The Gulf CurrenCy - Lancaster University

... to be confident that the other members will continue with responsible fiscal behaviour in the future. In GCC countries, hydrocarbon duties provide the bulk of government revenues and the question has to be raised as to what will replace this when hydrocarbon reserves become depleted. This is a not a ...

... to be confident that the other members will continue with responsible fiscal behaviour in the future. In GCC countries, hydrocarbon duties provide the bulk of government revenues and the question has to be raised as to what will replace this when hydrocarbon reserves become depleted. This is a not a ...

IPEII File - CSUN Moodle

... By 1958 the US no longer sought deficits. Run on dollar in November 1960 when speculators converted dollars into gold. The IMF also began to emerge. Also the Bank of International Settlements or Basel Group emerged. Central bankers met to manage crises. ...

... By 1958 the US no longer sought deficits. Run on dollar in November 1960 when speculators converted dollars into gold. The IMF also began to emerge. Also the Bank of International Settlements or Basel Group emerged. Central bankers met to manage crises. ...

Lecture 17: The IMF & Financial Crises

... Borrowing abroad: The temporary fix If you have a current account deficit: • You can borrow money from abroad to cover it, or • Sell off assets to foreigners This only works for so long. As the debt grows, will or can the borrowing country repay? ...

... Borrowing abroad: The temporary fix If you have a current account deficit: • You can borrow money from abroad to cover it, or • Sell off assets to foreigners This only works for so long. As the debt grows, will or can the borrowing country repay? ...

Chapter 5

... Automatic adjustment would cause an appreciation of foreign currencies, which would cause an increase in many prices for domestic consumers when goods and services markets are integrated. ...

... Automatic adjustment would cause an appreciation of foreign currencies, which would cause an increase in many prices for domestic consumers when goods and services markets are integrated. ...

Chapter 4 - Competing in Global Markets

... • Firm sells same product in essentially the same manner throughout the world. • Works well for products with nearly universal appeal and luxury items. ...

... • Firm sells same product in essentially the same manner throughout the world. • Works well for products with nearly universal appeal and luxury items. ...

China, the US, and Currency Issues

... Chen, Hong Yi, Wenshen Peng & Chang Shu. 2011. “The Potential of Renminbi as an International Currency,” in Currency Internationalisation: Lessons from the Global Financial Crisis and Prospects for the Future in Asia and the Pacific, BIS Papers No. 61, Dec. 2011. Gao, Haihong, & Yongdin Yu, 2011, “I ...

... Chen, Hong Yi, Wenshen Peng & Chang Shu. 2011. “The Potential of Renminbi as an International Currency,” in Currency Internationalisation: Lessons from the Global Financial Crisis and Prospects for the Future in Asia and the Pacific, BIS Papers No. 61, Dec. 2011. Gao, Haihong, & Yongdin Yu, 2011, “I ...

EXCHANGE RATE Chapter13 able

... The real exchange rate is the price of domestic goods (in terms of foreign goods). If Cadillacs become more expensive relative to Mercedes, then sales of Cadillacs fall and those of Mercedes rise. ...

... The real exchange rate is the price of domestic goods (in terms of foreign goods). If Cadillacs become more expensive relative to Mercedes, then sales of Cadillacs fall and those of Mercedes rise. ...

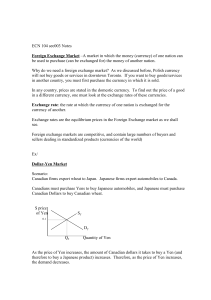

forex - Herricks

... – Capital Flow increase towards the US – British demand for U.S. dollars increases… – British supply more pounds Pound - depreciates Dollar - appreciates ...

... – Capital Flow increase towards the US – British demand for U.S. dollars increases… – British supply more pounds Pound - depreciates Dollar - appreciates ...

Reverse engineering network structures from dynamic features: the

... Fang Jin (fang8), Nathan Self (nwself), Parang Saraf (parang), Patrick Butler (pabutler), Wei Wang (tskatom) & Naren Ramakrishnan (naren) Department of Computer Science, Virginia Tech Email: pid@cs.vt.edu ...

