The European Currency Crisis (1992

... other countries have reduced control over monetary policy since they have to hold reserves and intervene when the exchange rate got too close to the edge of the band. It was believed that other Central Banks were not very good at keeping inflation under control, which is why they chose Germany becau ...

... other countries have reduced control over monetary policy since they have to hold reserves and intervene when the exchange rate got too close to the edge of the band. It was believed that other Central Banks were not very good at keeping inflation under control, which is why they chose Germany becau ...

exchange rate

... (current total allocation at ca. 204 bn SDRs, average rate 1 SDR = 1,50 USD) used as supplementary foreign exchange reserve asset (relatively minor importance) and unit of account XDRs are allocated to countries by the IMF. Private parties do not hold or use them. a 2009 proposal by Zhou Xiaochuan, ...

... (current total allocation at ca. 204 bn SDRs, average rate 1 SDR = 1,50 USD) used as supplementary foreign exchange reserve asset (relatively minor importance) and unit of account XDRs are allocated to countries by the IMF. Private parties do not hold or use them. a 2009 proposal by Zhou Xiaochuan, ...

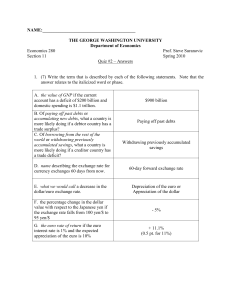

THE GEORGE WASHINGTON UNIVERSITY

... 3. (4) The current dollar/euro exchange rate is 1.35. Suppose you plan to invest $1000 in a simple interest one-year European CD paying an interest rate of 2% per year. A. (3) Calculate the rate of return on this investment if you expect the dollar/euro exchange rate to be 1.25 in one year. Show yo ...

... 3. (4) The current dollar/euro exchange rate is 1.35. Suppose you plan to invest $1000 in a simple interest one-year European CD paying an interest rate of 2% per year. A. (3) Calculate the rate of return on this investment if you expect the dollar/euro exchange rate to be 1.25 in one year. Show yo ...

Intervention in the Foreign Exchange Market

... the U.S., the U.K., Europe and Japan in a concerted intervention to stabilize the Japanese currency (press release). In September 2000, the Bank of Canada joined the European Central Bank, the Federal Reserve Bank of New York, the Bank of Japan, and the Bank of England in a concerted intervention to ...

... the U.S., the U.K., Europe and Japan in a concerted intervention to stabilize the Japanese currency (press release). In September 2000, the Bank of Canada joined the European Central Bank, the Federal Reserve Bank of New York, the Bank of Japan, and the Bank of England in a concerted intervention to ...

foreign exchange market (forex)

... • the variety of factors that affect exchange rates; • the low margins of relative profit compared with other markets of fixed income. ...

... • the variety of factors that affect exchange rates; • the low margins of relative profit compared with other markets of fixed income. ...

Lecture 3: Int`l Finance

... Mechanics of Foreign Exchange • People in different countries speak different languages; they also transact business in different currencies ($, €, ¥, or £), requiring conversion from one currency to another • Foreign exchange is the currency of another country that is needed to carry out internati ...

... Mechanics of Foreign Exchange • People in different countries speak different languages; they also transact business in different currencies ($, €, ¥, or £), requiring conversion from one currency to another • Foreign exchange is the currency of another country that is needed to carry out internati ...

Presentation

... • U.S. dollar obtained its position as a world currency; • But the dollar's behavior had been the regulated: the United States promised that the dollar was convertible to the gold at a fixed rate; • It is a system of fixed exchange regime pegged to the gold; • Opening capital market is also not enco ...

... • U.S. dollar obtained its position as a world currency; • But the dollar's behavior had been the regulated: the United States promised that the dollar was convertible to the gold at a fixed rate; • It is a system of fixed exchange regime pegged to the gold; • Opening capital market is also not enco ...

Document

... French sovereignty and independence. In fact, at a time when capital moves about in mere seconds, thanks to the computer, from one financial location to another, one notices that speculative movements are completely ignorant of borders.” ...

... French sovereignty and independence. In fact, at a time when capital moves about in mere seconds, thanks to the computer, from one financial location to another, one notices that speculative movements are completely ignorant of borders.” ...

Lecture 21: Exchange Rates and International Trade

... b. PPP: As we discussed, the purchasing power parity influences the exchange rate. The more a currency can buy, the more the currency is worth. E increases as CD’s purchasing power increases (each CD can be exchanged for more CF). c. A change in the relative domestic interest rate causes appreciatio ...

... b. PPP: As we discussed, the purchasing power parity influences the exchange rate. The more a currency can buy, the more the currency is worth. E increases as CD’s purchasing power increases (each CD can be exchanged for more CF). c. A change in the relative domestic interest rate causes appreciatio ...

