International Coordination Jeffrey Frankel 2015 Asia Economic Policy Conference

... – Perhaps they can narrow differences in perceptions. – But each country has an incentive to claim to believe in whatever model suits its interest in the bargaining process • Ostry & Ghosh (2015). ...

... – Perhaps they can narrow differences in perceptions. – But each country has an incentive to claim to believe in whatever model suits its interest in the bargaining process • Ostry & Ghosh (2015). ...

dl1.cuni.cz

... Fixed-but-adjustable exchange rates, Central role of the dollar, Government interventions used to peg the exchange rate (autonomous monetary policies), Limits on capital flows, Creation of IMF ...

... Fixed-but-adjustable exchange rates, Central role of the dollar, Government interventions used to peg the exchange rate (autonomous monetary policies), Limits on capital flows, Creation of IMF ...

Chris Mulhearn and Howard R Vane

... Rate Mechanism of the European Monetary System). Although, since parity changes are possible under fixed exchange rates, these innovations were not totally successful, they showed the benefits of monetary integration. They also showed the benefits of a common currency, such as the euro, under which ...

... Rate Mechanism of the European Monetary System). Although, since parity changes are possible under fixed exchange rates, these innovations were not totally successful, they showed the benefits of monetary integration. They also showed the benefits of a common currency, such as the euro, under which ...

Slide 1

... • The theory of optimum currency areas argues that the optimal area for a system of fixed exchange rates, or a common currency, is one that is highly economically integrated. – economic integration means free flows of • goods and services (trade) • financial capital (assets) and physical capital • w ...

... • The theory of optimum currency areas argues that the optimal area for a system of fixed exchange rates, or a common currency, is one that is highly economically integrated. – economic integration means free flows of • goods and services (trade) • financial capital (assets) and physical capital • w ...

Foreign Exchange Hedge Aust Procedures

... movement by locking in rates. Corporate Finance (Treasury) provide this service for large transactions denominated in foreign currency. ...

... movement by locking in rates. Corporate Finance (Treasury) provide this service for large transactions denominated in foreign currency. ...

P R I M

... benefits from the use of money. But another reason may be more important. Since the Great Depression, every country wants to have its own fiat money because it wants to have an independent monetary policy. Without a fiat money, a country cannot have (aspire to) truly independent monetary policy, and ...

... benefits from the use of money. But another reason may be more important. Since the Great Depression, every country wants to have its own fiat money because it wants to have an independent monetary policy. Without a fiat money, a country cannot have (aspire to) truly independent monetary policy, and ...

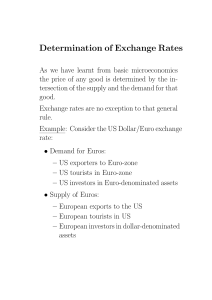

Document

... An exchange rate is the price of one nation’s currency in terms of another nation’s currency. Foreigners who wish to purchase U.S. goods, services, and financial assets demand dollars. The supply of dollars reflects the desire of U.S. citizens to purchase foreign goods, services and financial asset ...

... An exchange rate is the price of one nation’s currency in terms of another nation’s currency. Foreigners who wish to purchase U.S. goods, services, and financial assets demand dollars. The supply of dollars reflects the desire of U.S. citizens to purchase foreign goods, services and financial asset ...

Policy Coordination

... 3. Policymakers may present a “united front” in the face of home political pressures that could push them to adopt harmful policies. Daniels and VanHoose ...

... 3. Policymakers may present a “united front” in the face of home political pressures that could push them to adopt harmful policies. Daniels and VanHoose ...

1 William Krist`s book “Globalization and America`s

... currencies below the market value of the dollar to gain a trade advantage. President Nixon imposed an import surcharge, which was only removed after Germany, Japan and others revalued their currencies. And then the problem resurfaced again in the mid-1980s, particularly with regard to Japan and some ...

... currencies below the market value of the dollar to gain a trade advantage. President Nixon imposed an import surcharge, which was only removed after Germany, Japan and others revalued their currencies. And then the problem resurfaced again in the mid-1980s, particularly with regard to Japan and some ...

Diagnostic Tables - Description

... Unweighted geometric mean of all BH PLIs; Set upper limit for BH PLIs (here 2 times the geometric mean); Set lower limit for BH PLIs (here 0.5 times the geometric mean); Number of missing BH PLIs (hence missing PPPs); Number of BHs below set threshold in (5); Number of BHs above set threshold on (6) ...

