J.D. Han

... the ‘enemy’ countries such as the USSR block and China. The U.S. started sponsoring these ‘enemy’ countries into the integrated world market. The U.S. wanted a partner which could help the U.S. ‘s competitive industries such as the investment banking. The U.S. does not want a trading partner which w ...

... the ‘enemy’ countries such as the USSR block and China. The U.S. started sponsoring these ‘enemy’ countries into the integrated world market. The U.S. wanted a partner which could help the U.S. ‘s competitive industries such as the investment banking. The U.S. does not want a trading partner which w ...

Strong Dollar, Weak Dollar

... shops and Canadian currency is used (often at the official exchange rate) in U.S. establishments. But generally speaking, these areas tend to be small and in close proximity to the borders. Usually the decision to accept a foreign currency is made by local establishments as a convenience to bordercr ...

... shops and Canadian currency is used (often at the official exchange rate) in U.S. establishments. But generally speaking, these areas tend to be small and in close proximity to the borders. Usually the decision to accept a foreign currency is made by local establishments as a convenience to bordercr ...

Document

... How is the advent of the Euro likely to change the reserve currency status of the dollar? Is this good, or bad, for the U.S.? b. Performance of the Bretton Woods System For the Bretton Woods system to function properly, the world had to be confident in the value of the dollar. This implied that the ...

... How is the advent of the Euro likely to change the reserve currency status of the dollar? Is this good, or bad, for the U.S.? b. Performance of the Bretton Woods System For the Bretton Woods system to function properly, the world had to be confident in the value of the dollar. This implied that the ...

Lecture 10 - UTA Economics

... see two things happen: 1. Initial effect: I↓ → AD↓ → real GDP and the price level↓ 2. Feedback effect: the dollar appreciates → (EX – IM)↓ → AD↓ → real GDP and the price level↓ Principle of economics: Feedback effects magnify the effects of monetary policy. Monetary policy is stronger in an open eco ...

... see two things happen: 1. Initial effect: I↓ → AD↓ → real GDP and the price level↓ 2. Feedback effect: the dollar appreciates → (EX – IM)↓ → AD↓ → real GDP and the price level↓ Principle of economics: Feedback effects magnify the effects of monetary policy. Monetary policy is stronger in an open eco ...

Exchange Rates - Uniservity CLC

... and employees to keep their costs under control in order to remain competitive in international markets. This helps the government maintain low inflation - which in the long run should bring interest rates down and stimulate increased trade and investment. ...

... and employees to keep their costs under control in order to remain competitive in international markets. This helps the government maintain low inflation - which in the long run should bring interest rates down and stimulate increased trade and investment. ...

International Monetary Systems

... 2. The US dollar would be designed as a reserve currency, and other nations would maintain their FX reserves in the form of dollars. 3. Each country fixed its ex rate against the dollar and the value of dollar is defined by the official gold price $35 per ounce (Gold Exchange Standard). ...

... 2. The US dollar would be designed as a reserve currency, and other nations would maintain their FX reserves in the form of dollars. 3. Each country fixed its ex rate against the dollar and the value of dollar is defined by the official gold price $35 per ounce (Gold Exchange Standard). ...

Folie 1

... cent of GDP • Public debt: debt less than 60 per cent of GDP • These criteria had to be fulfilled in 1998 (the last year before admission) ...

... cent of GDP • Public debt: debt less than 60 per cent of GDP • These criteria had to be fulfilled in 1998 (the last year before admission) ...

Convertibility

... international community that it will pursue sound economic policies that will obviate the need to use restrictions on payments and transfers for current international transactions ...

... international community that it will pursue sound economic policies that will obviate the need to use restrictions on payments and transfers for current international transactions ...

The data refer to the Hong Kong Special Administrative Region

... that these commercial banks issue. The CIs are issued at a rate of HK$7.8 per U.S. dollar under the exchange rate system established in October 1983 whereby the Hong Kong dollar was officially linked to the U.S. dollar. In the accounts of the banking institutions, banknote liabilities are exactly of ...

... that these commercial banks issue. The CIs are issued at a rate of HK$7.8 per U.S. dollar under the exchange rate system established in October 1983 whereby the Hong Kong dollar was officially linked to the U.S. dollar. In the accounts of the banking institutions, banknote liabilities are exactly of ...

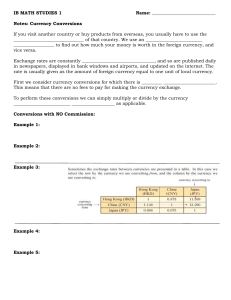

Commission on Currency Exchange

... each of the locations the family visits. Because currencies fluctuate all the time, the amount of money Mr. Dollabill receives in each local currency will change from day to day. However, the following example table shows you how much ONE American dollar (USD) is worth and will give you an idea of h ...