BOP Crisis and Economic Policy

... capital account, independent monetary and fiscal policies - expansionary policy caused higher inflation and appreciation of domestic currency but governments did not allow exchange rate to change. -When this policy became unsustainable government devalued. The debt stock of local firms and banks in ...

... capital account, independent monetary and fiscal policies - expansionary policy caused higher inflation and appreciation of domestic currency but governments did not allow exchange rate to change. -When this policy became unsustainable government devalued. The debt stock of local firms and banks in ...

DEVELOPMENT OF U.S. BANKING

... 1863–1864 National Currency Act and National Banking Act establish standards and tax state bank notes. 1864–1913 Problems with money supply persist. ...

... 1863–1864 National Currency Act and National Banking Act establish standards and tax state bank notes. 1864–1913 Problems with money supply persist. ...

DEVELOPMENT OF U.S. BANKING

... 1863–1864 National Currency Act and National Banking Act establish standards and tax state bank notes. 1864–1913 Problems with money supply persist. ...

... 1863–1864 National Currency Act and National Banking Act establish standards and tax state bank notes. 1864–1913 Problems with money supply persist. ...

Appendix: Description of Methodology Data Used in the Principal

... series are unobservable. They can be estimated by a quasi-Maximum Likelihood Estimation (MLE), which involves two following assumptions: i) and ii) are i.i.d and independent across series. These estimated principal factors are then used as factors augmenting the CAPM. All data was downloaded from th ...

... series are unobservable. They can be estimated by a quasi-Maximum Likelihood Estimation (MLE), which involves two following assumptions: i) and ii) are i.i.d and independent across series. These estimated principal factors are then used as factors augmenting the CAPM. All data was downloaded from th ...

operating_exposure

... An exporting firm in an imperfectly competitive market will experience an increase in total revenue and total cost after devaluation when amounts are measured in the firm’s home currency. The (home) price will rise by less than the currency depreciation because of the downward sloping demand cur ...

... An exporting firm in an imperfectly competitive market will experience an increase in total revenue and total cost after devaluation when amounts are measured in the firm’s home currency. The (home) price will rise by less than the currency depreciation because of the downward sloping demand cur ...

What does the historical record of reform suggest about the current

... economic fundamentals. 2 These externalities suggest a tipping point or landslide effect should one major creditor switch its assets, so that the retirement of a reserve currency is likely to be non-linear. The case of sterling in the post-war period helps to explore the determinants and timing of s ...

... economic fundamentals. 2 These externalities suggest a tipping point or landslide effect should one major creditor switch its assets, so that the retirement of a reserve currency is likely to be non-linear. The case of sterling in the post-war period helps to explore the determinants and timing of s ...

Diagnostic Tables - Description

... PPP-Ratio: Standardized price ratios based on the PPP converted prices. The PPP-Prices expressed as a percentage of their geometric mean. ...

... PPP-Ratio: Standardized price ratios based on the PPP converted prices. The PPP-Prices expressed as a percentage of their geometric mean. ...

Banking System in Saudi Arabia

... exchanged. As a store of value, it means that money is capable of holding its value over time. Therefore, people can store it for some time and yet it will not lose its value in exchange. Money is a means of exchange and therefore it facilitates transactions (p. 233). This means that in order to rec ...

... exchanged. As a store of value, it means that money is capable of holding its value over time. Therefore, people can store it for some time and yet it will not lose its value in exchange. Money is a means of exchange and therefore it facilitates transactions (p. 233). This means that in order to rec ...

doc Conference 1

... value and ranking over this time period informative? Relative to the range of HDI from top to bottom, these two countries are relatively close. If you were to suggest a unique development policy to each country to improve the HDI ranking for next year, what would ...

... value and ranking over this time period informative? Relative to the range of HDI from top to bottom, these two countries are relatively close. If you were to suggest a unique development policy to each country to improve the HDI ranking for next year, what would ...

opportunity cost

... The initial economic effects were positive: – Argentina’s chronic inflation was curtailed. – Foreign investment poured in. As the U.S. dollar appreciated on the world market the Argentine peso became stronger as ...

... The initial economic effects were positive: – Argentina’s chronic inflation was curtailed. – Foreign investment poured in. As the U.S. dollar appreciated on the world market the Argentine peso became stronger as ...

Reserve currency

A reserve currency (or anchor currency) is a currency that is held in significant quantities by governments and institutions as part of their foreign exchange reserves. The reserve currency is commonly used in international transactions and often considered a hard currency or safe-haven currency. People who live in a country that issues a reserve currency can purchase imports and borrow across borders more cheaply than people in other nations because they don't need to exchange their currency to do so.By the end of the 20th century, the United States dollar was considered the world's most dominant reserve currency, and the world's need for dollars has allowed the United States government as well as Americans to borrow at lower costs, granting them an advantage in excess of $100 billion per year. However, the U.S. dollar's status as a reserve currency, by increasing in value, hurts U.S. exporters.