... Unweighted geometric mean of all BH PLIs; Set upper limit for BH PLIs (here 2 times the geometric mean); Set lower limit for BH PLIs (here 0.5 times the geometric mean); Number of missing BH PLIs (hence missing PPPs); Number of BHs below set threshold in (5); Number of BHs above set threshold on (6) ...

No Case for Complacence* C.P. Chandrasekhar

... depreciation of the Chinese yuan over three days starting August 11, which brought its value down by a little more than three per cent relative to the US dollar. Even though the Chinese government had taken the yuan off its erstwhile implicit dollar peg in 2005, the government and the central bank h ...

... depreciation of the Chinese yuan over three days starting August 11, which brought its value down by a little more than three per cent relative to the US dollar. Even though the Chinese government had taken the yuan off its erstwhile implicit dollar peg in 2005, the government and the central bank h ...

MACROECONOMICS

... slide. Higher r reduces IS but increases LM. In the bottom slide, this should show as a disequilibrium, since r is on the vertical ...

... slide. Higher r reduces IS but increases LM. In the bottom slide, this should show as a disequilibrium, since r is on the vertical ...

To view this press release as a file

... Institutions (incl. insurance companies) Individuals and provident funds ...

... Institutions (incl. insurance companies) Individuals and provident funds ...

Currency Sovereignty And Policy Independence

... Still others peg the exchange rate to a foreign currency, but hold less than 100% reserve backing. In practice, this is a very risky proposition if the exchange rate is fixed and conversion on demand is permitted. Hence, the behavior of a prudent government operating with less than 100% reserves wou ...

... Still others peg the exchange rate to a foreign currency, but hold less than 100% reserve backing. In practice, this is a very risky proposition if the exchange rate is fixed and conversion on demand is permitted. Hence, the behavior of a prudent government operating with less than 100% reserves wou ...

International finance and the foreign exchange market

... Which of the following would cause the American demand for foreign exchange (pounds) to shift from D1 to D2? a. an increase in the U.S. real interest rate b. higher inflation in Britain than in the United States c. higher income growth in Britain than in the United States d. an increased level of v ...

... Which of the following would cause the American demand for foreign exchange (pounds) to shift from D1 to D2? a. an increase in the U.S. real interest rate b. higher inflation in Britain than in the United States c. higher income growth in Britain than in the United States d. an increased level of v ...

China’s Exchange Rate System after WTO Accession

... Capital brought in from abroad must be deposited in special accounts in designated banks. Any repayments and remittances from these accounts are also subject to SAFE approval. Foreign investment in the Chinese stock market is limited to B shares. Inbound foreign capital must get SAFE approval to con ...

... Capital brought in from abroad must be deposited in special accounts in designated banks. Any repayments and remittances from these accounts are also subject to SAFE approval. Foreign investment in the Chinese stock market is limited to B shares. Inbound foreign capital must get SAFE approval to con ...

Chapter 24 -- International Financial Management

... Purchasing-Power Parity (PPP) The idea that a basket of goods should sell for the same price in two countries, after exchange rates are taken into account. For example, the price of wheat in Canadian and U.S. markets should trade at the same price (after adjusting for the exchange rate). If the ...

... Purchasing-Power Parity (PPP) The idea that a basket of goods should sell for the same price in two countries, after exchange rates are taken into account. For example, the price of wheat in Canadian and U.S. markets should trade at the same price (after adjusting for the exchange rate). If the ...

The Gulf CurrenCy - Lancaster University

... when hydrocarbon reserves become depleted. This is a not a concern for Saudi Arabia and Qatar (table 3), provided that oil and gas prices do not fall significantly, but Bahrain and Oman (predicted to join the currency later) are less fortunate. Diversification into other activities such as tourism a ...

... when hydrocarbon reserves become depleted. This is a not a concern for Saudi Arabia and Qatar (table 3), provided that oil and gas prices do not fall significantly, but Bahrain and Oman (predicted to join the currency later) are less fortunate. Diversification into other activities such as tourism a ...