... each of the locations the family visits. Because currencies fluctuate all the time, the amount of money Mr. Dollabill receives in each local currency will change from day to day. However, the following example table shows you how much ONE American dollar (USD) is worth and will give you an idea of h ...

powerpoint files for units 4,5, and 6 of IFEL text 1

... and M3 - according to the type and size of account in which the cash and funds are kept. • The Money Supply can be defined as the quantity of money issued by a country's monetary authorities. But why is it important -? • The money supply is important to economists and the public trying to understand ...

... and M3 - according to the type and size of account in which the cash and funds are kept. • The Money Supply can be defined as the quantity of money issued by a country's monetary authorities. But why is it important -? • The money supply is important to economists and the public trying to understand ...

Finance & Accounting

... against other major currencies, 2002–06 Source: Financial Times, 6 December 2006 ...

... against other major currencies, 2002–06 Source: Financial Times, 6 December 2006 ...

10 years Euro, what are the prospects?

... Threats for the US dollar? • 1.Growing Debt to GDP in the USA (due to wars, trade deficits, budget deficits, higher oil-prices ) • 2.New international “currencies” as competitors of the dollar? • After the “Euro”, • Will we get the “Asio”?, “Arabo”?, “Latino”? ...

... Threats for the US dollar? • 1.Growing Debt to GDP in the USA (due to wars, trade deficits, budget deficits, higher oil-prices ) • 2.New international “currencies” as competitors of the dollar? • After the “Euro”, • Will we get the “Asio”?, “Arabo”?, “Latino”? ...

FIN_250_Chap02_shrtnd_0

... The US delegate led by Harry Dexter White proposed a currency pool to which member countries would make contributions and from which they can barrow. (IMF like) ...

... The US delegate led by Harry Dexter White proposed a currency pool to which member countries would make contributions and from which they can barrow. (IMF like) ...

3.1.4 Loss of competitiveness arising from exchange rate policies

... 3.1.4 Loss of competitiveness arising from exchange rate policies In addition to the factors above, the exchange rate regime adopted by most of the afflicted countries was seen by some as having played a crucial role in the emergence of the crisis in East Asia. Many countries in the region appear to ...

... 3.1.4 Loss of competitiveness arising from exchange rate policies In addition to the factors above, the exchange rate regime adopted by most of the afflicted countries was seen by some as having played a crucial role in the emergence of the crisis in East Asia. Many countries in the region appear to ...

Financial Statement Translation

... sold with the Bi-monetary Inventory processing feature, which eliminates the need to maintain these historical exchange rates manually. ...

... sold with the Bi-monetary Inventory processing feature, which eliminates the need to maintain these historical exchange rates manually. ...

Currency Wars - Harvard University

... • The question: for a given increase in Exchange Market Pressure (EMP), how much does the central bank absorb as an rise in the value of its currency (exchange rate) versus how much as an increase in the quantity (reserves). ...

... • The question: for a given increase in Exchange Market Pressure (EMP), how much does the central bank absorb as an rise in the value of its currency (exchange rate) versus how much as an increase in the quantity (reserves). ...

Argentina: Goodbye Currency Restrictions, Welcome Foreign I

... However, the government is aware of the risks, as several comments by Minister Prat Gay suggest. The market will give the government a “window of opportunity” (considering that their beginnings have been auspicious and the government has been fulfilling electoral promises). But the market will also ...

... However, the government is aware of the risks, as several comments by Minister Prat Gay suggest. The market will give the government a “window of opportunity” (considering that their beginnings have been auspicious and the government has been fulfilling electoral promises). But the market will also ...

Money Curriculum - Museum of American Finance

... Bretton Woods System, enacted after World War II, created a system of fixed exchange rates that allowed governments to sell their gold to the US Treasury at the fixed price of $35/ounce. This system relied on international confidence in the American economy, and formally established the US as the wo ...

... Bretton Woods System, enacted after World War II, created a system of fixed exchange rates that allowed governments to sell their gold to the US Treasury at the fixed price of $35/ounce. This system relied on international confidence in the American economy, and formally established the US as the wo ...

Exchange Rate Policy and Open

... but also disadvantages. Nations like the U.S. and Canada have determined that a floating exchange rate policy is superior to the fixed exchange rate policy ...

... but also disadvantages. Nations like the U.S. and Canada have determined that a floating exchange rate policy is superior to the fixed exchange rate policy ...

Reserve currency

A reserve currency (or anchor currency) is a currency that is held in significant quantities by governments and institutions as part of their foreign exchange reserves. The reserve currency is commonly used in international transactions and often considered a hard currency or safe-haven currency. People who live in a country that issues a reserve currency can purchase imports and borrow across borders more cheaply than people in other nations because they don't need to exchange their currency to do so.By the end of the 20th century, the United States dollar was considered the world's most dominant reserve currency, and the world's need for dollars has allowed the United States government as well as Americans to borrow at lower costs, granting them an advantage in excess of $100 billion per year. However, the U.S. dollar's status as a reserve currency, by increasing in value, hurts U.S. exporters.