cheaply than people in other nations because they don't need to exchange their currency to do so.By the end of the 20th century, the United States dollar was considered the world's most dominant reserve currency, and the world's need for dollars has allowed the United States government as well as Americans to borrow at lower costs, granting them an advantage in excess of $100 billion per year. However, the U.S. dollar's status as a reserve currency, by increasing in value, hurts U.S. exporters.