... Fang Jin (fang8), Nathan Self (nwself), Parang Saraf (parang), Patrick Butler (pabutler), Wei Wang (tskatom) & Naren Ramakrishnan (naren) Department of Computer Science, Virginia Tech Email: pid@cs.vt.edu ...

Chapter 12

... • Predicting forex rates is even more difficult than predicting interest rates and stock prices for several reasons. • Expectations play an even more important role • Central banks may intervene • Values may remain far away from economic equilibrium for many years or even decades ...

... • Predicting forex rates is even more difficult than predicting interest rates and stock prices for several reasons. • Expectations play an even more important role • Central banks may intervene • Values may remain far away from economic equilibrium for many years or even decades ...

4810syllabus

... The gold standard regime (July 3) – The gold standard regime prevailed in the world economy before the world wars and for a brief period between the wars. It has many proponents today. Explain how it functions. What were the costs and benefits of the gold standard regime? Why it could not be sustain ...

... The gold standard regime (July 3) – The gold standard regime prevailed in the world economy before the world wars and for a brief period between the wars. It has many proponents today. Explain how it functions. What were the costs and benefits of the gold standard regime? Why it could not be sustain ...

An Attack on a Currency

... Why might a currency be perceived as overvalued? Inappropriate domestic monetary and fiscal policies. Weakness in the country’s external (trade) position. Weakness in the country’s key financial sector (banking). Why might a currency be perceived as undervalued? Underlying strength in the ec ...

... Why might a currency be perceived as overvalued? Inappropriate domestic monetary and fiscal policies. Weakness in the country’s external (trade) position. Weakness in the country’s key financial sector (banking). Why might a currency be perceived as undervalued? Underlying strength in the ec ...

Chapter 16

... U.S. and foreign currencies must be translated to U.S. dollars. Generally, the accounting standards must first be brought into agreement and then the translation into U.S. dollars takes place. The currency of the primary operating environment in which a foreign unit spends and receives cash is refer ...

... U.S. and foreign currencies must be translated to U.S. dollars. Generally, the accounting standards must first be brought into agreement and then the translation into U.S. dollars takes place. The currency of the primary operating environment in which a foreign unit spends and receives cash is refer ...

Class 6: Economic Globalization

... • Also, many US companies were invested in Asia (or had made loans)… Now they were losing money ...

... • Also, many US companies were invested in Asia (or had made loans)… Now they were losing money ...

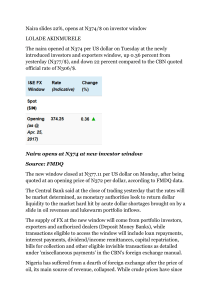

Naira opens at N374 at new investor window Source

... interest payments, dividend/income remittances, capital repatriation, bills for collection and other eligible invisible transactions as detailed under 'miscellaneous payments' in the CBN's foreign exchange manual. Nigeria has suffered from a dearth of foreign exchange after the price of oil, its mai ...

... interest payments, dividend/income remittances, capital repatriation, bills for collection and other eligible invisible transactions as detailed under 'miscellaneous payments' in the CBN's foreign exchange manual. Nigeria has suffered from a dearth of foreign exchange after the price of oil, its mai ...

My Big Fat Greek Crisis

... Benefits of fixing exchange rate dominate: Denmark Benefits of full currency union dominate: United States Where does Eurozone fit? ...

... Benefits of fixing exchange rate dominate: Denmark Benefits of full currency union dominate: United States Where does Eurozone fit? ...

Reserve currency

A reserve currency (or anchor currency) is a currency that is held in significant quantities by governments and institutions as part of their foreign exchange reserves. The reserve currency is commonly used in international transactions and often considered a hard currency or safe-haven currency. People who live in a country that issues a reserve currency can purchase imports and borrow across borders more cheaply than people in other nations because they don't need to exchange their currency to do so.By the end of the 20th century, the United States dollar was considered the world's most dominant reserve currency, and the world's need for dollars has allowed the United States government as well as Americans to borrow at lower costs, granting them an advantage in excess of $100 billion per year. However, the U.S. dollar's status as a reserve currency, by increasing in value, hurts U.S. exporters.