Chapter 7 Power Point Presentation

... Fixed versus Floating Exchange Rates Since the collapse of the Bretton Woods system in the early 1970s, debate has never ended on whether fixed or floating exchange rates are better. Fixed exchange rates: 1. Impose monetary discipline be preventing governments from engaging in inflationary monetary ...

... Fixed versus Floating Exchange Rates Since the collapse of the Bretton Woods system in the early 1970s, debate has never ended on whether fixed or floating exchange rates are better. Fixed exchange rates: 1. Impose monetary discipline be preventing governments from engaging in inflationary monetary ...

This PDF is a selection from an out-of-print volume from... Bureau of Economic Research

... number of large devaluations—deviations from the preannounced policy—have turned out to validate the expectations that market interest rates reflect. In the area of external debt, Brazil is surely the biggest (if not the leading) problem case. In June 1981 its external indebtedness to banks stood at ...

... number of large devaluations—deviations from the preannounced policy—have turned out to validate the expectations that market interest rates reflect. In the area of external debt, Brazil is surely the biggest (if not the leading) problem case. In June 1981 its external indebtedness to banks stood at ...

So, what`s exactly going on in Europe?

... - the Eurozone introduced a fixed currency peg (monetary union), a common monetary policy (European Central Bank), but forbade fiscal transfers among the countries, while equipping them only with some rules for fiscal prudency, which had been not properly honoured - however, markets believe in the U ...

... - the Eurozone introduced a fixed currency peg (monetary union), a common monetary policy (European Central Bank), but forbade fiscal transfers among the countries, while equipping them only with some rules for fiscal prudency, which had been not properly honoured - however, markets believe in the U ...

The data refer to the Hong Kong Special Administrative Region

... national currency and foreign currency, and exchange funds issued by the HKMA. Currency in circulation refers to certificates of indebtedness and notes and coins issued by the HKMA. M1 comprises currency in circulation and demand deposits in national currency and foreign currency of other financial ...

... national currency and foreign currency, and exchange funds issued by the HKMA. Currency in circulation refers to certificates of indebtedness and notes and coins issued by the HKMA. M1 comprises currency in circulation and demand deposits in national currency and foreign currency of other financial ...

Currency war

Currency war, also known as competitive devaluation, is a condition in international affairs where countries compete against each other to achieve a relatively low exchange rate for their own currency. As the price to buy a country's currency falls so too does the price of exports. Imports to the country become more expensive. So domestic industry, and thus employment, receives a boost in demand from both domestic and foreign markets. However, the price increase for imports can harm citizens' purchasing power. The policy can also trigger retaliatory action by other countries which in turn can lead to a general decline in international trade, harming all countries.Competitive devaluation has been rare through most of history as countries have generally preferred to maintain a high value for their currency. Countries have generally allowed market forces to work, or have participated in systems of managed exchanges rates. An exception occurred when currency war broke out in the 1930s. As countries abandoned the Gold Standard during the Great Depression, they used currency devaluations to stimulate their economies. Since this effectively pushes unemployment overseas, trading partners quickly retaliated with their own devaluations. The period is considered to have been an adverse situation for all concerned, as unpredictable changes in exchange rates reduced overall international trade.According to Guido Mantega, the Brazilian Minister for Finance, a global currency war broke out in 2010. This view was echoed by numerous other government officials and financial journalists from around the world. Other senior policy makers and journalists suggested the phrase ""currency war"" overstated the extent of hostility. With a few exceptions, such as Mantega, even commentators who agreed there had been a currency war in 2010 generally concluded that it had fizzled out by mid-2011.States engaging in possible competitive devaluation since 2010 have used a mix of policy tools, including direct government intervention, the imposition of capital controls, and, indirectly, quantitative easing. While many countries experienced undesirable upward pressure on their exchange rates and took part in the ongoing arguments, the most notable dimension of the 2010–11 episode was the rhetorical conflict between the United States and China over the valuation of the yuan. In January 2013, measures announced by Japan which were expected to devalue its currency sparked concern of a possible second 21st century currency war breaking out, this time with the principal source of tension being not China versus the US, but Japan versus the Eurozone. By late February, concerns of a new outbreak of currency war had been mostly allayed, after the G7 and G20 issued statements committing to avoid competitive devaluation. After the European Central Bank launched a fresh programme of quantitative easing in January 2015, there was once again an intensification of discussion about currency war.